Huawei recently held its Win-Win Innovation Week in late July 2022 in Shenzhen, China. After a flurry of presentations on a wide range of topics, it is possible to see how the telco landscape will continue to evolve over the next three to five years, as technologies that underpin 5.5G, digital cloud transformation and green Information and Communications Technology (ICT) shape the telco landscape.

5.5G era

Huawei set out a vision in which 5.5G could make a “10 Gbps network experience available everywhere on the planet.” This will be necessary not just for supporting prosumer video and video conferencing experiences, but also enterprise applications. Huawei believes that not only are Industrial Internet of Things (IIoT) applications rolling out across the factory floor, but they are also being turbocharged with Artificial Intelligence (AI). Greater collaboration between robots and people in work environments will impose greater requirements on next-generation industrial field networks.

In March 2022, The 3rd Generation Partnership Project (3GPP) announced the finalization of the Release 17 (R17) standard and highlighted 5.5G as being included in Release 18 (R18), which is scheduled to be finalized by December 2023. The 5.5G upgrades presaged in the 3GPP R18 do offer the mobile telco several advanced capabilities:

- Evolution in 5G New Radio (NR) Multiple Input, Multiple Output (MIMO): Enhancements for downlink/uplink throughput, coverage, lower-power consumption and size/weight.

- Mobility Enhancements: Reducing handover latency from improving layer one- and layer two-based inter-cell mobility.

- AI/Machine Learning (ML) in the end-to-end 5G system: Applying AI/ML to optimize deployment decision-making, network energy saving, Channel State Information (CSI) feedback, beam management and positioning.

- Network energy savings: Defining the network energy consumption model, evaluation methodology, Key Performance Indicators (KPIs) and power consumption reduction techniques under various deployment scenarios, e.g., urban micro in the mid-band (FR1) and Millimeter Wave (mmWave) (FR2) spectrum deployments for beam-based scenarios with massive MIMO.

- Sidelink: Expanding Sidelink to FR1 unlicensed spectrum and FR2 licensed spectrum, enhancing the power saving and co-existence with the previous generation, and using Sidelink to improve positioning. Previously, Sidelink was mainly for Cellular Vehicle-to-Everything (C-V2X), while with 5G-Advanced, it may extend to more devices, including smartphones.

- Enhancements for extended reality (XR): Specifying Radio Access Network (RAN) support for XR-specific Quality of Service (QoS) and KPIs for both system-level and end-user experience. This work depends on the outcome of Release 18 (R18), which has not been finalized.

- Reduced Capability (RedCap) use: RedCap, also known as NR-Light in R17, is aiming to further embrace new use cases, especially requiring low-cost devices and low-energy consumption. Examples are industrial sensors, connected cameras and wearables.

- Precise positioning and time resilience: With 5G-Advanced radio access, the location accuracy can reach centimeter-level for both outdoor and indoor locations without satellite coverage.

Therefore, 5.5G would help merge distributed computing with stored data information and allow very low-latency computation and analysis for a wide range of industrial and commercial applications. ABI Research agrees that this not only removes bottlenecks in computing but can serve to balance out the utilization of data center resources. Wi-Fi 7, fiber-optic deployment, 50G PON and 800G help ensure that the data transmissions underpinning those computing processes are seamless.

Operator cloud transformation

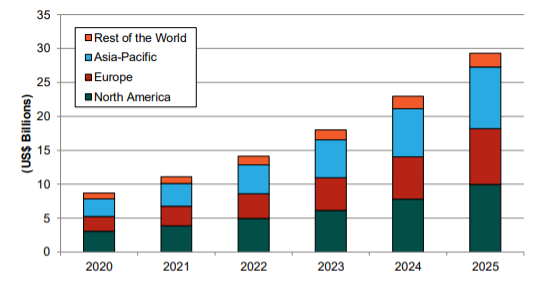

Cloud-based services for end-user customers or to support back-end network operations are becoming a pressing matter for telcos. At the Win-Win event, Huawei advocated that operators need to expand their network boundaries with the cloud and improve network value in the Business-to-Business (B2B) market. ABI Research agrees that telcos need to do a better job of spinning up and commercially launching novel digital services if they are to compete with Over-the-Top (OTT) Internet application providers. To achieve that, they need to build cloud platforms that enable Application Programming Interface (API)-based microservices. These cloud platforms, in turn, require a distributed network that can meet the data security and management requirements of rapidly evolving telco architectures. This activity is translating into investments. ABI Research forecasts that telco cloud revenue will grow from US$11 billion in 2021 to almost US$30 billion in 2025. Huawei reported having helped set up 260 intelligent cloud networks and 40,000 intelligent clouds as of June 2022.

Figure 1. Telco cloud revenue by region, 2020 to 2025

Telcos should always be in the business of providing cutting-edge connectivity solutions to their customers, but given the advances in 5.5G, telcos could harness applications such as cloud computing, big data and edge computing.

While carrier cloud transformation will secure the long-term future of telcos in an increasingly competitive landscape, operators need to evaluate their own core advantages, as well as the market opportunities presented to them. They then need to implement a digital transformation roadmap that factors in data security, system stability and service agility. While some telcos will have the in-house expertise to execute this process, it would be prudent to carefully select a system integrator that is very familiar with the underlying technologies, systems and applications.

Intelligent cloud network 2.0

The cloud is evolving from being an “add-on” to an enterprise’s existing “on-premises” Information Technology (IT) network, to being highly integrated in the enterprise’s IT network. At the event, Huawei announced its intelligent cloud network 2.0 solution, which is an upgrade to its 2020 original solution. Telco service providers have an opportunity to transform from “connection providers” to being “digital service providers.” Distinctive features in Huawei’s Intelligent Cloud Network 2.0 solution include a data center architecture that is complemented by a high-density metro center office router, as well as campus architecture that integrates Wide Area Network (WAN) and Local Area Network (LAN) services. End users can utilize a mobile Virtual Private Network (VPN) solution to maximize connectivity and security that keeps the enterprise’s traffic on the telco’s 5G network.

From ABI Research’s ongoing research, Communication Service Providers (CSPs) must embrace the telco cloud, but they should use a low-commitment strategy. CSPs can obtain all the benefits of disaggregated stacks, but they need to balance the risk of deploying open solutions. Furthermore, the industry must work on “operational effectiveness” for telco cloud deployments. Due to the range of cloud components that may be sourced from a single vendor, or indeed from multiple vendors, solution diversity translates to a wide range of infrastructure that will need to be automated and an effective operations management model will be needed.

Green ICT

The telco industry cannot ignore its responsibilities toward carbon emission goals and green development. Indeed, several operators have been setting out their goals and expectations since the United Nations Climate Change Conference was hosted in Glasgow, United Kingdom, 2021. Some examples include:

- The Vodafone Group declared the group will be carbon neutral by 2030 and have net zero global carbon emissions by 2040.

- Telefónica achieved 50% reduction in Carbon Dioxide (CO2) emissions in 2019 and has brought forward its target of net zero emissions in its four main markets to 2030.

- Bharti Airtel aims to reduce operational emissions by 50% and Scope 3 greenhouse gas emissions by 42% over the next 10 years.

These goals are noble, but telcos are facing challenges on several fronts. For example, data traffic is expected to increase to 5.8 million petabytes by 2024. Efficient data transmission enables reduced energy consumption, which contributes to lower carbon emissions. Networks are the foundation of digital services, so telecommunication operators play a key role in mitigating the adverse impacts that arise from the surge in data consumption by their customers.

Telcos can take major strides toward their green development goals through a number of initiatives:

- At the site and at the telco equipment level, more integrated designs and innovative materials can help migrate sites fully outdoors, reducing the need for air conditioning, improving the energy consumption profile of telco equipment, and finally integrating renewables into the energy supply.

- In cross-site coordination and networking, a simplified network architecture and improved forwarding efficiency can maximize energy efficiency and make networks all-optical, simplified and intelligent. The swap-out of twisted copper cable not only increases data throughput, but also reduces energy consumption by 80%.

- Operations & Maintenance (O&M) are essential to improving energy efficiency over time. New O&M and energy-saving policies need to be easily developed and rapidly disseminated. Energy efficiency indicators and baselines are essential to this process. Huawei reported that it has contributed to the benchmarking process in a number of telco domains. A Network Carbon Intensity (NCIe) energy-efficiency indicator proposed by Huawei was approved by ITU-T SG5 and is now in the process of public consultation. The vendor has also developed an Operator Data Storage Power Index.

Summary and conclusions

Telcos cannot stand still. Many of the telco business models of just 5 to 10 years ago have been commoditized. Telcos must keep innovating to demonstrate their value to their customers—consumers, businesse and enterprises. Digital services are evolving from voice communications, messaging and web browsing, to integrated video streaming and collaborative applications, such as digital whiteboards and group-prepared presentations and media experiences. In the industrial sector, sensors, AI, robotics and asset tracking are being integrated into personnel work processes. Telcos have an opportunity to be not just the data pipe for these applications, but invaluable to the experience. Huawei’s Win-Win event demonstrated how 5.5G, digital cloud transformation and green ICT can help telcos achieve their commercial goals and complement each other.

The post Does Huawei’s event set out a blueprint for future telco success? (Analyst Angle) appeared first on RCR Wireless News.