Small cells can be deployed indoors or outdoors and in licensed, shared or unlicensed spectrum, making them a versatile coverage and capacity solution. However, for Rex Chen, director of business development LitePoint, densifying urban environments that have a high user population is the most obvious use case for small cells.

“In places like metropolitan urban areas […] small cells play a pretty unique role of getting a roll out in the metropolitan urban area [and]play a critical role in making sure that mmWave deployment can really happen to [for]the masses,” he shared with RCR Wireless News.

The second type of location ideal for such deployments, he continued, are communities “with just a few hundred users,” where a macro tower might be “overkill.”

“When operators put in a new network, they have to think about their return, which might take three, five, if not seven years see. [Small cells] lower the capital expenditure initially because [they]are going to be much more economically competitive than a macro cell,” he said.

Chen added that this type of deployment will likely be seen in emerging cellular markets like China and India, where even previous generations of cell coverage is still limited in some communities

Sport complexes, concert halls and other enclosed venues where thousands of people gather at one time are also promising use cases for small cells, which can provide the extra capacity needed during moments of data influx.

And while still in the early stages, there is growing interest in the use of small cells for private networks, according to Peadar Forbes, Director of Radio Platform Development, Analog Devices.

“There is a lot of interest in private networks — mining, ports, manufacturing — and 5G brings a lot of benefits to those use cases. A lot of these use cases will use small cells. In a factory or a small campus […] the natural thing you would do is deploy small cells,” he told RCR.

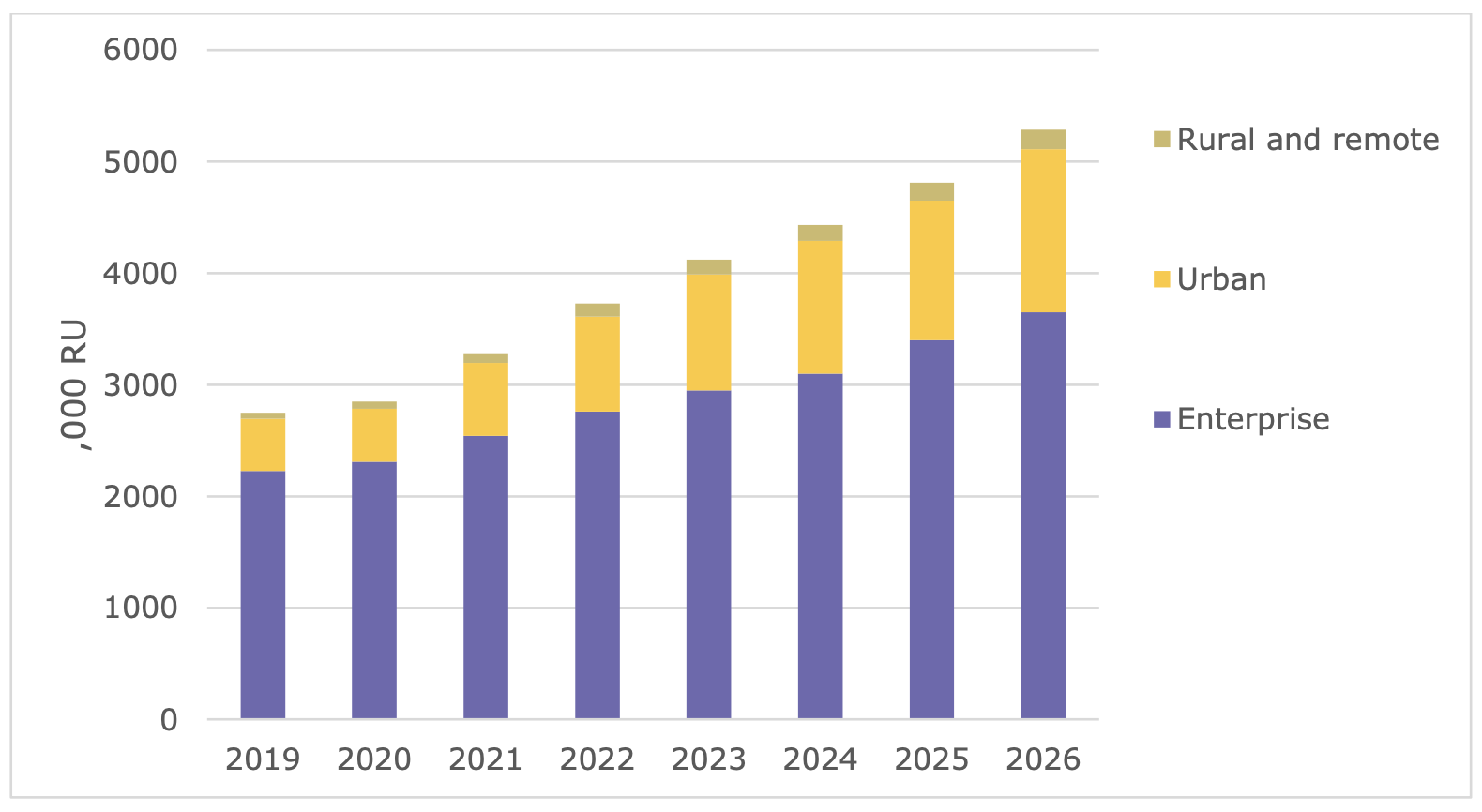

A recent Small Cell Forum report supported this emphasis on both urban densification and in-building for enterprises. The report concluded that when looked at by environment, “the highest CAGR will be in urban outdoor small cells, driven by major densification and smart city projects in large Asian markets, the USA and parts of Europe and Latin America,” but added that “enterprise small cells will remain the largest percentage of unit deployments, accounting for 62% of roll-outs in 2026 and 70% of the total across the period of the report.”

New deployments and upgrades of small cells by environment 2019-26 (by numbers of radio units deployed or upgraded)

Within the enterprise category, retail, government and finance will have the highest small cell demand and deployment numbers until 2021, at which point demand will shift to transport and manufacturing as technologies like 5G, edge computing and AI become more commonplace.

Additionally, it is believed that 5G small cells can be used for cellular vehicle-to-everything (C-V2X) connectivity to enable reliable and speedy communications between vehicles and between cars and infrastructure. Similarly, they can also be attached to traffic or light posts to provide the network coverage and capacity necessary for smart city initiatives, analytics and intelligence.

Small cell deployments in the U.S. market

According to data from Altman Solon Research and Analysis, the U.S. market can be segmented by their current stage of deployment:

- Dense metropolitan cities such as New York, Boston and Chicago are typically the leaders in small cell growth in the U.S. They have had this type of infrastructure deployed for at least four to five years and have established franchise agreements with major carriers.

- Growth locations such as Boulder or Fort Worth, with mid-size population densities often have deployments in a “Central Business District” and have a small cell deployment history of about three to five years. These environments are continuing to evolve and mature.

- Early-stage areas of suburbia, where small cells and outdoor Distributed Antenna Systems (DAS) are proliferating, such as Montgomery County, MD.

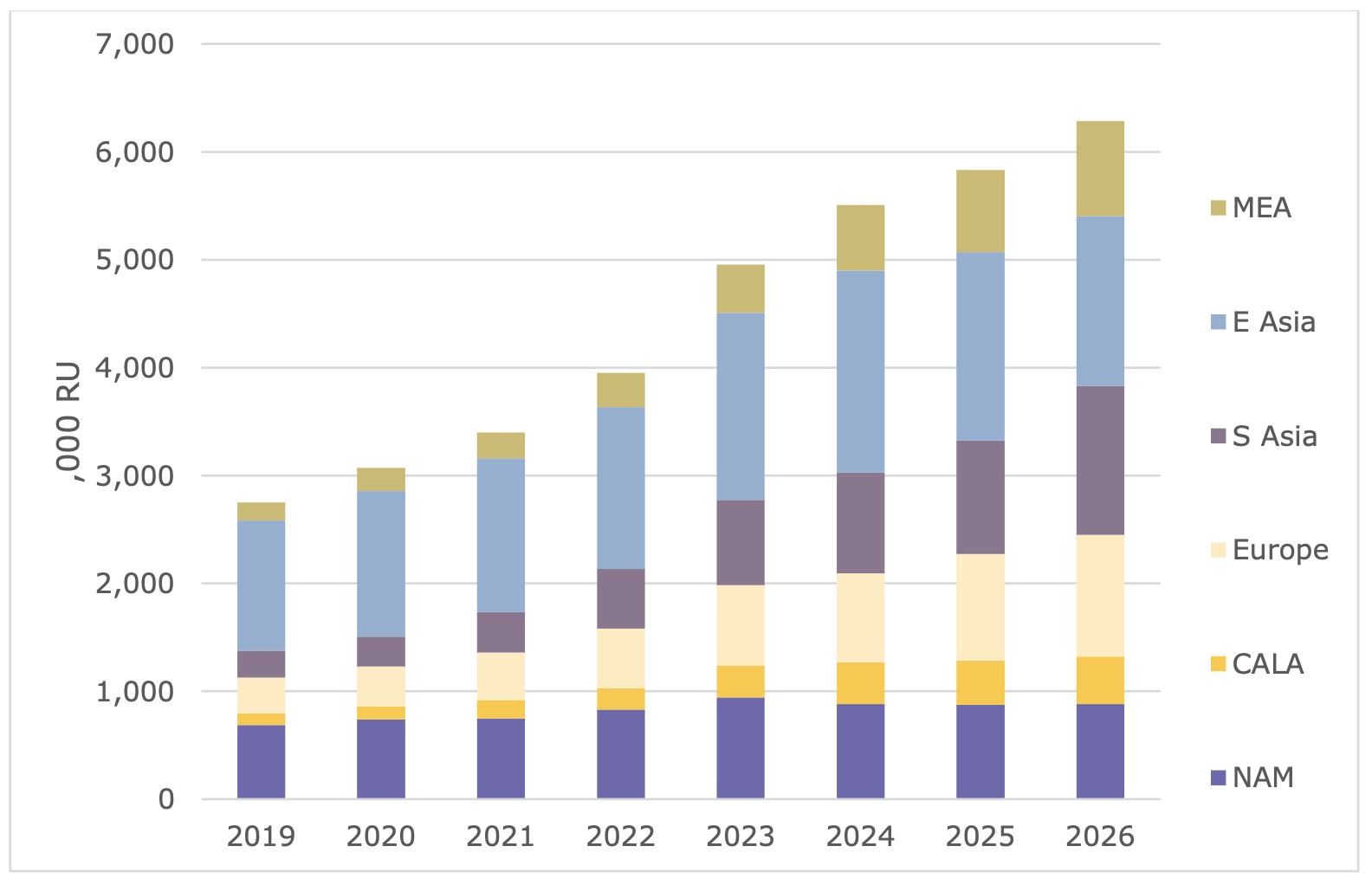

Small cell deployments globally

Regionally, Asia will remain the biggest driver of small cell deployments throughout the period, with Japan and South Korea leading the first phase of densification. However, progress made by the U.S. and China in the last few years was responsible for much of the scale achieved by 2021, according to the SCF.

New deployments and upgrades of small cells by region 2019-26 (by numbers of radio units deployed or upgraded)

As these countries become fully densified in the coming years, other players, such as India and Italy, are expected to emerge as the next pack of deployment leaders.

Due to the Covid-19 pandemic, the SCF report included best- and worst-case scenarios for these deployments, depending on several acceleration/deceleration factors identified by operators; however, a key takeaway regardless of the scenario was that the rising pace of deployments and upgrades to support 5G will be the key driver of small cell acceleration after 2022.

To read more about small cells, check out Is powering small cells the greatest densification challenge?

[1] As a minimum, supporting an industry agreed open fronthaul and midhaul (where relevant) interface between RU, DU and CU. Some will also support other open interfaces and controllers. Open interfaces may include SCF nFAPI or O-RAN

The post What are the top small cell use cases and places? appeared first on RCR Wireless News.