Mother’s Day greetings from Georgia and many parts of Missouri. Pictured is our dog, Abby, relaxing after a full-stride run on the farm in Willard, MO. It’s been a packed weekend, and we hope that yours, too, was enjoyed with family and friends.

The last two weeks have been filled with earnings news and some industry developments. After a brief market capitalization analysis, we will cover T-Mobile and Comcast earnings in detail. We will also comment on two important industry developments: 1) The Charter/ Comcast JV announcement on streaming/ OTT video; and 2) T-Mobile’s latest Uncarrier announcement on fixed wireless. Earnings analysis of Charter, Frontier, Consolidated Communications, and Lumen is slated for the May 22 Brief (unless preempted by major news).

The week that was

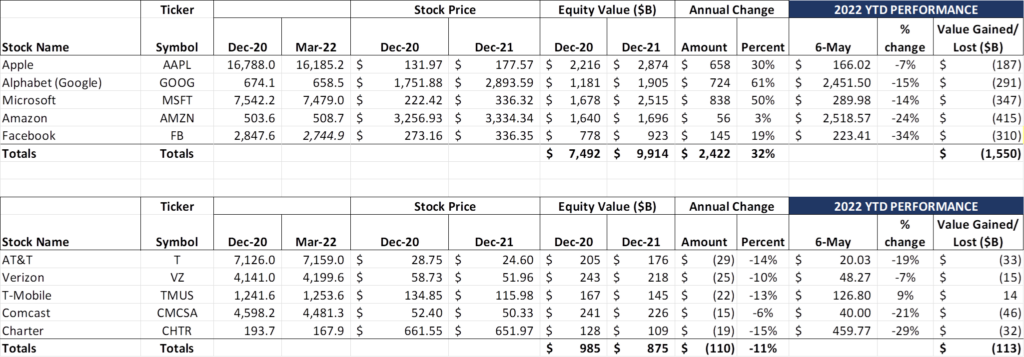

While it may not feel like we had a recovery over the past two weeks, four of the Fab Five have increased their market capitalizations since April 22. Only Amazon (earnings announced on April 28 – package here) weakened over the period. This can be attributed to strong earnings reported in late April as well as a “flight to big cap safety” that occurred during a tumultuous beginning of May.

Enthusiasm for the Telco Top Five was surprisingly tepid given the dividends of Verizon (5.3% yield as of Friday’s closing price), AT&T (5.5%) and Comcast (2.7%). Even with strong earnings (described below) and an aggressive fixed wireless offering announcement last week (also described below), T-Mobile’s stock is basically where it was two weeks ago (down $2 billion on a $159 billion total market cap over the last two weeks), and Magenta and a spin-adjusted AT&T are the only companies in the Telco Top Five that have gained value in 2022. Verizon, however, still posted middle of the pack performance versus their Dow peers (now ranked 17 out of 30 for equity performance).

The hand-wringing about the cable industry continued (Comcast down 21% and Charter down 29% so far in 2022). Specifically, concerns about the source of Q1 broadband weakness are beginning to mount. Is it driven by a sluggish housing market slowing the growth of passings, or by increased fiber competition from AT&T and fixed wireless offerings from T-Mobile and Verizon, or is it simply a reflection of accelerated broadband adoption during COVID in 2020 and 2021? The correct answer is all of the above, but the weighting of these and other reasons will clearly drive terminal value/ price multiple assumptions.

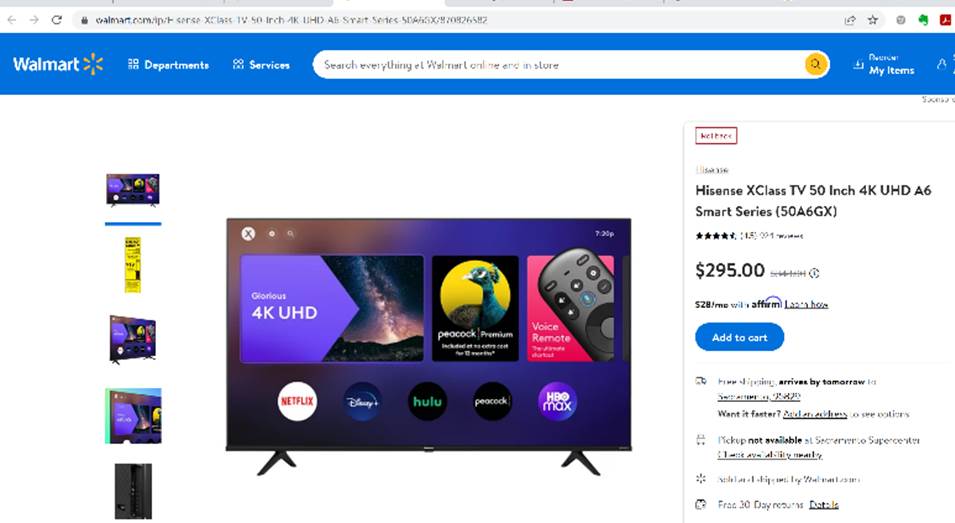

Cable is not standing still, however. Just after the last Brief was published, Charter and Comcast announced the formation of a joint venture focused on the distribution and deployment of the Flex and XClassTV platforms. Comcast will contribute the hardware and software capabilities developed to date (including Xumo, a free streaming service purchased by Comcast in 2020), while Charter will contribute $900 million in funding over several years (a picture of the current XClassTV product marketed through Walmart is shown nearby). Brian Roberts, Comcast’s CEO, highlighted the benefits of the venture in his opening comments on their Q1 earnings conference call:

“This joint venture is a win-win. Consumers will get our proven world-class user and search experiences, simple content navigation and more choice in the streaming marketplace. App developers, retailers and hardware manufacturers will have access to one platform and one set of standards to quickly deploy their offerings across the U.S. And we’ll be able to share in the investment and innovate alongside a partner we know well.”

So, if you were a streaming apps developer, where would this new venture fit relative to Roku or Google or Samsung or Apple? It might be pretty high if it also comes with edge computing support. It also might be very interesting if billing integration was a snap (or even if the application was included in a premium bandwidth bundle). Or maybe attractive if applications developers had low/ no distribution fees.

It makes perfect sense to form a cable JV to create national reach – anything less would have been destined to fail. But this venture will need to create a new level of platform attractiveness compared to Apple, Samsung and Roku, all of whom operate with global scale. We don’t think that cable has a lot of choices with respect to video streaming (absent collectively buying Roku, which has a market capitalization of just over $13 billion as of Friday’s close).

The silver bullet for the JV is the fact that they can create a private connection (content server through the XClassTV) for content. This could allow them to effectively create an edge cache in every home. This cache could significantly reduce the need for backbone capacity and alleviate a lot of network congestion while delivering a superior customer viewing experience (whether on a 60” screen or on a 6” mobile device). We are not experts on how large the cache would need to be, but, if 2 terabytes of externally attached storage can be purchased for $55 on Amazon today, XClassTVs could easily accommodate 5 TB of storage in a couple of years. That’s enough to store entire seasons of previously viewed content securely.

To make the silver bullet a reality (in our opinion, that’s the real “win-win”), they need cooperation from content providers. In the past, security was a concern: simply put, there were too many opportunities for intruders to enter the network. Having in-home experience and the ability to add and change the content in the multi-terabyte cache is unique to cable. It may not be different enough in the end to matter, but there is a competitive advantage with this joint venture.

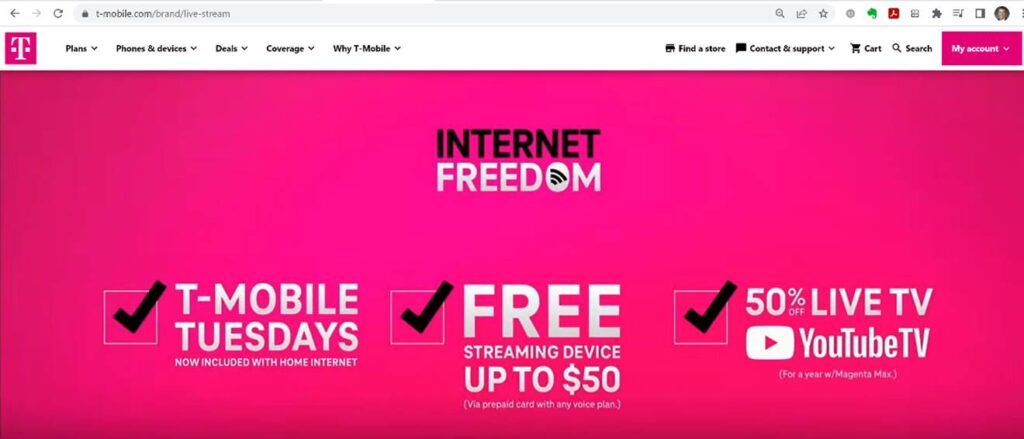

One other important non-earnings development over the past two weeks was T-Mobile’s announcement of an Uncarrier fixed wireless offering (full announcement here). We hinted at this move in our April 10 Brief titled “Broadband and Wireless.” Rather than describe the plan in paragraphs, let’s show the money shot from their video:

For the first time that we can recall, a fixed wireless competitor is offering to buy out cable contracts (up to $500) and provide potential customers with a free router. Both of those are available without a bundling requirement (note that the free streaming device and/or 50% off YouTube TV promotions described in the picture above require either a voice plan or a Magenta Max family plan).

As T-Mobile stated in their announcement, the broadband conversion process is much easier than wireless porting. Customers can actually side-by-side compare cable or fiber to T-Mobile prior to making a long-term commitment (something we did during the early days of T-Mobile’s Home Internet product while living on Lake Norman). There’s no win-back “trigger” seen in the wireless and home telephony worlds (unless cable is monitoring dramatic changes in usage levels at the individual home level – doubtful).

We think that T-Mobile’s fixed wireless service is going to get a bump from this offer. We also think that there is a sizeable (~15% of total homes) segment that is very cost conscious and is willing to tradeoff benefits of fiber and Gig-speed cable for a lower overall cost. We do not think, however, that T-Mobile’s solution as it stands today, will compare favorably to an AT&T 300 Mbps symmetric service that costs $55/ mo (their everyday low price for their lowest fiber tier) or even a promotional rate from one of the many FTTH providers popping up across the country (e.g., Vexus Fiber pricing for Amarillo here).

As we have stated in previous Briefs, the key assumption is that fixed wireless attracts more customers to T-Mobile’s wireless offerings. But if T-Mobile limits the number of fixed wireless users to merely fill excess capacity, doesn’t this limit the growth velocity (more wireless users could eventually result, but isn’t there a temptation to deploy capital?). T-Mobile has gone to great lengths to explain their discipline, but we view any discipline gaps as a vulnerability for the company.

First quarter earnings review—when cable growth slows…

Because we have made a commitment to be brief, our earnings section will focus on the 1-2 most important items from T-Mobile and Comcast’s earnings releases.

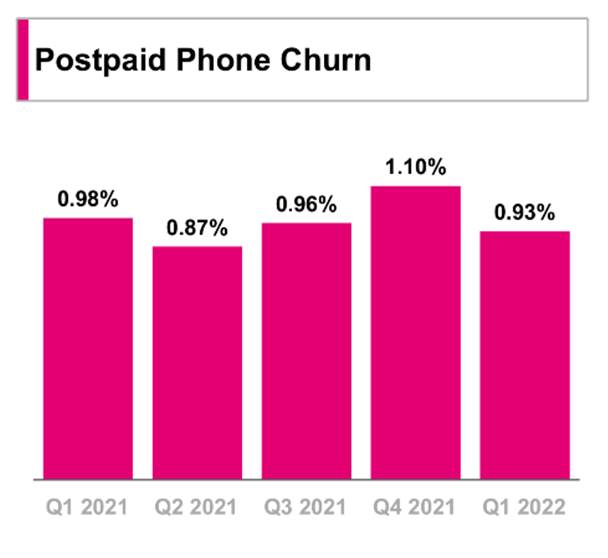

T-Mobile had a terrific quarter where they demonstrated that they can walk (achieve merger synergies) and chew gum (grow wireless postpaid subs and fixed wireless) at the same time. Our key metrics for T-Mobile are postpaid customer churn (see nearby five-quarter trend from T-Mobile’s Investor Factbook) and free cash flow.

The process of turning down towers is an immediate churn trigger for most of the legacy Sprint base. Either service is materially degraded or is altogether unavailable. As Mike Sievert, T-Mobile’s CEO, stated in his opening remarks on the most recent earnings conference call (package here), Sprint has not only turned off nearly all of the CDMA network, but they have also decommissioned about a third of the legacy Sprint sites that were redundant. T-Mobile clearly felt pain from these events – they indicated that postpaid phone net additions would have been closer to 900,000 if legacy Sprint churn had matched legacy Magenta churn. The good thing for T-Mobile is that these comparisons will be a thing of the past by the end of 2022.

The management of the Sprint transition has exceeded our objectives, and we were early in our assessment of the relative ease of base conversion (see our February 2020 assessment here – handset by handset). We thought it would be carefully managed (meaning it could take longer than expected), but that there would be a Sprint legacy churn “spike.” T-Mobile converted Sprint faster and that spike has been a speed bump – a truly remarkable achievement.

Decommissioning savings is the ultimate measure, the final synergy – everything else is an intermediary. To have schedule certainty on the remaining sites within four years of “Day 1” is remarkable. To have enough certainty about the base to raise guidance on 2022 full year postpaid net additions by 300,000 (even though many of those could be standalone Home Internet customers) is also remarkable.

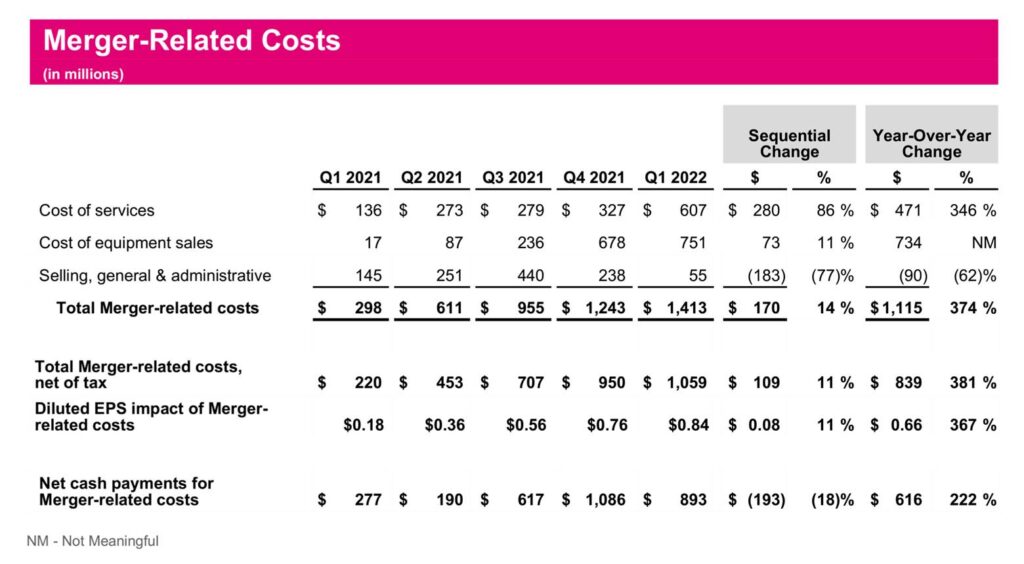

T-Mobile’s free cash flow growth reflects merger costs. Even with their inclusion, it’s the best forward-looking metric. Two schedules from their earnings release paint the picture. First, here’s the merger related costs by type of expense from the Investor Fact Book:

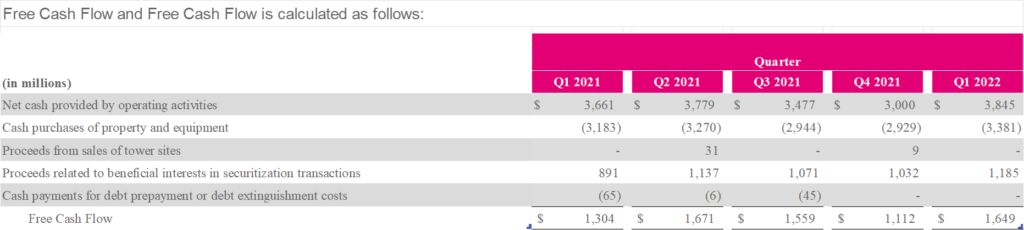

And here’s the FCF trend for the last five quarters from their detailed financial schedules:

The $1.649 billion of free cash flow includes $893 million in net cash payments for merger-related costs. Said another way, once T-Mobile is through the knothole, they are either generating $10+ billion in annual free cash flow (taking all of the newly generated cash to pay down debt, repurchase shares, or increase fiber/backhaul investments), or they are at $8-9 billion in free cash flow because they invested in additional market share growth opportunities (likely in their business segment). Both would be terrific.

It’s hard not to be optimistic about T-Mobile’s future. It’s a bit tougher, however, to be as optimistic about cable given the billions of dollars being spent by fiber competitors and the quickly diminishing value of video as a bundled product (thanks more to YouTube TV and Comcast-funded Hulu Live than anything else).

We titled this brief “When Cable Growth Slows…” because we don’t think that the industry is completely homogeneous. Without a doubt, they (except for Altice) will be working on DOCSIS 4.0 development (through CableLabs), and, from the discussion above, it appears that many of them will be working on a streaming alternative. As we will discuss next week, we think that Charter and Comcast respond to slower growth differently.

For Comcast, the answer appears to be “When cable growth slows, blame the economy and increase competitive analysis.” In case you missed the earnings release and call, there was fret concerning the COVID-adjusted net broadband additions (~180,000). This consumed the post-call analysis (as 2Q tends to be a slower quarter for net additions) and drove Comcast’s stock price down below $40 last week.

The reason why the net additions number is so important is that the cable unit generated 77% of the corporate EBITDA in Q1 (NBC Universal and Sky make up the rest), and more than half of that EBITDA comes from residential broadband. When that engine slows, it’s impossible to rely on another single portion of the business to make up the remainder.

While lengthy, here’s the Comcast Cable President and CEO’s (Dave Watson) reply on competition (emphasis added):

“So we think that the main thing that we’re dealing with right now in this cycle, while there has definitely been an uptick in competitive activity… the main thing in this case is our churn is at record lows. And it has been decreasing churn activity for over a long period of time, and it has continued. So this last quarter, it’s record low quarter for any quarter.

… And with fixed wireless and fiber, we have a real game plan that we’ve had and added to over time, where we’ve segmented the marketplace; we compete at a very granular basis going where there’s new launches and focus on leveraging every product that we have; and most certainly, we’re playing offense with Mobile. So we have great broadband, and it kind of goes towards pricing that when we segment the marketplace, we have granular approaches towards competing and then being able to have multiple tiers of great broadband, and really focus on the strength of our network that is ubiquitous.”

There’s an even lengthier (and more confusing word salad) version to this answer, and you can read it in the transcript here. We greatly admire Dave and the team, but he should have stuck with his initial answer – a low gross add environment is minimizing opportunities (which is even more concerning as 30-year fixed mortgages topped 5.6% last week). Chicago, San Francisco, and New Jersey aren’t the destination choices of movers and homebuilders.

We are not 100% positive, however, that the economy is the sole or even main cause of future weakness. AT&T is rapidly deploying fiber in several of Comcast’s largest markets: Houston, Chicago, Atlanta, Miami, San Francisco, and Los Angeles. We estimate that these markets in particular are receiving a disproportionate level of capital as AT&T accelerates their “fill in” areas and create larger metropolitan operating clusters.

There happens to be a larger inflow of movers into these markets from non-Comcast territories (call it North to South/ West). Comcast mentioned that they are tracking changes in address, but does that cover those who are moving out of a non-Comcast region into Atlanta? Said another way, if there is a move-related disconnect, what’s the re-connection rate (vs AT&T) and when?

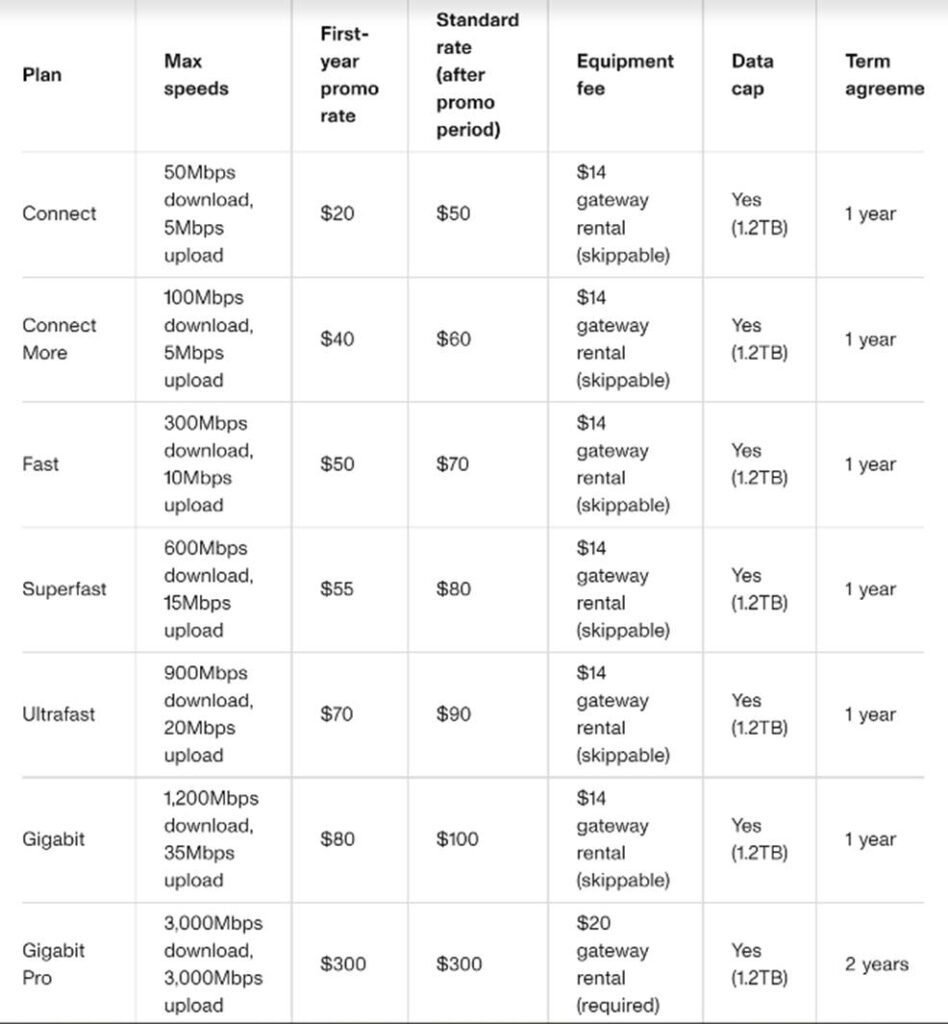

While we are confident that Comcast is segmenting and tracking new entrants, they also have some of the largest spreads between promotional and regular pricing. AT&T’s everyday low pricing strategy offers three simple tiers: $55 for 300 Mbps symmetric, $65 for 500 Mbps symmetric, and $80 for 1 Gbps symmetric. The nearby chart, taken from CNET’s April 2022 review of Comcast’s service offerings) shows Comcast’s promo and standard rates.

The $55 offer is clearly better than Comcast’s $70 standard rate, and the $65 offer is better than either Comcast’s 300/ 10 or 600/15 rates. And AT&T’s 1 Gbps offer includes HBO Max, no data caps and is still $20 less per month than Comcast’s out of contract rate. There’s no doubt that Comcast can counter with matching pricing, but won’t a subsegment of that base at least try AT&T?

We are big believers in Comcast, but history is driving a lot of their thinking with respect to competition. While the interest rate environment could crush some smaller competitors, is AT&T going to halt their march simply because the 10-year Treasury note is now above 3.1%? Or will CenturyLink (“RemainCo”) decide that it’s too hard to build an expansive footprint in Colorado, Washington, and Oregon? We strongly doubt that they are going to slow down at all.

As we suggested in the “Broadband and Wireless” column back on April 10, the best way for Comcast to counter fiber is to go quickly for the 1 Gbps speed mantle. All new Xfinity Mobile family plans (2 lines or more) should get the Gigabit plan for $50/ month with no contracts and no caps. That’s a bold move that makes long-term economic sense and would confine many/ most T-Mobile gains to suburban and rural markets.

There’s so much more to cover, including some very interesting comments concerning competition by Chris Winfrey on the Charter call. However, this is the lengthiest Brief in several years, and we are going to sign off for now. In two weeks, we will attempt to wrap up the earnings picture with detailed looks at the companies mentioned earlier. Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the website). Until then, go Royals, Sporting KC, and Davidson College Baseball!

The post The Sunday Brief: First quarter earnings review—when cable growth slows (Part 1) appeared first on RCR Wireless News.