Mother’s Day greetings from Lake Norman and Charlotte, North Carolina, where businesses are starting to show signs of life. Pictured is Bossy Beulah’s, a Charlotte chicken establishment revived by local restauranteur Jim Noble. The lines are back at Bossy’s and, while we are physically distanced, the chicken is as good as ever.

Mother’s Day greetings from Lake Norman and Charlotte, North Carolina, where businesses are starting to show signs of life. Pictured is Bossy Beulah’s, a Charlotte chicken establishment revived by local restauranteur Jim Noble. The lines are back at Bossy’s and, while we are physically distanced, the chicken is as good as ever.

This week’s Sunday Brief will be divided between T-Mobile’s earnings analysis and a new feature looking at The Great American Move. We will move our analysis of CenturyLink’s mxed earnings and our follow up on the Open RAN Policy Coalition announcement to next week’s edition.

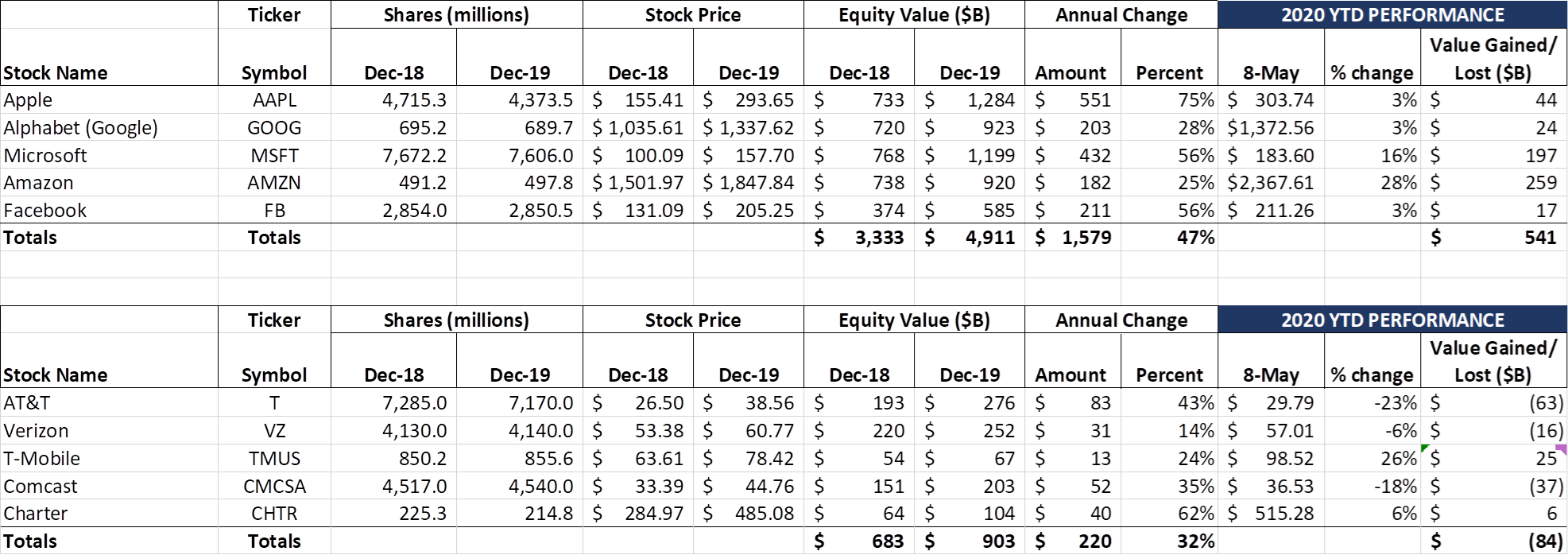

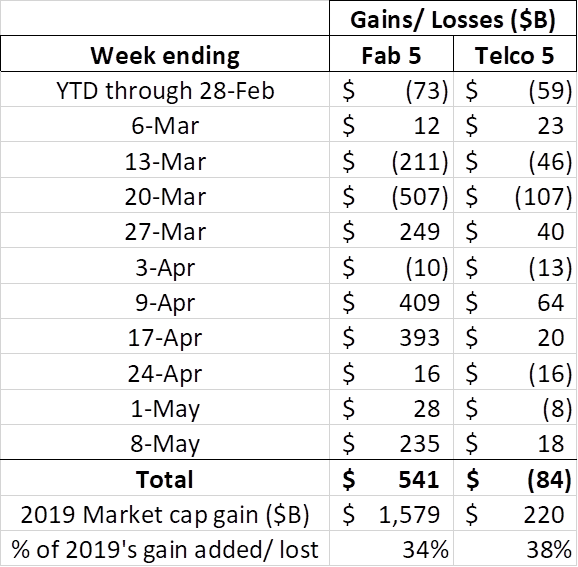

For the first time since we have been keeping track of weekly valuations, each of the Fab 5 can now boast of 2020 share price gains. Yes, even in the middle of a pandemic that has generated 14+% unemployment, Facebook is above water for the year. Through 18+ weeks, these five stocks have generated just over a half trillion in new market capitalization.

For the first time since we have been keeping track of weekly valuations, each of the Fab 5 can now boast of 2020 share price gains. Yes, even in the middle of a pandemic that has generated 14+% unemployment, Facebook is above water for the year. Through 18+ weeks, these five stocks have generated just over a half trillion in new market capitalization.

If this pace holds through the rest of 2020, these five stocks will just about equal the record $1.5 trillion added in 2019. Microsoft continues to be the leader since 2019, adding more than $629 billion in market cap in less than 17 months.

The Telco Top 5 also had an up week. With the accurate share count now showing for T-Mobile’s value gained in 2020 (1.24 billion shares including the Sprint acquisition), the Bellevue telecom giant has now added $25 billion in market capitalization since the beginning of 2020 and $38 billion since the beginning of 2019. That’s more market cap added then AT&T (+$20B) and Verizon (+$15B) combined over the last 16+ months (but not as much total shareholder value created when you include dividends).

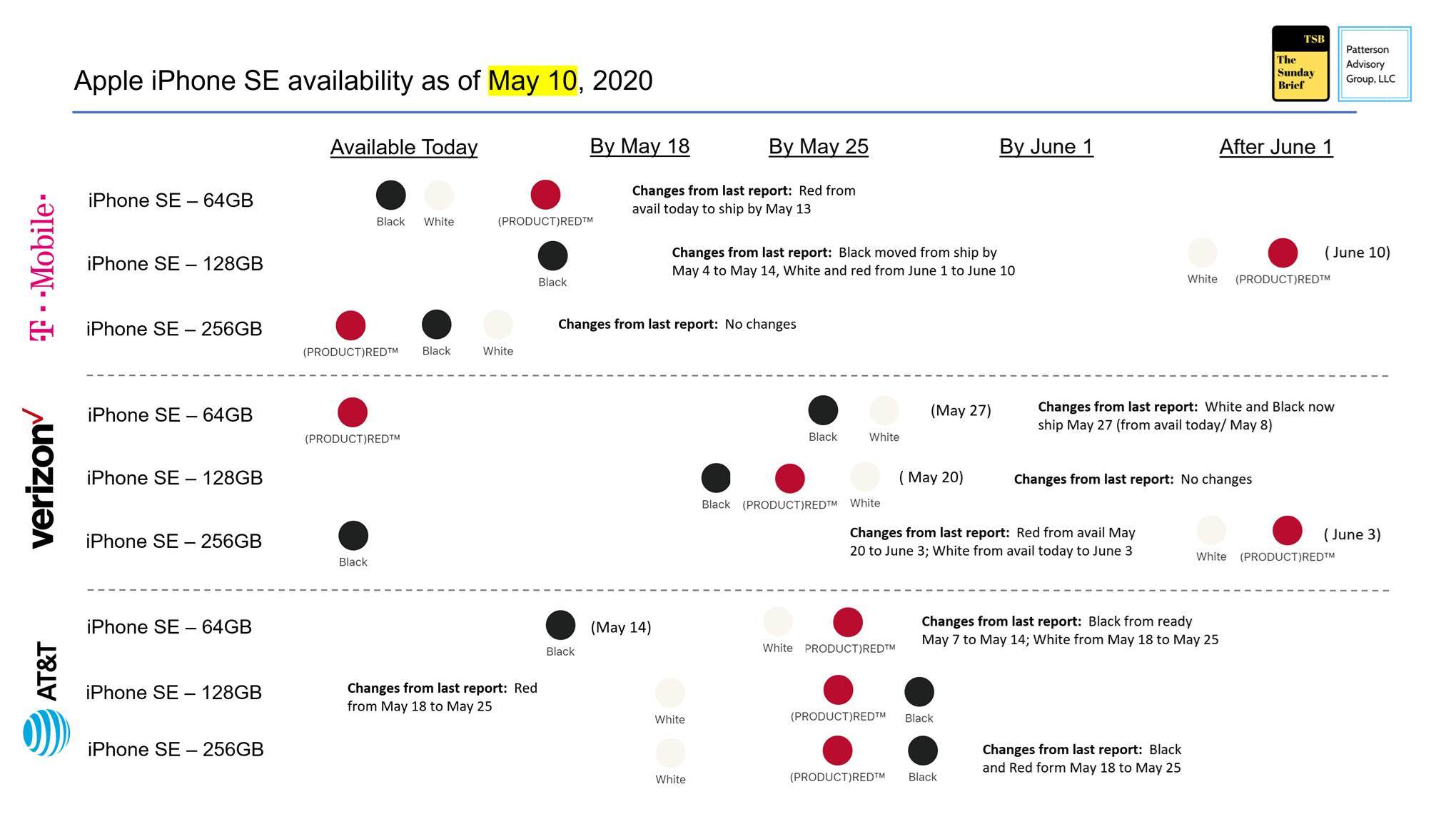

iPhone SE – supply shortages are likely related to form factor, not economics

The iPhone SE officially went on sale on April 24 and we established a baseline for availability observing that demand for 128GB exceeded supply. Last week, we began to see shortages of 64GB storage models at AT&T and are now starting to see a similar trend at Verizon (which is more likely related to increased retail activity than their Mother’s Day BOGO device promotion). Like we saw with the iPhone 11 (including Pro and Pro Max) launches, back order dates on extremely popular color/ memory pairs (e.g., the 128GB iPhone SE in White or Red at T-Mobile) are encountering a week-for-week slip. It’s likely this will continue another few weeks before inventories catch up.

It’s also likely that longer store hours and state shelter-in-place relaxations will also potentially extend some back order intervals. Adding additional pressure was Apple’s announcement on Friday that they would begin Apple Store reopenings in four states (ID, SC, AK, and AL) next week.

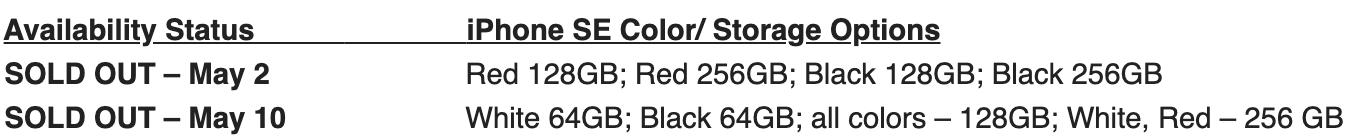

Best Buy rarely sells out, but the following models were sold out (or nearly so) as of Saturday noon ET (note that there are only nine total color/ memory model SKUs available):

Bottom line: Despite store closures, the iPhone SE continues to sell well as a value-oriented iPhone with white representing the most popular color. As stores reopen or extend their hours (and as word of mouth spreads about the iPhone’s value), expect some additional spot back orders in June. (Chart avail in PPT or PDF formats on request).

Earnings analysis: T-Mobile’s value-seekers proposition

Earnings analysis: T-Mobile’s value-seekers proposition

Mike Sievert’s first earnings call as CEO of the new T-Mobile had the ingredients of failure: a) Dispersed, new management team; b) Global pandemic uncertainty; and c) Rear-view T-Mobile only earnings (which were strong). But things are going so well at the new T-Mobile that the CEO could leave the call a few minutes early, and the stock price went up ~$12/ share (11%) over the next two days, adding $12+ billion in market capitalization. Continued consistent performance of legacy T-Mobile inspired confidence that the new Magenta has better opportunities ahead of it because of the merger – a “strong today and stronger tomorrow” message that was clearly evident on the call.

Mike Sievert’s new T-Mobile is not the same one that John Legere inherited in 2012. There is no AT&T iPhone exclusivity to overcome. Survival of the company does not depend on a cash infusion from a failed merger coupled with an attractive roaming deal (two key elements of T-Mobile survival in 2012 after the AT&T merger fell apart). Mike has entirely different problems, and this leadership challenge requires a different leader than was needed eight years ago.

The stage for new T-Mobile is set with the following statement: Value Seekers Welcome Here. T-Mobile is very formulaic in their approach to value: superior network quality + excellent customer service = high gross additions (with high ARPU) + low churn = higher profitability. We could probably end the T-Mobile analysis there – Mike is a Chief Operating Officer who is very adept at understanding the correlation of investments (people, network, brand) to results. Making survival fun is a tall task, but, in a world of record-high unemployment and stay-at-home frustrations reaching a boiling point, T-Mobile may “gamify” the next two years of transition into millions of net additions.

Mike, Neville, and Braxton outlined some items that will make it easier to realize this vision:

- Legacy Sprint churn needs to go down – quickly. As we discussed in last week’s column, T-Mobile released Sprint’s results separately last Friday – postpaid phone churn was 1.89% per month. Every 0.1% that is reduced equates to ~ 78,000 revenue generating months each quarter (26 million legacy Sprint postpaid phone customer base * 0.001 * 3 months). The gap between Sprint and T-Mobile postpaid phone churn is currently ~ 1% so at height, the churn opportunity is around 780,000 quarterly revenue units, and, at $46 in revenue per subscriber per month, that’s worth at least $36 million per quarter in revenue/ high incremental margin opportunity.

The leading indicator for churn cited by T-Mobile is Net Promoter Score. With Mike reporting record-level net promoter scores in his opening comments, and with the report that 80% of the current Sprint handsets are already compatible with T-Mobile, it appears that the new company is well on its way to recognizing this early synergy win (or, conversely, if low Sprint postpaid phone churn is not realized, merger success sirens will go off).

- Network and business transitions need to stay on track even with COVID-19 disruptions. Thanks to the debt raise following merger close, T-Mobile has the money to transition Sprint to the new T-Mobile network. Now the tough part begins: implementing LTE Band 41 (2.5 GHz spectrum) and fully integrating that into T-Mobile’s sub-6 GHz spectrum package (effectively creating the first two layers on the T-Mobile cake – picture right).

We have discussed several places where the gap between Sprint’s legacy performance and new T-Mobile’s performance will be most noticeable (see Sunday Brief here) but Florida must be an initial focus area. While current Sprint customers can roam on T-Mobile today (at least 10 million Sprint customers roamed on the T-Mobile network in April per the call), they cannot leverage carrier aggregation and get the real data “boost” that a single network brings. Roaming is a great band-aid, but not quite the long-term network experience.

Mike Sievert and Braxton Carter both talked about acceleration of certain synergy plans to hangle potential earnings pressure from 2Q and 3Q COVID-19 pressures. As Braxton stated: “We are laser focused on acceleration of these synergies to offset some of the impacts that we’re seeing given this unprecedented crisis.” Even with short-term costs to achieve, every redudant store closure, tower, and call center change reinforces the merger thesis and keeps T-Mobile from having to increase their debt.

During the call, Neville Ray discussed their 2.5 GHz approach:

“We will launch and build out and lay 2.5 GHz spectrum across thousands of sites in 2020. We’re off to a great start, benefitting from that work which last year we did at risk… the rollout of 2.5 is going to be super super quick… We actually built out over 1,000 sites in April rolling out new spectrum onto those sites. Our plan is to ramp very heavily as we move into May and on through the year.. Lots of 2.5 GHz coming.

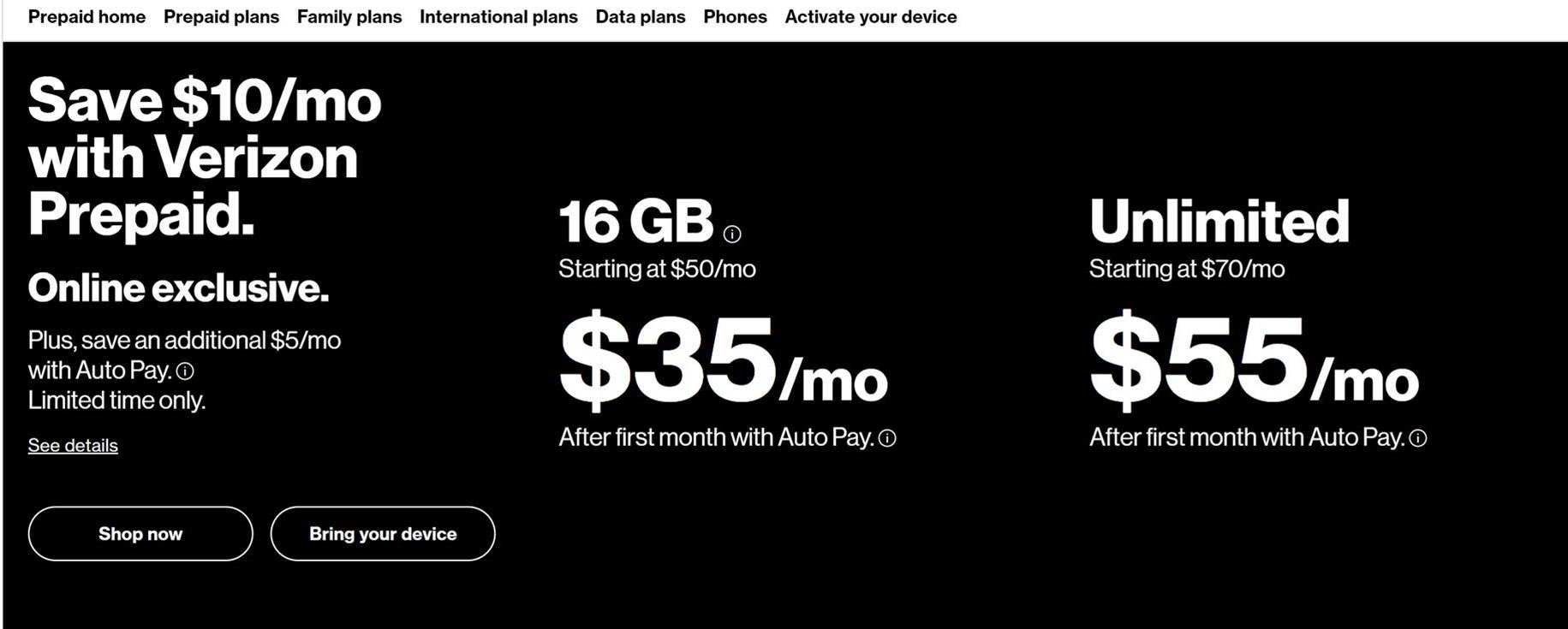

- New T-Mobile needs to be able to quickly react to competitor moves as gross addition growth opportunities shrink. No revenue synergy program will work if it’s performed in a vacuum. As Jeff Moore pointed out in a tweet late this week, Verizon Prepaid is now offering the following promotional rates for new customers:

What’s interesting about this is that Verizon is not only making it’s presence felt in the prepaid space (although its store network in poorer areas tends to be more sparse or dominated by StraightTalk or Total Wireless), but this 16GB offer is a sidewinder into their cable MVNO partners (at least for that segment regularly consuming between 3 and 16GB – the unlimited offering is still at least $10 (20%) higher priced than cable’s unlimited offerings). This plan is extremely attractive to those users who don’t stream with regularity.

Verizon’s newly released plans make Metro’s plans look small (2GB for $30, 10GB for $40) and out of date. Even against new T-Mobile plans (5GB for $25 with no opporutnity to purchase additional GB) it looks “less than.” Prepaid has more pricing volatility, and today’s dream rate could be gone tomorrow. T-Mobile needs to remain responsive throughout 2020 as competition increases (note to self: send this offer to @NYAG Letita James and @CAAG Xavier Becerra who consistently argued that consolidation to three players would result in higher prices).

Bottom line: T-Mobile’s last reported earnings prior to incorporating Sprint were really good, even with COVID-19 impacts. Now the fun part begins – showing sustainable value to potential AT&T and Verizon switchers. That only comes with a consistent network experience.

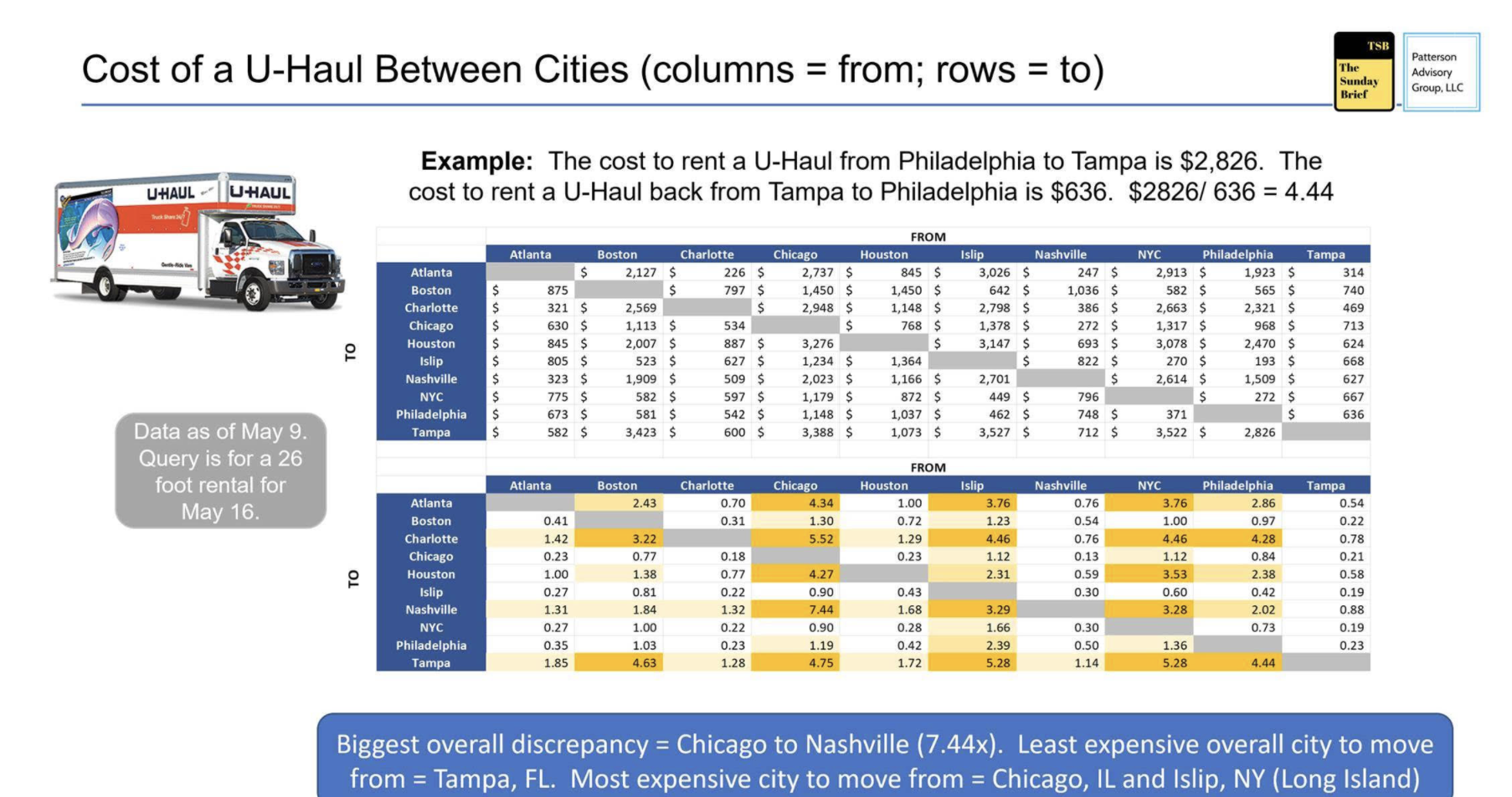

The great American move in one chart

Our Brief on the Great American Move generated many comments, mostly from data deniers who resorted to snarky subjective comments to disparage life in the South (and Texas). We are not one to back down from a fight, so, in that spirit, we present the U-Haul index, an ten-by-ten chart showing the cost differences between renting a 26 foot U-Haul from five select cities in the North (including Chicago) versus the South or West. (We are leaving California out of the mix for now because they warrant an entirely separate analysis).

Using a one-way 26’ U-Haul matrix is not a scientific study, but a snapshot of the “spot” market for movers. The thesis is that a wide gap (more than 1.5) over time likely signals a diaspora from the numerator (column) to the denominator (row) city. We requested the same details for each city pair shown below:

In most cases, the U-Haul theory holds. For example, a moving van rental from Houston to Atlanta costs exactly the same regardless of the originating city. Tampa and Nashville, both fast-growing cities, have overall higher ratios to move into these cities (see the Nashville row in the second matrix – except for Tampa, all of the ratios are above 1.0 meaning it’s more expensive to move to these cities than to move from the Music City).

In general, as we saw with the figure in the Sunday Brief devoted to this topic, cities in the South have better higher to/from ratios than their Northern counterparts. And even in the middle of the effects of a pandemic, it’s still only slightly more to move from New York to Chicago than vice versa. In the Northeast, the most attractive place to move to (at least from other towns in the Northeast) is Philadelphia. But that’s not saying much as the ratios to move from Philadelphia to any parts south is significantly more than the return trip.

As mentioned earlier, this is a snapshot. If the diaspora extends to the suburbs (e.g., to Port Jarvis, PA, instead of Manhattan, NY) that’s one thing, but if it triggers a multi-hundred mile move to Nashville/ Charlotte/ Tampa/ Houston/ Atlanta, that’s more permanent. What’s safe to say for now is that few are saying “Let’s move (back) to the City” after the last eight weeks. The economic impacts of that mindset are potentially devastating to the Northeast. Networks need to adjust to these changes which is why we will definitely be refreshing this analysis.

That’s it for this week. Thanks again for your readership. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!

The post The Sunday Brief: T-Mobile’s value seekers’ proposition appeared first on RCR Wireless News.