Greetings from Davidson/ Lake Norman where the 2-year-drought has ended! The editor has a question for all the TSB-reading technology innovators, implementers and investors: Why is it 2021 and we’re still having to do THIS with our TV’s? Picture-in-picture was an ‘80’s phenomenon. After 40 years we’re still hauling in the old set from the kids room and setting it up on a TV tray? The collective wisdom of TSB readers has got to be able to put together something better. It’s only 5 months ‘til football season …

Meanwhile, there’s still a lot to cover from the analyst days held the week before last. Our focus this week will be on the “elephant in the room” for each wireless carrier.

A final editorial note: Like many of you, we will be taking a break for the Easter holiday (in two weeks). We will publish a “videos to watch” article on the Sunday Brief website in lieu of a mailing.

The week that was

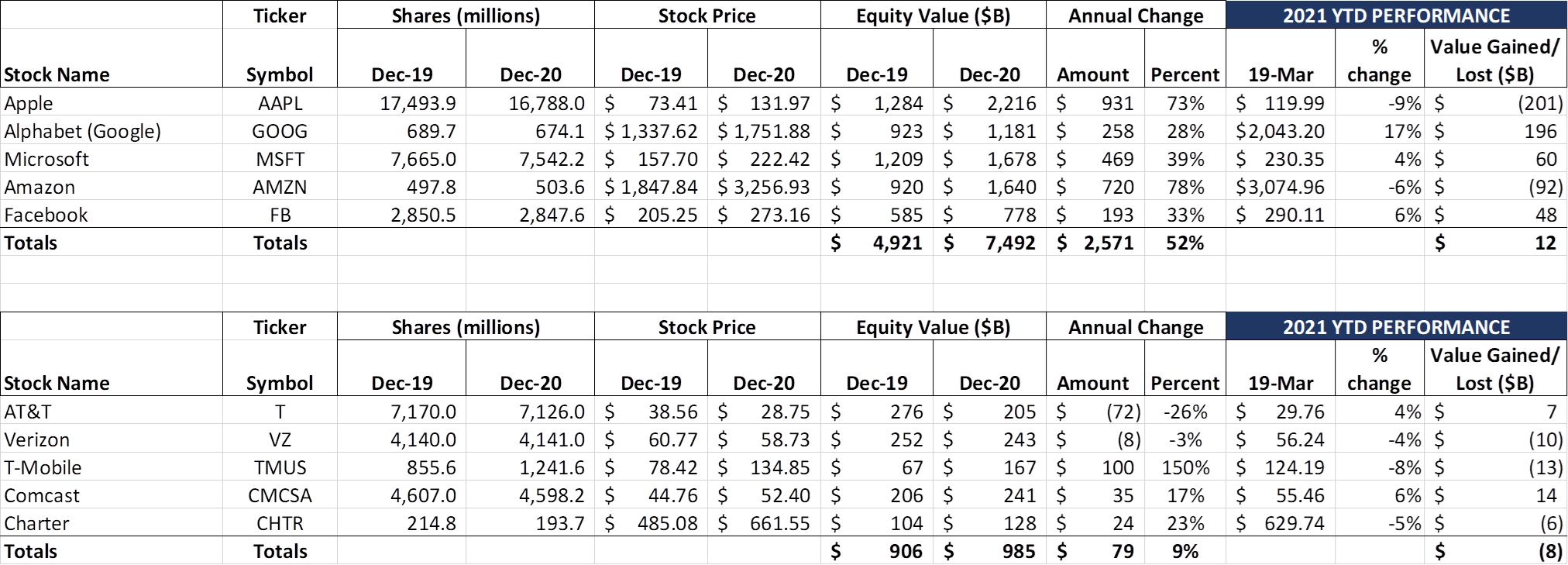

This word to describe this week’s activity is “sideways.” Apple lost $17 billion in market capitalization (on more than $2.1 trillion in total value), despite an encouraging leak on their upcoming tablet releases (more on that from Bloomberg here). Microsoft lost $41 billion in market capitalization this week, Amazon lost $8 billion, and Google lost $13 billion. Offsetting this was an economic recovery-driven pop at Facebook (+$62 billion). Overall, the Fab Five lost $16 billion for the week and has added a mere $12 billion to last year’s $2.57 trillion gain. Sideways never looked so good.

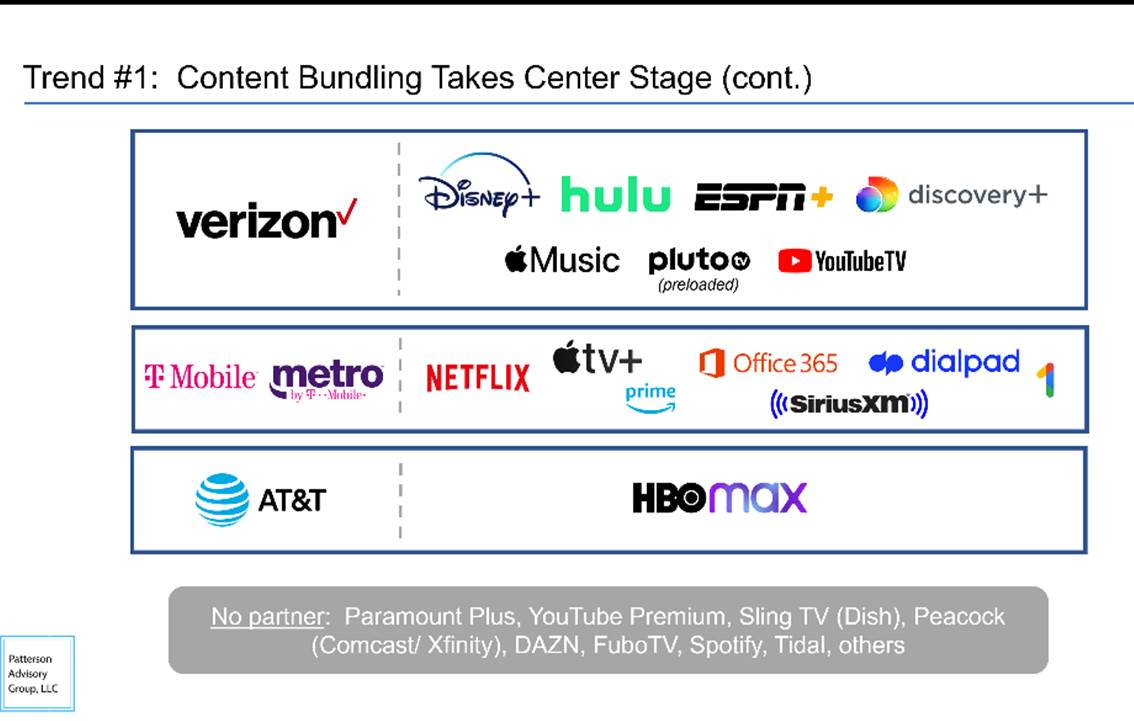

The Telco Top Five started to slip last week, driven by T-Mobile (-$3 billion) and Comcast (-$8 billion). Verizon continues to recover as the “an extra $53 billion in debt isn’t as bad as it first looks” theme proliferates. T-Mobile had the biggest announcement this week on Wednesday, signing up Pandora/ Sirius XM for exclusive musical content and ad-free weekend offerings for the Magenta faithful who redeem the code through the T-Mobile Tuesdays app. For those of you who have lost count, this now brings T-Mobile’s business and consumer content suppliers to seven: Netflix, Pandora/ Sirius XM, Dialpad, Microsoft 365, Apple TV+ (TVision), Amazon Prime (Metro by T-Mobile) and Google One (Metro by T-Mobile). See the nearby slide for a comparison to AT&T and Verizon’s offerings.

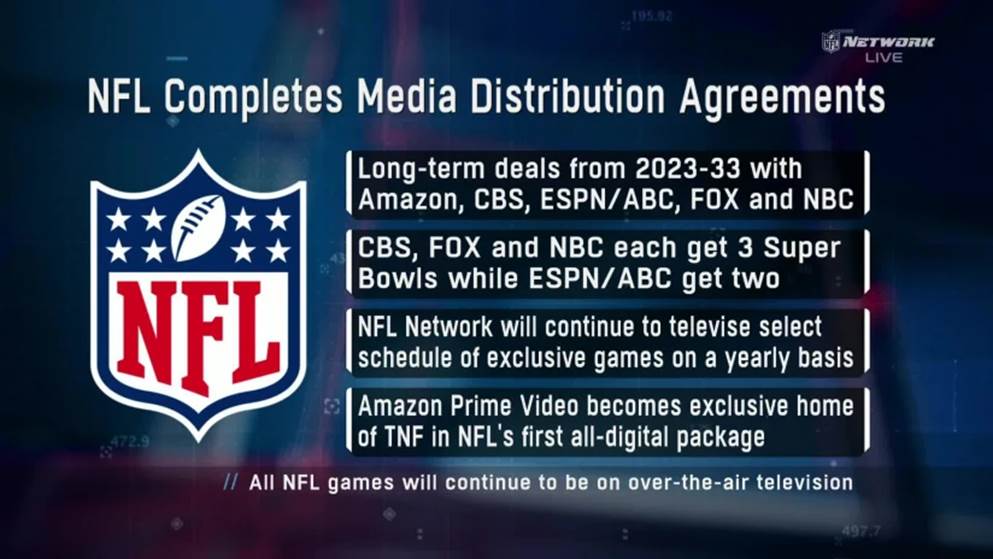

The biggest news of the week, however, involves one company from the Fab Five and the Telco Top Five. On Friday, Comcast announced that they (including streaming over Peacock) had retained the NFL Sunday Night slot for the next 11 seasons (through 2033). NBC Sports will also broadcast four of the next thirteen Super Bowls. While no figures have been released, Bloomberg estimates it cost NBC around $2 billion annually for the rights to broadcast the #1 Primetime show.

Amazon, who announced Wednesday that they would be expanding their Amazon Care program nationally (and increasing coverage beyond Amazon employees to other companies), made news on Thursday when they landed exclusive rights to the Thursday Night football slot (announcement here). The impact to the NFL Network (Amazon’s previous simulcast partner) is yet to be seen. Bloomberg estimates in the link above that Amazon paid around $1 billion per year (with 126 million US Amazon Prime members, that amounts to ~$8 per subscriber per year before any advertisement offsets). Comcast, Fox, ViacomCBS and Amazon set a high bar for AT&T’s DirecTV unit, who has yet to announce an extension.

AT&T’s HBO Max sponsored data ends

Speaking of AT&T, they noticed customers this week that smartphone data consumed by HBO Max will be counted toward data limits starting next Thursday (CNBC article here). The change is driven by California’s Net Neutrality law, which went into effect after CTIA/ NCTA/ US Telecom lost their challenge to the ruling. From AT&T’s statement:

“We regret the inconvenience to customers caused by California’s new “net neutrality” law. Given that the Internet does not recognize state borders, the new law not only ends our ability to offer California customers such free data services but also similarly impacts our customers in states beyond California.

A state-by-state approach to “net neutrality” is unworkable. A patchwork of state regulations, many of them overly restrictive, creates roadblocks to creative and pro-consumer solutions. We have long been committed to the principles of an open Internet. We deliver the content and services our customers want because it’s what they demand, not because it’s mandated by regulation. We also believe Internet access should be available and sustainably affordable to all Americans, and strongly advocate for Congress to adopt federal legislation to make that possible while providing clear, consistent, and permanent net neutrality rules for everyone to follow.”

It’s unclear how many customers are going to be impacted by this change as their Unlimited Elite plans offer 100 GB of “premium data” while their Unlimited Extra plans include 50 GB. Our estimate is that 1-2% of the HBO Max base is impacted. Regardless, having to notify customers of a perk removal is not pleasant. And blaming California infuriated our friends at Ars Technica, who published a scathing critique of AT&T’s actions.

Perhaps this lights a fire under Congress for legislation. Then again…

The elephant in the room (Analyst Day analysis, part two)

Last week’s Brief was chock full of information: 7.5 hours of presentations provide plenty of content, but leaves little room for analysis. As we frequently discuss with respect to quarterly earnings calls, it’s important to consider what’s not being discussed in addition to the key takeaways. This week, we will look at those “elephants in the room” (each telecommunications carrier has at least one) and suggest ways management can address them.

AT&T’s Elephant: Balance Sheet Obligations

As we discussed last week, AT&T did a good job of presenting a lot of information in two hours. While some were surprised that wireless did not get more airtime (and HBO Max did), we think AT&T chose to strike a “balanced portfolio” theme versus pursuing one that was wireless-centric.

If AT&T were to deploy fiber to three million homes this year, and achieve the lowest monthly postpaid churn in the wireless industry, and launch HBO Max globally to rave reviews, and have a few blockbuster theatrical surprises, then the balance sheet would be strong. Cash would be plentiful, and deleveraging could accelerate. If any one of these initiatives fails to meet management’s lofty objectives, however, there’s little “wiggle room” to take on debt or other obligations.

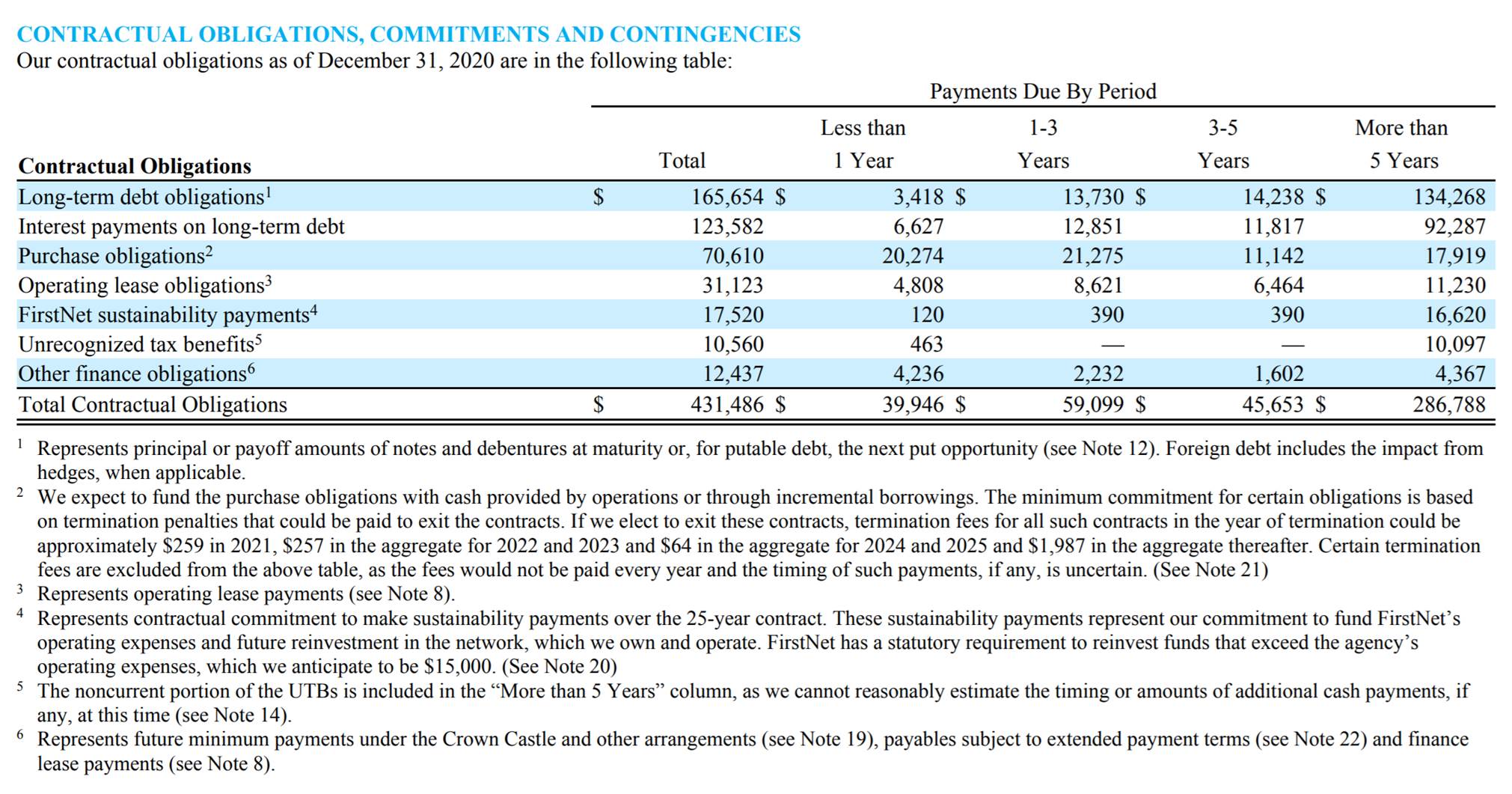

The schedule from AT&T’s 10-K paints the picture (we have included footnotes as well):

AT&T’s total obligations, including the additional $27 billion in debt needed to pay for C-Band licenses and the receipt of funds from TPG in the DirecTV transaction, will likely eclipse $450 billion dollars. About $100 billion of that is due in the next three years. Even when weighed against cash flow from operations (CFFO) expectations of around $140 billion for 2021-2024 (~$47 billion per year) and assuming dividends stay intact ($45 billion over three years), there’s not a lot of room to maneuver. Everything has to go right, assuming AT&T keeps their dividend flat and also retains an investment grade rating (currently rated by S&P as BBB, two notches from junk status).

We do not mean to imply that AT&T is flirting with insolvency – they have very strong cash flows and should be able to re-term and roll over debt as they execute on their plan. But any ambitions beyond local fiber, HBO Max and C-Band are going to be put on hold. And, if T-Mobile or Dish or cable disrupts the competitive landscape, operating cash flows will suffer.

Bottom line: AT&T has a lot of assets, but must execute on all fronts to meet their obligations. The sizes and due dates of those obligations are the elephants in the room.

Verizon’s elephant: T-Mobile’s network superiority

While many of you think “Obligations” should also be the elephant in the room for Big Red, we think it’s slightly worse for Ma Bell (Verizon’s total obligations equal $258 billion per their 10-K before C-Band debt, and $70 billion is due in the next three years. Verizon should also generate ~$120-130 billion in CFFO over that period and have $30-33 billion in dividend payments. Still tight, but more room to maneuver than AT&T). And, assuming the TracFone transaction is completed, they will have ~$1 billion in additional CFFO generation.

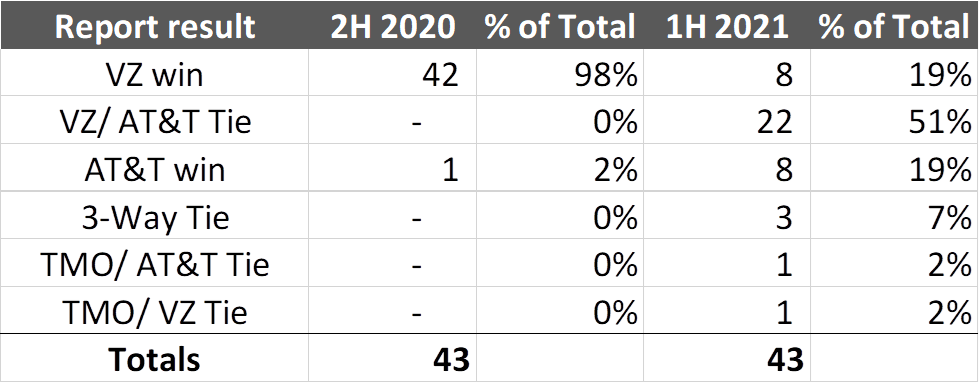

The elephant in the room for Verizon is that their reign as undisputed network champ is ending. As we are seeing in the RootMetrics RootScore Reports for most metros (the first 43 market results are shown in the nearby table), it’s just as likely that AT&T wins and 3x more likely that the metro ends in a tie. And, while T-Mobile does not have any outright wins today (only five ties), they have just begun to deploy their 600 MHz/ 2500 MHz carrier aggregated 5G network. We will be especially interested to see how one of their earlier 5G markets (Philadelphia) helps T-Mobile versus Verizon.

There appears to be corroborating evidence to support T-Mobile’s ascent. OpenSignal released their 5G rankings in January and crowned T-Mobile the winner in upload speed, download speed, and availability (see here). T-Mobile also scored well in OpenSignal’s state-by-state rankings. Ookla weighed in a few weeks ago as well with AT&T winning the overall download speed (Verizon fourth behind legacy Sprint) and T-Mobile winning latency, availability, and 5G time spent. Many of you have requested spending a portion of one Brief explaining the differences between various testing company methodologies, but the bottom line is that Verizon’s 4G championship is not extending into 5G.

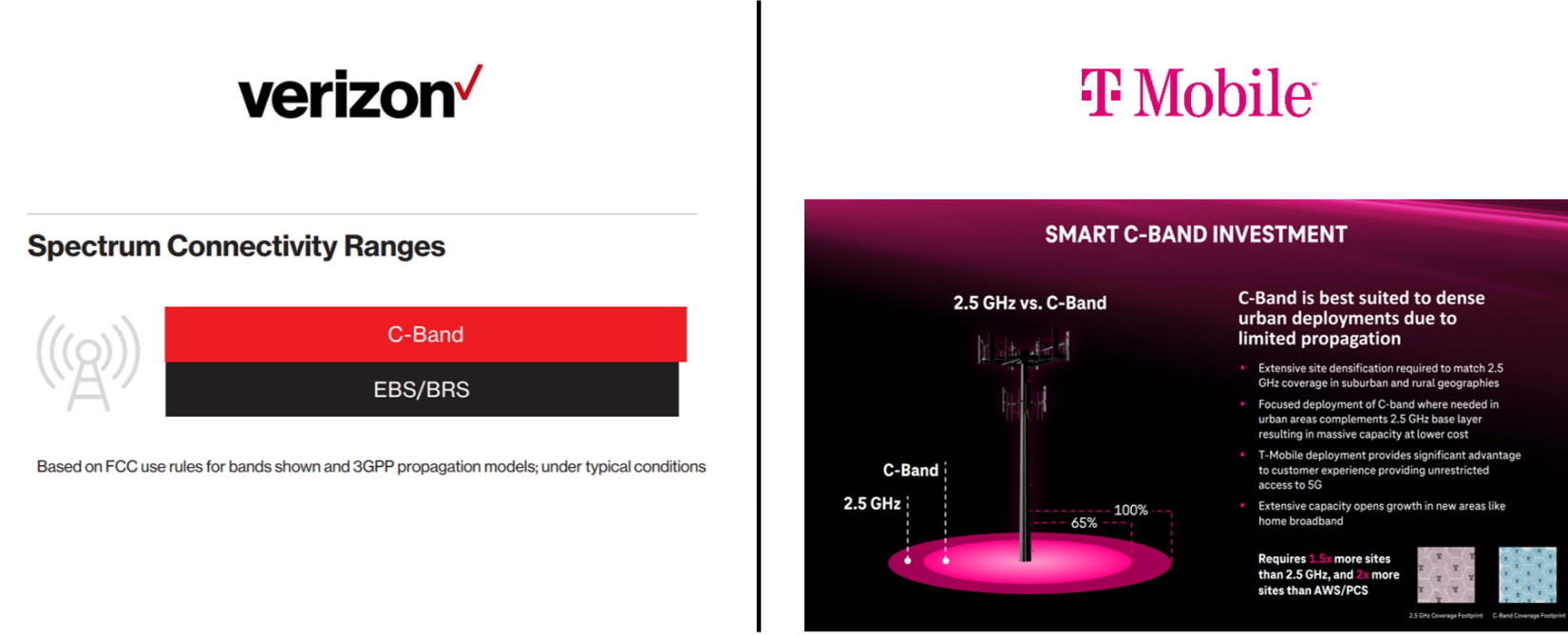

Short-term (until C-Band arrives) disadvantages can be overcome with additional retention incentives (including content bundling) and more advertising. But what if T-Mobile’s Clearwire Band (their flavor of C-Band) is better than Verizon’s new network? This is why there was a lot of discussion of these two slides over the past week:

In their analyst day presenttion, Verizon made the argument that because of power limitations imposed for 2.5 GHz spectrum (relative to C-Band), T-Mobile would have no advantage whatsoever (left side of the picture). Verizon also made the argument (as did several industry analysts) that Verizon already has a lot of cell site density in many metropolitan areas today and that deploying C-Band would not leave coverage gaps (Mike Dano has a great article in Light Reading on this here if you want to read more).

T-Mobile countered Verizon’s argument quite effectively, arguing that they are going to use their low-band (600 MHz) as the uplink, and that this would create an additional 30% range extension for their 2.5 GHz. They also indicated that they plan to deploy this nationwide using their arsenal of ~85,000 cell sites. They committed to over 200 million POPs of coverage with this new configuration by the end of thie year (just as Verizon is receiving their C-Band licenses).

Bottom line: If Verizon cannot claim undisputed network performance as their competitive differentiator, then their ambitions to charge more for their services (see last week’s article about the critical importance of growing ARPU/ ARPA to meet deleveraging targets) are going to be challenged. Without network and engineering superiority, Verizon will need a new corporate identity (“We’re #1 in a tie” won’t cut it).

T-Mobile’s elephant: Credibility

Having watched the T-Mobile Analyst day three times, there aren’t a lot of gaps. We mentioned a possible chink in the armor last week (lack of a cohesive fiber/ transport strategy), but there’s an easily identified remedy for that – develop and execute one! Identify the clusters of towers where T-Mobile should own and manage connectivity and build local operations teams. That would cement low-cost superiority (when spectrum costs are included).

We aren’t quite sure that Jeff Katz’s reply to a question where he basically said “We can still win wireless deals without wireline – they are two separate contracts” is completely accurate, but can give him the benefit of the doubt that they will win enough wireless to meet their market share goals without owning and operating the fiber connection to the factory or headquarters.

Mentioned time and again throughout the presentation were the phrases “Once they discover” or “After they try.” This is the common cry of the challenger: It’s better, and here’s why you can believe us! We think credibility is T-Mobile’s elephant in the room, and that it’s going to take many programs across many years to implant confidence and conviction.

There are many ways T-Mobile can address this problem. After deploying their LTE network, T-Mobile launched an Uncarrier initiative called Test Drive (original 2014 announcement here). They changed the program to a 30-day Hotspot in 2019 for consumers, and included small businesses last year. Test Drive allowed potential customers to experience T-Mobile’s network changes before they actually committed to a relationship (since a growing number of smartphones are purchased through Apple and Samsung directly, Equipment Installment Plans don’t have the retentive power of yesteryear).

T-Mobile indirectly learned about the power of a test drive when they launched Home Internet in 4Q 2020. Many (including yours truly) were skeptical, and switched between cable and T-Mobile networks to see if there was any material difference. Unlike smartphones with voicemail losses and the pains that occasionally happen with porting phone numbers, data is free from those hassles.

If T-Mobile could figure out how to use the eSIM now present in many smartphones to provide a similar test, many of those “I had T-Mobile back in 20XX” prospective customers might try Magenta again.

Bottom line: As we discussed last week, T-Mobile has a tremendous amount of merger and network momentum. They have a talented team of experienced leaders who can manage growth and change. But they lack credibility with many who had T-Mobile in the past, or who still equate Magenta with “cheap.” There is no short-term fix as brands are not supercharged overight, but T-Mobile can accelerate their net additions by making aggressive Uncarrier moves that improve credibility.

Next week, we will start our Q1 preview with a look at the overall economic conditions (read our March 7 Brief if you need a refresher). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Have a great week and Go Davidson Wildcats!

The post The Sunday Brief: The elephant in the room (Analyst Day analysis, part two) appeared first on RCR Wireless News.