Thanksgiving greetings from the West, Midwest and Southeast, where we are hitting the road and logging many miles. This week’s picture, however, comes from a Charlotte-based startup that I have been advising since the early 2018 (Lucid Drone Technologies). They were the belles of the ISSA ball last week in Las Vegas (ISSA was formerly known as the International Sanitary Supply Association). Per my text from Andrew Ashur, Lucid’s CEO “It’s not only great to see thousands of people at a convention, but it’s even better to see them crowded around our booth.” Kudos to Andrew, David Danielson, and the entire group on their successful show!

After a short summary of market capitalization changes over the past two weeks, we will discuss earnings comments from Lumen, Windstream and Frontier. These will round out our theses on broadband competition and fiber deployments. We forego commentary on the iPhone 13 backlog, but you can access the latest charts here. We will continue to track iPhone 13 Pro and iPhone 13 Pro Max availability weekly until inventory levels subside (or until 2022 arrives, whichever is earlier).

Jim will also be participating (on behalf of American Broadband) in the Fierce Wireless Digital Divide Summit (details and free registration here). Specifically, we will be participating in “The Opportunity For Fiber” panelist session on December 14 moderated by a long-time friend of The Sunday Brief, Craig Moffett. The entire agenda looks spectacular and we are very grateful for the opportunity to share our thoughts on rural deployments.

And to close out the announcements — Jim will be attending CES 2022 this year, and, like years past, we will have an “open table” dinner at Gordon Ramsay Pub on Wednesday, January 5th, at 7 p.m. A couple of seats still remain, so if you would like to join a lively conversation, please let us know by email (sundaybrief@gmail.com) and we will do our best to save you a spot.

The Week That Was

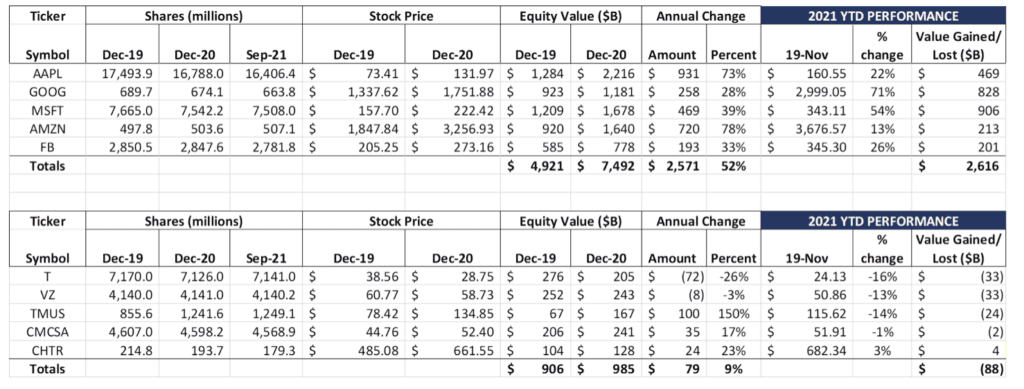

A distinct pattern has started to emerge as we exit 2022: Market multiples for all but the largest stocks are beginning to contract, while each of the Fab Five are seeing expansion. Over the last six weeks, the Fab Five have expanded their cumulative market value by $1.02 trillion, more value than the entire telecom industry has created over their lifetimes. This is not driven by what these companies represent (each are truly great, “best in class” companies in their own right), but by what they don’t represent (relatively low risk driven by high growth and global diversification). No one is flocking to Microsoft (0.72% yield) or Apple (0.55%) for their dividends, but, in times of volatility driven by high market multiples, each of these stocks is viewed as a “flight to safety” play, an alternative to sovereign debt.

Meanwhile, the Telco Top Five are slip sliding away, with AT&T/ Verizon/ T-Mobile a trio of 2021 teen losers. Even with the improved prospects through a spinoff then merger of WarnerMedia into Discovery (learn more on this by watching the full CNBC interview of last Thursday’s conversation with Liberty Media Chairman John Malone here; transcript here), AT&T continues to plummet, now having lost $105 billion in market value in the last 22+ months. Their stock price was last seen at these levels in 2010. That’s the legacy of the former CEO, Randall Stevenson (and to a lesser extent, former CFO John Stephens).

To put this into perspective, entering 2017 Microsoft’s market capitalization was roughtly double that of AT&T’s (more or less, MSFT was around $500 billion and AT&T at $250 billion). Assuming current trends hold, that gap will be close to $2.4 trillion entering 2022 (MSFT currently at $2.58 trillion and AT&T at $172 billion, with WarnerMedia accounting for at least 25% of that value). Relevance matters – and telecom’s importance is on the decline as transport is subsumed into software.

On a less sober note, the latest FCC spectrum auction closed last week with nearly $22 billion raised. Rather than rehash the stats, everyone who is interested should read Sasha Javid’s LinkedIn post here on the auction. Couldn’t say it any better.

While not mentioned below, Comcast made some local headlines this when they announced that they were taking their Pro Extreme ($299/ mo.) speed tier from 2 Gbps to 3 Gbps, making them the fastest ISP to the home (see the CNET analysis of their announement here). With a $7200 total commitment (2 yr contract for $300/ mo.), Comcast has done a good job of marketing to a very small subset of high net worth households.

On the other end of the demographic spectrum, many of us were surprised to see that the state of California, long known as the “holdout” state for any approvals (e.g., the T-Mobile/ Sprint merger) actually approved Verizon’s acquisition of Tracfone prior to the FCC or DOJ (Fierce Wireless summary of their agreement including major conditions here). Still no idea why that occurred, and, as we have written previously, not sure if the price is still a good one to pay given Tracfone’s recent string of quarterly customer losses, but it appears to be on its was to approval shortly (FCC approval proposals began to circulate late last week according to this Reuters report).

What They Said on Those Earnings Calls (Part 2)

We have spent the last two Briefs (here and here) discussing key earnings trends for wireless and broadband. In these writeups, we have discussed several items, including:

- T-Mobile’s multi-year 5G mid-band network advantage, which could/ should translate into share gains until AT&T and Verizon have deployed C-Band spectrum;

- Cable’s “conversion-less” network architecture advantage, which will drive faster and more symmetric speeds without material conversion expenses/ customer interruptions (we highlighted the impact of running two networks in AT&T’s Consumer Unit margin compression);

- Comcast’s (and we think this is unique to the Philly-based cable provider) emphasis on hardware (TV, Wi-Fi access points) investments to drive expanded service ubiquity and awareness;

- Verizon’s increasing dependence on cable MVNOs for revenue and EBITDA growth (something we think has short-term stability but is not sustainable as cable builds out their CBRS footprint);

- Verizon’s fiber and wireless revenue/ EBITDA potential given their extensive national fiber metro deployments (in contrast with AT&T’s in-region fiber/ capital focus);

- AT&T’s fiber focus, which is significant and accelerating, but which requires a “challenger” (vs. incumbent) mentality.

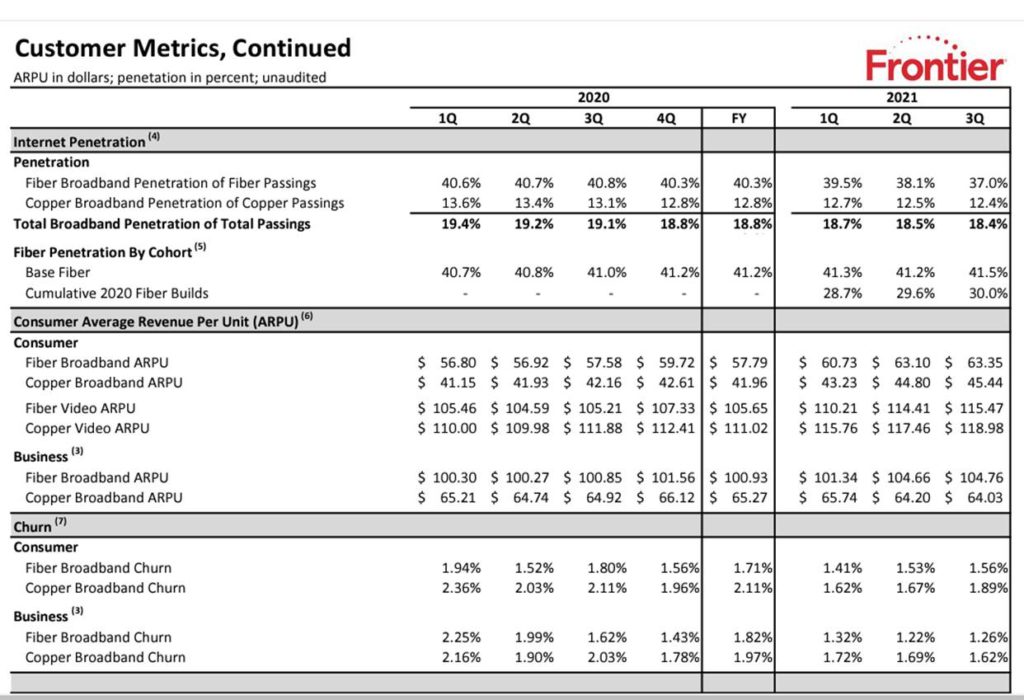

In this Brief, we look at several other fiber challengers: Frontier, Lumen, Consolidated, and Windstream. Each of them has a disproportionate share of rural properties that have lost significant market share over the last decade to cable. If Frontier’s copper plant is to serve as a proxy (see chart at right), only 13% of homes passed choose the copper technology (leaving 70+% share for cable, a roughly 5x market share advantage).

Most of the metrics news is good for Frontier – while their 2020 builds were relatively small compared to 2021 (Frontier deployed more new fiber homes in 3Q 2021 than in the first 10 months of 2020), they have managed to grow their fiber penetration to 30% for this cohort. Said another way, the “lowest hanging fruit” strategy worked, although management stated in the earnings presentation (full package here) that larger deployments would likely yield smaller (15-20%) first year results.

It’s difficult to extrapolate from a limited sample (87K total over the last 7 quarters) that Frontier has a clear path to victory over cable. Specifically, the argument that “we will win because cable will lose more RGUs due to their incumbency” raised by both Chairman John Stratton and COE Nick Jeffery is rather twisted. If Frontier wins (defined by the company as 45% share of gross adds), it will be because they provide a new and innovative (perhaps “rural/local focused”) value proposition to cable, a gateway to higher home appreciation and quality of life than any other alternative. To do this, they need to compete against a broadband + mobile bundle, not broadband + video.

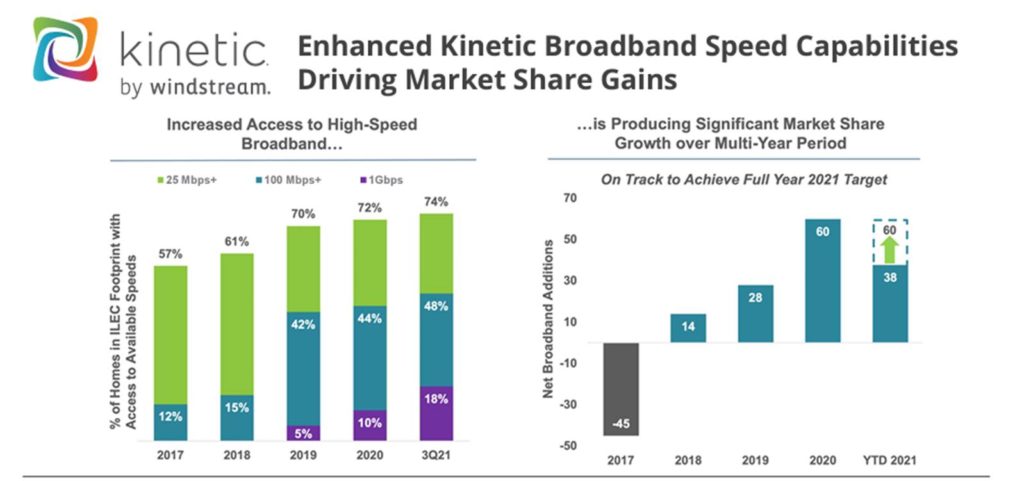

Consolidated and Windstream are also in the middle of fiber builds, with the latter releasing very little operating progress except for the following chart (link to 3Q Fact Sheet here):

Windstream clearly has made strides in certain portions of their footprint, with 8% growth in their fiber to the home footprint in nine months. With a footprint of ~ 4.6 million homes passed, deploying an incremental 368K seems like a big step, but this still leaves 82% vulnerable to cable. With Windstream eligible for $520 million in Rural Development Opportunity Funds (RDOF) over the next ten years they definitely have their hands full. And, while the five year chart shows meaningful progress in 2020 and 2021 (roughly 1.3% market share increase per year), over the last six years Windstream’s net gains have been +73K or about 1.6% (details on 2016 losses are on page 4 of the 2020 annual presentation here).

That leaves Lumen, a favorite topic of many previous Briefs (our latest wireline assessment from 2019 is here). Full disclosure: We still hold a small (and dwindling) portion of CTL stock from our days at Sprint (which became Embarq which was purchased by CenturyLink later renamed Lumen), but it has no impact whatsoever on our assessment of the company.

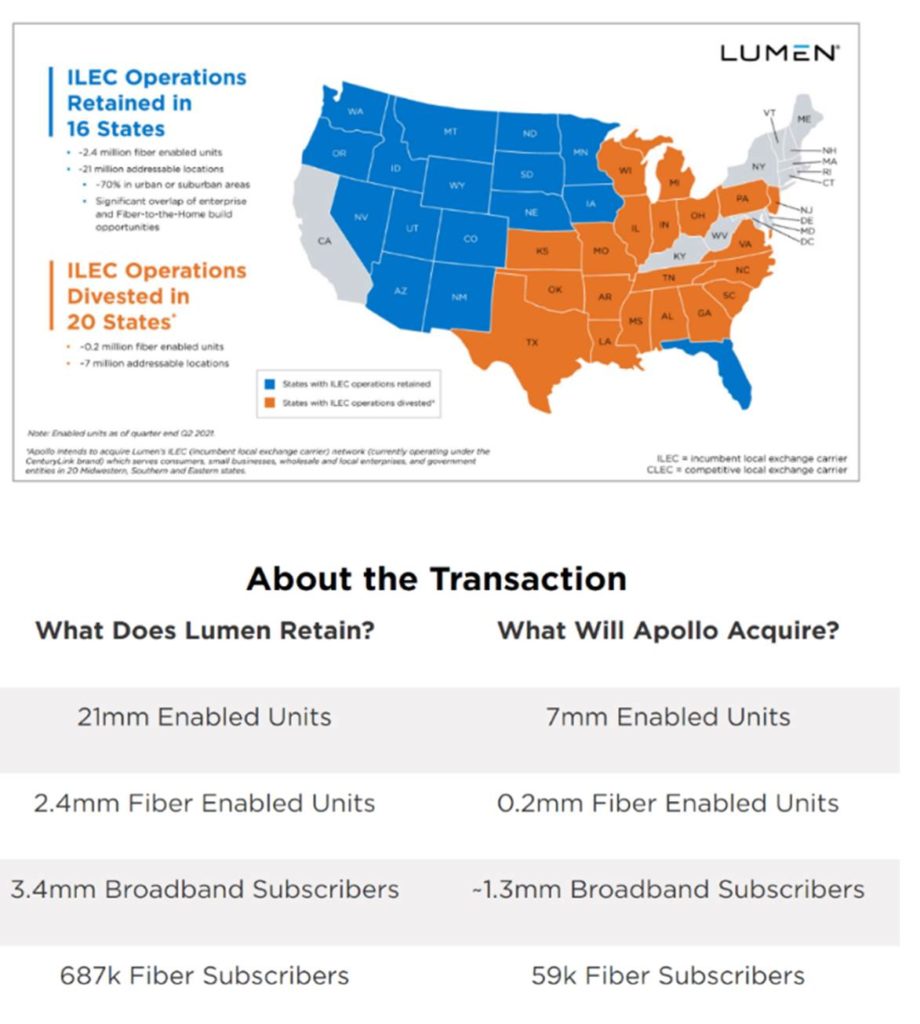

To understand Lumen’s condition, you first need to understand what stays and goes with the Apollo transaction:

Markets like Seattle, Denver, Phoenix, Salt Lake City, Portland, Omaha, Orlando and Las Vegas remain with Lumen. Killeen TX, Monroe LA, Lima OH and a host of smaller markets go to Apollo. As Lumen stated on their call, 70% of remaining markets (15 million of the 21 million remaining households passed) will be in urban areas, spread across each of the three largest cable providers – Comcast (NorthWest, Denver, Salt Lake City), Cox (Las Vegas and Phoenix), and Spectrum (spread throughout, but a large portion in Florida).

While denser markets will likely lead to accelerated incremental gains, these also happen to be areas where new household growth is prevalent. Density and market growth are two major considerations for overbuilders. With $40 billion of fresh capital entering the market as a result of the infrastructure bill, where will overbuilders focus – Killeen, or Las Vegas suburbs?

No Apollo-sized transaction can ever have perfect timing, but Lumen’s expectation of a 2H 2022 close may be too late to take best advantage of the opportunity. Today’s funding has been slimmed significantly: 3Q capital spending in 2021 dropped below $700 million for both enterprise and mass markets (a significant minority of the $690 million is maintenance capital which cannot be significantly altered in a particular quarter, leaving even less capital for discretionary fiber builds). States will be making decisions on how to allocate infrastructure funds just as the Apollo transaction approvals are being negotiated. And RDOF-funded companies and wireless will be ramping as supply chain issues begin to subside early to mid-2022. If Lumen misses the approval deadline by a couple of quarters, it could be disastrous for both themselves and Apollo.

Bottom line: Rural-based fiber deployments are progressing with fresh (post-bankruptcy) company balance sheets. This creates more competition for rural-focused companies like Mediacom, Altice/Suddenlink, and Sparklight/ Cable One. Each of these cable providers knows its market intimately and has improved its balance sheet. Lumen (post-Apollo) faces the greatest headwind, especially if overbuilders eclipse their market share in the early quarters. It all comes down to telco’s ability to compete against the new bundle of broadband + mobility.

That’s it for this week’s Brief. In two weeks, we will look at the winners from the latest FCC airwaves auction and also start to summarize key themes going into CES. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, Go Sporting KC and Go Chiefs!

The post The Sunday Brief: What they said on those earnings calls (Part 2) appeared first on RCR Wireless News.