iPhone Kick-Starts 5G’s Mass Market Appeal

5G was officially launched in South Korea in mid-2019 with a few smartphones, followed by many countries with additional commercial launches and new devices. Prior to this, and in a very similar pattern to 4G launches, 5G was only accessible through larger form factor devices, including MiFi units and Customer Premises Equipment (CPE) that had very limited mass market appeal. Even the few initial 5G-capable smartphones that kick-started the 5G race were Android and first-generation devices, which needed optimization and many improvements to reach the efficiency and user experience level subscribers have come to expect in modern smartphones. As of 2021, these improvements have arrived and, according to ABI Research analysts, sub-US$200 5G-capable Android devices will be available in the market in 2021, signaling that 5G has indeed reached the mass market.

However, a major influence on the “mass market” status of a new generation is the introduction of a capable iPhone, which appeals to a very broad subscriber base and typically translates to an almost immediate market penetration of new-generation-capable devices. Moreover, iPhone devices are in the high-end premium segment, thus attracting the interest of high-value clients that all operators wish to acquire and retain. This subscriber base is vital for any operator to monetize the new generation.

Apple launched the iPhone 12 in October 2020, with the full product lineup supporting 5G connectivity, namely the iPhone 12, iPhone 12 Mini, iPhone 12 Pro, and iPhone 12 Pro Max. ABI Research estimates that Apple shipped nearly 80 million iPhone 12s in 2020, which is much more than any other device vendor’s 5G-capable smartphones, let alone a single model. As an effect of this, many networks throughout the world experienced network spikes shortly after the launch of these iPhones. It is an industry-accepted fact that these devices have a major effect on both network performance and the perceived user experience.

5G is a revolution in terms of network technology, especially when considering the effect on the user experience. In 4G, network performance was expected to be on par between different vendor equipment, affected mostly by software differences (e.g., the radio scheduler) and hardware/software performance and optimization. On the other hand, 5G operators have new deployment choices: massive Multiple Input, Multiple Output (MIMO) flavors (e.g., 32T32R versus 64T64R), Time-Division Duplex (TDD) spectrum configurations, and, most importantly, software features. For example, beamforming algorithms for massive MIMO are not part of the official standard, which is a competitive differentiation between vendors, especially when operators now need to offer the best user experience possible.

Crowd-Sourced 5G Measurements

The commercialization of 5G and the launch of the compatible iPhone has urged operators to use network performance as a marketing tool to entice consumers to have the best user experience. This effect, coupled with the fact that consumers do not have a technical understanding of 5G, translates to an expectation of an improvement when migrating from 4G to 5G. The commercialization of 5G has brought on new headaches in competitive markets, where operators are racing to deploy the best networks and show that theirs is the best. All 5G operators will claim that their network is the best, but independent benchmarks are necessary to compare like-for-like. This is where third-party companies, including Ookla, RootMetrics, and umlaut (formerly P3), excel, providing either drive testing (umlaut) or crowdsourced (Ookla, RootMetrics) measurements. Both approaches have merits, although crowd-sourced data points are expected to be closer to the user experience, rather than the network itself.

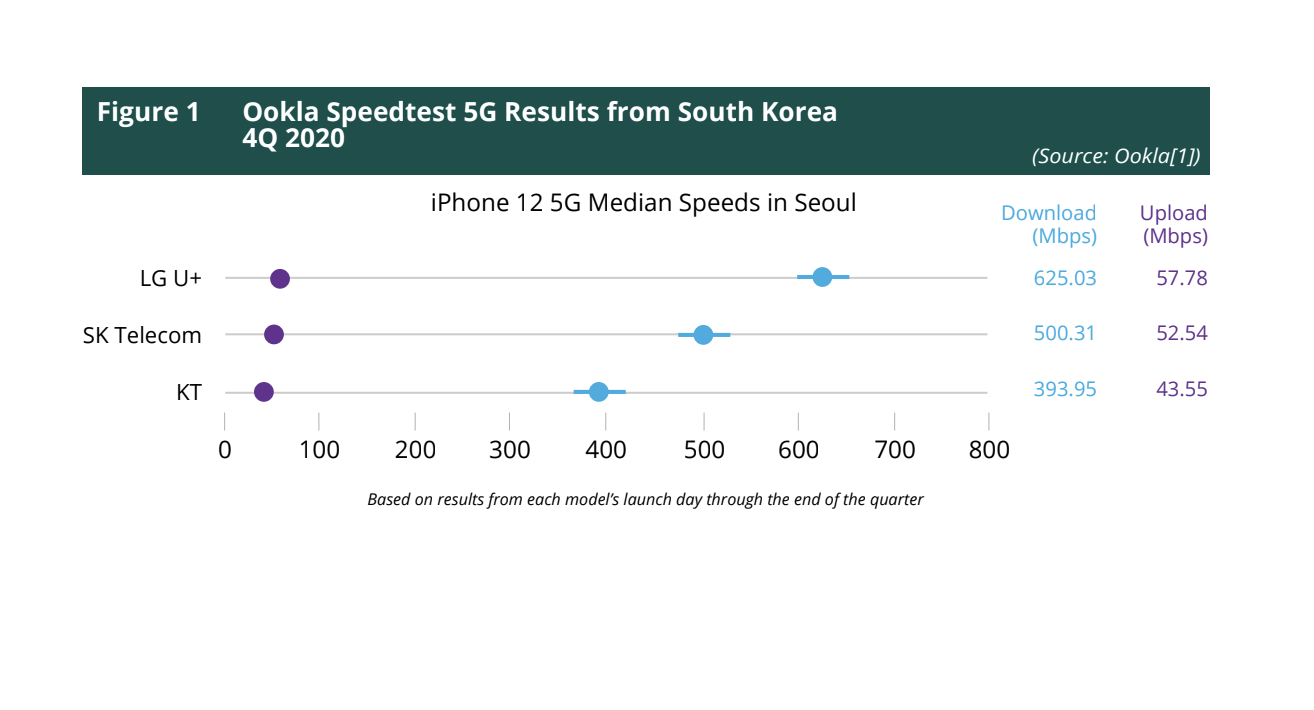

These measurements illustrate that there are differences in terms of user experience between different networks, even when networks are using almost the same amount of spectrum and in the same frequency band. For example, the following Ookla results from South Korea illustrate a stark difference between the three competing operators.

It should be noted that all three 5G operators in South Korea operate in the New Radio (NR) band n78 and LG U+ uses 80 megahertz (MHz) of spectrum, while SK Telecom and KT use 100 MHz. Despite this, LG U+ can boast a superior user experience, either through better management of its network or a denser distribution of cell sites. Ookla’s “Apple has 5G! But How Fast is the iPhone 12?” article illustrates material differences between competitors in many different countries:

- In Hong Kong, China Mobile HK outperformed its competitors by a large margin, offering 70 Megabits per Second (Mbps) higher speeds compared to CSL, 3HK, and SmarTone. The same performance was illustrated in the uplink, with similar spectrum holdings: China Mobile HK holds 60 MHz of spectrum, CSL and SmarTone hold 50 MHz, and 3HK holds 40 MHz.

- In Madrid, Vodafone outperformed Orange, Yoigo, and Movistar in both uplink and downlink, when all four operators had very similar amounts of spectrum. Vodafone and Movistar have 90 MHz of spectrum in the n78 band, while Yoigo has 80 MHz and Orange has 100 MHz.

The RootMetrics U.K. mobile network performance review² also illustrates that EE performs better than its competitors, in most cases, in similar spectrum holdings and network rollout plans.

The umlaut road test report for 2020³ is a much more comprehensive overview of cellular network tests across Europe that still indicate network performance, but not directly from the end-user perspective. Nevertheless, the very same differences that were collected from Ookla’s and RootMetrics’s tests are evident in umlaut’s road tests: early drive tests indicate that the average 5G download speed is 3X faster than 4G. Moreover, umlaut measured Sunrise 5G with an average throughput of 405 Mbps compared to Swisscom’s 219 Mbps. Sunrise holds 100 MHz in the n78 band, while Swisscom holds 120 MHz.

So, what do these crowd-sourced and road test measurements tell us in terms of network quality? Setting spectrum holdings aside, what differentiates 5G networks in terms of network performance?

5G network performance differentiators

Crowd-sourced measurements show us that 5G networks are not created equal, even when they are deployed in the same countries, often by operators that share the very same sites and the same amount of spectrum. Although the equipment that Ookla, RootMetrics, and umlaut have benchmarked may have been “Generation 1” 5G base stations, these differences are expected to remain in the market as vendors refine their software algorithms and enhance existing infrastructure with new features and more optimizations. Two major areas of improvement are expected in the massive MIMO beamforming domain, as well as the Active Antenna Unit (AAU) power consumption, to reduce the energy footprint of 5G base stations.

As 5G devices become mainstream, and the market penetration of the iPhone 12 continues, these new software features may create an even bigger difference between competing operators, especially when 5G networks start to become congested. At that time, and just like previous cellular generations, network optimization and new software features will be vital for operators to ensure 5G user experience remains superior to competition. It is also vital for the industry to start working on additional features and technologies to augment existing deployments, especially when enterprise 5G is expected to significantly increase traffic and cellular network requirements. What we can only say with certainty is that the world has experienced only a fraction of what 5G can provide and new use cases will emerge in the following years.

- https://www.speedtest.net/insights/blog/apple-iphone-12-launch-5g-speeds/

- https://rootmetrics.com/en-GB/content/uk-mobile-performance-in-review-2H-2020

- https://www.umlaut.com/uploads/documents/2020-Network-Test-DACH-English.pdf

The post Not all 5G is created equal (Analyst Angle) appeared first on RCR Wireless News.