This week, we will spend the majority of our time examining earnings results. Rather than simply recap metrics from each broadband carrier, we will explore broader themes we think will drive activity through the end of 2021.

We are adding over 50 new readers every week to the Brief (many due to job changes). As you encourage friends to subscribe, please suggest the WordPress email option through the website. Thanks again for the referrals.

The Week That Was

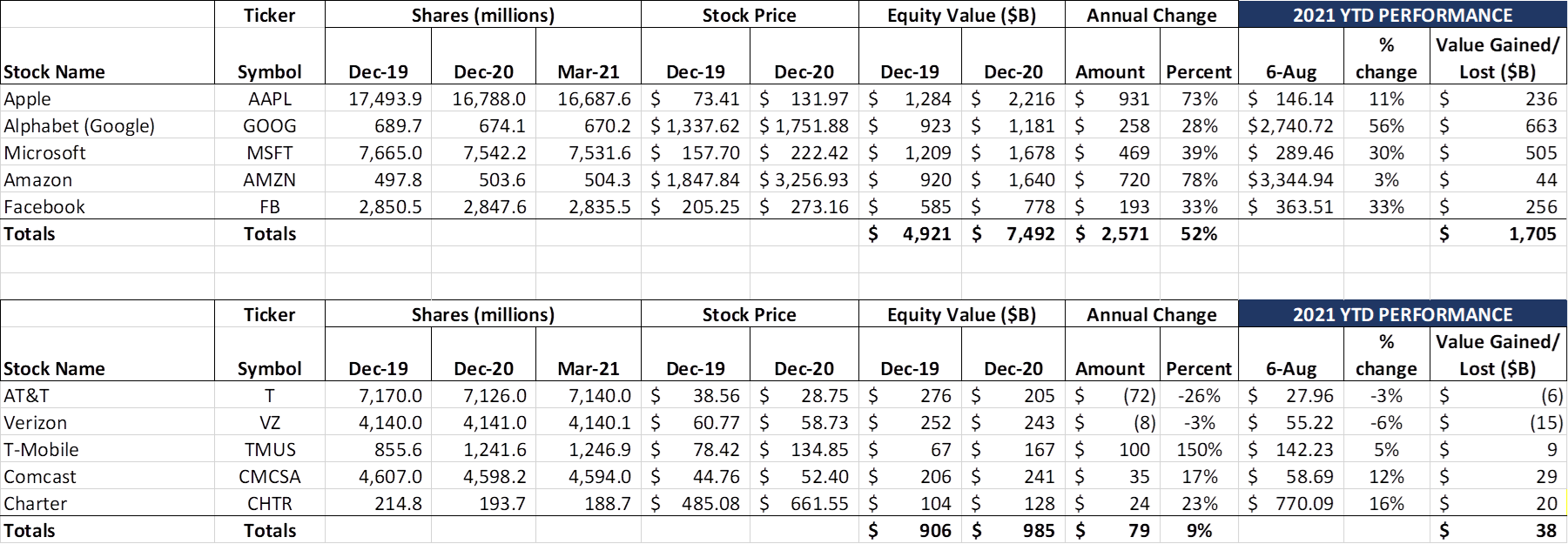

Each of the Fab Five announced earnings shortly after the last Brief was published. Over the past two weeks, there has been a slight pullback for four of the five stocks, with a sharp brake on Amazon (down $157 billion in market cap since July 26th). Overall, the group lost $217 billion over the last two weeks, partially offsetting the $280 billion it gained in the July 12-23rd time period. Regardless, the Fab Five is still up $1.7 trillion in market cap since the beginning of the 2021 and has an equity value in excess of $9 trillion as of this writing.

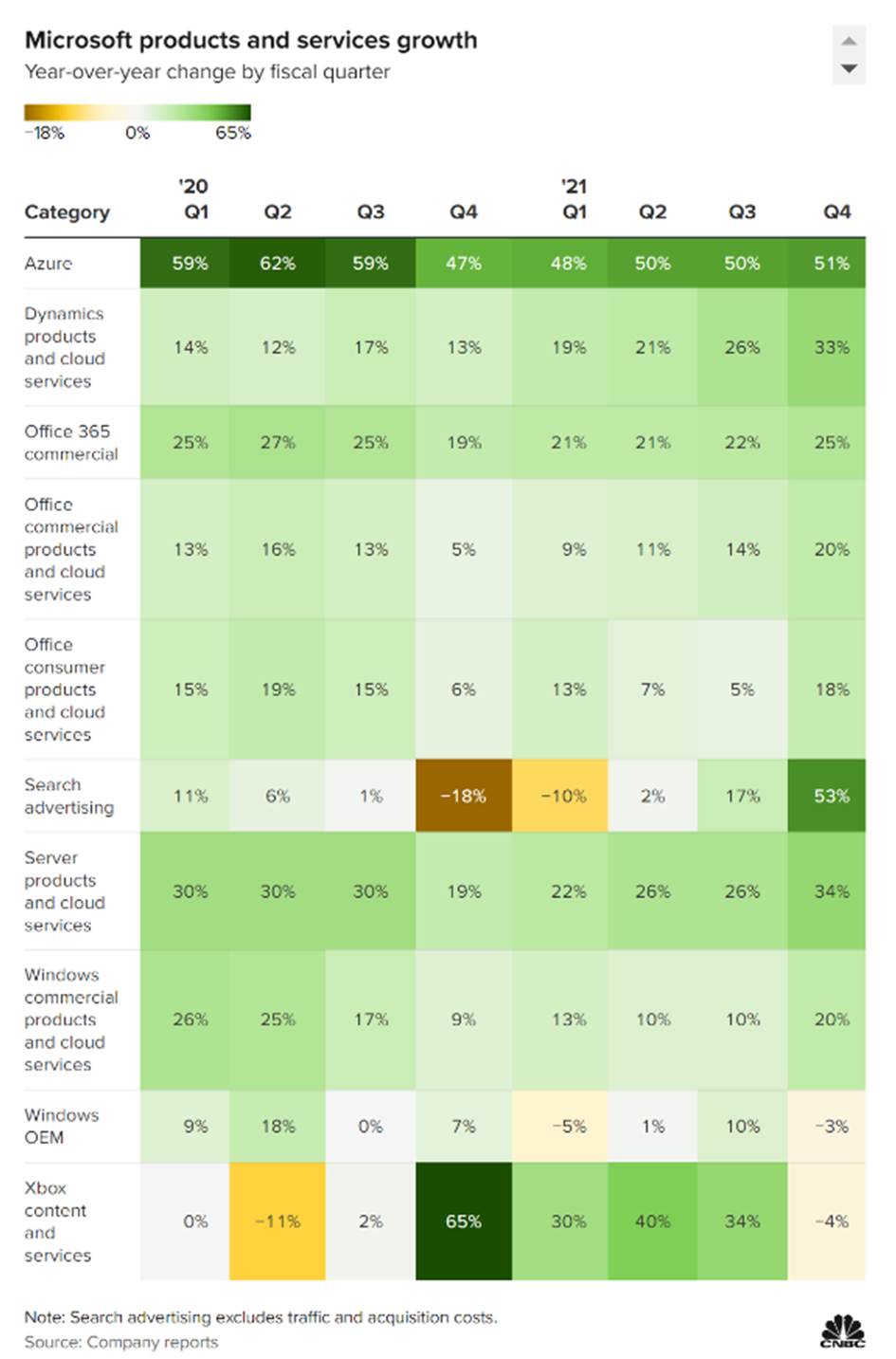

CNBC put together a very interesting multi-quarter trend chart to show where Microsoft was growing and/or shrinking (full article here). Not surprisingly, products with more “at home” or hardware characteristics showed less (or negative) growth in 2Q 2021 versus the same quarter in 2020. Also, seeing search advertising pick up steam (+53% y/y) from a low mark a year ago is expected.

What is encouraing, however, is to see the relatively constant double-digit growth in commercial software licensing as well as robust Azure metrics. Microsoft is challenging Amazon AWS in cloud, and the results show it.

While there was a lot of discussion about Amazon’s earnings outlook (the main driver of their 10% drop in market capitalization after reporting earnings), it’s important to put this into the context. Here is Amazon’s income statement from the most recent quarter:

Unlike discussions about AT&T and Verizon (and to a lesser extent, Comcast and T-Mobile), the revenue and profit growth Amazon has managed to achieve through the pandemic is extremely impressive: 25% net product revenue growth ($23 billion) over 1H 2020 (albeit 2021 includes a Prime Day), 47% service sales growth ($34 billion) over 1H 2021, and operating expense growth of only 33% ($50 billion).

Amazon grew revenues $57 billion and operating expenses slightly more than $50 billion over the last six months (versus 1H 2020). Compared to Verizon’s 6-month revenue growth ($4.6 billion with more than half coming from very low margin smartphone sales) and AT&T’s growth ($4.3 billion with more than 60% coming from smartphone sales), Amazon is a thoroughbred. And, if the growth story weren’t enough, Amazon still has negative net debt (-$39.6 billion as of Q2 even with a relatively large increase in long-term debt in the quarter). That’s why the Seattle-based behemoth, even after the pullback, is worth $1.69 trillion in market cap today, slighty less than four times that of AT&T and Verizon’s combined value.

We don’t have enough space in this week’s Brief to talk about Google’s earnings announcement, but if you want to read ahead for the next Brief (earnings package here), we will cover Google’s results and outlook then. The bottom line is that Google is just beginning to transform the TV into a highly personalized advertising portal. Just have a look at the cost to purchase a 65” 4K TV on Amazon (Samsung here – $800), Walmart (LG here – $580), or Best Buy (Hisense here – $560). As TVs get smarter and cheaper, Google’s addressable market gets bigger (and linear cable’s challenge grows).

YouTube TV’s ascension threatens to have the same impact as Facebook and Google had on the wireless industry – one app (or class of app) captures a disproportionate amount of ecosystem value, with advertising as a key contributor. It’s hard not to draw parallels between the wireless industry pre-iPhone launch and the wired/ wireless broadband industry today. More on Google’s structural advantage in the next Brief.

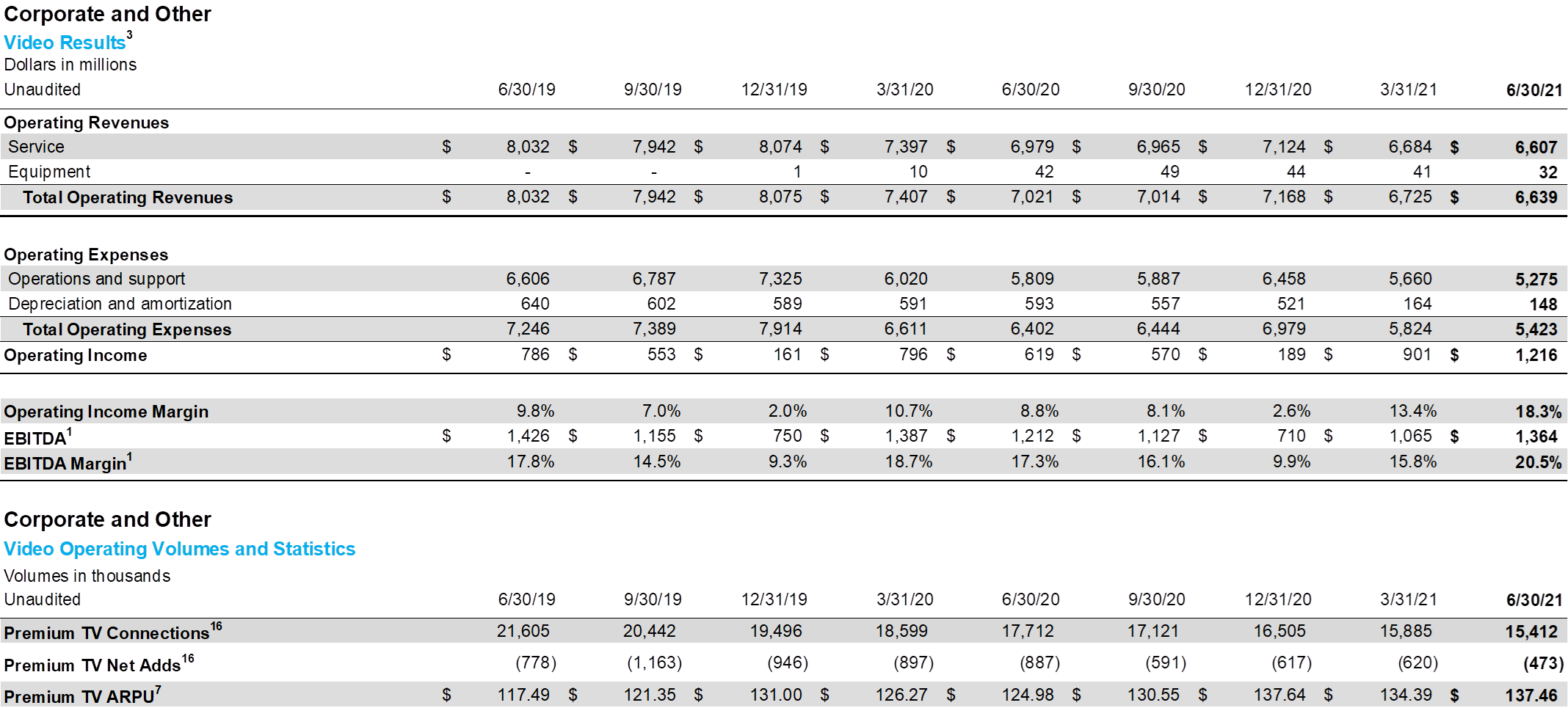

Finally, since we will not cover it below, two interesting divestiture milestones happened since the last Brief was published. Last Monday, AT&T announced that they had closed their transaction to spinoff DIRECTV and other AT&T assets into a separate company (with TPG Capital as the capital investor). Here is the unit’s performance through 2Q 2021:

It’s interesting to note that at 18.3% operating margin, the new DIRECTV is now more profitable than AT&T’s Business Wireline business unit. Maybe the freedom from a larger corporation has its advantages.

While AT&T received $7.1 billion in cash as a result and retains 70% of common equity ownership, AT&T branded video services will continue to be sold in AT&T stores (at least for the forseeable future). When AT&T deploys fiber, the video service that they will bundle with broadband to compete against cable’s double play will likely come from the new DIRECTV (streaming moreso than satellite). While their writedown of the original purchase is significant, and the intensity to promote double-play (vs Gig speeds) will lessen as the addressable market shrinks, the AT&T divestiture is more a financial engineering story than a video jettisoning. For our thoughts on the transaction, see the Feb 28 Brief here.

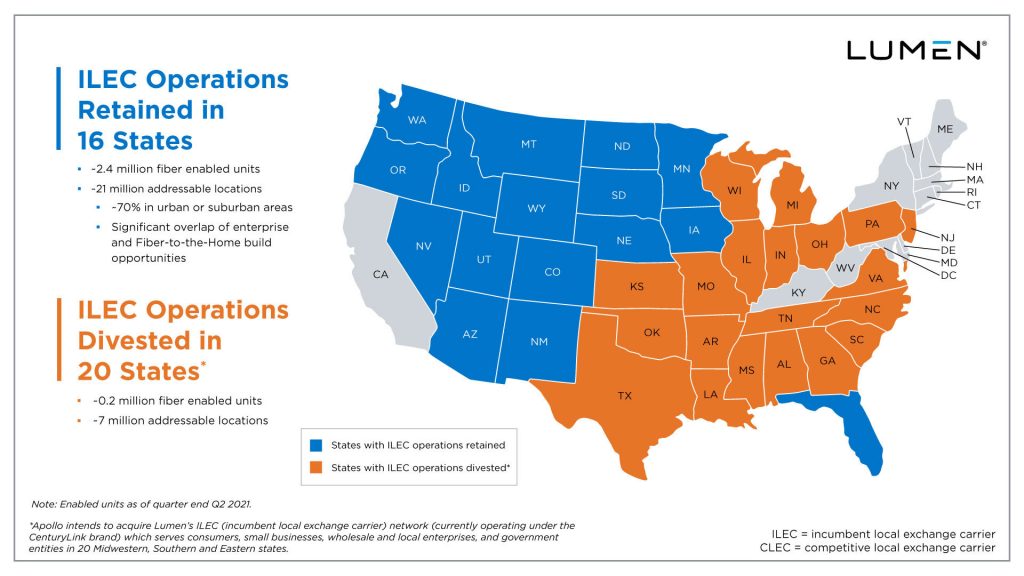

Many of you sent me emails about the Lumen divestiture announcement (full package here). The best way to summarize what happened is shown in the picture below:

If the remaining (blue) properties bring back memories of US West, you are not alone. In fact, I described the transaction to several regular Sunday Brief readers as “Lumen is keeping US West + Las Vegas and Orlando.” That’s a pretty good summary of the transaction, and kudos to Jeff Storey and his team for pulling it off.

This leaves a large swath of local (orange) properties in various states of fiber deployment – mostly not deployed, but, in a very few cases (~3% of “orange” homes and businesses passed have a fiber option), there’s fiber readily available.

In their communications website (here), Lumen also discloses their performance in the blue markets – about 11% of the enabled units (homes and businesses passed) have a fiber option, and the company has a 29% share in these deployed areas (687,000 fiber customers out of 2.4 million fiber-enabled units). Plenty of opportunity to focus on filling out fiber areas and enabling more choices for consumers (while still leaving opportunity for companies like T-Mobile to offer their Home Internet services to less dense locales).

Apollo has assembled a rock solid, Verizon-based management team (Bob Mudge, Chris Creager, and Tom Maguire) to manage the new business. While deploying fiber in Johnson City, TN, is different than New York City, the trio bring a great deal of construction and operations expertise to the table. They also understand the importance of a clean systems transition (think Frontier, Fairpoint, Hawaii Telecom and others). By the time the transaction closes (2H 2022), however, the costs to retrench fiber might inflate, labor and other materials might be in short supply, and, as we discuss below, cable might be in the middle of deploying a more symmetrical version of DOCSIS. The competitive response will be more intense as cable becomes more focused on standalone broadband as a revenue source. While not without risk, the team Apollo has assembled has the potential to upend cable’s monopoly.

One final note on the Lumen transaction: it is not lost on long-time telecom folks that one of the divested areas is Monroe, Louisiana, the current headquarters location. It’s highly likely that there will be few if any Apollo employees moving there. So what will happen to the newly constructed CenturyLink Technology Center (see nearby picture)? One can only wonder.

Q2 Telecom Earnings Wrap: ABC (Apple, Broadband, C-Band)

Trying to fold in Comcast, Charter, and T-Mobile earnings into the previous Brief (which focused more on AT&T and Verizon’s broadband achievements) would be a challenge under any word limit. Based on your direct feedback (when it’s too long, you are not shy in commenting), however, we are going to keep the results future-focused and brief. The bottom line is that telecommunications providers have three focus points through the end of the year: a) Apple phone launch; b) Broadband net additions (wired and wireless); and c) C-Band (or, in the case of T-Mobile, 2.5 GHz + 600 MHz 5G) deployment.

There’s a lot of build-up to September’s Apple announcement. As we reported in the last Brief, the company has suggested to suppliers that this year’s demand will be 20% higher than 2021 (more in this article). iPhone launches create switching opportunities, and this year promises to be one of the biggest ever (see more on predicted pent-up demand here).

Every wireless carrier mentioned some variant of “premium smartphone launches” in their 2H 2021 outlook. John Frier at T-Mobile categorized it best in their earnings call (a paraphrase validated by the webcast as T-Mobile does not provide a transcript):

“…In the second half of the year, you have three big moments. You’ve got a big back-to-school moment that will be much more of a prominent moment this year versus perhaps last year. Then like Mike [Sievert, T-Mobile’s CEO] said, you have a premium smartphone introduction that’s typically in the fall time frame, you never know, but typically in the fall time frame. And then, of course, you have the holiday period.”

Without a doubt, the Apple launch is on everyone’s mind. With AT&T continuing to be aggressive in its offers to existing customers, however, how will any challenger (T-Mobile, Comcast, Charter) convince AT&T customers to switch? Charter CEO Tom Rutledge took no options off the table in response to a question around smartphone subsidies:

“we have a variety of tools to grow our market share. And we have – and I would not preclude any of them that anybody else has ever used in history. But fundamentally, we haven’t changed our pricing since we launched the product. And we have that ability to be – to move the needle in terms of the amount of mobile customers that we create as part of our broadband strategy.”

As Charter also indicated on their earnings call, they are in the midst of a large systems project which likely will need to be completed prior to launching new structural changes. But an Apple launch is not merely a share gainer for T-Mobile this year – it will also result in gains for Comcast and Charter/Spectrum (note: Dave Watson from Comcast had a similarly rosy outlook for their wireless product, and is ahead of Charter in their family plan parity structure. We will discuss more on Comcast in the next Brief).

Broadband is the next key item to watch in the second half of this year. While we talked a lot about broadband in the last Brief, let’s see how the Telco Top Five + Lumen fared in the latest quarter:

Verizon: 92K FiOS -22K DSL =70K total broadband resi net adds; +7K FiOS – 7K DSL = zero comm net adds

AT&T: 246K fiber –218K non-fiber = 28K total bb resi net adds; commercial figures not disclosed

Charter: 299K total bb resi net adds; 33K total comm net adds

Comcast: 334K total bb resi net adds; 20K total comm net adds

Lumen: 62K total bb resi net loss; commercial not disclosed

T-Mobile: started year with 100K Home Internet; targeting 500K by end of year. Est. 95K net adds in 2Q

Overall, Verizon + AT&T netted approx. 100-105K net broadband additions in the quarter. Lumen lost 62K. Including the remaining telcos, it’s likely they ended up with about 40K net additions. This compares to 686K from Comcast and Charter, and another 50K from the remaining providers (Cox and Mediacom being the lion’s share of this). This roughly equates to 95% net flow to cable prior to including T-Mobile’s gains.

We have a lot of questions about how AT&T in particular will position their fiber product versus a cable + mobile bundle. Currently, AT&T promotes a TV bundle and includes HBO Max with their highest speed, but does not offer any wireless bundles. We think that they (and cable) have an immediate opportunity to drive bandwidth upgrades and wireless revenues in tandem, as well as an opportunity to be the “work from home hero” by offering bandwidth upgrades to premium busines clients. Cable also enjoys a similar opportunity, and both face an imminent threat from T-Mobile as they continue to upgrade their 5G network.

Speaking of network upgrades, C-Band continues to be on everyone’s mind, especially Verizon’s (they mentioned C-band 42 times in a 61 minute earnings call). Specifically, they committed to 7-8K towers deployed by year end, with a 46-market launch following quickly thereafter. Most of the new 5G phones purchased (including the new iPhone) will be C-Band compatible. Verizon has committed to spend $2-3 billion in capital on C-Band deployment this year. They also deftly wove C-Band into their 5G Home Broadband strategy. Without a doubt, it’s the highest priority for Verizon in 2H 2021.

T-Mobile is also moving swiftly, however, with their new network deployments, announcing that they are targeting 100 MHz of 25 GHz spectrum deployments by the end of 2021 (more than AT&T and Verizon combined). Neville Ray, T-Mobile’s President of Technology, assessed competitive network deployments on their earnings call:

“..if you compare and contrast [our network deployment plan]to what AT&T and Verizon have announced to date, they’re talking about 100 million people covered at some point in time in the new year. And between them, on their C-band spectrum holdings, they have 100 megahertz. Verizon’s 60, and AT&T, 40. So when you compound the footprint and the spectrum available, obviously, we have a massive lead.

And the good news is that that lead is there, and it’s durable and it’s sustainable as we move into the coming years. AT&T and Verizon will try and match what we will do this year by the end of 2023, when they get more C-band spectrum available in the second tranche. Of course, we get C-band spectrum at the end of 2023, too. But the important piece is we’re not sitting at 200 million covered POPs at the end of this year.”

As we discussed in a previous Brief (here), T-Mobile will need to establish broader credibility that their new network is superior (“switch-worthy” as one of you put it to me this week). That will not be an easy task, and definitely one to watch through the remainder of the year.

Bottom line: Every carrier met or beat earnings estimates. Most met or beat revenue estimates. Wireless churn is slowing down for now, but an Apple iPhone introduction usually shakes things up. T-Mobile is winning using metrics on 5G deployment, but Verizon and AT&T have large ad budgets to shape message. And cable can and will use their broadband leadership to sell more mobile services – a lot more. It’s going to be a dynamic and exciting end to 2021.

There were many topics that did not make this week’s cut, specifically Google’s and Comcast’s broad-based blowout quarters. We will definitely cover their earnings in greater detail in two weeks. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals and Go Sporting KC!

The post The Sunday Brief: Q2 Earnings Wrap – ABC (Apple, Broadband, C-Band) appeared first on RCR Wireless News.