Aggregate royalty payments for licensing cellular technology standard-essential patents (SEPs) in smartphones have remained in modest single-digit percentages and have declined since 2013.

This defies purported concerns that the stacking of patent royalties paid to multiple licensors have led to or would lead to unreasonably high aggregate rates on mobile devices. It also counters the claims of some OEMs and others that various SEP owners demand licensing fees in excess of what is fair, reasonable and non-discriminatory (FRAND).

The true aggregate price is fair and reasonable

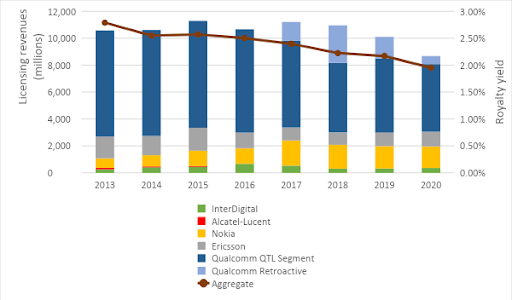

Amid wild speculation about SEP licensing charges up until 2015, one article drawing a lot of attention around then outrageously asserted the cost could be 30 percent of a $400 smartphone price. In response, I set about measuring how much in patent royalties was actually being paid in comparison to total revenues generated on mobile handset sales (e.g. $410 billion in 2014, according to IDC). I termed the ratio of the two figures, expressed as a percentage, the “royalty yield.” This is an average reflecting all royalties paid divided by the total of licensed and unlicensed handset sales revenues. I found the royalty yield to be no more than around 5 percent in aggregate including all licensors. That percentage is the sum of the royalty yields for individual licensors.

My assessments were conservatively high because some of the royalties paid are for licensing intellectual property other than cellular SEPs, or are for network equipment, devices such as PC data sticks or IoT appliances.

I found that major licensors Alcatel-Lucent, Ericsson, InterDigital, Nokia and Qualcomm accounted for most royalties paid, even with conservatively high estimates for other licensors. For example, I included 3G and 4G LTE patent pool licensing at rate card prices, even though it was evident hardly any implementers were signing up for those.

My methodology and results were replicated and validated in a couple of academic research papers, including one enduring peer review before publication, which with more detailed analysis showed aggregate yields to be even lower than my estimates.

Aggregate royalties declined despite global boom in 4G LTE smartphones and introduction of 5G

Total royalties and royalty yields have fallen substantially since 2015 for those major cellular SEP licensors. While 4G LTE smartphone sales surged, OEMs have managed to reduce royalty rates paid for licensing. For example, even though royalties are generally charged as a percentage of a phone’s selling price, royalty caps limiting the royalty charge—as if the phone price was, for example, $200 or $400—ensure that royalty yields reduce as smartphone prices are raised, for example, with introduction of new models priced at $1,000 or more in recent years.

Nokia completed its acquisition of Alcatel-Lucent in 2014.

Qualcomm figures include retroactive allocations of licensing dispute settlement payments of $4.7 billion by Apple in 2019 and $1.8 billion by Huawei in 2020 that were not included in Qualcomm Technology Licensing segment figures.

With the introduction of each new generation of mobile technology since 3G, it was also alleged that charges for the new standards would stack further to an unreasonable aggregate burden on OEMs and consumers. However, despite 5G’s commercial introduction in 2019, aggregate royalties have not risen for these companies that also first announced programs and charges for 5G licensing.

Up and downs

There is was substantial increase in royalty income for Nokia from 2014. But this is unsurprising due to a dramatic change in the company’s industry profile and business model following the divestiture of its smartphone business to Microsoft that year. For Nokia prior to 2014, as for Samsung and Apple since then, SEP licensing was more oriented to minimizing—through cross-licensing—the licensing fees charged by other patent owners on market-leading handset sales, than to generating cash royalties. A question posed to me by a hedge fund client back then was: ‘to what extent and how quickly could Nokia “unroll” its cross-licenses to increase the cash royalties it receives?’ Nokia’s licensing revenues more than doubled between 2014 and 2017 before declining around 15 percent in the following years to 2020. The company’s royalty yield also doubled to 0.4 percent before falling back somewhat over the same time periods.

Though royalty fees for Ericsson, Nokia and Qualcomm are modest in comparison to revenues from all their other sales, royalties are very important because profit margins on licensing are relatively high. SEP licensing fee income is crucial to fund the substantial ongoing R&D investments by all these licensor companies, also including InterDigital. With development of further standard-essential technologies, the benefits of those investments also become openly available to the entire mobile ecosystem.

The major licensors detailed in my 2015 analysis received more than half of all royalties paid and still do despite the overall decline in licensing revenues for these companies. The aggregate royalty yield including the above-named companies and all other licensors has also declined. As other players have become more significant in licensing, these have had only minor effects on aggregate royalties paid by OEMs to all licensors. For example, while Huawei now boasts large shares of patents declared essential to LTE and 5G standards, with its smartphone market share second only to Samsung in 2019, like old Nokia, Samsung and Apple, Huawei has also been more focused on minimizing the royalties it has had to pay out than on increasing the cash royalties it generates. With cross-licensing, OEMs with SEP portfolios share their intellectual property while minimizing licensing costs on their product manufactures and sales.

With the US chip supply bans on Huawei and with it spinning off its Honor sub-brand, Huawei’s smartphone market share has plummeted and it is also now seeking to increase its patent monetization. While Huawei has reportedly paid out more than $6 billlion in patent fees over decades, it is expecting to generate between $1.2 billion and $1.3 billion in patent licensing revenues between 2019 and 2021. I presume that means revenues averaging around $420 million per year over three years. Similarly, with LG exiting the smartphone market due to its poor profitability there, despite its large mobile SEP portfolio, it could also seek to increasingly monetize its SEPs through licensing, or through patent sales.

There are other cellular SEP licensors, including some so-called patent assertion entities that have obtained headline-grabbing licensing awards. But the significance of these on aggregate royalty yields is also relatively small. Large award figures tend to cover numerous years of infringement and it can take many years of litigation with awards being amended or revoked before appeals processes are exhausted or settlement with lower amounts paid. Following the annulment of a $506 million jury verdict last year in favor of PanOptis for 4G LTE patent infringements by Apple, a recent jury retrial including directions to consider requirements for FRAND licensing terms has revised the award to $300 million. Apple says It plans to appeal.

It is OEM conduct that unlevels the playing field

Contentions about royalty charges are as much about the differences in licensing fees among licensees as they are about the level of charges overall. It is these differences that effect competition among OEMs.

The absolute costs of patent licensing fees have never had much effect on overall market demand because aggregate royalties paid by OEMs are modest in comparison to their handset prices and revenues. While many OEMs, including larger ones like LG in recent years, struggle for profitability, it is the disparities in the amounts paid—or not paid—for licensing that can cause significant competitive disadvantage or advantage among smartphone and other device OEMs. For example, all manufacturers have to pay somewhat similar prices for commodities such as batteries and memory chips, and European value added taxes are levied at exactly the same rate on all manufacturers’ devices sold, at national rates ranging from 17 percent to 27 percent.

While the onus is upon licensees to be non-discriminatory in their licensing charges, it is OEMs implementing SEP technologies that push for the inequalities. All the major licensors publish rate cards and would willingly license to all OEMs at those prices. However, major licensees such as Apple are formidable counterparties in licensing negotiations and disputes. They have the motivation, deep pockets and clout to force burdensome and drawn-out litigation, and yet can offer enticements such as substantial cash lump sums up-front for settlement at low effective royalty rates. Other OEMs have found it advantageous to hold out from making any royalty payments for years under the rationale that litigation is cheaper, even if it only delays eventual payment of FRAND royalties.

While for many years the debate on FRAND was largely about what might be a fair and reasonable rate for individual licensors in general, and for all of them in aggregate, SEP litigation is increasing about discriminatory pricing. Unacceptable versus acceptable discrimination (i.e. differences in royalty pricing for different licensees) apparently hinges on whether different licensees are deemed “similarly situated.” It was a key question in selecting “comparable licenses” in TCL v. Ericsson, as it is in other disputes. This is still work-in-progress in the courts.

Expanding the royalty base with licensed sales in IoT

My royalty yield figures are conservative because they are based on the denominator of mobile phone sales revenues which does not includes any sales revenues from other cellular-enabled products including tablets, PC data sticks and IoT devices. The inclusion of any such revenues would reduce royalty yields further. With IoT becoming more significant in mobile communications in recent years, omitting the increasing revenues for those devices from the denominator of my royalty yield calculations makes my yield curve the above graphic an increasingly conservative depiction of how low royalty charges are.

Measuring and assessing whether royalty charges are FRAND or burdensome overall is more complex beyond phones where the royalty yield was a simple and useful metric. Other devices range from simple sensors to refrigerators, cars and industrial equipment. The prices for these and the value they derive from cellular connectivity varies enormously.

Non-phone devices are commonly licensed, but sales of these and licensing revenues on them have been relatively small. Mobile phones continue to dominate numbers of cellular devices sold and licensed, but the proportion of non-cellular devices has gradually increased. According to GSMA Intelligence, the percentage total cellular network connections that are “machine-to-machine” increased from 2.7 percent of 6.9 billion worldwide in 2013 to 17.4 percent of 10 billion in 2020. The percentages of non-phone device sales, upon which royalties are due, would be higher in these growing markets because it is the accumulated sales of devices over several years that drive the total numbers of connections.

With the anticipated growth in IoT including 5G and applications such as connected cars, some analysts, including JP Morgan in a June 2021 equity research report, project significant non-smartphone revenues: for example; “an estimated ~$1 bn of the ~$6.5 bn of QTL revenue being derived from non-handset license royalties.”

The post Modest SEP royalties on smartphones have declined and licensing is stabilizing (Analyst Angle) appeared first on RCR Wireless News.