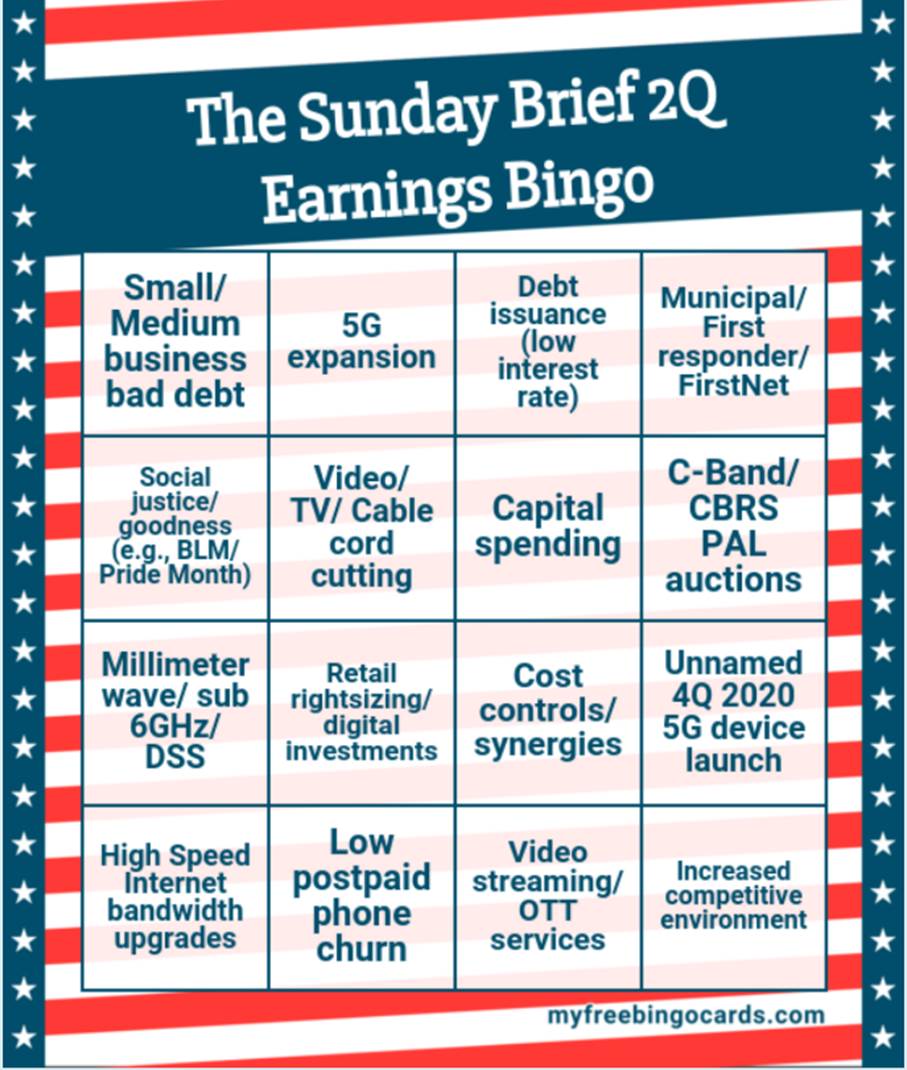

Quarter-end greetings from Houston and Lake Norman. We will be continuing this week’s Buzzword Bingo edition as we preview second quarter earnings.

Quarter-end greetings from Houston and Lake Norman. We will be continuing this week’s Buzzword Bingo edition as we preview second quarter earnings.

As a reminder, in last week’s Sunday Brief (here), we discussed a series of events impacting T-Mobile (including the naming of their new CFO, Peter Osvaldik). We also discussed the swift changes evolving as they shape the T-Mobile Business unit, and also the finalization of the Boost divestiture to Dish (which will occur this Wednesday). We touch on this week’s Softbank share issuance in the market analysis section below.

Next, we went into detail on a very insightful analyst conference appearance by AT&T CFO John Stephens. As we indicated, John clearly painted a picture of a company dealing with a series of COVID-19 headwinds and tailwinds (link at the end of this week’s Brief). We also noted that one of the accelerations that will impact AT&T as businesses relocate and downsize is the movement from remaining AT&T copper/DSL to other alternatives. This has largely been underway for the last 10-12 years, but increased office relocations/ downsizings might be a catalyst for DSL disconnections, particularly with small business customers. Our key 2Q metric for AT&T, despite the launch of HBO Max, is residential fiber penetration. If they cannot clearly demonstrate the ability to grow residential market share against cable with a promotional $40/ month for the first year offer (which they have had in market for the entire quarter) in a COVID environment, then there are much deeper issues for new CEO John Stankey to resolve.

This week, our attention turns to Verizon and cable companies. This is a good combination on many fronts as both will benefit from Work-From-Home/ Stay-at-Home (WFH/SAH) trends, but both also have exposure to small/medium business closures/ bad debt. Comcast and Charter are also Verizon MVNO customers, and likely bidders in the upcoming CBRS Preferred Access License (PAL) auction.

While Verizon has a broad nationwide network, they also have local asset exposure in the Northeast (a company-specific risk, in our view). As populations disperse (at least temporarily) and associated moving activity increases, Verizon’s share of new legacy FiOS decisions could decrease. If only the 5G Home Fixed Wireless Product had been ready earlier, or, in the words of the Verizon Consumer Group CEO Ronan Dunne at a May Bernstein Strategic Decisions Conference “If I’d had the opportunity to sell 5G Home in the last 12 weeks, I would have made out like a bandit.”

There is a lot more discussion of both cable and Verizon below. But first, a look at market valuation changes.

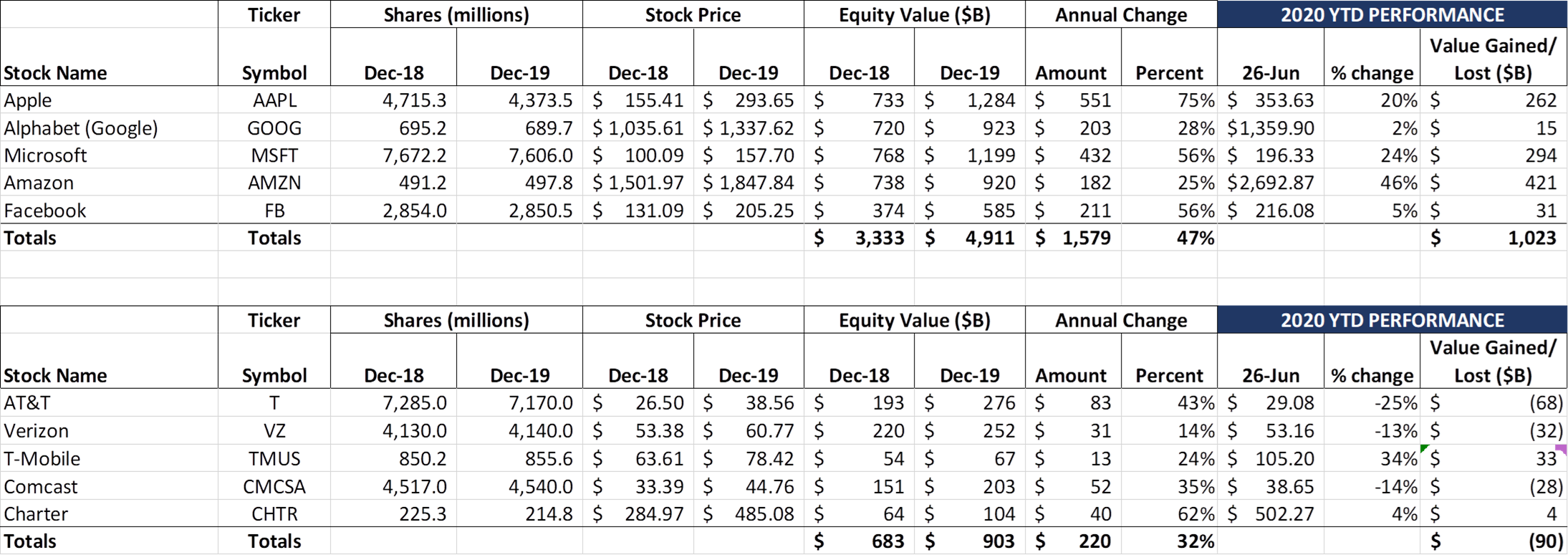

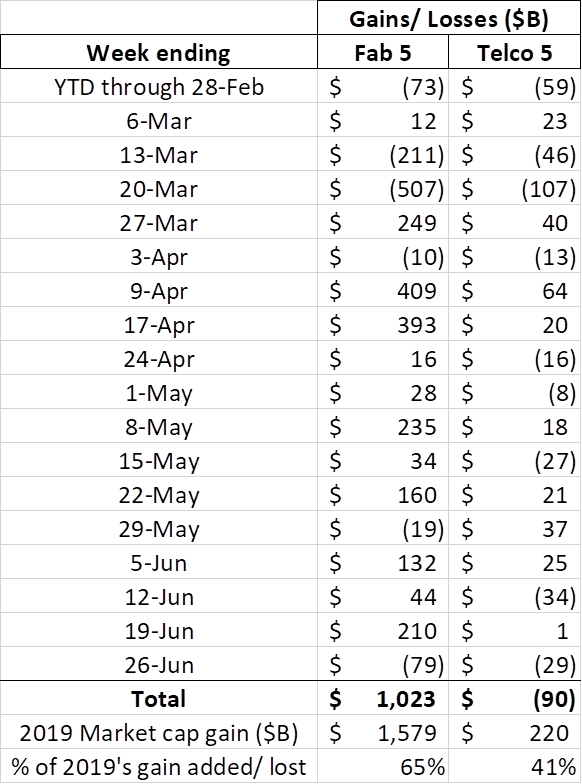

While there were a lot of headlines about the sources of this week’s market selloff (stoking the COVID-19 hysteria embers), there’s a high likelihood that the recent price pressure related to significant quarterly gains already experienced by investors. As the weekly change chart shows, the Fab 5 went from a $540 billion YTD capitalization loss (the sum of the first six weekly change numbers) to over a $1 trillion gain…. in 12 weeks. No doubt, increases in confirmed COVID-19 cases and ICU occupancy matters, and the Fed’s instruction to financial institutions to hold on buybacks and dividend increases raised eyebrows, but a lot of the losses we saw last week and will likely see through Tuesday is due to fund window dressing.

While there were a lot of headlines about the sources of this week’s market selloff (stoking the COVID-19 hysteria embers), there’s a high likelihood that the recent price pressure related to significant quarterly gains already experienced by investors. As the weekly change chart shows, the Fab 5 went from a $540 billion YTD capitalization loss (the sum of the first six weekly change numbers) to over a $1 trillion gain…. in 12 weeks. No doubt, increases in confirmed COVID-19 cases and ICU occupancy matters, and the Fed’s instruction to financial institutions to hold on buybacks and dividend increases raised eyebrows, but a lot of the losses we saw last week and will likely see through Tuesday is due to fund window dressing.

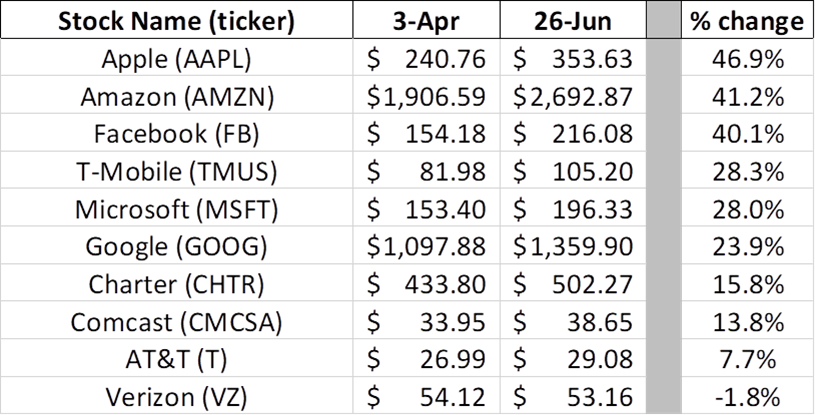

To add additional context, here are the Fab 5 and the Telco Top 5 closing share prices (and period % change) from April 3rd and June 26th (12 weeks):

There is no common thread between the top five performers – Apple is neither an enterprise cloud provider (large tailwind), nor in the grocery business, nor highly dependent on advertising revenues. Amazon has AWS, Whole Foods, but minimal advertising revenues. T-Mobile USA, by definition, has no global downside (or upside), with the possible exception of some international roaming revenues. And both Amazon and T-Mobile had higher share prices on April 3 than at the beginning of the year – not so for the others. Two pay small dividends, and three do not. A common theme is elusive (except for the fact that their corporate HQ locations are all on the West Coast).

What also does not make sense is the relative weakness of Verizon. We will discuss more below, but they have a decent balance sheet, no theme parks, no content production delays, no theater disputes, less than average international revenue exposure, no satellite revenue declines, and a rock-solid wireless network made up of generally higher credit quality residential and enterprise customers. They have partnerships with Disney+, Amazon AWS and YouTube TV. No one doubts that they operate as an essential service provider. Yet the stock is behaving more like one of their predecessor companies (NYNEX) than as a global telecommunications leader. More on why this is a head-scratcher below.

Before leaving the market analysis, two additional notes:

- Microsoft announced that they were acquiring Massachusetts-based IoT security company CyberX for an undisclosed amount. ZDNet does an excellent job summarizing the transaction here. Another strong portfolio addition (see our previous Brief titled “Is Microsoft the New Ericsson?” here for additional insights).

- Microsoft also announced on Friday that they would be closing all retail stores (83 total) and taking a $450 million charge in 2Q. More details here (announcement) and here (CNBC). We were equally as surprised that Microsoft stores actually existed.

- It appears that the Softbank sale of T-Mobile USA (TMUS) stock went off without a hitch (full description of the transaction from this SEC filing – Braxton Carter, Peter Osvaldik and many other T-Mobile Investor Relations and Treasury personnel were busy!). Based on recent TMUS volumes (nearly 171 million shares over the last four trading days), the placement of shares at $103 went off very smoothly. No small feat, and Deutsche Telekom gains full control of TMUS in the process. Softbank retreats from the US with a gain, and the promise for more value creation when T-Mobile’s shares reach $150.

Bottom line: We will likely not see another $1.5 trillion quarterly gain across the Fab 5 (or any other five individual stocks) in our lifetimes. Thanks to the pandemic, the strongest got stronger, due to ample liquidity and company-specific competitive advantages. Next up: A post-election mega deal that leverages the price appreciation of one (or more) of the Fab 5.

2Q earnings preview – Buzzword bingo (Part 2)

As we discussed above, this quarter’s earnings are going to contain a mix of company-specific as well as COVID-19 information. Here are a few trends that will impact both the cable companies and Verizon:

- Wireless gross additions will decelerate thanks to store closures and significantly reduced advertising. The percentage impact on cable will likely be much less than Verizon (could even be flat as existing Comcast and Charter customers look to economize single and two-line spending), but less activity and marketing spend will lead to fewer gross additions.

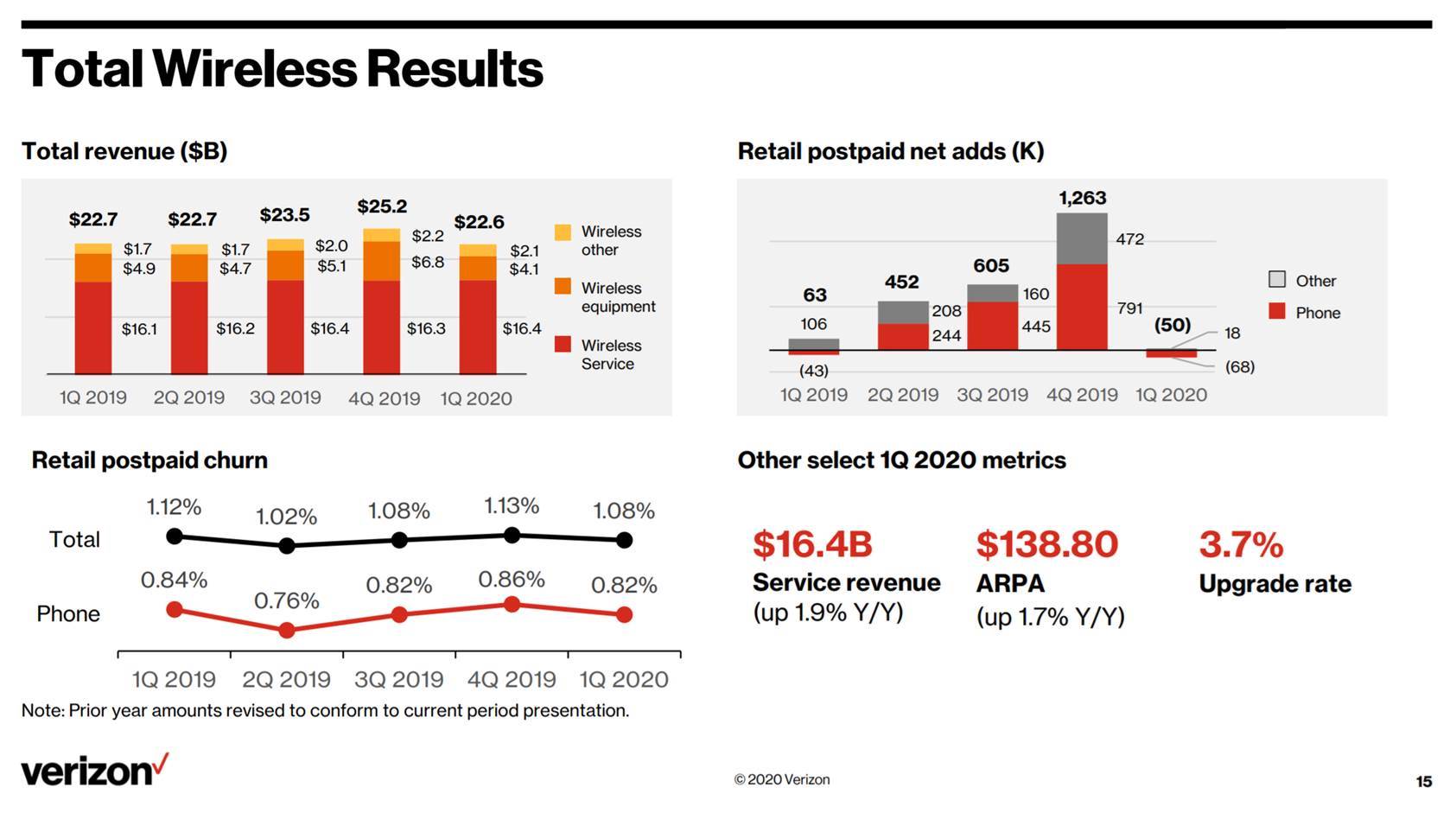

- Wireless revenues per user (and account, in the case of Verizon), will rise. Based on disclosures made at various conferences, it’s clear that increased data needs drove some wireless service upgrades in the quarter. It’s unclear to what extent they were offset by downgrades due to business closures or immediate economizing efforts. Our guess is that the growth rate for both Verizon and the cable companies will surprise. Verizon’s wireless “on a page” Q1 summary is as follows:

- Thanks to the impact of the Paycheck Protection Plan, increased unemployment benefits, and other government relief efforts, bad debt potential for both small businesses and some consumers appears to have been postponed. In Q1, each of the cable and telecommunications companies indicated that they would have a clearer picture by the next earnings release. We think the view will only be marginally clearer by late July/ August, and that the real impact will be felt after the increased unemployment benefit ends in July. Hotels, airlines, retailers, theaters, entertainment/ sports venues and dine-in dependent restaurants are clearly at risk, even more so for companies with high Northeast exposure.

Cable High Speed Internet share of net additions will again exceed 100%, as Comcast and Charter (and Cox and others) continue to take share from those neighborhoods and communities where FiOS was not deployed or where AT&T has not yet invested (as the Houston chart from last week’s column showed, AT&T has a ways to go to complete their fiber vision – we do not believe that the percentages on that map are unique to Houston). While Verizon halted in-home tech visits during the COVID-19 pandemic (cable companies generally limited but did not stop in most FiOS markets), they did resume in June on a very limited basis and our view is that FiOS (but not legacy DSL) churn will continue to be low.

- Cable advertising will be down 8-10% or more compared to 2Q 2019 (flat qtr/qtr for Charter, and a slight qtr/qtr decline for Comcast). This is a high-cash flow generator for Comcast and Charter, and it’s likely that advertising yields also declined. AT&T lost the most when March Madness (NCAA playoffs) was cancelled; other sports league activity (NBA, NHL, MLB) has been delayed.

- Despite the headwinds, wireless capital spending trends will continue to grow as Verizon focuses on fiber densification (which enables 5G Home) and cable continues to reduce spending relative to revenues (see Charter’s historical quarterly trends by NCTA category nearby).

7. The focus areas for cable are as follows:

- CBRS participation and deployment strategy. Our view is that CBRS will be an important strategic asset to the cable industry and that they will more quickly to reduce Verizon CBRS costs wherever possible. Cable will also continue to upgrade their existing Wi-Fi infrastructure (CableWifi SSID) to Wi-Fi 6. In this recent analyst interview (the same Credit Suisse conference referenced earlier), Charter CFO Chris Winfrey seemed to imply that their company would be more likely to be a tower provider to Verizon as opposed to a full-fledged, facility-based competitor.

- Impact of cord-cutting as many homes economize. Our view is that the cord-cutting trend flattened in the second quarter, there was no “rush for the exits,” but that cord-cutting will continue in the second half of the year.

- High Speed Internet ARPU growth. Comcast’s HSI monthly revenue per average customer was ~ $63 in the first quarter, up from ~$61 in Q4 and ~$61 in Q2 2019. This is due to mix shifts (revenue goes up for High Speed Internet when it’s the only product), as well as COVID-related bandwidth upgrades. Our best guess is that we will see $64-65 revenue per average HSI customer in 2Q on moderate net additions. It’s entirely possible that Charter could exceed their HSI expectations as we noted in our February 2nd “Why is Tom Rutledge Smiling?” Brief.

- Impact of small business slowdowns and the overall outlook for their Commercial/ Business services divisions. Bill Stemper (Comcast) and Phil Meeks (Charter until very recently) have led straight-line mid- single to low double-digit annual revenue growth for many years. Many of those customers are shuttering their businesses. Management’s response to the first material business downturn in the last decade will tell a lot about the future of these businesses (our guess is that they will get more aggressive in small business and enterprise).

- Our focus areas for Verizon are as follows:

- Fiber rollout schedule and evidence that the One Fiber strategy is actually working. Verizon gave a progress report Thursday, announcing that they would be rolling out 5G Home services in Houston (going head-to-head against MVNO partner Comcast and the densest areas of AT&T’s residential fiber deployment), as well as providing updates on their Dearborn, MI trials with equipment partner Pivotal software (announcement link above and Light Reading article here). Understanding that the primary purpose of the fiber rollouts is densification, it would be very interesting to understand their success definition in the highly competitive “in the I-610 loop” Houston market. As a reminder, here is the slide shared by Verizon in February defining how One Fiber would create value:

- Enterprise cloud computing connectivity gains (this would be an upside as we believe that fiber and other connectivity is largely going to competitors such as Zayo, Comcast, FirstLight and other regional fiber providers). Little has been said about Verizon’s relationship with AWS since the December 3rd, 2019 announcement – understanding the nature of their relationship would help investors understand competitiveness vs. AT&T.

- 5G devices as a percentage of total upgrades and total 5G base as a percentage of all smartphone users. Given the relatively high price of 5G devices and retail store closures, our estimate is that less than 10% of the total Verizon base owns a 5G device and is actively using 5G services today. COVID-19 elongated the adoption curve, and economic pressures (even with new devices such as the Samsung A71 5G at $600 or $25/ mo may be out of reach for many Android users).

As we indicated earlier, Verizon appears to have a very clear path to deploying fiber-fed wireless services. It does not appear that there’s any sign (at least yet) that they are slowing down. But 5G device adoption is low, and most smartphone screens cannot display resolutions above average 4G speeds (UHD consumed ~ 25 Mbps). That leaves 5G home as the most important non-business case for 5G, and AT&T, CenturyLink, and cable will not take any market share losses lying down. How Verizon positions their service (e.g., uncongested fiber-to-the-pole) will determine whether the fixed wireless business case will succeed.

That’s it for this week. Next week, we are taking a Fourth of July break but will resume the Brief on July 12 with insights on the upcoming Federal infrastructure bill as well as a detailed assessment of the upcoming Apple IoS changes announced at last week’s virtual WWDC (great summary from Ars Technica here).

In the interim, we suggest watching two interviews to understand the macro landscape: 1) AT&T CFO John Stephens’s interview here and 2) Charter CFO Chris Winfrey’s interview here, both from June’s Credit Suisse Virtual Communications Conference. There are many other good ones, but, in our opinion, these two provide the deepest insights.

Thanks for all the referrals – we are signing up new readers every day. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. Also, If you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!

The post The Sunday Brief: 2Q earnings preview–Buzzword bingo (Part 2) appeared first on RCR Wireless News.