Greetings from rural Midwest. Pictured is the American Broadband fiber inventory for a new market we are in the process of launching. More details on that launch in a few weeks as we bring fiber goodness to unserved and underserved homes and businesses.

This has been a very busy couple of weeks with insightful earnings news from many companies. We are going to do our best to sort through 10+ hours of earnings calls and focus on a few questions we think were left unanswered.

The fortnight that was

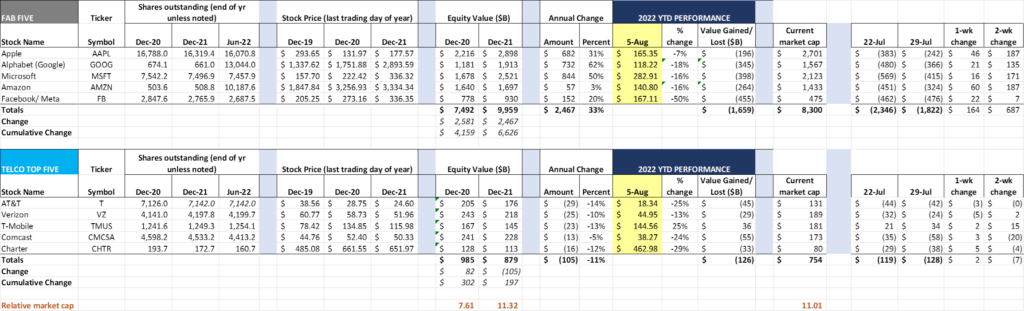

In the previous Brief, we discussed AT&T’s and Verizon’s earnings. After that Brief was published, the remaining eight companies (including each of the Fab Five) reported earnings. For the Fab Five, reaction was positive across the board – even Meta/ Facebook added to their market capitalization. Over the last two weeks, the Fab Five have added $687 billion in value with 99% of that coming from Apple, Amazon, Microsoft and Alphabet. Cumulative Fab Five losses, which peaked at $2.7 trillion in June, are now a trillion less.

The Telco Top Five had more of an intra-company realignment rather than large-scale movement. Over the last two weeks, they have lost $7 billion in total market capitalization with $24 billion in Comcast and Charter losses offset by $17 billion in T-Mobile and Verizon gains (re: Verizon took their stock price haircut three weeks ago). Comcast has lost $55 billion in market capitalization this year and now trails T-Mobile in total value. Interestingly, T-Mobile is only $8 billion away from taking the “most valuable company” spot from Verizon.

While the discussion of the Telco Top Five has a distinctively US-focused bent, the Fab Five are more closely linked to the global recovery. With the dollar remaining at record highs (see the Bloomberg dollar index measure here, dollar to yen index from Yahoo here and the Wall Street Journal dollar to euro exchange rate history here), earnings continue to require constant currency adjustments. Each of the Fab Five are likely keeping significant currency stores abroad and borrowing in US dollars as necessary to fund daily operations.

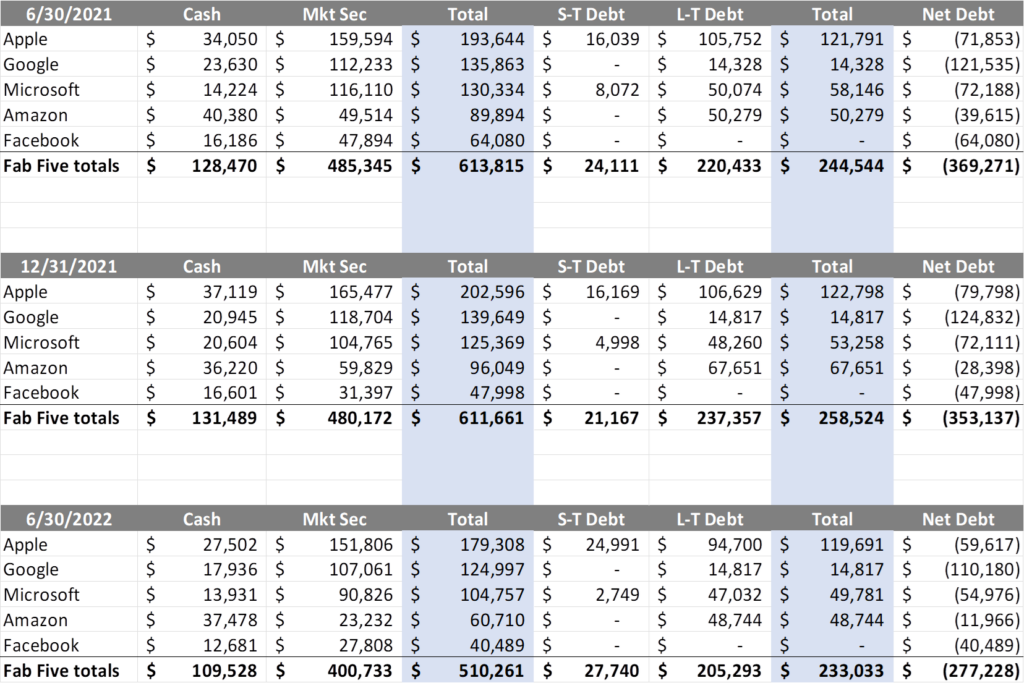

Not much funding is needed thanks to large cash balances for each of the Fab Five. The following chart was posted to our online-only interim Brief post (here) and reflects the net debt for each of the Fab Five from 2Q 2021, 4Q 2021, and 2Q 2022:

Negative net debt shrank by about $92 billion over the four quarters ending 2Q 2022, with $24 billion coming from Meta/ Facebook. While each of the Fab Five have share buyback plans, it does not appear that recent market capitalization losses have triggered the action of taking on additional debt to buy back shares. These corresponding drops would seem to indicate that foreign repatriation of funds has slowed to a crawl, but the situation is not dire.

Each of the Fab Five generates plenty of cash to continue their businesses generally unabated; provided that there is no forecasted long-term recession (even with all of the back and forth on our current economic state, no one is predicting long-term economic declines).

A strong cash position is also good for quick execution of acquisitions. As we discussed in the last Brief, Amazon is looking to supplement its health care portfolio with their $3.1 billion One Medical acquisition, and last Friday they announced the acquisition of the Roomba parent, iRobot for $1.7 billion (including debt, announcement here). If only the FTC would cooperate with a quick approval (more on the FTC’s activities with respect to Amazon and Meta in this Bloomberg article).

One other use of cash (copious amounts in this instance) is buying up rights to selected games in various sports. Apple has been on a tear with Major League Soccer (MLS – 10 year term – $2.5 billion – takeaway from ESPN) and Friday Night Baseball (term unknown, but multi-country streaming rights), while Amazon snagged Thursday Night Football from Fox (NFL – 11 year term – price ~$11 billion) and NBC expanded their Sunday Night Football rights with Peacock streaming and Telemundo Deportes broadcast rights (NFL – 11 year term – price ~$20 billion).

The biggest prize, however, is the NFL Sunday Ticket. We have discussed this in a few Briefs, and expect Apple to take the prize with somewhere between $2.5 and $3.0 billion per year (Dylan Byers has a good summary of the Apple advantage in this Puck article). The question then becomes term – will the NFL make the contract concurrent to the existing deals, locking in a marquis global streaming and distribution partner? Will Apple then turn around and strike an exclusive streaming distribution deal for commercial locations (e.g., with AT&T or Verizon)?

One of the nice things about September is that it features the start of the NFL season (Sept 8 – Buffalo Bills at the Los Angeles Rams) and also the annual Apple iPhone and other hardware announcements. Whether Tim Cook could have a special “one more thing” depends on Apple’s appetite to spend for these rights. We think that Apple will expand their audience because of this deal and will also step up their distribution agreements with rural and suburban fiber providers to convert as many satellite Sunday Ticket customers as possible.

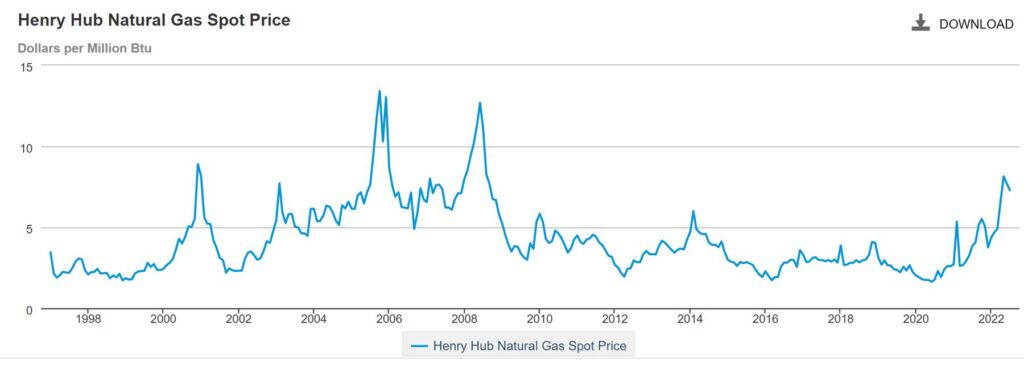

Finally, many of you have asked about price increases in the communications space and the potential persistency of our current wage-price trend. As I have discussed with many of you, when you own a part of a rural broadband provider with legacy operations in Alaska, Nebraska, and Louisiana, certain commodity prices drive regional economic outlooks. In Louisiana (Lake Charles), natural gas is very important. Here’s the price of natural gas going back to 1997 from the U.S. Energy Information Administration:

Natural gas is at a 14-year high with annual price gains in the 75-80% range. Heat for many homes and businesses, particularly in the Midwest, comes from natural gas. This will impact real estate costs for a broad array of service providers this winter, particularly hospitals, commercial offices, and delivery vehicles that have converted to natural gas. While we do not have time to go into heating oil and propane, prices have increased on par with their natural gas counterparts (more here).

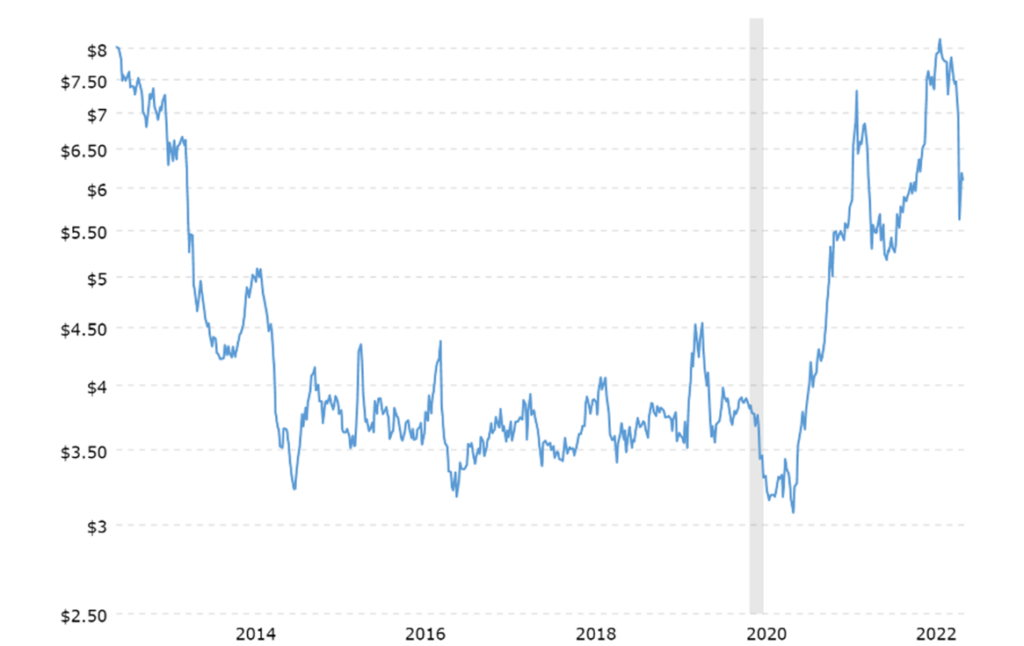

In Nebraska, corn drives the economy. Here’s that chart :

In early 2021, as the world was beginning to think about a post-COVID economy, corn shot up from the COVID-low $3-$3.50 per bushel to $5-$6 per bushel. That has served as an effective floor for the last two harvests. Like petroleum, corn is an essential ingredient in many foods. The 6-7 years of persistently low prices seems to have been broken, and, while that has many Nebraska farmers happy (especially if fertilizer prices continue to decline from their recent highs), it’s not a good sign for long-term inflation.

This is not a commodity blog, but to answer several of your questions, there’s no sign from the heartland using petroleum, natural gas, propane/ heating oil, or corn prices that we are in a transitory phase. It’s time to think about 4-6% annual inflation, at least for several years. (And, for those in Alaska who look beyond petroleum costs, check out the price trends of various shell fish from the Alaska Department of Fish and Game here – yikes!).

Bigger questions after second quarter earnings

There’s a lot to unpack from the second quarter earnings calls. To use space and print as effectively as possible, we will spend this Brief and the next attempting to explain and answer four questions:

- How can cable mobile/ broadband bundling succeed?

- How aggressive will (holiday) promotions be for the rest of 2022?

- Is T-Mobile a meaningful business player beyond small business (50+ employees) in the next five years?

- Can any meaningful acquisition activity receive approval?

There are many more questions to think about, but these are the big multi-company/macro questions in our view.

Question #1: How can cable mobile/ broadband bundling succeed?

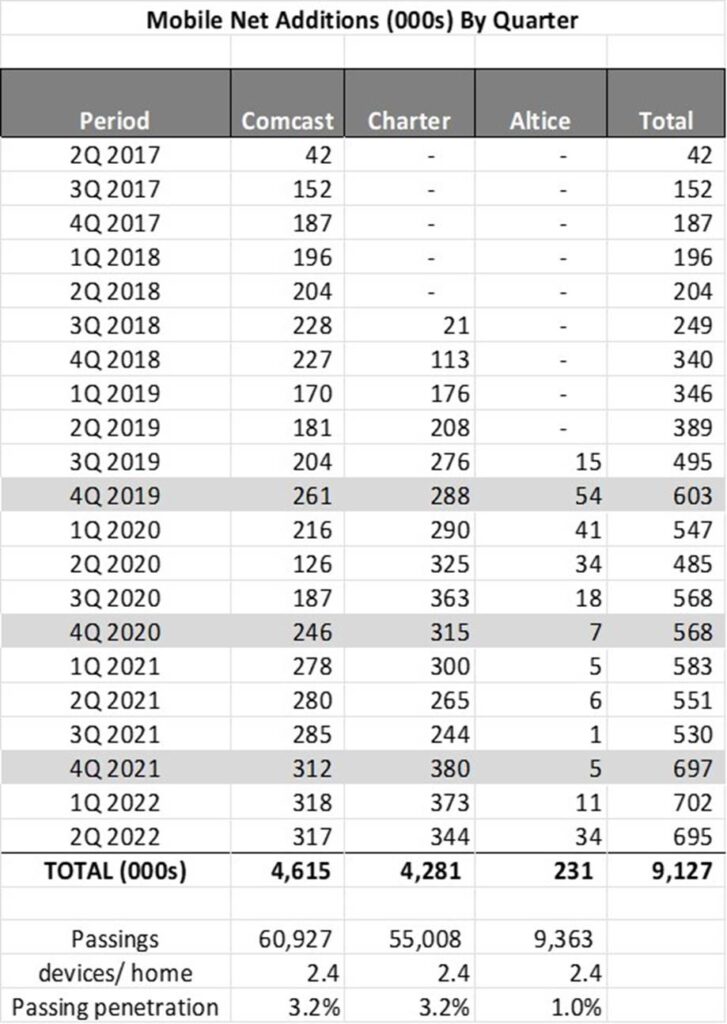

Most of the cable companies have reported earnings, and mobile bundling success/ opportunity was at the top of the list. Nearby is the chart showing net additions for each cable company since each launched MVNOs.

To date, using 2.4 devices per home (a lower figure than we would use for a traditional wireless provider), Comcast and Charter have penetrated approximately 3.2% of their total passings with wireless. Comcast’s wireless offering turned five years old this quarter, and Charter’s will turn four years old next quarter. If the tables were turned, and we were examining penetration of a new fiber provider in a Charter or Comcast territory, would 4% (or even 24%) be acceptable for the business case? Cable’s performance in wireless has been plodding patient (no subsidies or crazy offers), but can they afford to wait much longer?

Comcast and Charter don’t emphasize triple play bundles any longer. Digital phone has been deselected in favor of mobile (finally). Programming costs continue to rise, and YouTube and Hulu now define skinny bundles (and skinny margins) even as they redefine the advertising world. Both companies would rather have broadband from a new passing than an incremental revenue generating unit (RGU) of video at an existing home.

Mobile is a slightly better gross margin business for traditional cable companies than video (although nowhere as good as digital phone). Tom Rutledge, Charter’s CEO, has gone so far as to (rightly) redefine his company as one of the largest wireless companies in the world. Why has market share been so elusive?

Charter’s COO, Chris Winfrey, addressed this issue on their earnings call in response to a question from Peter Supino, saying that Charter has struggled with bridging the gap between household (stationary) revenues versus device-driven revenues.

“So nothing to announce today, Peter, but clearly, we think a lot about mobile and its ability not only to attach to existing Internet customers, which has been the predominant path so far. But, as the market understands better our product, the fact that it is the fastest mobile product in the country and that it’s real, that it really does save customers a lot of money, no contracts, no taxes, no fees, I do think there’s a really powerful case that we can use mobile to actually drive significant Internet net adds and particularly in the market with low volume to be able to kick start in volume in the marketplace by using mobile to do just that.

So we’re constantly testing different concepts in the marketplace. Economically, it’s a no-brainer and it makes a lot of sense, but it is a new package structure for educating customers to get them to think about buying a household service and an individual service together so that they can get those savings and they can get that better product, and that may take a little bit of time for us to find the right connection as well as to educate the marketplace.”

Spectrum Mobile is a very strong product when it is paired with a broadband connection that customers value. With their network provider (Verizon) now in market with a $30/ month price point (albeit with the 5th line), is the bloom off the rose? Can cable play defense and offense at the same time?

We believe strongly that cable can win 25% share if they combine switching with the introduction of new (Apple) devices. Aggressive device promotion (via aggressive trade-in credits and perhaps a free speed upgrade) will win the day but Charter and Comcast need to commit to the short-term financial risk. They also need to improve their unserved base marketing once they get a new offer in place. Running Spectrum Mobile spots during unused ad inventory is fine at the beginning, but the business is entering its fifth year.

Most of the same points above can be made for Comcast or even Altice (who is now growing at pre-Sprint rates and appears to be off to a good relationship with T-Mobile). One additional point for Comcast would be to at least match Spectrum’s growth rate – for 12 out of the last 14 quarters, Spectrum has outpaced Comcast on net additions with six million fewer households passed.

Question #2: How aggressive will (holiday) promotions be for the rest of 2022?

Times are going to be tight for 40-50% of consumers heading into the Holiday selling season. Salesforce published their predictions for the Holiday season late in June – it was chock full of interesting data. One important data point: 51% of consumers plan to spend less in the 2022 holiday season than 2021.

They make several predictions:

- Shoppers will buy even earlier to avoid price hikes (37% more US shoppers are starting earlier)

- Loyalty shifts to value (half of all shoppers will shift brands this holiday due to pricing)

- Physical stores will drive growth across all channels (60% of all digital orders are now influenced by the store)

- Shoppers will gravitate toward sustainable options (64% of consumers will stop doing business with a company if corporate values don’t align to their own)

- Retailers will test NFT drops (creating digital “twins” of physical goods)

While we aren’t sure that all of these are applicable to the communications industry, we definitely think that the first three predictions could shape the attractiveness of one broadband or wireless carrier over another.

Both Verizon and AT&T suggested in their earnings calls that increased content bundling is “on the table” for the fourth quarter. T-Mobile already has a terrific Tuesdays app that gives stuff away for free (including 20 cent gas discounts at Shell – our personal favorite). Charter and Comcast, with their new joint venture, could actually give away a free television (with set top box already included) for the right contract term and product mix.

These are all good, but the real “free” to most consumers is devices, particularly the iPhone. Or, even better, the Phone + Apple Care. How that is accomplished within the boundaries Apple places on carrier pricing remains to be seen, but we have a feeling that many teams are working on the solution at each company. We think that we may soon see the most competitive wireless device environment in the last decade, one which will spawn switching and likely lead T-Mobile to market capitalization leadership. More on that the next Brief.

Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of August and go Royals and Sporting KC!

The post The Sunday Brief: Bigger questions after second quarter earnings appeared first on RCR Wireless News.