The size of the Multi-Access Edge Computing (MEC) Market depends on the goals trying to be achieved. Several factors need to be considered, such as the part of the edge and edge compute applications included in the definition, whether the market being described is the Public MEC or Private MEC, the latency being delivered, server capacity, and how much of the population is covered. Answering these questions helps us to predict how large the future MEC market will be. This article will examine the impact of these variables using the U.S. market as an example.

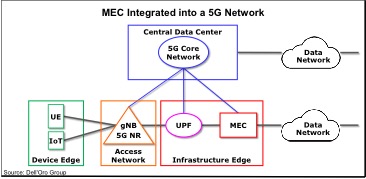

First, let’s define MEC. Dell’Oro Group’s recently released Multi-Access Edge Computing report describes the Infrastructure Edge and the Device Edge. The Infrastructure Edge is located on the upstream side of the access network, as opposed to the user side of the network, which is known as the Device Edge (Figure 1). Content Delivery Networks (CDNs) are not included in our definition of MEC.

The size of the market depends primarily on the desired latency to be offered and the coverage, as measured by population coverage by a given service provider (SP). A natural side-effect of MEC, which will benefit a SP, is backhaul optimization.

Low-latency networking is growing as a new requirement for new applications under development. A myriad of use cases has been identified, centered on real-time and near real-time communications, such as multi-player online gaming, augmented reality/virtual reality (AR/VR), AI-assisted video analytics, and autonomous driving. In addition, new standards for 5G are being developed and are nearing completion for Ultra-Reliable Low-Latency Communications (URLLC) for factory automation, and massive Machine Type Communications (mMTC) for extremely high-density sensor networks. Edge computing is the vehicle for addressing these new requirements. The closer edge computing is to the edge (the access network), the lower the latency.

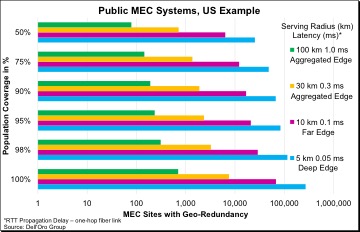

Dell’Oro Group has developed a U.S. MEC System deployment model for one nationwide Public MEC connectivity network for the Infrastructure Edge. The model is presented here to provide insights into the potential size of the number of MEC Systems that vendors will have the opportunity to capture over the long term.

The model is based on the 2018 population estimates from the U.S. Census Bureau by county. Population density is accounted for based on land area. Variables in the model include the serving radius of a MEC system, the capacity of the servers, and the desired population coverage. Two choices exist for population coverage: the counties ranked by population, regardless of population density; and counties ranked by population density.

One of the first takeaways from the model is that with just 10% coverage of the U.S. land mass, 75% of the population can be covered. One can thus surmise the timing of market penetration based on a deployment schedule of MEC systems.

Figure 2 illustrates the different number of MEC systems estimated for different population penetration rates and latency requirements based on the round-trip time (RTT) of the propagation delay of a one-hop fiber link.

- A SP may have a strategy for locating MEC services at every macro base station providing the shortest latency possible for Public MEC in what is characterized as the deep edge at 0.05 ms latency or less with smaller servers.

- Far edge sites may be deployed for Public MEC consumers and other enterprise applications that can be handled with a 0.1 ms latency, such as AR/VR and other real-time applications. These sites would have larger servers addressing a broader customer base.

- Aggregation sites could be reserved for less demanding requirements at 0.3 ms or 1.0 ms latency for non-real-time applications. Servers may be a full rack of servers to meet the broader demand.

- The centralized site would be used for the rest of the requirements that are not low-latency dependent with racks of servers.

A SP could have a tiered pricing structure, routing traffic to the appropriate MEC server based on the service level agreement. Also, MEC and VRAN compute and storage can be combined in the same location on the same servers. This would provide further economies of scale for both VRAN and MEC. The Far Edge model best approximates this requirement for how many MEC Systems are needed.

In summary, the size of the MEC market depends on many variables such as: 1) Infrastructure and/or device edge; 2) Public MEC and/or Private MEC; 3) latency requirement; 4) server capacity; and 5) population coverage. In the U.S. example, a starting point might be 90% population coverage for the Aggregated Edge with a 100 km service area and a 1.0 ms latency, which would require over 150 MEC systems with geo-redundancy. As demand grows for lower latency, aiming for 50% population coverage with a 30 km serving radius and a 0.3 ms latency would require greater than 500 MEC systems with geo-redundancy. The MEC opportunity is expected to be market driven with MEC systems being deployed as the business develops over time. This model can aid a SP in gauging the investment required for low-latency services in a given geographic area.

About Dave Bolan

Dave Bolan is Research Director at Dell’Oro Group. His focus is on the Mobile Core Network market, and the Multi-Access Edge Computing market research. As a seasoned industry executive, Dave brings over 35 years of experience in sales and marketing roles from leading wireless and telecommunications companies. He has been quoted in trade and business publications, such as FierceWireless, SDxCentral, RCR Wireless; and Telecom Asia. He speaks at industry forums such as CTIA Wireless conference, NetEvents, Ribbon Perspectives and SDN & NFV World Congress. Mr. Bolan has received several awards for his work in the RF and Microwave industries.

The post Many factors will determine the size of the MEC market (Analyst Angle) appeared first on RCR Wireless News.