With the announcements by the Korean mobile service providers and AT&T in the US, turning up 5G service in late 2018, this might be a good time to pause and reexamine the road to 5G – how we got to this point, and where 5G is going in the future. There have been many twists and turns on the way, and I am sure there will be many more. A few of the twists we have recently seen discussed in the media revolves around the definition of 5G. In this article, the primary focus are the packet core and the RAN, and I will discuss 5G based on the 3GPP specifications.

5G vision and milestones to date

3GPP has defined a set of 5G standards to address a vision of a network to meet the needs of four categories of use cases: (1) Extreme Mobile Broadband, often referred to as enhanced mobile broadband (eMBB); (2) Massive Machine Type Communications (mMTC); (3) Ultra-reliable Machine-Type Communications (uMTC), often referred to as ultra-reliable and low-latency communications (URLLC); and (4) Fixed Wireless Access (FWA).

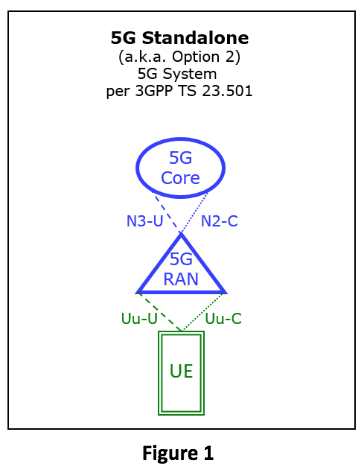

Originally, 5G was planned to launch globally in 2020. The 3GPP technical specification that has evolved to describe a 5G System is 3GPP TS 23.501, “System Architecture for the 5G System, Stage 2.” It defines a 5G system that contains three elements:

- 5G New Radio (5G NR or NR)

- 5G Core Network (5GC)

- User Equipment (UE)

The 5G System has come to be known as 5G Standalone or Option 2 for a 5G network architecture (Figure 1). In addition, a wireless system must work over certain spectrum and a 5G spectrum has been defined by 3GPP as well. 5G frequency bands for UEs are identified in two specifications: frequency range 1 in 3GPP TS 38.101-1 applying to frequencies below 6 GHz, and frequency range 2 in 3GPP TS 38.101-2 for millimeter wave (mmWave) frequencies.

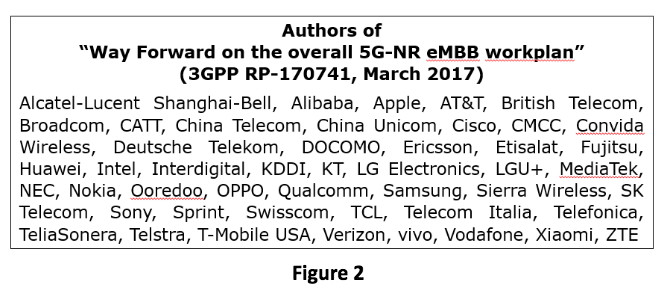

In 2016, many service providers and vendors in the ecosystem for mobile networks realized that the insatiable appetite for mobile broadband data was soon going to catch up with the networks. Plans were drafted for accelerating 5G for launches in 2019 for the eMBB business case. Thanks to Qualcomm’s Lorenzo Casaccia’s blog, an historic milestone in the progress of the 5G standards process was preserved. By March of 2017, a consortium of 45 players (Figure 2) in the mobile network ecosystem came together to propose a work plan to accelerate the 5G standardization process.

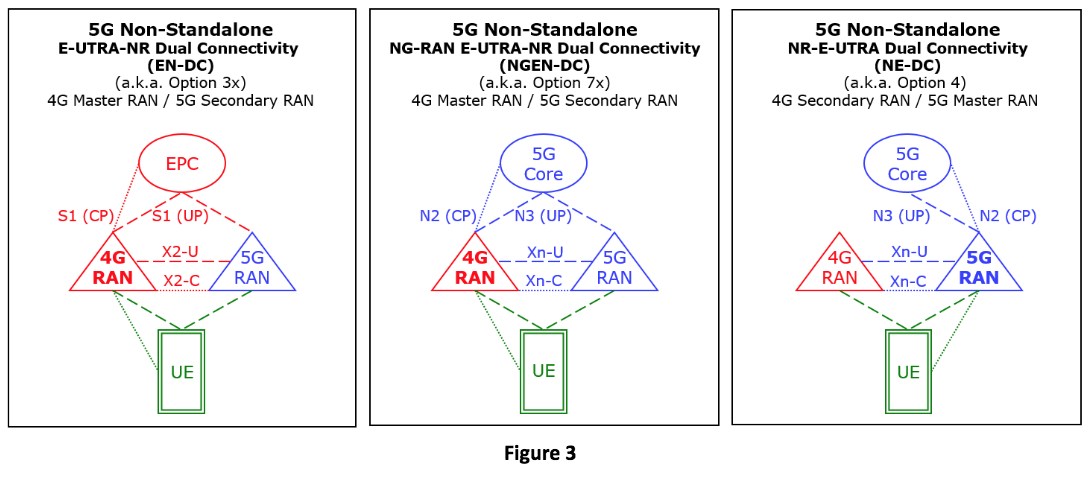

As a result, plans were put in place to complete a specification for what has become known as 5G Non-Standalone (NSA) network architecture by December 2017 by leveraging the 4G Evolved Packet Core (EPC) and not using the 5G Core. 3GPP successfully met this goal in specification 3GPP TS 37.340 relying on the concept of Multi-RAT Dual Connectivity (MR-DC). MR-DC requires that a UE connect simultaneously to two radio access networks (RANs), in this case, a 4G base station and a 5G base station. One RAN acts as the master base station and the other as the secondary base station. The two must be able to communicate with each other. In other words, everywhere you want to add a 5G NR, there must be an associated 4G base station, an eNodeB.

Twist or turn to 5G?

The industry coalesced around the 5G NSA E-UTRA-NR Dual Connectivity (EN-DC) architecture as shown in Figure 3 for early deployments of 5G in 2019. As it turns out, MR-DC is a way to deliver more bandwidth by combining the capacity of the 4G RAN and the 5G RAN and balancing the load when necessary. To take advantage of EN-DC, the EPC needs to upgrade to a control and user plane separation (CUPS) architecture to handle 5G traffic. This is outlined in the 3GPP TS 23.214 specification. To migrate to the 5G Core, the standards have evolved. The December 2018 version of the MR-DC specifications, the Option 7 family and the Option 4 family, were added. The Option versions most likely to be used from the respective families are Option 3x, Option 7x, and Option 4.

Now service providers will have several options for migrating to 5G Standalone (a.k.a. Option 2). Besides competitive pressures, factors that will determine the migration plan for each vendor will be based on the geographic coverage of 5G RAN, the penetration rate of 5G UEs, and the need to address business cases beyond eMBB and FWA. To date, most service providers have selected EN-DC (Option 3x), choosing to leverage their EPC to address the eMBB use case.

5G core is key to achieving the 5G vision

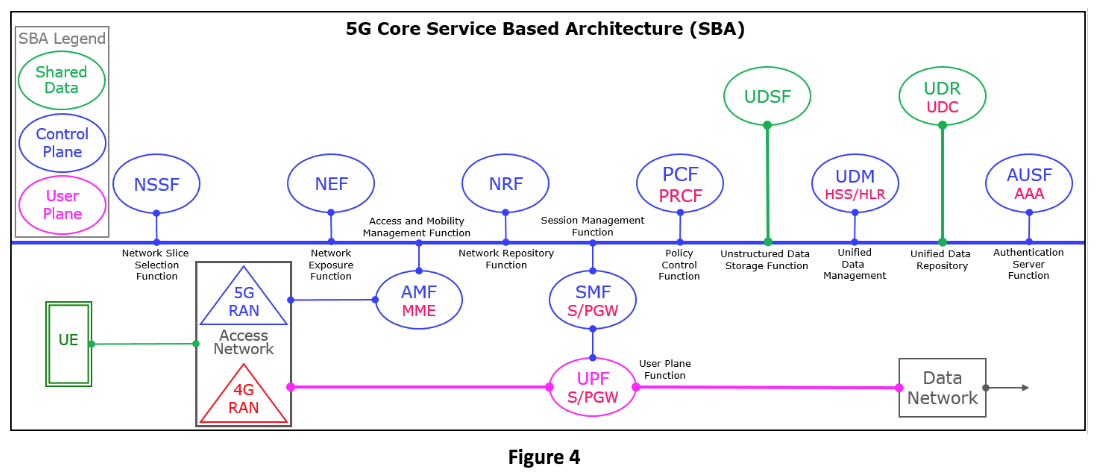

The 5G Core (Figure 4) is designed to be a service-based architecture (SBA) to provide a resilient, efficient, and flexible network to meet the requirements of all of the 5G uses cases (eMBB, mMTC, uMTC/URLLC, and FWA). The SBA is designed to meet these needs with cloud-native and stateless virtual network functions (VNFs) and a shared data layer, enabling–among other things–network slicing with micro services to provide unique services to vertical industry segments. With CUPS, multi-edge computing (MEC) is enabled, allowing for the distribution of the user plane, moving it as close to the edge as necessary for low latency requirements.

3GPP release 16 will finalize many of these features beyond the eMBB requirements in 2019, in time to prepare for 3GPP’s final submission to the International Telecommunications Union’s IMT-2020 (International Mobile Telecommunication) vision for next-generation wireless networks.

Path to the 5G vsion

So, what is 5G? At a minimum, 5G can be UE devices (e.g., 5G hotspot or 5G smartphone) and an access network (e.g., 5G NR) that utilizes the defined 5G spectrum and is defined by 3GPP that leverages the EPC. Technically, the network would be described as a 5G NSA EN-DC network. These networks can address the eMBB and FWA use case and meet the needs of networks requiring lower latency with a distributed user plane (EPCs that have been upgraded with CUPS).

In order to meet the other uses cases (mMTC and uMTC/URLLC), service providers would need to migrate the EPC to the 5G Core. They would have the choice of moving to 5G NSA NGEN-DC, 5G NSA NE-DC, or 5G Standalone. To meet the 5G vision, a 5G System would be required with 5G NR, 5G Core, and UE devices utilizing 5G spectrum.

At the other end of the spectrum of the true 5G vision, one might ask if a complete end-to-end, cloud-native network, including the RAN, with thousands of MEC nodes is feasible. Will it play out in practice? The answer is yes, but it will take time for service providers dealing with legacy networks. However, with the opportunity of a greenfield deployment, some service providers will be able to meet the vision sooner rather than later, for example, Rakuten in Japan.

Predictions for 5G deployments

The timing of 5G deployments over the next five years is a hot topic we are watching. Following are some highlights from the latest Dell’Oro Group Five-Year Forecast reports for Mobile Radio Access Network, Wireless Packet Core, and 5G:

- The projected five-year compounded annual revenue growth rate for the Wireless Packet Core (WPC) market is 3% (2018-2023).

- Initial 5G NR network launches are being implemented with 5G NSA architectures that utilize the 4G EPC; therefore, we have pushed out by one year (from 2019 to 2020) our expectation of when we will see the first commercial deployments of 5G Core.

- WPC revenue growth is expected to continue during the next five years, primarily due to subscriber growth, subscriber migration to VoLTE, and increasing data usage per subscriber. Other factors contributing to growth are the upgrade of EPC to a CUPS architecture to handle 5G traffic and Internet of Things.

- The robust demand for 5G NR will propel the cumulative worldwide RAN market to nearly $160 B over the next five years.

- The sub-6 GHz spectrum is expected to drive the lion’s share of the RAN capex.

The post The twisted road to 5G (Analyst Angle) appeared first on RCR Wireless News.