Greetings from New York City (aerial shot of Manhattan pictured), Philadelphia and Davidson/ Charlotte. This week’s Sunday Brief is kind of lengthy but worth careful reading as we have entered a new phase of state-based regulation (many current and former local telephone employees are quietly thinking “History does repeat itself”).

This week, we briefly examine the impact of the D.C. Circuit Court of Appeals ruling on October 1 and look ahead to the provisions of California Bill SB 822. As you will see, there’s a lot of interpretation required (telecom attorneys will be fully employed), but this will hopefully get folks thinking about the ultimate impacts of regulation to the consumer. We also have several TSB follow ups.

We had a substantial positive reaction to last week’s TSB on three start-ups. One note: we had mistakenly reported that Starry had raised $130 million from three rounds; we were reminded that they closed their fourth round in September having raised $300 million from four rounds. Also, a typo on Starry – they are using the lower part of the 37 GHz spectrum, not the 38 GHz spectrum. Despite these corrections, we were very encouraged by the sharing and dialogue (for those of you who were thinking about sending in wireless financing arm Affirm as a suggestion, please hold your fire as we received several dozen “What about Affirm?” inquiries. We promise to cover in our next round).

Internet Policy: Our Communications “Light switch”

When I was a young child growing up in Manchester, CT (and later in Mohnton, PA), one of my favorite things to do was to play with the light switch. There’s something magical about creating light with a simple motion. And, as the youngest of three (many of you are thinking “that explains everything about Patterson – he was the youngest”), I would frequently flicker the lights to annoy family members. This would be accompanied by a sibling or, more likely, parental admonishment of “Stop it… You’ll break the switch.”

The Internet policy of the United States is our communications light switch. Since 1998, we have applied erudite terms like “Title II” and “Information Services Provider” to make the flickering policy seem more mature. But the switch position keeps changing, and, as discussed below, we are in danger of breaking the Internet through investment uncertainty. Here’re some high-level definitions and chronology:

The Internet policy of the United States is our communications light switch. Since 1998, we have applied erudite terms like “Title II” and “Information Services Provider” to make the flickering policy seem more mature. But the switch position keeps changing, and, as discussed below, we are in danger of breaking the Internet through investment uncertainty. Here’re some high-level definitions and chronology:

- Telecommunications Services Providers are subject to Title II regulation, which prohibits providers from engaging in “unjust or unreasonable practices.” This is not a stationary target. Today’s “just” practice (e.g., T-Mobile’s Binge On! Wireless service plan introduced in 2014, or Verizon’s Start Unlimited plan, which we discussed in a previous TSB) was initially viewed as “unjust or unreasonable” (more on the Electronic Frontier Foundation spat with John Legere in his blog post here and in this article here), but has changed with the passage of time.

2. Commercial Mobile Services are subject to Title II regulations, while Private Mobile Services are not.

1996 (Clinton): Telecommunications Act Passed by Congress

1998-2002 (Clinton/ George W. Bush): Broadband is considered a Telecommunications Service subject to Title II. DSL deployments continue; cable begins to trial High Speed Internet services using a common standard called DOCSIS (Data Over Cable Service Interface Specification)

2001: CableLabs introduces DOCSIS 1.1 standard which incorporates Voice over IP capabilities. Cable companies launch HSI services more aggressively starting in 2002/2003 (see why below).

2002-2015 (George W. Bush/ Obama): Broadband is now considered an Information Service and subject to less regulation (The Supreme Court upholds this designation in the Brand X decision).

2015-2018 (Obama/ Trump): Broadband is re-recategorized as a Telecommunications Service (again subject to Title II) and, more importantly, mobile broadband is categorized as a Commercial Mobile Service and subject to “unjust or unreasonable practices” determinations.

2018 (Trump): Broadband is re-re-recategorized as an Information Service and mobile broadband as a Private Mobile Service. This re-re-recategorization triggered the lawsuit from Mozilla which was heard in the DC Circuit Court of Appeals.

Four changes in 20 years may not seem like a lot compared to the news cycle swirl we see today. And, as Craig Moffett pointed out in a note this week, each administration party change is likely to reverse the previous one. That’s not good commercial policy, but rather light flickering, and eventually the switch will break. In the process, the ability to create meaningful competition and superior customer experiences is sidelined by politics. More on possible solutions below.

What the DC Circuit Court Ruled

The DC circuit ruled as follows:

We uphold the 2018 Order, with two exceptions. First, the Court concludes that the Commission has not shown legal authority to issue its Preemption Directive, which would have barred states from imposing any rule or requirement that the Commission “repealed or decided to refrain from imposing” in the Order or that is “more stringent” than the Order. 2018 Order ¶ 195. The Court accordingly vacates that portion of the Order. Second, we remand the Order to the agency on three discrete issues: (1) The Order failed to examine the implications of its decisions for public safety; (2) the Order does not sufficiently explain what reclassification will mean for regulation of pole attachments; and (3) the agency did not adequately address Petitioners’ concerns about the effects of broadband reclassification on the Lifeline Program.

Simply put, a blanket FCC preemption on what the states can (or cannot) do is ruled out. But, as Roger Entner points out in this Fierce Wireless piece and Craig Moffett points out in his note, the FCC can challenge any rules after they are approved by the state (state-by-state preemption not ruled out).

T he reaction to the ruling is best summarized by FCC Commissioner Jessica Rosenworcel in a series of Tweets shown nearby. She also issued a short press release (here) saying, “When the FCC rolled back net neutrality it was on the wrong side of the American people and the wrong side of history. Today’s court decision shows that the agency also got it wrong on the law. The agency made a mess when it gave broadband providers the power to block websites, throttle services, and censor online content.”

he reaction to the ruling is best summarized by FCC Commissioner Jessica Rosenworcel in a series of Tweets shown nearby. She also issued a short press release (here) saying, “When the FCC rolled back net neutrality it was on the wrong side of the American people and the wrong side of history. Today’s court decision shows that the agency also got it wrong on the law. The agency made a mess when it gave broadband providers the power to block websites, throttle services, and censor online content.”

Former FCC Chairman Tom Wheeler (a subject of many TSBs from 2013-2016) wrote a tersely worded editorial in The New York Times stating:

The (D.C. Circuit Court) decision opens the doors for states to fill the regulatory void. Internet service providers should be quaking in their boots: As of today, they run the serious risk that they’ll have to follow a patchwork of different state requirements. The companies may not have liked the previous administration’s decision to classify them as common carriers, but that at least provided them with a uniform national policy. That is now gone.

As of this writing, five states have enacted net neutrality legislation: California, Washington, Oregon, Vermont, and New Jersey, and another 29 states have some form of legislation pending. The self-proclaimed “gold standard” of state legislation, however, is California. The California Internet Consumer Protection and Net Neutrality Act of 2018 does the following (full legislation here):

This act would prohibit fixed and mobile Internet service providers, as defined, that provide broadband Internet access service, as defined, from engaging in specified actions concerning the treatment of Internet traffic. The act would prohibit, among other things, blocking lawful content, applications, services, or nonharmful devices, impairing or degrading lawful Internet traffic on the basis of Internet content, application, or service, or use of a nonharmful device, and specified practices relating to zero-rating, as defined. It would also prohibit fixed and mobile Internet service providers from offering or providing services other than broadband Internet access service that are delivered over the same last-mile connection as the broadband Internet access service, if those services have the purpose or effect of evading the above-described prohibitions or negatively affect the performance of broadband Internet access service.

The California legislation is very broad. Of particular interest is their definition of Reasonable Network Management (emphasis added):

“Reasonable network management” means a network management practice that is reasonable. A network management practice is a practice that has a primarily technical network management justification but does not include other business practices. A network management practice is reasonable if it is primarily used for, and tailored to, achieving a legitimate network management purpose, taking into account the particular network architecture and technology of the broadband Internet access service, and is as application-agnostic as possible

This definition appears to obviate two common practices: a) bit prioritization, which is the practice of slowing down unlimited plan users after certain thresholds are reached (as there is no technical network management justification for this practice at 5 a.m. on a non-congested highway), and b) throttling, which slows down speeds as a result of a business service plan parameter as opposed to a network parameter (this is especially important to service providers like Xfinity Mobile who would rather not offer Hotspot service than to have their current throttled service rendered illegal).

The impact of this bill (unless overturned by the ISP lawsuit immediately filed after the bill was signed into law) will be as follows:

- California wireless subscribers who are being throttled will have to select new plans provided by the carriers (we presume the new plans will be capped and include overage charges)

- It is unclear if per device proof that throttled traffic is not going to degrade service is an acceptable network management practice. Regardless, as we have discussed in many TSBs, devices are increasingly becoming 1080p (or higher) resolution. Prohibiting a lower resolution in exchange for a lower price would be the law of the Golden State. (As reference, 480p video uses 3-4x less data then 720p video and 10x less data than 1080p video. Ironically, preventing video resolution throttling could create a significant network management event which would likely require prioritization as an acceptable network practice!)

- Hotspot services will either be dropped entirely from plans (this would likely include all hotspot plans that contain video throttles) or significantly modified. With no overall throttle or bit prioritization for exceeding thresholds, it’s likely that there will need to be hard caps and overage charges for all hotspot plans

- The impact on the MVNO community is unknown (which is one reason why Comcast and Charter are a part of the ISP lawsuit). For providers like California-based Mint Mobile, who have throttles after certain high speed allocations are met, they could either impose overages or (presumably) gain throttling consent from the consumer if there’s a day or two left prior to the commencement of a new billing cycle (note: it does not appear that the California bill allows consumers to choose lower-cost plans where their data is prioritized and video traffic is throttled – any prioritization that is not network management related is prohibited)

- This would make “by the Gig” plans the network standard and likely lead to a higher-priced unlimited service (our guess is ~$20 more per line, likely assessed via a California-based surcharge). It would make Comcast, Spectrum, and other MVNO providers less effective in their marketing efforts ($65/ line is less attractive). Ironically, as California ramps up efforts to prevent the T-Mobile/ Sprint merger, this bill would halt the expansion of MVNOs in the Golden State.

- All California plans would need to be converted to “by the Gig” with hard stops on usage. Unlimited plans, if they exist, would likely be very expensive, and wireless service dependency would shrink.

The above analysis is from a several hour scouring of the California bill and interpretations like the one seen here from the National Law Review. I am sure that the ramifications have been thought through, but, if it results in no throttling after certain caps are reached, no throttling based on the business service plan (e.g., non-network management) and no throttling of any sort for Hotspot services, the California consumer is in for a big surcharge. That’s what the D.C. Circuit Court ruling means for consumers.

TSB Follow-Ups

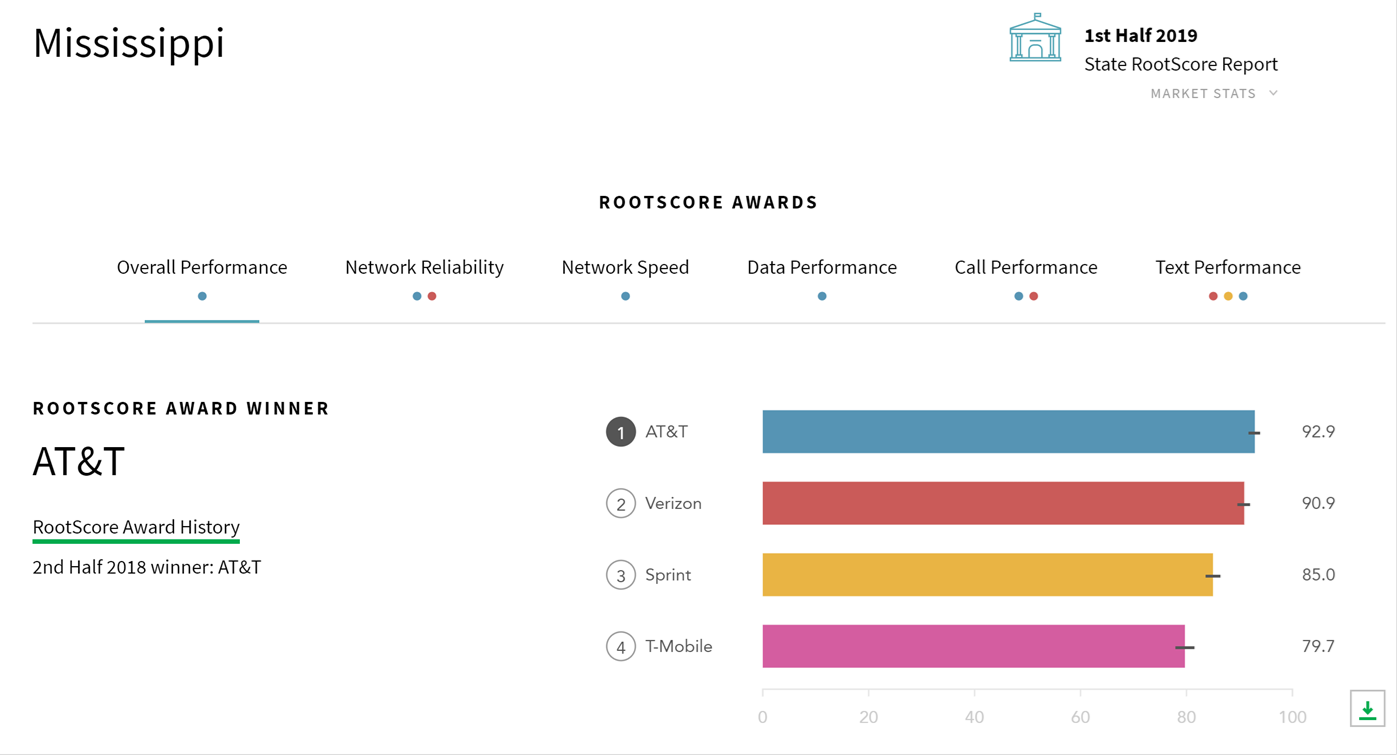

- Magenta Loves Magnolias – Mississippi AG negotiates a coverage deal in exchange for merger support. In an unsurprising move (32nd least dense state in the US), the Magnolia State changed their tone on the T-Mobile/ Sprint merger. In exchange for average speed commitments (100 Mbps or higher) to 62% of the population within three years, and 92% within six years, Mississippi signed on to the DOJ consent decree.

Both T-Mobile’s and Sprint’s coverage in the state follows interstate highways and the state capital (see RootMetrics coverage for Jackson here and for the state here and in the nearby pic – there is a very big difference between the two for Magenta). However, T-Mobile has strong 600 MHz spectrum holdings that cover the state (Spectrum Omega map here).

2. Seven economists say the DOJ was wrong. On Thursday, the NET Institute, a not-for-profit institution that counts Google, Microsoft, and AT&T as donors, submitted a white paper in which they state “the Proposed Final Judgment cannot and will not address the anticompetitive harms identified in the Complaint, or restore the ex ante competitive conditions in the affected antitrust product markets.”

Having just written on the topic, we read their comments in great detail, and found many of the same arguments that opponents of the merger have been making. We hashed through the reasons why we think the state AG case is weak in a previous TSB here, but one point is particularly worth examining. The paper goes down an unusual rabbit hole where it seems to imply that the scale produced by the merger of T-Mobile and Sprint would not result in unit cost reductions. From the paper:

Having reviewed the record evidence presented by the merging parties in the FCC proceeding, we… conclude that there is no compelling evidence that the merger would reduce the marginal costs of New T-Mobile.

The economists then go on to explain in a footnote what marginal costs represent (the cost of the last minute or megabyte produced). This is very disturbing to those who have worked in the industry. Wireless economics are particularly dependent on equipment purchasing economics (the infamous “discount to MSRP rate” which any telecom expert can attest is a lot easier to negotiate if you are a large vs small carrier), tower-to switch connectivity (usually fiber access – more MB using the same fiber strand would lower per MB costs. In the event of a traditional circuit, the next bandwidth size usually comes at a per unit discount of 30-50%), router/ port size (same as the bandwidth levels), and data center connectivity costs (more MB using the same or slightly larger number of servers/ racks lowers the total unit costs).

This excludes the fact that scale brings entirely new aggregation options. For example, if Sprint did not have a presence at the Spectrum Center Distributed Antenna System (this is the Charlotte Hornets arena) and, as a result of the merger, they now were able to use this efficient infrastructure at a lower cost, the unit cost would be lower.

Perhaps the argument could be that the regional or allocated costs would be lowered with the scale attributable to the merger, but the next unit would cost the same. That is only true if no aggregation opportunities and no purchasing power exist as a result of the increased scale.

Well-articulated arguments can be crafted on poor assumptions. That appears to be the case with this paper. Dish execution arguments aside, it’s weak because it fails to incorporate real world experience designing and engineering data and broadband networks.

3. AT&T Announces that they will be deploying stand-alone 5G networks in 2020. In this Light Reading article, AT&T announces that they will complete their standalone 5G core network in the 2020-2021 timeframe. The biggest impact from this announcement is not its effect on AT&T per se, but its impact on Dish as they seek to solely deploy a 5G standalone network. With AT&T on target to deploy in the next 24 months, a Dish initial rollout by the end of 2021 is entirely possible.

4. AT&T also announced the widely anticipated sale of its Puerto Rican/ Virgin Islands properties to Liberty Global, a broadband provider in Puerto Rico (news release here). The purchase price of $1.96 billion in cash was also in line (although on the low end) with estimates. The sale to Liberty will create a strong bundled service provider in the region just as T-Mobile launches its new fixed wireless product.

5. Another premium smartphone with CBRS launches next Friday. The OnePlus 7T, a $599 device with a Qualcomm 855 Plus (up to 2.96 GHz) processor, 8 GB of internal memory, and a 48 Megapixel triple lens camera now has the latest network – CBRS (LTE Band 48). Interestingly, the device does not have 802.11ax, also known as Wi-Fi 6. The next generation of Google Pixel is expected to be launched this week and, if reports are true, will likely have CBRS and 5G capabilities as well.

Because of space issues, we will be attaching the latest Apple device availability charts and posting on the TSB website with commentary. We will continue to update next week and promise more commentary then.

That’s it for this week. Next week, we will provide ten questions we want to see answered in the analyst calls. Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list.

Have a terrific week… and GO CHIEFS!

The post The Sunday Brief: What the DC Circuit Court of Appeals ruling means for (California) consumers appeared first on RCR Wireless News.