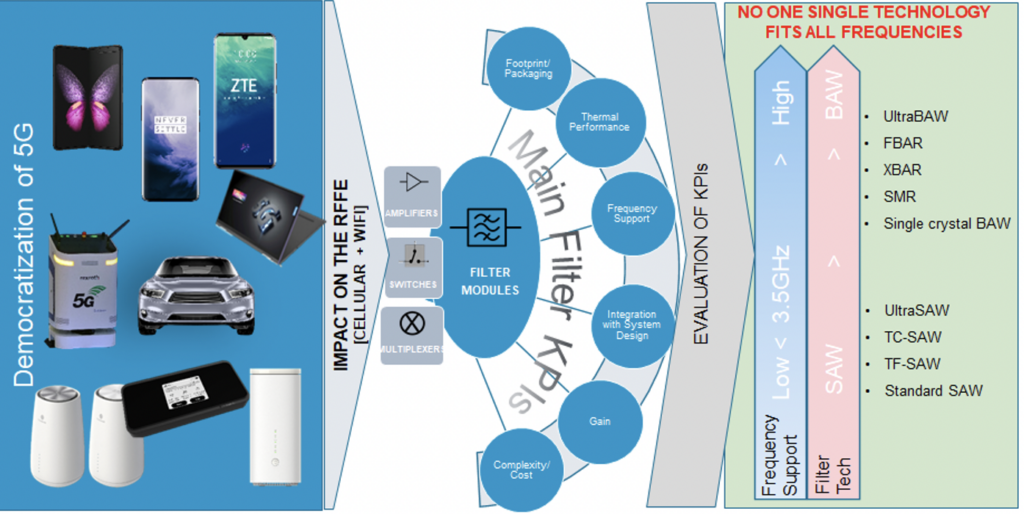

The adoption of 5G continues to thrive in the mobile devices market and is expected to become more diverse and expand exponentially across all types and price tiers. However, device democratization of the 5G experience will be constrained, not just by the modem and application processor, but by the Radio Frequency Front-End (RFFE). In turn, within the RF, it is the filters that will be the most challenging and essential area to address fully as the market moves to 5G.

Filters have been an integral part of mobile devices and the sheer numbers now needed in a 5G device have grown exponentially, while pressure to improve performance, increase thermal efficiency and reduce the overall die area of the chipset have become ever more important to reducing the cost and ensuring integrity of the signal and communication reliability.

Filters are needed specifically to unlock the high bandwidths available in 5G, as well as for next-generation Wi-Fi co-integration. While they need to extend performance into these higher frequencies, working across multiple frequency bands and bandwidths, they must also remain low-cost and small enough so as not to impact the overall device form factor. Other Key Performance Indicators (KPIs), such as thermal performance, efficient packaging and integration with the system design, are all crucial aspects that need to be addressed to make sure that the correct choice of filter technology is selected.

Figure 1: Filter Performance Essential to RFFE as Markets Move to 5G

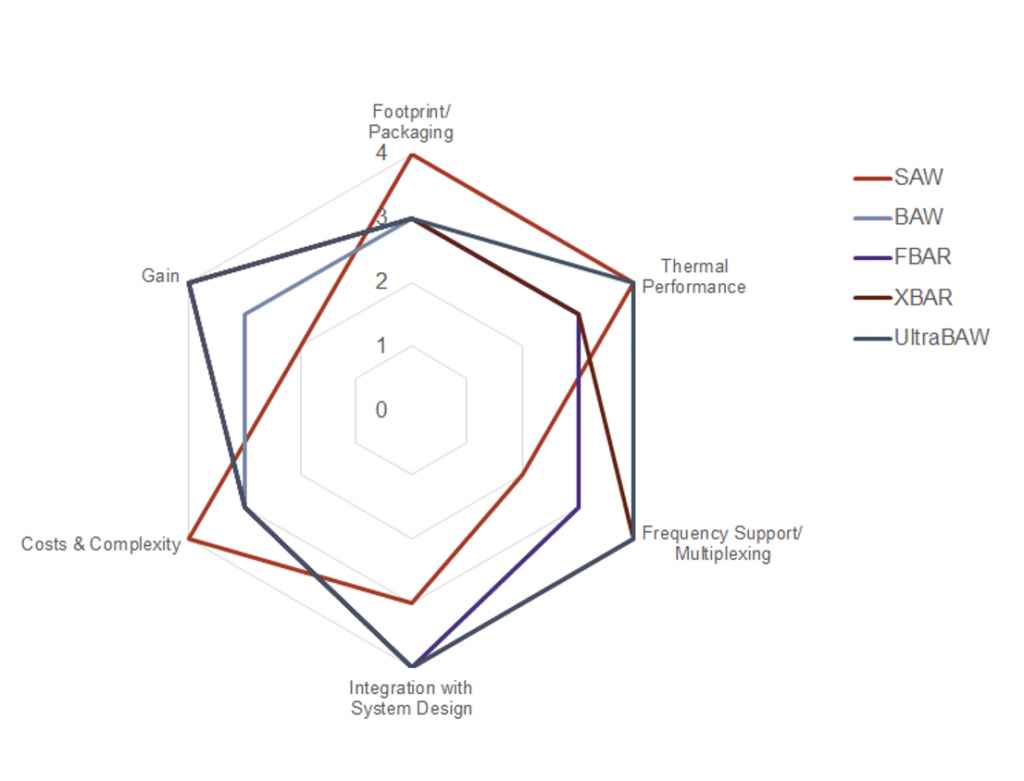

A variety of filters are available in the market, notably acoustic-based piezoelectric filter technologies, such as Surface Acoustic Wave (SAW) and Bulk Acoustic Wave (BAW), each of which have their strengths in distinct frequency bands and come with varying levels of complexity and costs. Figure 2 provides top-level benchmarks for competing technologies across multiple KPIs, including thermal performance, frequency spectrum support, ability to integrate with other components and systems, complexity and implementation costs, spectral performance and packaging footprint.

The SAW family of filter technologies, which generally operate at lower frequencies and have a simpler manufacturing process, are supplied by companies such as Qorvo, Skyworks, Murata and Qualcomm. Additional SAW technologies, such as Thermo-Compensated SAW (TC-SAW) and Thin Film SAW (TF-SAW), as well as piezoelectric-based SAW (ultraSAW)provide an uptick in performance over standard SAW through addressing more challenging bands and having lower insertion losses. However, these technologies are often more complex to build, which means they are more costly than traditional SAW filters for an equal die size.

In contrast, BAW filters work most effectively at higher frequencies and the market is led by companies such as Broadcom, Murata, Skyworks, Qorvo and Qualcomm. Included in the BAW family are Film Bulk Acoustic Resonators (FBAR), other BAW technologies based on electromechanical coupling materials, such as XBAW and XBAR and piezoelectric-based BAW, such as ultraBAW. Each technology enables a level of improved performance at higher frequencies, although some are at an increased cost due to differences in the manufacturing process.

The ability to pack so many filters into a 5G device becomes a challenge as Original Equipment Manufacturers (OEMs) attempt to strike a balance between achieving the best gain and power consumption against the use of these differing, competing filter technologies. At the same time, they need to implement a technology that allows integration as best as possible across the desired spectrum, while reducing device Stock-Keeping Unit (SKU) counts.

Figure 2: Selection of Filter Technology Key to Minimizing Complexity and Cost

The relative strengths and weaknesses across the KPIs show that no one filter technology fits all. This leads to a debate over which one is the best technology that holds a major competitive advantage, and therefore, the filter vendors that will lead the market. At present, the mobile handset market is dominated by SAW filters. However, as the market moves to adopt the higher frequencies of 5G—coupled with a growing need for precise, higher-performance filters—there is a strong shift toward the use of BAW technologies, notably because SAW will not perform as well or scale in higher bandwidths.

However, it is worth noting that piezoelectric-based filters, such as ultraSAW and ultraBAW, have some additional advantages compared to alternative technologies thanks to their ability to integrate better with other RFFE components, such power amplifiers, duplexers, antenna switches, diversity modules, Wi-Fi and Global Navigation Satellite System (GNSS) extractors, as well as other discrete components. This quality enables these technologies to offer more integrated RF system designs with superior performance and a reduced silicon footprint on the Printed Circuit Board (PCB).

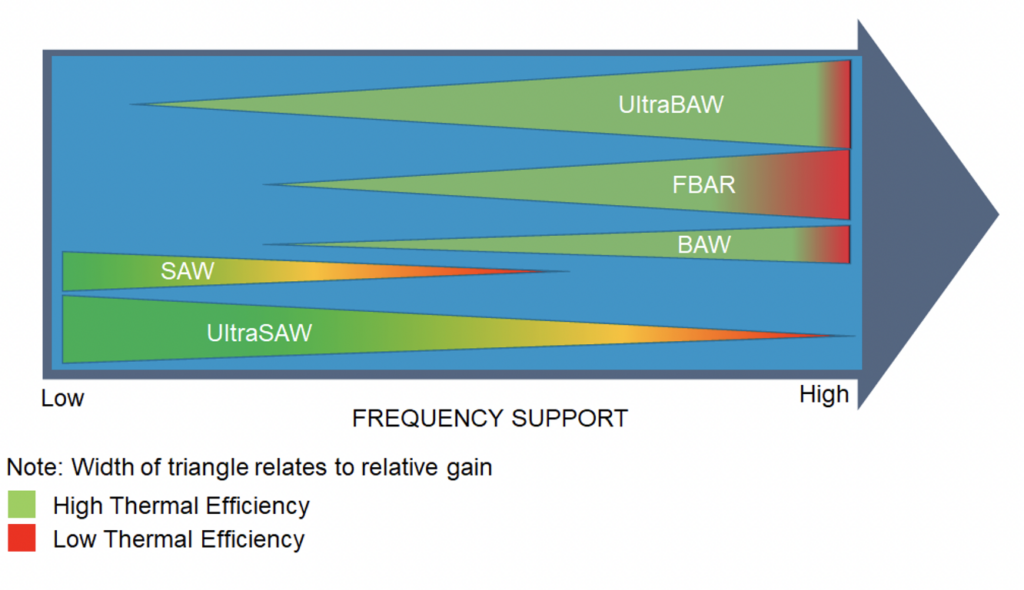

The ongoing move toward supporting 5G higher frequency bands also requires a stark improvement in filter thermal performance to cope with the much higher power needed in these higher frequency bands. The growing number of filters now needed in devices means that they generate a lot of heat and their lifespan can be compromised if they do not have the requisite thermal performance. Similarly, the co-existence with Wi-Fi, although not new to the industry, also becomes more complex when transitioning to higher frequencies, notably with the move to the ultra-wide bands of Wi-Fi 6 and Wi-Fi 6e. Again, ultraSAW and ultraBAW filters have better inherent thermal efficiency thanks to their piezoelectric nature, as opposed to alternative technologies using micromechanical designs.

Figure 3: Filter Technologies Extending Thermal Performance and Frequency Support

The shift to 5G has stimulated a growing need for higher performance filters, meaning that BAW looks to be the most likely beneficiary. However, with more competition expected from the introduction of new players and filter technologies, the expanding filter market is far from settled. Those that can create an end-to-end design will win out in terms of performance, cost, and therefore, industry support. Ideally, all 5G filter technologies not only have to minimize the inherent complexity in the RF, but also have a desire to expand their addressable markets and push toward a greater level of democratization. Such an approach will generate greater economies of scale, which will allow for better price points.

In turn, the ultimate goal of widespread use of a technology will ensure that many other use cases and 5G applications can be addressed. Such a strategy will offer the industry better filter solutions versus those technologies that are focused on a specific part of the market or application, which will again help reduce overall costs.

The post Filter technology selection key to RFFE performance in high 5G frequencies (Analyst Angle) appeared first on RCR Wireless News.