Verizon withdrew future revenue guidance in the face of the ongoing COVID-19 pandemic and posted customer losses that it said were largely due to most of its retail stores being shuttered. However, the network operator still plans to put additional money into network capital expenses this year. Verizon also cut its earnings per share projections for the year, from previous guidance of 2-4% to between -2% to 2%.

Earlier this week, AT&T withdrew all future financial guidance, due to uncertainty around the impacts of COVID-19.

Verizon said it has temporarily closed around 70% of its wireless retail locations. The carrier reported 525,000 retail postpaid net losses, which included 167,000 postpaid smartphone net losses and 307,000 phone net losses. Its retail postpaid churn rate was 1.01%, with retail postpaid phone churn at 0.77%.

Total revenues for wireless products and services was essentially flat, seeing just a 0.5% decrease year-over-year to $22.6 billion. While wireless service revenue grew in both the consumer and business segments, Verizon said, that growth was countered by sharp reductions in equipment revenue because in-store customer engagement was limited by social distancing measures. Consolidated operating revenues for the company were down 1.6% to $31.6 billion.

Chairman and CEO Hans Vestberg said that the company started off 2020 with “strong operational performance” in spite of the pandemic.

“In an unprecedented time, Verizon took decisive and balanced actions that will serve our stakeholders in the long term, including protecting our employees, maintaining our network quality and reliability, serving our customers, and supporting our communities,” Vestberg said. He said that Verizon would maintain its commitment to invest in 5G and fiber and “will emerge from this crisis stronger.”

Verizon’s capital expenditures for the first quarter were $5.3 billion, and it said that its capex spending is focusing on capacity to support the “unprecedented traffic growth” it is seeing across its networks, as well as ongoing deployments of fiber and new cell sites for 5G deployment. Capital spending for the full year is expected to be between $17.5 billion-$18.5 billion, up from the $17-$18 billion which Verizon had originally laid out at the beginning of the year. Verizon had announced the increased capex plans in mid-March.

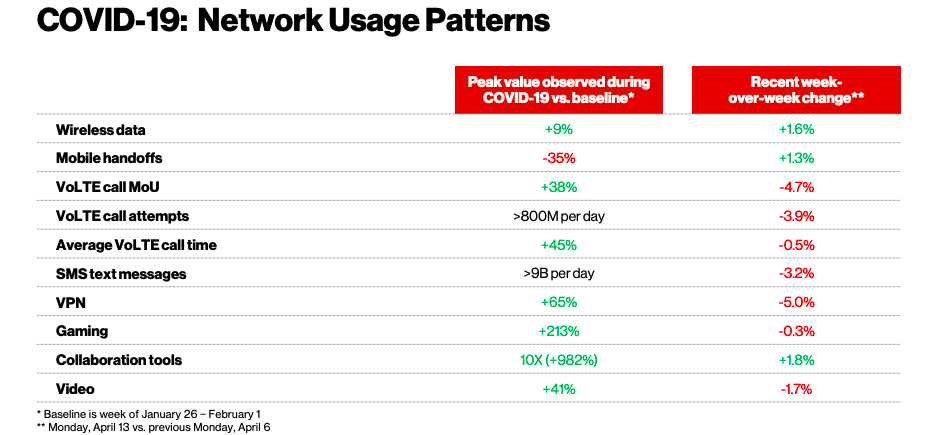

In terms of network usage pattern changes, Verizon said it is seeing a 9% increase in wireless data use as compared to typical network usage, as well as a 38% increase in voice over LTE minutes of use, a 45% increase in VoLTE call times, and a 65% increase in virtual private network usage. Use of collaboration tools is up 10 times its usual traffic volume, and gaming traffic is up more than 200% than typical. Video use is up 41% over baseline.

Image: Verizon

Verizon reported a pre-tax loss of $1.4 billion for the quarter, most of which ($1.2 billion) was attributed to the recently completed millimeter wave auction.

The carrier also noted that it has boosted its bad debt reserve by $228 million, anticipating that an increasing number of its customers will be unable to pay their bills and/or will seek relief under the FCC’s Keep Americans Connected pledge. It also increased its cash on-hand from $4.5 billion at the end of 2019 to $7 billion as part of its financial planning to make sure it has enough liquid assets.

Verizon reported 59,999 Fios internet additions due to an increase in demand for at-home broadband service, but saw 84,000 Fios video subscriber net losses as part of the ongoing shift toward over-the-top video. Its Verizon Media segment saw a stronger hit than the rest of the business, withe revenues down 4% year-over-year due “almost entirely” to COVID-19 impacts and a steep drop in advertising, according to the company.

The post Verizon posts customer losses, withdraws guidance appeared first on RCR Wireless News.