Snow and ice-filled greetings from Davidson, NC, and Springfield, MO. Pictured is yours truly (with assistance from a nephew) providing an afternoon snack to a few of the many bovines at the in-laws’ Missouri farm. A relaxing family holiday in a rural setting seems to be the antidote to the surreal events of the past week.

After an examination of equity market value changes and some industry news, we will focus the Brief on a preview of this year’s virtual Consumer Electronics Show (CES) and provide an initial view of the acceleration of private network adoption for enterprises.

The week that was

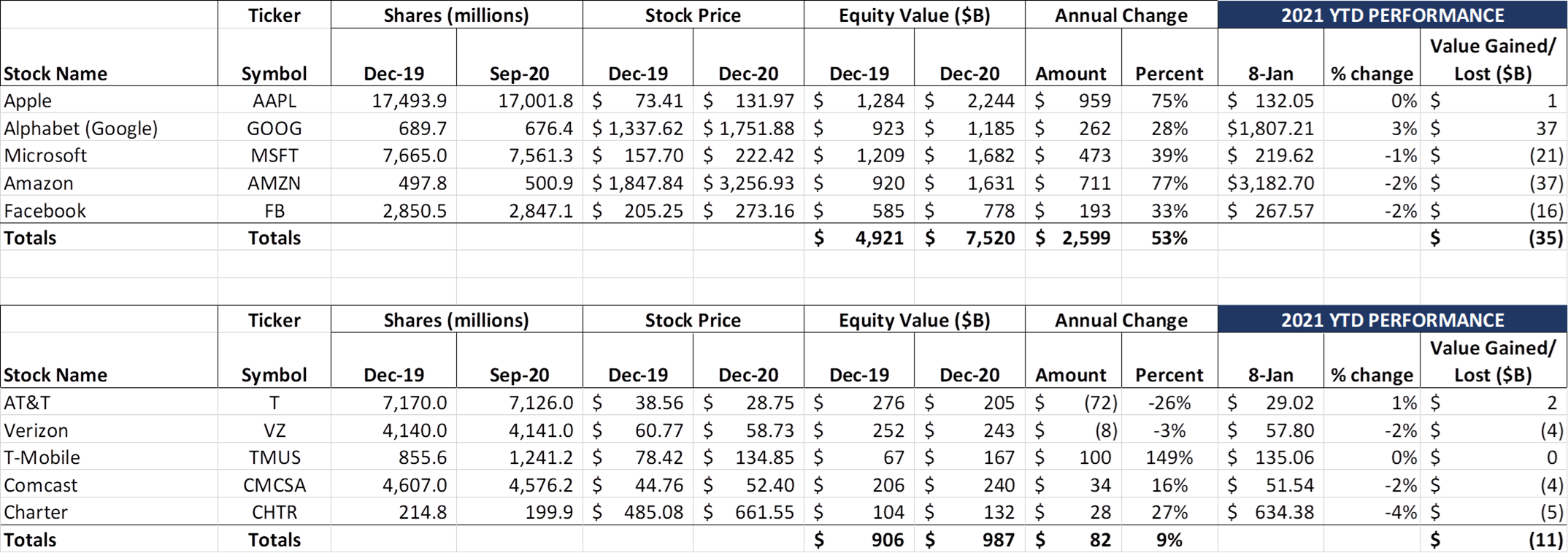

With a new year comes new opportunities to create value. As we said last week, 2020 was an unprecedented value creation year for the Fab Five. For many reasons, it’s unlikely we will see them duplicate $2.6 trillion in value creation in 2021. This week, the Fab Five lost $35 billion in value while the Telco Top 5 lost $11 billion, a similar pattern seen in January 2020.

Facebook, Twitter, and to a lesser extent Google, received a lot of attention this week after the Capitol riots. The Washington Post (owned by Jeff Bezos, CEO of Amazon) ran an article on Friday that contained excerpts of a local TV interview Senator Richard Blumenthal (D-CT) gave (posted to Facebook here) which discuss the role of the three tech companies:

“They bear major responsibility for ignoring repeated red flags and demands for fixes,” said Sen. Richard Blumenthal (D-Conn.), who stands to play a key role leading a tech-focused congressional panel in the coming months. The lawmaker faulted Facebook, Google and Twitter for failing to act as the riots unfolded “until well after there was blood and glass in the halls of the Capitol.”

“They have done enduring damage to their own credibility,” Blumenthal added in an interview, “and these events will renew and refocus the need for Congress to reform big tech.”

In upcoming months, expect the chorus for more regulation and reforms. Of special interest is the role that mobile operating systems owners Apple and Google will play in allowing alternatives to Twitter and YouTube (Parler and Rumble, respectively) a platform to flourish and thrive. On Friday evening, Google removed the Parler app from the Play Store, and Apple placed Parler on notice. On top of this, Amazon employees have called on their AWS unit to stop providing cloud services to the Twitter challenger. If the repeal of Section 230 of the Communications Decency Act does not put Parler out of business, the mobile operating system providers will step in and police their app. After the events of the last week, content policing (and the monitoring of the policers) will be front and center. A lot more to come on the topic, but for an additional opinion, this column (here) by Stephen Levy is an excellent read.

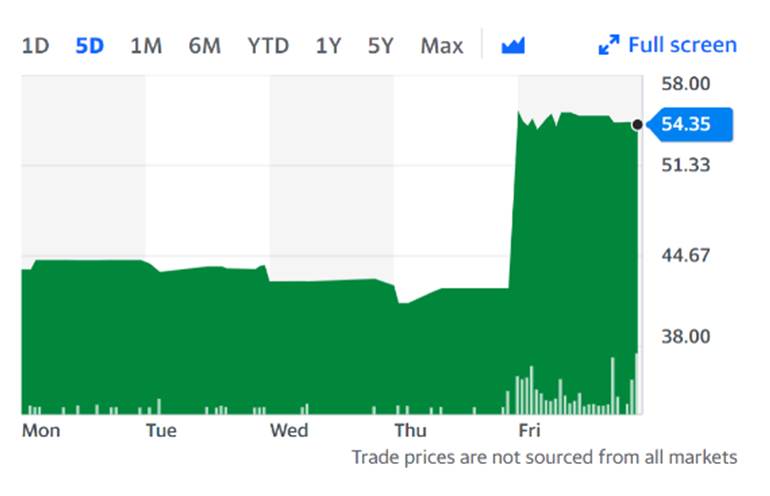

On a completely different topic, Hyundai Motor made headlines late in the week when they announced that they held preliminary talks with Apple about developing an electric car (see article here). Hyundai’s stock price surged 28% on the news (see nearby picture); by Friday morning they clarified their original statement, saying “We’ve been receiving requests of potential cooperation from diverse companies regarding development of autonomous driving EVs, but no decisions have been made as discussions are in early stage.” The sustainability of their share price throughout the day Friday portends otherwise. To quote the old adage “Where there’s smoke, there’s fire.” More to come.

The C Band auction—coming to a conclusion

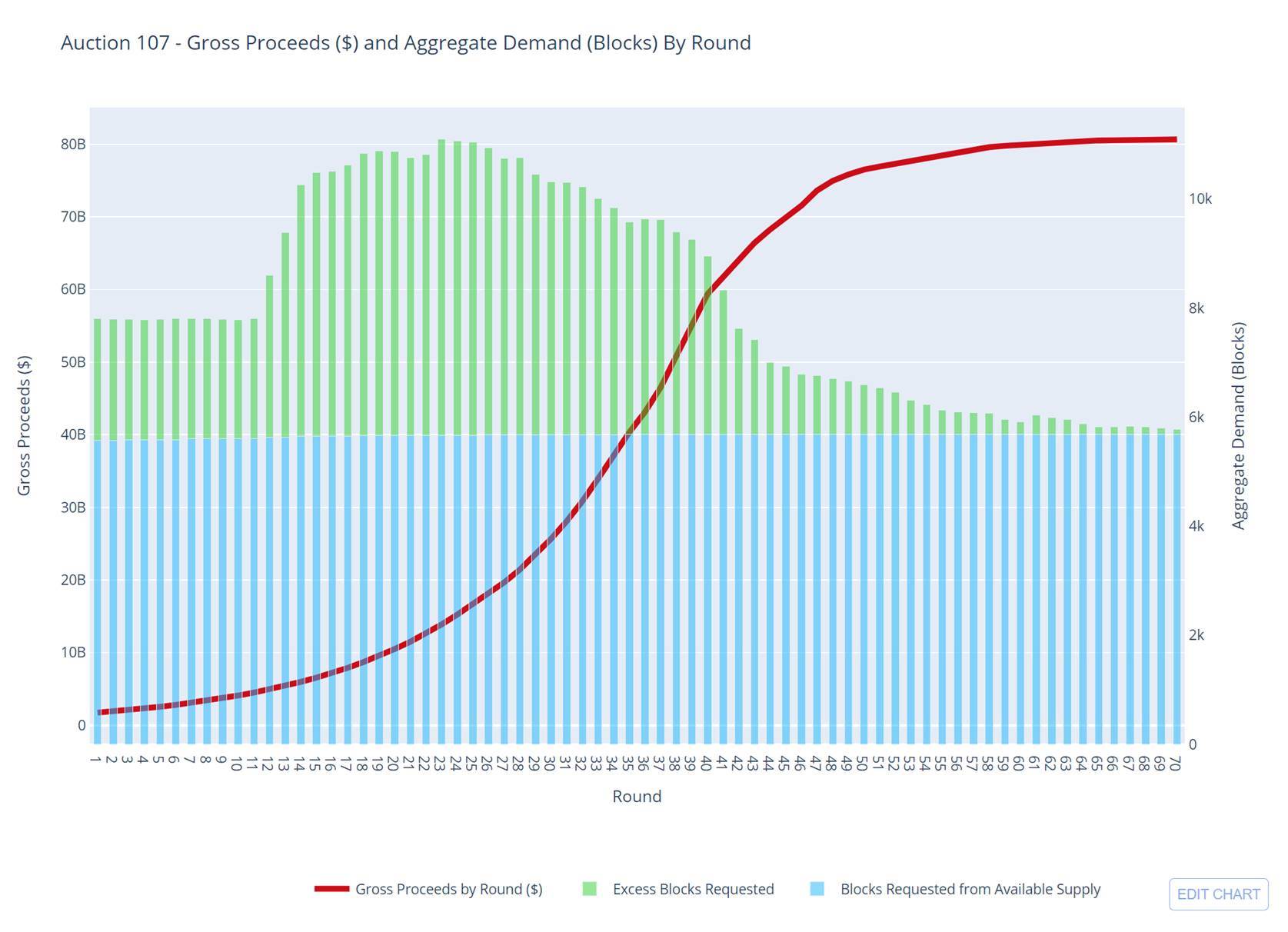

We would be remiss if we did not comment on the latest C-Band auction results (more here from Sasha Javid’s excellent tracker). For those of you who are not as close to the action, the bidding as of Friday is up to $80.7 billion (~$94 billion including relocation costs and accelerated clearing payments), and there are 29 areas (roughly 6-7% of the total available) where auction demand exceeds spectrum supply.

Two charts from the tracker mentioned above show that we are close to wrapping up the auction. The first correlates the aggregate purchase price versus the supply/ demand imbalance:

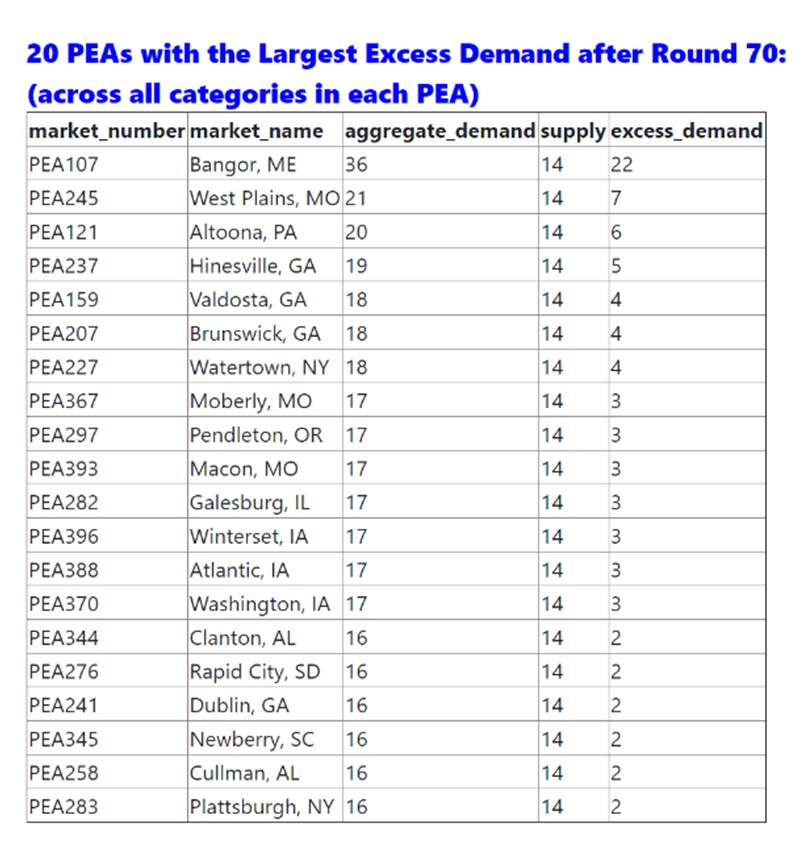

The green part of the stacked chart is down to a sliver. But, as we saw in previous spectrum auctions, there are a few (usually smaller) markets where bidding continues. Here is the status of the 20 largest Partial Economic Areas (PEA) where demand exceeds supply:

As we saw in the CBRS auctions earlier in 2020, some of the smaller locations can see fierce bidding. While we think the number of rounds will accelerate this week, the bidding should end shortly and by next Sunday’s Brief we will be able to identify more accurately the highest bidders (at these prices, the term “winners” rings hollow).

In the CBRS Priority Access License auction, spectrum licenses covering Loving County, Texas, generated a whopping $141 per MHz POP (Loving County hosts the Delaware Basin, one of the largest shale oil formations in the world). As noted in this Fierce Wireless article, population has little meaning because the spectrum is largely going to be used for machines.

While we are not experts on each PEA listed nearby, there seems to be more of a mix of agricultural/ rural areas with supply/ demand imbalances than shale/ petroleum. In many of these locales, there are 1-2 businesses who might be interested in establishing private networks, and there are Wireless Internet Service Providers (WISPs) who might be interested in establishing or augmenting their spectrum holdings. Even with a flurry of bidding in the last several rounds, however, it’s unlikely that we will see price per MHz POP levels in the remaining open bidding exceed $5, let alone $141.

Over the Holiday, many who wrote about the elevated prices in Auction 107 suggested that “no one saw this coming.” We were reminded this week at the Citi Global TMT West Conference, however, that Mike Sievert’s comments in September (at the Goldman Sachs conference) were pretty darn close. Here’s what the T-Mobile CEO predicted (starts at roughly 21:50 in the link here):

“AT&T and Verizon are going to spend the next year spending tens of billions of their shareholders’ dollars, stressing out their balance sheets to get an asset base that still isn’t as good as T-Mobile’s. And then finally, after all of that action, with no synergies to pay for it, will be on a strategy that’s two to three years behind T-Mobile’s.”

While we do not know the exact magnitude of who is going to end up paying what, we do know that a few more telecom balance sheets are going to be pressured by the C-Band auction. As we have stated many times, T-Mobile’s purchase of Sprint might prove to be the type of seminal event that provides one telecommunications provider a sustained economic advantage. Only time will tell.

CES 2021: Don’t let the virtual format fool you

The Consumer Electronics Show has been a one of the most influential tech events since its inception in 1967. Many of us have counted on those 30,000 daily steps to work off excess Holiday calories. This year, however, it’s all virtual. While 2021 will be a very different format, don’t let that fool you. There are some interesting things going on in the tech world, and CES will frame those events.

The first trend we discussed a few months ago in conjunction with Comcast CEO Brian Roberts at the Goldman Sachs conference mentioned earlier: The television will take center stage not only as an improved electronic display, but also as a broadband gateway. What’s inside the TV is now going to develop at a similar pace as displays. This leaves those of us who like tech history to wonder “Maybe Gateway was right, but just early to introduce their TV/ computer concept in 2002… ”

As we discussed in November, our attention was piqued when we saw the Wall Street Journal article indicating that the owner of the Peacock Network was in detailed discussions to produce and launch a TV featuring the Xfinity X1 platform at Walmart. As the article mentions, this would involve Comcast launching a national marketing campaign and potentially competing with other cable companies for services.

There’s no doubt that if Comcast’s offering included a full-fledged X1 instance (not just the Roku-competing Flex product), it would be different. But Walmart (and other distributors like Best Buy) want nationwide inventory. With Cox already on board with the X1, that leaves Charter. Once they come to terms with Comcast, the likelihood of national hardware distribution to counter Apple, Amazon and Roku increases significantly.

Bottom line: Be on the lookout for comments concerning the hardware modularity (the ability to detach and attach different components to satisfy the needs of multiple streaming services). Given the fragmented nature of the television industry, we may be headed towards customized hardware (we like this for many reasons, including the ability to locally store terabytes of content, thereby reducing the strain accessing the same content through cell towers). We would also not be shocked to see the equipment installment plan wave envelop televisions and other in-home electronics.

The second trend that will buzz through the virtual halls of CES is in-home productivity. Hard to believe, but last year’s CES was largely devoid of work from home (WFH) technology. Simple things like lighting, multi-screen configurations, portable air purifiers and software applications that enhance collaboration and employee development are going to be front and center. There could be more charging solutions as well, but less mobility means less reliance on long battery lives, at least for the next couple of quarters.

Finally, look for big announcements on electric vehicles (EV). The Ford Mustang Mach-E announcement at last year’s CES certainly was a highlight (picture at last year’s show nearby), and General Motors’ Mary Barra is the opening keynote speaker this year (Bloomberg article here).

With the rise of EV charging stations (and the information that is extracted from the vehicle and sent to servers while charging), and the corresponding rise of edge computing, we think there might be an opportunity to merge the requirements of these two trends.

Bottom line: Even with the return of a major Samsung “Unpacked” event to close the show, CES will be different without Vegas. COVID-19 has accelerated the need for technology solutions, expanded the WFH commute, and driven an unexpected home electronics boom. This year’s rooftop parties may be virtual, but progress continues at a torrential pace.

Private wireless networks: Focused but not mainstream—yet

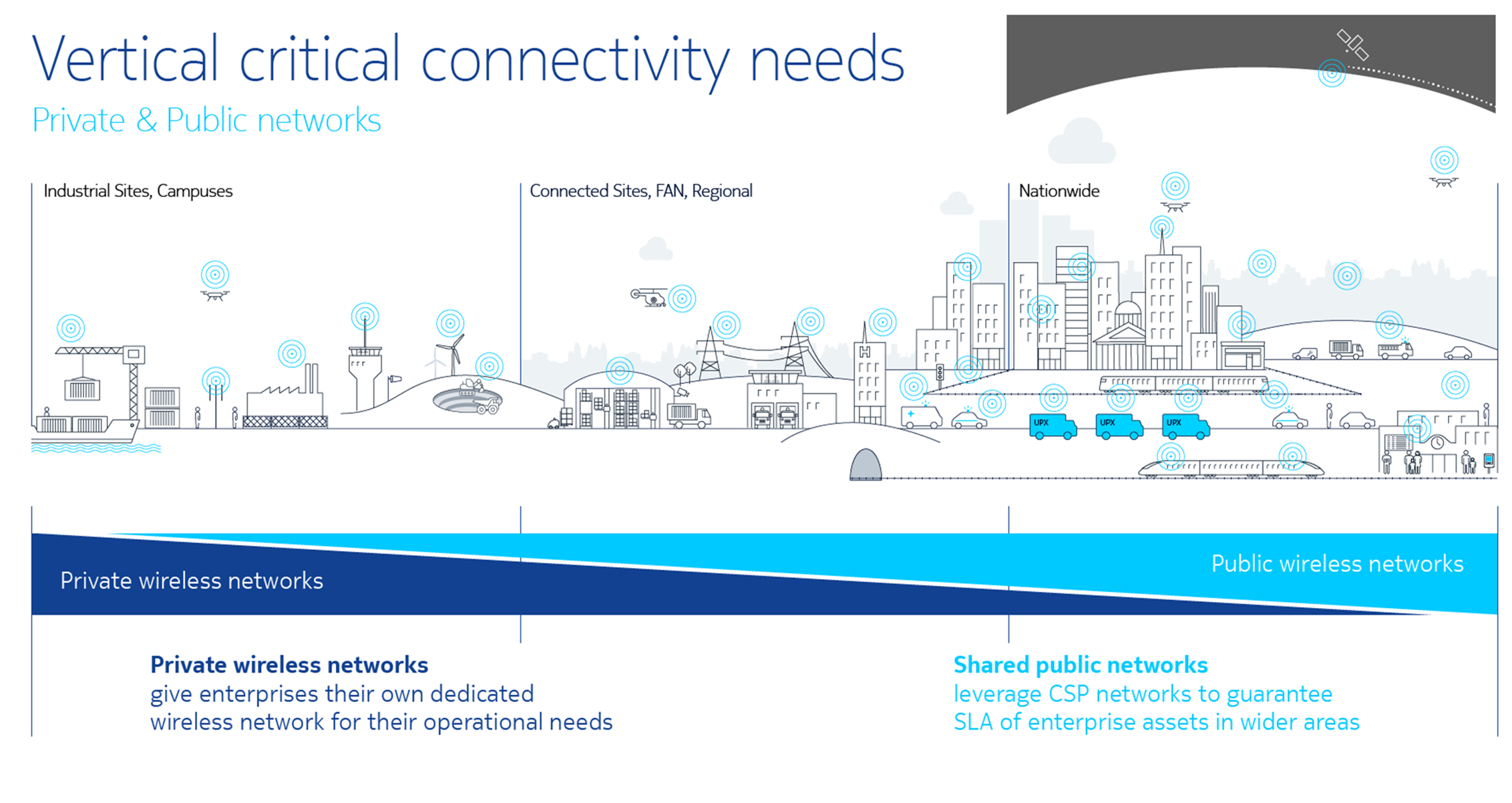

(Above chart courtesy of Nokia).

In previous Briefs, we have discussed two trends that will impact the industry in 2021. In the December 13th Brief, we talked about content competition – how HBO Max bundling would be AT&T’s cudgel to regain market dominance. T-Mobile’s pre-released metrics this week clearly show that content matters (postpaid phone churn did rise slightly) but there are plenty of smartphone users willing to try T-Mobile’s new network. Xfinity and Spectrum Mobile will also post strong numbers without a content bundle (although they do require broadband service to get the most attractive rate). Content is going to become more important: whether it’s as important as the tie between frequent flier miles and long-distance services in the 1990s remains to be seen.

On December 20th, we discussed the role of fixed wireless consumer and small business alternatives to cable, specifically rollouts from T-Mobile and Verizon that are focused on DSL-served areas. Our view is that price-sensitive customers will give fixed wireless a try, if only to be eligible for the winback rate from their previous provider in 90 days. We think that many of them will stay, however, and wireless carriers will challenge cable for a small but growing subset of customers in 2021.

The last major trend for 2021 is the rise of private 5G/CBRS wireless networks. It will require the next couple of Sunday Briefs to fully explain the impact that this will have on the wireless carrier community (particularly AT&T and Verizon), but our prediction/ theme is this: Private Wireless Networks will expand from the largest shipyards, ports, factory complexes and large campus settings (see terrific Nokia explanation above) into increasingly smaller venues such as hospitals and schools. As a result, redundant fiber connectivity requirements will proliferate (if they are not already in place), and latency/ throughput service level metrics will become even more critical.

Interestingly, this last trend will likely be led by more than one wireless provider. More to come next week. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Stay safe, keep your social distance, and Go Chiefs!

The post The Sunday Brief: CES 2021—don’t let the virtual format fool you appeared first on RCR Wireless News.