September greetings from the Midwest and Southeast. Pictured is one of the many “Instawalls” in Kansas City that celebrate our local football team, the Chiefs. We are excited about our return to the City of Fountains and are anxious about the bruising schedule the Chiefs have this year.

This week, we conclude the two-part series on “best positioned” companies with a detailed look at Google. Like Comcast, Google seeks to embed their presence in every broadband-enabled device, especially smartphones and smart TVs. After the market commentary, we will discuss their work to date on that initiative (and others).

Before exploring market gains and losses in the telecom and technology sectors, however, a quick thank you to D.A. Davidson for allowing American Broadband to participate in their 20th Annual Software and Internet Conference this week. Fellow panelists were Randy Meunch from TriStruX and Cheri Baranek from Clearfield – we discussed disparities in broadband access (geography, income, MDU/MTU vs. single-family homes, etc.). Terrific panelists and wonderful hosts. Unfortunately, there is no public replay available of the panel.

The Week That Was

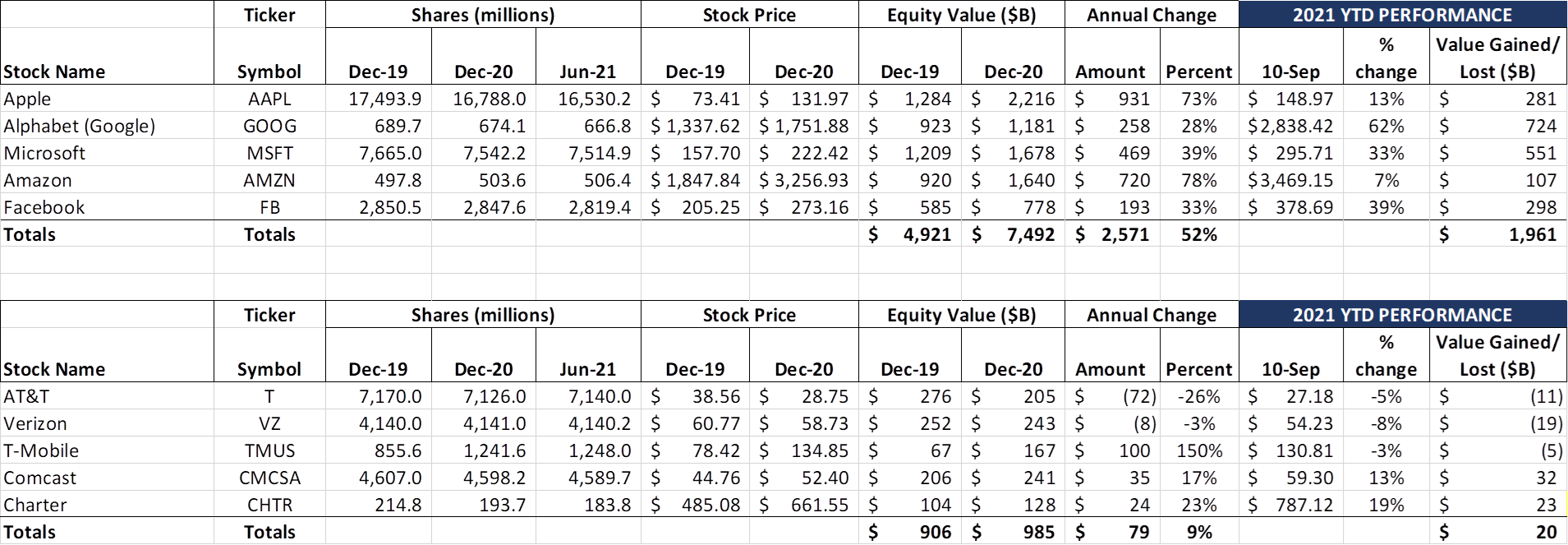

While equity markets overall have declined over the past two weeks, the Fab Five managed to eke out an $18 billion gain, bringing their year-to-date total to slightly less than $2 trillion. Leading the way over the fortnight was Amazon (+$61 billion) and Facebook (+$17 billion), with Google/ Alphabet and Microsoft both posting losses and Apple treading water. Since May 24 (the week prior to Memorial Day), the Fab Five have gained $1.4 trillion in market capitalization.

There were no gainers over the last two weeks in the Telco Top Five (-$15 billion). Buying conviction is missing for both AT&T and Verizon, and there are increasing doubts about T-Mobile’s ability to steal market share given chipset shortages and competitive promotions. Comcast and Charter account for $55 billion of the Telco Top Five’s gains. The bloom is off the rose for facilities-based wireless providers.

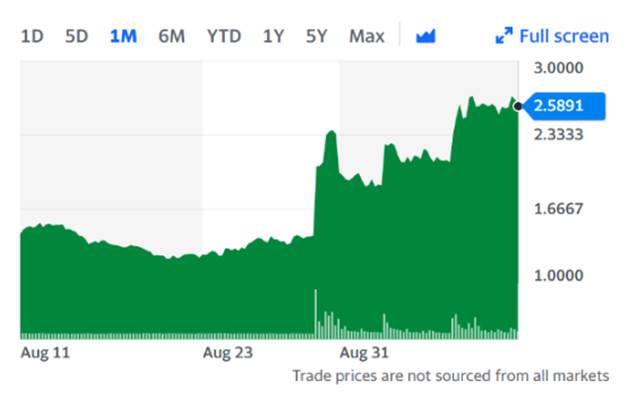

Next Tuesday, Apple will introduce their new lineup of iPhones (likely called iPhone 13). There are many rumored features, including an improved camera, a 1 TB storage option, Wi-Fi 6E support, and better battery life (particularly for the Mini model). The element that has had network folks buzzing is the inclusion of limited satellite capabilities. Bloomberg has the most details on this development here. Based on their reporting, it appears that Apple’s initial focus will be on providing emergency response services in hard to reach areas. This will take two forms – messaging communications and incident reporting. It’s also rumored that they are developing this capabilty with Globalstar (+80% since the rumors began to surface two weeks ago – see nearby stock chart). Looks like a good use of Globalstar’s assets.

The iPhone is not the only product expected to be introduced next week – rumors are flying that a new Apple Watch will also be introduced, which will feature the first face redesign since 2015. There’s a detailed description of each feature thought to be included in the Series 7 from Macrumors here.

Apple’s iPhone and Watch announcement-driven momentum came to a screeching halt on Friday, however, when Judge Yvonne Gonzalez Rogers issued her order in the Epic v. Apple case. This New York Times article summaries the decision well:

“The judge, Yvonne Gonzalez Rogers of U.S. District Court for the Northern District of California, said Apple violated California’s laws against unfair competition by barring app developers from directing customers to other ways to pay for their services. She ordered Apple to start letting developers include links in their apps to other payment methods within 90 days.”

The article (and others from Bloomberg here and The Wall Street Journal here) also emphasizes that Judge Rogers did not declare that Apple had a monopoly in the mobile games market, while also concluding that Epic breached their contract with Apple when they included payment links to Apple Pay alternatives within their Fortnite app. Epic’s reaction to the verdict came through Tim Sweeney’s Twitter feed (three tweets consolidated in the quote):

“Today’s ruling isn’t a win for developers or for consumers. Epic is fighting for fair competition among in-app payment methods and app stores for a billion consumers. Fortnite will return to the iOS App Store when and where Epic can offer in-app payment in fair competition with Apple in-app payment, passing along the savings to consumers. Thanks to everyone who put so much time and effort into the battle over fair competition on digital platforms, and thanks especially to the court for managing a very complex case on a speedy timeline. We will fight on.”

Apple will likely appeal the ruling, Fortnite will remain out of the app store, and Epic’s parallel lawsuit against Google will begin in earnest. Market power is being challenged, but the fight is costly and long and the consequences for Apple are significant if future cases result in more punitive remedies.

In a final note, we have the latest leaks concerning NFL Sunday Ticket negotiations here from CNBC (whose parent company, Comcast, is bidding for the rights). If you don’t think the stock capitalization gains and net debt tracking we have done for over a decade in this column matter, think again. According to the article, Amazon ($1.7 trillion in market capitalization) is the front runner for the $2.5 billion/ year prize, with Disney/ ESPN ($335 billion) and Apple ($2.5 trillion) also circling. As for AT&T, the article cites two analysts who indicate that DirecTV “may not have the balance sheet to compete with Amazon or Apple.” Who would have thought this a decade ago?

Based on an interview earlier this week with NFL Chairman Roger Goodell (here – comments on NFL Sunday Ticket start ~5:30), an Amazon deal might include investments in both the NFL Network and NFL Red Zone channels. Goodell’s comments clearly indicate that the NFL wants to move in a different direction from satellite distribution to a “strategic partnership that makes the fan experience better.”

An Amazon win would be significant for the company, not only positioniong themselves as an alternative to ESPN and RSNs as a sports source, but also as an “end to end” provider. ESPN/Disney does not have the Fire Stick (or, as we will discuss below, their own line of televisions). Apple does not have AWS (Amazon is already the cloud services and next generation statistics provider to the NFL – announcement here). And Amazon also has one of the largest subscription bases in the country with Prime (likely in the 115 million range in the US alone) which could help increase interest in the NFL. All of this discussion shows the extent to which addressable market has changed in the last decade: broadcast ubiquity is now defined by smart TV/ hardware penetration, not by network transmission type. Something to ponder as you watch your favorite team this weekend.

Google: Best of the Fab Five, Yet Minimally Threatening to Traditional Telco Revenue Streams

It is no secret that this column has recognized Google as one of (if not the) most important technology companies in the world. We started The Sunday Brief in September 2009 with an RCR Reality Check column that focused on “The Question Every Board and Shareholder Wants You to Answer.” That question was “How will Google affect our business model?”

At the time, Google’s share price was ~$240-250 (total equity market cap was ~$140-150 billion). Google is now one of the most valuable companies in the world with $1.9 trillion in market capitalization (5-year stock chart shown nearby). They did not get there by simply having a better advertising solution, or developing an alternative operating system to iOS (or Blackberry or Symbian or PalmOS in 2009). No large share buybacks or dramatic leveraging of the company.

Google gained value through learning and innovating. They hired some of the smartest people in the world (direct knowledge contribution), and formed Google Ventures to keep a close eye on Silicon Valley entrepreneurs (indirect knowledge contribution).

They invested heavily in the Android ecosystem with a focus on enabling lower cost devices for India and other lower-income countries. But they also formed the Android Open Source Project, which enabled Amazon to “fork” that code and form their own Fire OS app store. Within Android, they developed Maps, Google Assistant, and other productivity improvements, while consistently enabling interoperability. A harder path than Apple, but one that has yielded value and kept regulators (slightly) farther away.

In their most recent earnings announcement (as well as I/O, their annual product announcement event), Google has clearly turned their interests to machine language and artificial intelligence. One of these developments is Multitask Unified Models (MUM within the company – blog post here) which reduces the number of searches required to solve complex problems. MUM also incorporates results from 75 different languages as well as multimodal (text and images) datasets to improve search result quality. The result is a faster and more accurate response (and, to the extent applicable, more applicable advertising). Google continues to find a “higher gear” for search.

While there are more developments on the search front, our attention for the remainder of this Brief turns to four communications-focused products and services: a) YouTube TV; b) Google Fiber; c) Android 12 and d) Google Pixel devices. YouTube TV by most estimates has around 3.0-3.2 million subscribers (3 million as of October 2020), while Hulu Live TV just reported their third quarter of losses (now at 3.7 million subscribers). YouTube TV + Hulu Live represent around 6.7 million subscribers, or about 45% of Spectrum’s video base (15.42 million as of 2Q). Bottom line: There are millions of addressable customers representing billions of revenue growth for YouTube TV to address.

The impact of each incremental YouTube TV customer is apparent to an advertising-centric company – more ad inventory (and, as we mentioned with Amazon, more end-to-end control of the ad creation/ distribution/ placement process). Unlike traditional cable and IPTV providers, Google knows how to place ads for maximim effectiveness. More information on viewing habits (including cloud DVR recording preferences, replay propensity, and genre consumption) makes all of Google’s properties (especially YouTube) more effective.

This is one of the driving forces behind YouTube TV’s introduction of their 4K plan (Google blog post describing the plan changes here). While cable struggles to figure how out to monetize 4K (outside of adding a surcharge to cover increased programming costs), Google has come up with a simple add-on that not only adds 4K programming (important to live sports and home theater fans), but also unlimited in-home simultaneous streams and offline replay of recorded content (re: Google has no recording caps but deletes recorded content after one year). On top of this, Google added Dolby Digital 5.1 Surround Sound audio to all YouTube plans. The plan also introduces a stepped-up cost structure after the first (free) month – $9.99 for the first year, and $19.99/ month after that. It’s hard to decipher what Comcast’s strategy is with 4K but the statement in this link(Compatible TV Boxes section) indicates that customers need to lease a specific X1 box which is not available in stores or through customer service (yikes!).

The recipe for YouTube TV success is straightforward: a) 4K SmartTVs proliferate; b) YouTube TV presents a more valuable option to many customers than traditional linear TV (especially with unlimited in-home streaming and DVR recording as well as simplified pricing); c) YouTube TV mobile app continues to develop features and functionality (including offline DVR portability); and d) Google monetizes as much ad inventory as possible as the business grows. We also expect that the company will continue to merge traditional YouTube content with YouTube TV as possible.

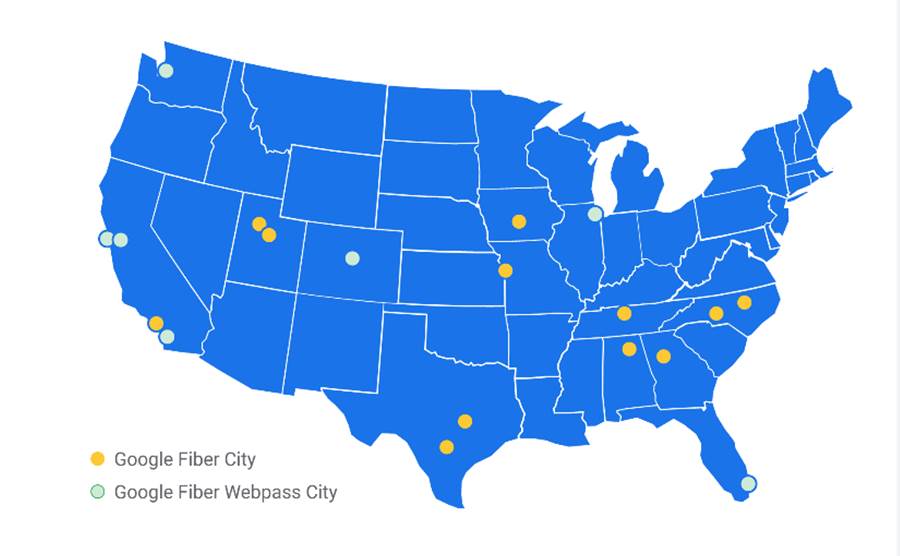

Google Fiber represents another possible threat to broadband providers in the markets where they currently operate (list here). Based on recent blog posts, it appears that Google is trying to expand their metro footprint (see the Charlotte expansion announcement here which includes a significant expansion into the Windstream markets of Concord and Matthews). Details on additional city announcements can be found here.

The recipe for Google Fiber success is also straightforward: a) expand presence (including commercial) in existing markets; b) improve operational efficiency (which will naturally happen with in-market expansion), and c) upsell the entire suite of Google products and services (including Nest, Fibit and 4K) to current and prospective customers. While Google Fiber got off to a rocky start, cash flow growth from current markets can fund expansion and each of the existing markets can achieve material market share gains with smarter builds. The company appears to have come to the realization that the value of more broadband will yield short and long-term value – we hope that resolve continues through this decade.

Android 12 also has the ability to leapfrog Apple with more customization. Google calls this “Material You” and the first feature is having buttons that match whatever wallpaper colors you establish. This seems small to many folks, but for those who live on their phones, color matching is one more way to improve one’s mobile lifestyle. Google also has redesigned the Android Clock (specifically Android Alarm) and the Calculator apps. Both appear to be easier to use, yet we still cannot understand why the latter does not include voice-activated commands.

Finally, Google launched the Pixel 5A to great acclaim in August (see CNET’s review of the device here). At $449, it’s a terrific mid-range device with a decent camera, 6 GB of internal memory, and 5G low-band support (the 5A also supports T-Mobile’s mid-band spectrum – full specs here). This lower price point will complement the Pixel 6 and 6 Pro which are expected to be formally introduced in October.

The early reviews of the Pixel 6 are in, however (picture nearby). The Verge concluded that “Google is finally trying to make a competitive flagship phone.” CNET states that the Pixel 6 “may be able to stand with the best from Samsung and Apple.” And Ars Technica raised the prospect that Google may be able to offer a lengthier product support period (currently three years for Pixel models) because they will manufacture their own chipset for the Pixel 6. With Samsung continuing to have issues with Galaxy S21 availability (Verizon here and T-Mobile here), maybe this is the year for Google to gain market share.

Bottom Line: We think Google is best positioned in mobile with the greatest upside in Android 12 and Pixel developments. We think Google can deliver incremental cash flow in broadband and make each Google Fiber (and Webpass) market more profitable as they develop operating efficiencies. We know that Google has a hit with YouTube TV that will resonate with both 4K-hungry sports fanatics as well as value-seeking traditional linear TV devotees. Each of these products and services contributes to improved Google customer profile development which results in higher yielding advertising revenues. In total, Google’s end-to-end approach gives them an opportunity to drive more value as the economy closes the COVID-19 chapter later this year.

That’s it for this week’s Brief. We will discuss Apple’s iPhone announcement and begin exploring 3Q earnings themes in the Sept 26th Brief. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals, Go Sporting KC and Go Chiefs!

The post The Sunday Brief: The Two Strongest Headed into 2022 – Comcast and Google (Part 2) appeared first on RCR Wireless News.