May greetings from five states. Lots of miles in the last month traveling through amazing parts of the Midwest and South. The opening picture is of the Apple Man at the Fontanelle Orchard in Nebraska. Celebrating their 16th year, they are located a mere 10 miles from downtown Fremont, Nebraska. Just one highlight of many seen this month.

Because of broadband connectivity dynamics, there has been a lot of news over the past six weeks. In the last Brief (here), we focused on Comcast’s comments (“When cable growth slows, blame a lousy economy, then analyze and segment.”). This week, we turn our attention to the other major cable company, Charter Communications, who shares some similarities with Comcast yet has approached slowing growth in a very different manner.

Prior to our market commentary, however, we must note the announced retirement (or, rather, end of “Chapter 1”) of Verizon EVP and CEO – Verizon Business, Tami Erwin. We have known Tami nearly 20 years (a little known fact is that Sprint’s IP network served as the backup IP backbone for Verizon during their DSL launch prior to their purchase of Worldcom-MCI; Tami and other colleagues supported that selection). Her reputation as a friendly and pragmatic competitor has endured. She speaks from experience, and understands the importance of scaled networks at a detailed level that is seldom seen today in executive ranks. On top of that, she’s a tremendous recruiter who has mentored many within Verizon. She will be missed. Her interview with Craig Moffett last week at the 9th Annual MoffettNathanson Communications Summit is worth listening to during the upcoming Holiday week. Best wishes to Tami as she begins the next chapter.

The week that was

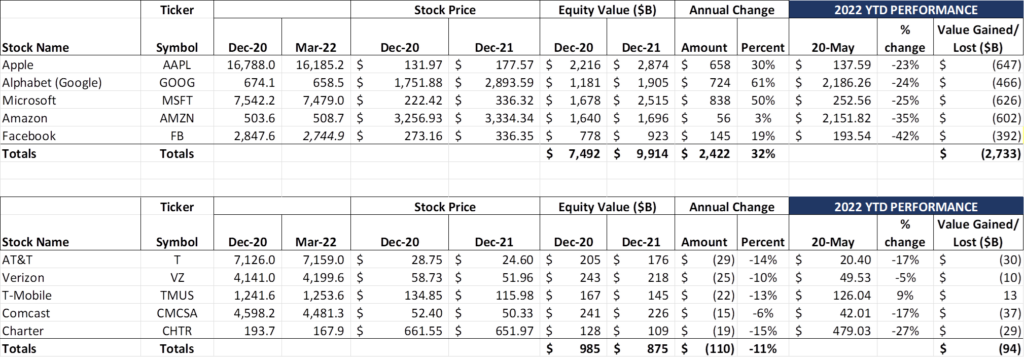

News flash: The last two weeks were not kind to the Fab Five. In a new record, they lost over $1.1 trillion in market capitalization during that period. Said another way, they lost more in the last two weeks than the Telco Top Five has created since their respective companies began trading publicly. Each of the Fab Five lost value over the fortnight, with Apple’s total losses nearly reaching $460 billion (in the telco world, that’s a Comcast + Verizon + half of AT&T combined loss in just two weeks!). Most importantly, on a combined basis, 2022’s losses ($2.7 trillion) have now eclipsed 2021’s gains ($2.4 trillion).

However, Amazon’s stock price is still 34% higher than pre-pandemic levels. Microsoft is basically at the same stock price it was at the beginning of June, 2021. Apple has collapsed to levels not seen since – you got it – June 2021. Alphabet/Google’s stock price is slightly worse, at a “not seen since April 2021” level. Only Facebook has had a legitimate crash, and one can argue that the signs of weakness were known there with the Crimson Hexagon scandal in 2018. Hyperventilate if you will, but four of the Fab Five are actually sitting pretty right now. Let the buybacks begin continue, knowing that there are plenty of cash balances to fund acquisitions initiatives. Apple may not have to find a new trillion dollar addressable market every five years with it’s new valuation – that’s probably been elongated to six or seven.

The underreported story as of Friday afternoon is that the Telco Top Five actually increased market capitalization over the last two weeks. T-Mobile was the only one in that group that decreased over the period (~$1 billion), but is still up for the year (+$13 billion by our count). Comcast still leads the group in losses (down $37 billion thus far in 2022, and over $50 billion since the beginning of 2021), but Charter is not far behind ($48 billion since 1/1/2001). May’s performance is not a reason to pop champagne corks – the Telco Top Five merely had fewer losses thus far in 2022 than for full year 2021 – there are no “plus signs” for anyone (including T-Mobile) using the last 16+ months as the gauge.

In the “never let a crisis go to waste” category, both Verizon and AT&T decided to use recent inflationary trends to hike their fees to customers (see last week’s Bloomberg article here). We are especially attentive to the business categorization of an “economic adjustment charge” mentioned in the Bloomberg article. Rather than raise the basic service plan rate by $3.18/ month, Verizon created a new charge, and raised the basic service plan fee by 98 cents. Brilliant.

Raising the “below the line” fees is convenient and allows Verizon and AT&T to advertise rates with the caveat “plus taxes and fees.” Because taxes vary by state and municipality, it’s too difficult to show one rate. Look for T-Mobile and cable (specifically Spectrum Mobile) to begin to highlight that their plan pricing includes “taxes and fees.” We also would not be surprised to see increases in legacy phone and DSL rates, and perhaps a fee added to AT&T’s 300 Mbps fiber plan in 2023. A few dollars per line across (tens of) millions of subscribers pays for a lot of fuel and pay raises.

Google held it’s annual I/O day right after the last Brief was published (The Verge has an 18 minute exerpt of the session here), and there were a host of announcements. The most important one from our perspective was Google’s continued expansion of hardware offerings. A company known for it’s terrific apps and search now wants to sell more hardware. We knew it was coming with the Fitbit acquisiiton in 2019 (original annoucement here), and this was a reminder of how serious Google is about not losing out on hardware.

We had originally planned on using a portion of this Brief discussing Google’s bigger plan (hint: it’s bigger than most of you think), but we will park that Brief for at least a month. Suffice it to say, they are very serious about the Pixel 7 smartphone (teased at I/O), but also equally adamant about the Pixel watch (pictured nearby) and the tablet announced at I/O – by the next I/O, Google will have a full suite of services, from exercise band through powerful Chromebooks and Nest controllers (for the complete store, click here – we would recommend you keep it bookmarked).

While Google already makes Chromecast hardware that connects to TVs, we think they may be the next Fab Five member provider to jump into TV production, increasing their largest screen size sold from 13” to 65” (or 80”). Amazon introduced the FireTV through third-party providers a few years ago, and self-sourced their FireTV starting last year (ICYMI – Amazon announced earlier this year that they fold their 150,000,000th TV in late 2021 and would be presenting smaller Fire TVs in BMW, Lincoln, Jeep and Chrysler brands). It’s a bit of a stretch, but, as a response to a Comcast XClass TV (see models from Walmart here), might Google be contemplating a TV+YouTubeTV bundle? If so, could we potentially be in for the era of cheaper TVs that are subsidized by a subscription service, a la smartphones? Or at least a bundle that Verizon FiOS could sell (they already offer YouTube TV in their video lineup)? It’s hard not to believe this is only months/quarters away – TVs are too easy to produce, and, once the supply chains adjust back to 2019, there should be plenty of wholesale capacity in the system. To Google, it’s a monster display tied to Google Cloud (just like Amazon Prime is connected to AWS) – scale away!

A Google TV would likely lead to a Disney-Apple partnership which might team with TCL or Sony to counter Amazon and Google. Regardless, as we have predicted in previous Briefs, the TV is the dumbest electronic device in most electronics stores (especially compared to the advances in smartphones, laptops, and gaming consoles over the last decade) – it’s time for the big money to get involved.

One final note from Google I/O – we were extremely impressed with a Google Doc feature that automatically summarizes long documents (more about it midway through Sundar Pichai’s opening statement here – ironically a 20 min read). Perhaps this will be demonstrated using a 2022 Sunday Brief, the ultimate TL/DR (Too Long/ Didn’t Read) document!

When cable growth slows (Part 2 – Charter)

Charter Communications, the product of a “once in an industry lifetime” merger between Time Warner Cable, Charter Communications, and Bright House Networks announced in 2015, is the second largest cable provider behind Comcast (see full stats from Leichtman Research Group here – note that Charter now has more than 2x more broadband subs than AT&T and more than 4x the number of broadband subs than Verizon – including fixed wireless). We included Charter in the Telco Top Five when we resumed the Brief in 2019, and consider them to be the purest large cap broadband play in the telecommunications industry.

Charter has had a rough nine months since reaching a peak of $811/ share last September, as this chart from Yahoo! Finance shows:

Friday’s closing price represented a 42% decline from peak. However, it represents about the same price that it had entering 2020. It’s enough to make the average CEO cringe and compel them to a 30-60-90 day action plan to “right the ship.” Fortunately for his shareholders and the industry, Tom Rutledge is not that CEO. In a wide-ranging interview with Craig Moffett this week (the same conference referred to earlier in this Brief), Tom delivered a comprehensive picture of Charter’s future, one which was not clouded with obscure engineering, ESG terminologies, or short-term window dressing. Tom called it as he sees it, and, from his pedigree as the head of Time Warner’s largest legacy operation, New York City, we think he’s very well informed.

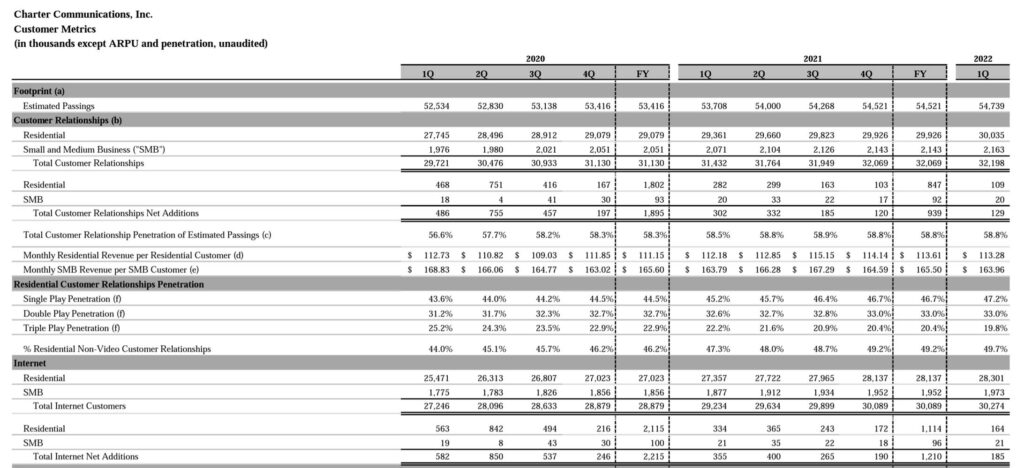

Before finishing the phrase “When Cable Growth Slows…” for Charter, let’s look at their nine-quarter trend (schedule available here):

Prior to going into the details of this schedule, it’s important to remember how most of the cable industry has historically priced services:

- Have a low introductory price (and usually low/ free install charges) for switchers and new homeowners

- During the first year, increase the breadth (mobile) and depth (e.g., advanced Wi-Fi) of services

- After the promotional rates have expired, reinforce the value of the residential/ small business relationship

This strategy worked very well when cable rolled out their Triple Play suite (home phone + linear TV + High Speed Internet) twenty years ago. The Triple Play did two things: 1) at the point the customer selected the Triple Play, the telco was shut out from that relationship (and, as the gap between DSL and DOCSIS download speeds increased, the tenure of that lockout increased), and 2) it substantially increased returns on capital or ROIC (one coax, many uses).

But then video pricing got too high, and home phone got old (compared to cheap wireless plans). Even through COVID, triple play penetration decreased, and, as we have stated in previous Briefs, single play penetration increased from 43.6% to 47.2% of all customer relationships.

Enter Spectrum Mobile. While not as good as the Triple Play (ROIC++ and door shut on telco), mobile devices access the Internet through home Wi-Fi a lot more than they do through the nearby cell tower. Why? Historically, it’s been because of the speed difference between Wi-Fi and the macro cellular network. The rollout of DOCSIS 3.1 cemented the importance of Wi-Fi during the height of LTE, and many small businesses (think AT&T’s acquisition of Wayport) featured reliable but oftentimes less secure guest Wi-Fi access for users.

Before their foray into mobile, Charter and their predecessor companies deployed a lot of “around town” Wi-Fi throughout their territories. Depending on where you drove, up to 35% of your traffic remained on cable Wi-Fi. Charter knows how to deliver value to customers through network leverage, and they are just starting that journey.

In his discussion with Craig Moffett, Tom Rutledge brushed off the impact of competition. These comments mirror those of Chris Winfrey, Charter’s Vice Chairman and former CFO on the earnings call (this is our transcription from the webcast):

“The history of these tertiary overbuilders is pretty demonstrated as well. And my experience is they all start out with a rosy story, and they get a lot of capital going in. And the early penetration is because there’s something new and environment starts to look good. And as long as you can sell fast enough you can do okay as a return.

“But the history is that they all go bankrupt and they end up having to be recapitalized. And so I think there’s that repeat that takes place every so often in the marketplace. And so you see some of that. And our job is just put our head down and be competitive like we always have and go dig out customers and continue to develop products pricing and packaging that people can’t replicate.”

Charter’s answer to the question is “When cable slows, put your head down, be competitive, and go dig out customers.” In the case of Charter, that means heavier upsell of Spectrum mobile while housing/ move activity recovers. It also means devising lower-end video packages and qualifying every eligible customer on a government-subsidized plan. And it means building out additional government subsidized (RDOF) markets where and when cost effective labor is available (Tom disclosed that Charter has “thousands of unfilled positions” for their rural builds today).

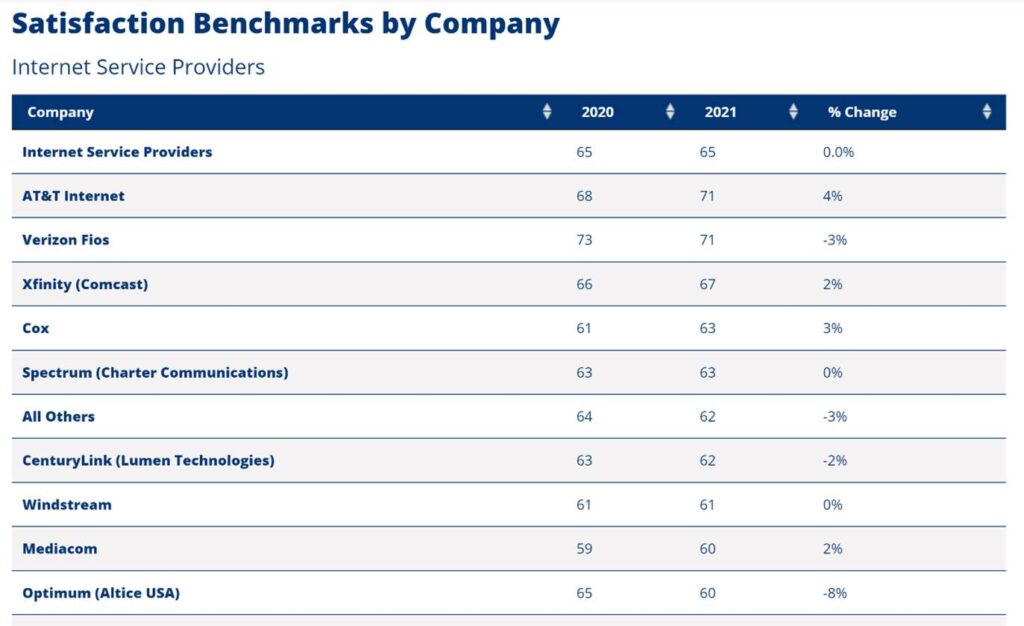

Charter is not without issues. Their ACSI (customer satisfaction) score needs work (see nearby chart and link here). Spectrum’s 2021 score did not improve, they are actually closer to the bottom (Altice USA) than they are to than Comcast, and they are a full eight points away from the market leader. Said simply, they are not liked by many customers (as T-Mobile reiterated in their Uncarrier announcement covered in the last Brief).

Charter has also been late to embrace streaming as a full-fledged product offering. The recent announcement of the joint venture with Comcast and others is a very welcome sign and an admittance that video needs may be met in multiple ways.

Charter also faces a very different competitor than the one Chris Winfrey referenced in his quote above: AT&T is aggressively building out fiber in Dallas/ Ft. Worth, San Antonio, Austin, Atlanta, and Los Angeles – all of these are “priority one” markets for a newly focused organization. And, with AT&T’s wireless momentum beginning to slow, they need to create additional competitive advantage – what better than a wireless + fiber package.

Bottom line: Charter has the upper hand. In many of the smaller DSL/ VDSL markets, they enjoy market shares above 80% (of homes that they currently pass). A combination of network architecture changes, pricing changes, mobile acceleration and the joint venture results with Comcast will keep Charter’s top line growing for the next decade.

That’s it for this week. In two weeks, we will summarize in less than 2500 words the latest federal infrastructure developments (specifically the Notices of Funding Opportunity or NOFOs). Seriously.

Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Until then, go Royals, Sporting KC, and Atlantic 10 regular season champs Davidson College Baseball!

The post The Sunday Brief: First quarter earnings review—when cable growth slows (Part 2) appeared first on RCR Wireless News.