Big news over the weekend for the wireless communications industry, as T-Mobile and Sprint announce a decision to merge — but essentially T-Mobile is buying Sprint. The announcement came just before earnings calls for both companies and was amplified by joint CEOs taking to YouTube and social media channels to share the news and push the overall message of a bigger and better company leading the charge with 5G. A few details that Compass Intelligence has gathered are shared below:

- Deal valued at $26.5B, and will create a combined company valued at $146B

- The T-Mobile branding remains, no word on what happens to the Sprint branding and sub-brands, No word on what happens to Sprint Wireline business

- John Legere remains as CEO of the joined companies, with Sprint CEO Marcelo Claure serving on the board of directors, and Mike Siervert takes over as President

- The main headquarters will remain in Bellevue, Washington with the Sprint campus acting as a secondary headquarters

- The new company will take executives from both companies to lead the charge and no word on staff changes. But in a memo to T-Mobile employees, Legere wrote, “We’ll still be called T-Mobile, we’ll still be magenta, I’ll still be your leader, and we’ll continue to be customer obsessed!”

- Softbank gets 27% shares w/ Deutsche Telekom holding 42% controlling voting and the board

- Deal is pending regulatory approvals (FCC, DoJ, FTC) but this is expecting to close the 1H of 2019

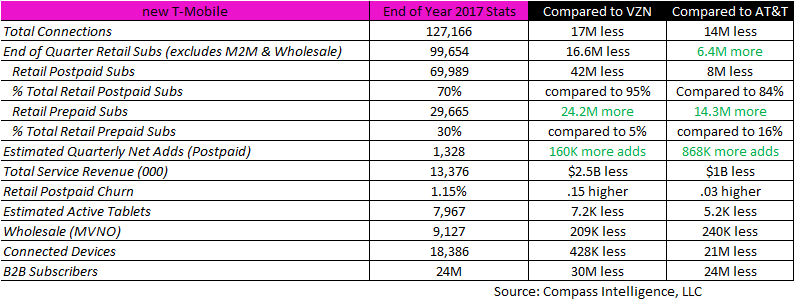

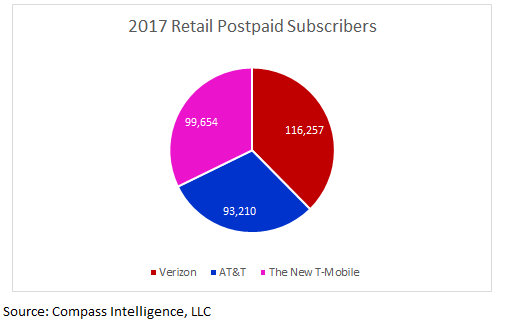

Based on Compass Intelligence tracker research, if we look at the end of 2017 numbers and stats we collect and forecast alone, this will get T-Mobile to a combined 127M in connections which is 17M less than Verizon and 14M less than AT&T. What is substantial for the combined company is this…

- The NEW T-Mobile will shine in overall retail subscriber adds, having added 6.4M more than AT&T in 2017 alone.

- The NEW T-Mobile will dominate prepaid, maintaining about 30% of their overall retail subscriber base as prepaid customers and an estimated 24.2M more than Verizon and 14.3M more than AT&T.

- More work will need to be focused on two areas: (1) B2B —- The combined company is estimated to have around 24M B2B subscribers, which is 30M less than Verizon and 24M less than AT&T (2) M2M and IoT Connections. Compared to AT&T, the new T-Mobile is extremely behind but only 428K connections behind Verizon.

From a 2017 revenue perspective, overall revenue is estimated to be about $1B less than AT&T and $2.5B less than Verizon. This new energy and push to take customers away from Verizon and AT&T will be invigorated with the new entity. Compass Intelligence expects T-Mobile to place a heavy bet on pushing up the SMB market to take market share away on the B2B wireless side and will continue to sway consumers to switch as the combined entity will have a larger footprint for the Un-Carrier strategy that has been hugely successful in the consumer sector. Some of the positive things the new T-Mobile can take from Sprint might include their go-to-market strategy on the B2B side and vertical segmentation expertise, as well as leveraging spectrum assets to lead in the industry. Also, Sprint has a legacy knowledge base in prepaid and MVNO brands, public sector (public safety), and also youth and underserved consumers.

The post Analyst Angle: The new T-Mobile — winners in retail postpaid ads, prepaid market share; needs work in B2B and IoT appeared first on RCR Wireless News.