NFL playoff greetings from Lake Norman, NC (we only wish we were at Kansas City’s Union Station, pictured right). As we await two excellent NFL football games, we thought we would dive in to the opportunities facing one of the Telco Top 5 – Comcast. We think they have a unique set of challenges given their relative size, wireles spectrum holdings, and innovative products such as Xfinity X1, Xfinity Flex, and Xfinity Mobile.

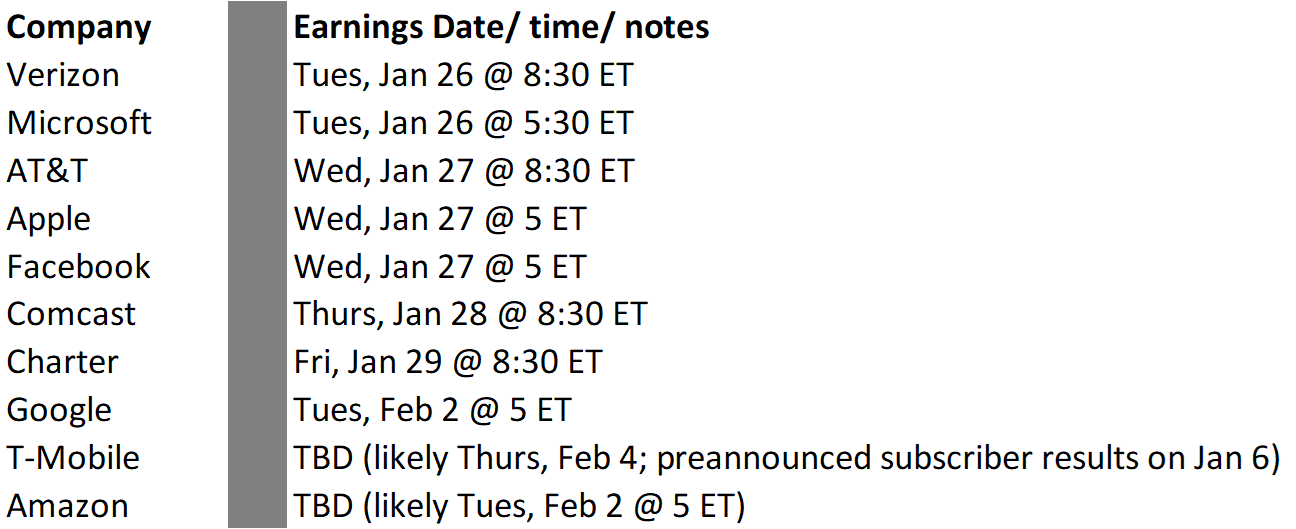

Given the amount of time we will spend on the Comcast section of this week’s Brief (and the fact that next week’s issue will likely run long), we will limit our market commentary. As a reminder, upcoming earnings calls are scheduled as follows:

The week that was

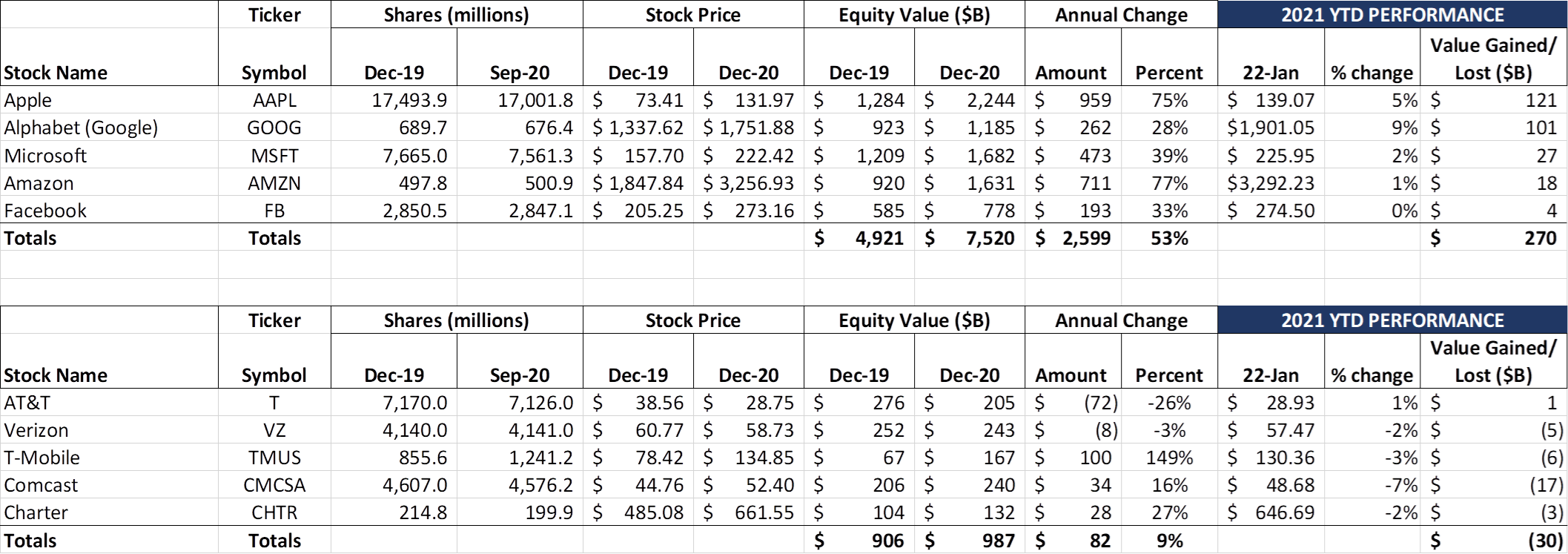

During the first half of January, I received several emails asking “Had the Fab Five made their run?” Last week, it appeared that there was going to be some pullback due to long-term growth prospects and the threat of increased regulation. This week, the tone seemed to be “just kidding” as each of the Fab Five raced ahead. Apple had the biggest move, growing $204 billion in market cap (9.4%) over the holiday-shortened trading week. In contrast, AT&T, which has a market capitalization of about $206 billion, lost $2 billion this week.

Google also had a remarkable recovery this week, growing $122 billion in market capitalization. They are still more than a trillion dollars smaller than their Cupertino neighbor, however. Google made headlines on Thursday when they announced via a blog post that they were pulling the plug on Loon, a project that used orbiting balloons to bring Internet to underserved (and catastrophe-ravaged) regions of the world (see nearby picture provided by Google). Much of the technology spun out of Loon will be used by Taara, another Moonshot company that is focused on using light beams as a substitute for fiber in difficult to reach areas.

On a more encouraging note, there was a report from Ookla this week showing that average wireless speeds improved in 4Q 2020 and that the US is now ranked 20th in overall download speeds globally. AT&T took the prize as the fastest download speed overall as well as fastest 5G download speeds, and T-Mobile took the prizes for lowest latency, best 5G signal availability, and data consistency. More details in the link above. Based on our experience with RootMetrics, Ookla, and Opensignal, we find that each method has its pluses and minuses. One item that is not in dispute, however, is that networks are becoming faster and developing at a far faster clip than the capabilities of smartphone screen displays. We think that data consistency is going to quickly become the most important factor for both smartphone and fixed wireless users, provided that there are not material differences in speeds. More great information in the link above.

Many were surprised by news out of Korea this week that LG’s smartphone division may be on the chopping block (and some of us so fondly remember the innovative matching faceplates of the LG Fusic pictured nearby). According to this report from The Korea Herald, LG appears to be ready to make some tough choices. An LG spokesperson to the Herald explained that “Since the competition in the global market for mobile devices is getting fiercer, it is about time for LG to make a cold judgment and the best choice. The company is considering all possible measures, including sale, withdrawal and downsizing of the smartphone business.” Good news for Samsung and perhaps TCL in the US, and also great news for Huawei and Xiaomi globally. We will continue to track the latest developments.

Finally, Jessica Rosenworcel was named the FCC’s Acting Chairwoman this week by the Biden administration (her Twitter post is linked here – many of the comments are especially interesting). While we view the role of regulation very differently, Chairwoman Rosenworcel is deserving of this leadership position and we look forward to seeing the “acting” qualifier removed expeditiously.

Comcast’s crossroads

Last week, we focused on Verizon’s renaissance – the changes that would be required inside Big Red to match the changes that were occurring in the industry. These include developing long-lasting content partnerships, refining value propositions for their 5G Home Internet Service, and leading the private network movement (in tandem with partners like Microsoft and Amazon AWS).

But what if you are a telecommunications company that already has a significant market leadership position in broadband, own a top-tier broadcast network (and other extremely valuable content including this year’s delayed summer Olympics and next year’s regularly scheduled Winter Olympics), and have already started the content distribution transformation process through the launch of a streaming product that grew to over 26 million subscribers in the first two quarters?

To use a poker analogy, Verizon has a full house, but does Comcast hold a four-of-a-kind? Outside of a few Northeast and mid-Atlantic metros where Verizon’s FiOS and Comcast’s Xfinity home and business connections duke it out daily, are Verizon and Comcast really competing against each other today? How will this change with 5G Home Internet? To carry the poker analogy further, what’s tomorrow’s ante?

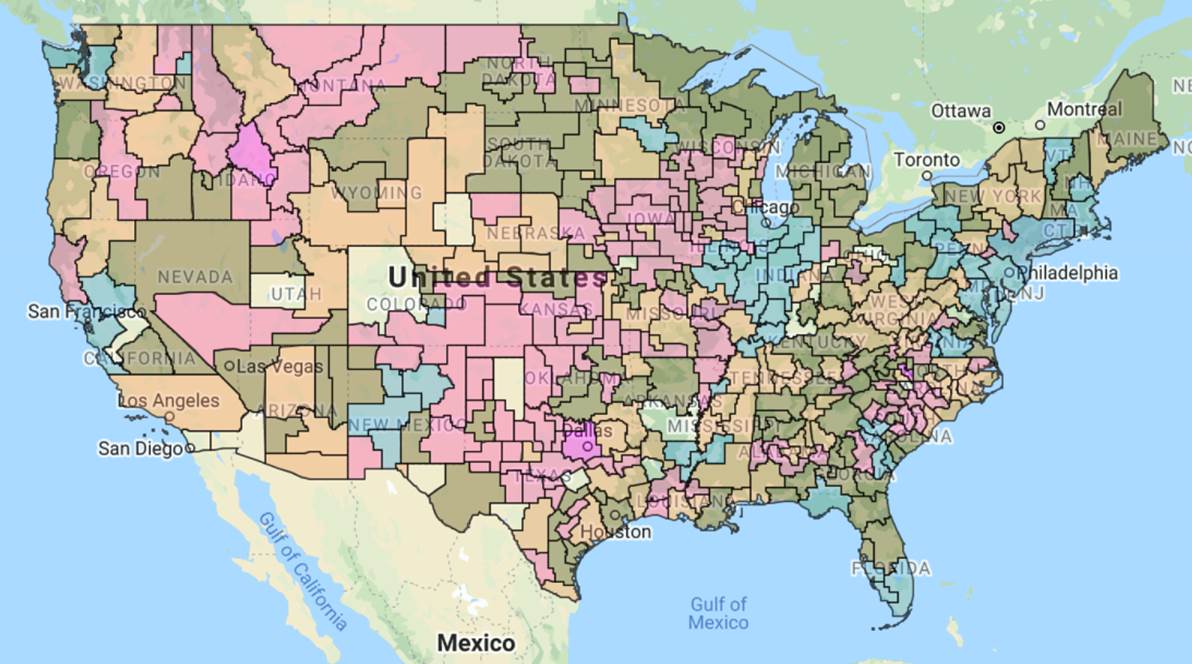

For those of you who are not familiar with Comcast’s cable footprint, here’s the map from their most recent 10-K. Comcast, like most of their cable peers, is highly clustered, with five clusters: Mid-Atlantic, Chicago, Florida, Northwest, and Northern California. They are under-indexed in Texas (despite a strong cluster in Houston), the Carolinas, and Arizona, some of the fastest growing areas in the US. Those territories belong in large part to Charter (TX, NC, SC) and Cox (Phoenix/ Tuscon, Las Vegas, New Orleans, others). To the extent that competitiveness is driven by territory, Comcast has a competitive edge in many parts of the country but cannot provide national services without help from other facility-based providers. Companies relocating their HQ from San Francisco to Dallas will result in net losses in connections for Comcast, while moves from New Jersey or Chicago to West Palm Beach or Ft Myers are more neutral.

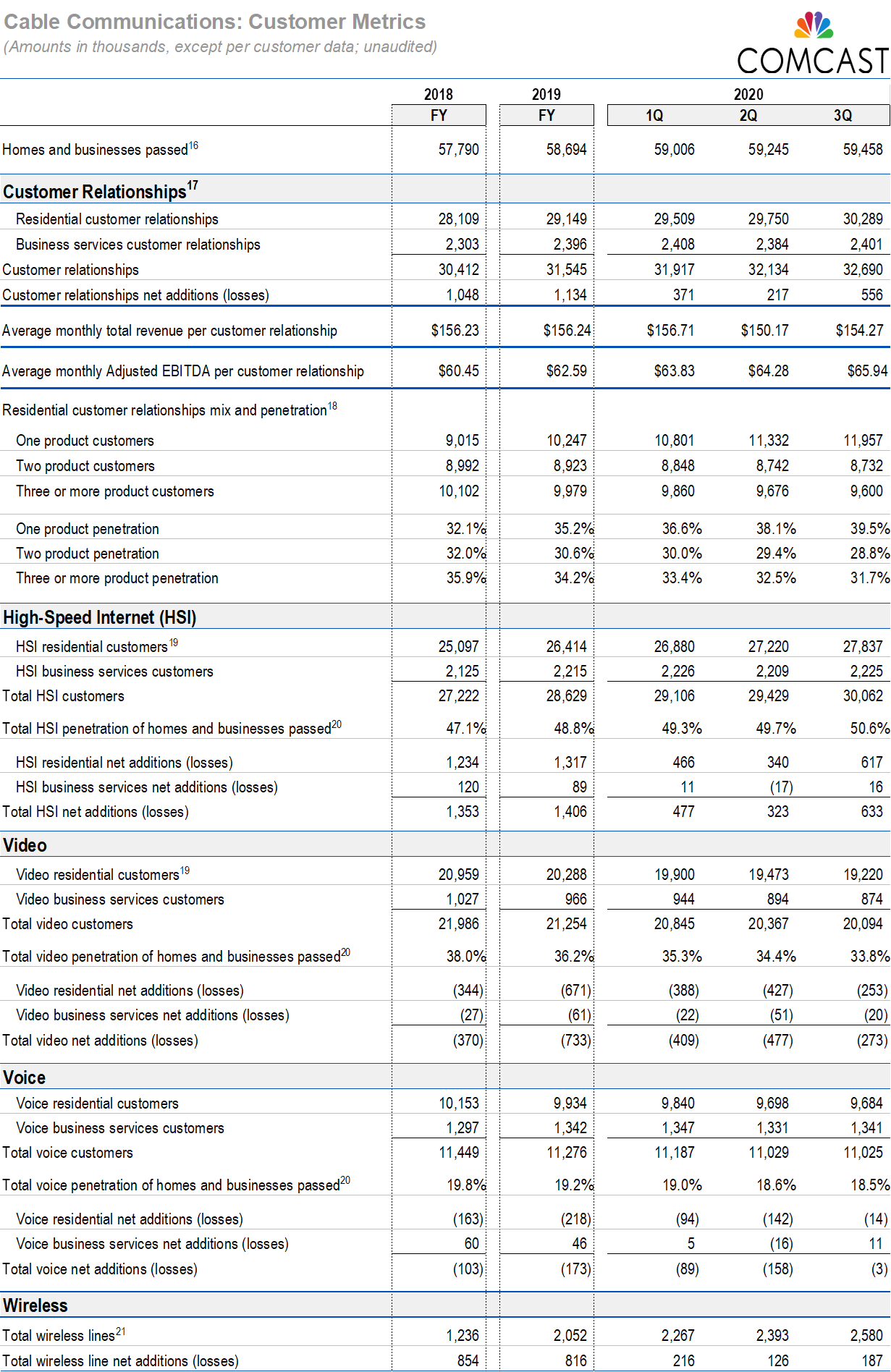

The nearby table shows Comcast’s growth in selected cable products and services through 3Q 2020. There’s a lot of information here to support Comcast’s winning strategy.

First, Comcast’s addressable market – homes and businesses passed statistic at the top of the table – continues to grow. In 2019, homes grew by about 900K, and 2020 appears to be a similar growth level based on three quarters of information.

A “fair share” of High-Speed Internet growth would be 50%, or about 800-850K net additions for 2019 and 2020. Comcast’s High Speed Internet growth for this period was 3.4x that figure – over 2.8 million. It would be impossible to achieve such a growth rate without growing share in all parts of the country – fast-growing Denver, Atlanta, Miami are all increasing share as well as flat-to-declining Chicago and Detroit.

Second, as we have highlighted in previous Briefs, growth is becoming more concentrated around High-Speed Internet. As of 3Q 2020, HSI represented 35% of Cable Communications segment revenues, up from 30% at the beginning of 2018. Video revenues dropped during the same period from 41% to 36%. Post-COVID, the movement away from traditional video should accelerate to ~2 million net losses annually (we predict 1.5 million in 2020 with pent-up disconnects coming after contracts expire); we would not be surprised to see HSI comprising 40% of total revenues in two years with video less than 30%.

Revenue concentration makes the target clearer and brighter for potential competitors. A potential overbuilder who has to invest in TV and voice infrastructure faces more barriers to entry. But if that would-be challenger has a distribution agreement with YouTube TV or another streaming provider, as well as a wireless provider for voice services, a competitive value proposition is clearer.

But not all competition is approaching Home Internet in the same manner as a fiber overbuilder. There’s T-Mobile, coming with their next-generation 5G Home Internet product that will be bundled with their TVision Live service (CEO Mike Sievert’s recent comments that TVision will not be a profit source is worth noting). And, as discussed in last week’s column, the prospect of broader deployment of Verizon’s 5G Home Internet product in cities like Houston. And, in a few markets like Northern California, Atlanta, Houston and Florida, the possibility that AT&T might actually “walk the talk” and widely deploy residential fiber. Where does that leave Comcast?

Hence the title of this week’s column. Comcast enjoys many tailwinds heading into 2021:

- Strong growth in High Speed Internet with weak competition and increasing margins

- Even with COVID-related shutdowns, good small business prospects

- “Roaring Twenties” mentality starting this summer which will increase theme park cash flow

- The Olympics (two in the next 18 months)

- Strong growth with their Peacock streaming service (26 million as of mid-December and growing)

- A resurgent advertising environment as economic recovery begins in 2Q 2021

- “It can only get better” prospects for theatrical entertainment

Even with each of these opportunities (and the strong prospect that cash flow from operations will return to the mid/upper $20 billion levels shortly), Comcast faces several crossroads:

- Is Peacock a national broadcast network (as the company has stated) or a national “network of networks?” As Peacock heads towards the latter to better compete with Netflix, what impact does this have on their relationship with Charter, Altice, and, to a lesser extent, Cox? Or does Peacock become the distributor for sports and other content for the rest of the cable industry to better compete with Disney/ Hulu/ ESPN?

- Did/ does Comcast finally enter the wireless market on a national basis (using past tense as we are not sure how active they were with Charter/ Cox/ others in the C-Band auction)? Comcast has been a wholesale provider for each of the wireless companies and already has facilities at thousands of towers today. The past three years has helped them build relationships with Apple, Samsung and other handset providers and also streamline their retail and online operations.

As a reminder, Comcast continues to hold 600 MHz spectrum (roughly 10 MHz across its serving territory) in both the A and E Blocks (A Block map shown nearby courtesy of Spectrum Omega – Comcast holdings are in blue – link to map here). This could pair well with the C-Band block to create a 600 MHz + CBRS Priority Access License (3.5 GHz) + C-Band (also 3.5 GHz) solution.

The cable industry does not face an “either/ or” decision with respect to their main MVNO partner Verizon. Comcast will likely build out their network in Chicago, then the suburbs, then to nearby towns with “Least Cost Routing” precision, leaving Verizon with dwindling data revenues in their highest cost locales. The importance of a wholesale data stream to Verizon cannot be stated enough – high margin revenues with little ongoing effort – a difficult profit source to replace.

We think more wireless will be in Comcast’s future, and that it will start with more attractive family plans for Xfinity Internet subscribers. There’s also a near-term opportunity to incorporate Peacock content with wireless to grow ARPU and fend off AT&T/ HBO Max.

- While righting the small business ship as the economy recovers, and also seeking increased returns from wireless service deployments, Comcast faces additional strategic decisions regarding enterprise services. Because connectivity is critical to enabling private wireless networks, Comcast is going to increasingly face the need to have out-of-region network partners. Charter, Cox, and Altice are logical partners, assuming equitable terms of a cable enterprise JV can be negotiated. This JV would handle national (and international) opportunities. If participation is not unanimous, however, there will be additional partnerships necessary.

That’s where a partnership with (or acquisition of) Zayo or even Level3 could be very valuable to Comcast. Both have extensive local reach (Zayo particularly in the Northeast and Upper Midwest – see nearby map), and Zayo also has 44 colocations globally to store Peacock content. While an outright acquisition is a longshot, Comcast would benefit from Zayo’s understanding of backhaul and cloud requirements for enterprise and government customers.

Bottom line: The Triple Play (data, video, voice over one line extension) generated significant cash flows for Comcast. Revenue sources are changing however, as Roku, Neflix, Hulu/ Disney+/ ESPN, and others join Xfinity Flex as viable content gateways. The days of local territory optimization are quickly ending, and Comcast is well positioned to expand their territory.

Next week, we have seven companies reporting earnings and will be challenged to have the Brief live up to its name. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Stay safe, keep your social distance, and Go Chiefs!

The post The Sunday Brief: Comcast’s crossroads appeared first on RCR Wireless News.