2021 is the year when 5G continues to progress while both infrastructure and device ecosystems have matured, creating economies of scale. In the infrastructure market, vendors have shipped more than 1 million 5G base stations while the device ecosystem has matured enough to include <US$200 5G capable devices. Both developments have allowed 5G to enter the mainstream domain with mass market consumer adoption and for it to be seriously considered as an important component of enterprise digitization.

Market activities in Western and Eastern markets

Despite 5G being a true global standard, there are differences in terms of deployment strategies and progress. The Asian market, predominantly driven by South Korea and China, and to a certain extent, Japan, is much further ahead compared to Western markets in terms of population coverage and market penetration. This is clear in measurement campaigns performed by a variety of companies, including OpenSignal and RootMetrics. For example, RootMetrics H1 2021 report highlights that 5G is available to 90% of Seoul’s population, while OpenSignal’s latest report from South Korea highlights that users equipped with capable devices spend as much as 25% of their time on 5G networks.

On the other hand, Western markets illustrate much lower scores across the board, and users most often spend ~10% of their mobile online activity in 5G, since coverage is sparser than the three Asian markets. China is also accelerating its 5G deployment and ABI Research estimates that there are already about 900K 5G base stations deployed across China. Dividing the total population in China by this number yields an impressive 1,500 people per 5G macro cellular base station, which translates to a much denser deployment than any other market globally.

These markets can provide a glimpse into the future for the Western 5G domain, especially when considering new applications or use cases in both consumer and enterprise domains.

What can the West learn from the East?

In the consumer market, South Korea shows how the availability of a faster network provides the foundation for new types of services, including cloud gaming and Extended Reality (XR). LG U+, for example, initially started its XR Gallery to showcase new types of applications and has since folded this initiative into the newer Global XR Content Telco Alliance to develop these types of applications within a larger ecosystem. Other operators in South Korea have been involved in similar activities, including SK Telecom launching a mixed reality capture facility called “Jump Studio” and Korea Telecom launching an Augmented Reality (AR) mobile shopping experience. All South Korean mobile operators reported that these applications have been invaluable for consumer applications during lockdown periods in 2020 and 2021.

Of course, these applications—and any new type of application in fact—requires consistent and extensive population coverage, but South Korea illustrates that 5G can indeed become the foundation for new services and create new ecosystems. Contrary to the Western world, where 5G is simply used as a faster wireless technology, Asian networks show us that there is a lot more that can be done after a critical mass of coverage is achieved.

The most important aspect of a technological “new generation” is whether it can provide new revenue streams in the consumer and enterprise domains. With 5G, the opportunity to create new revenues has been questioned but there are significant indirect benefits, especially if we look at Eastern markets and more specifically, LG U+. The South Korean operator has feature and price parity between its 5G and LTE packages: the “LTE Premier Essential” and “5G Premier Essential” packages both offer unlimited voice, SMS, and data access for approximately US$75 (or KRW 85,000) as of August 2021. This puts 4G and 5G on the same level, meaning that LG U+ would theoretically have no grounds to increase revenues and profitability.

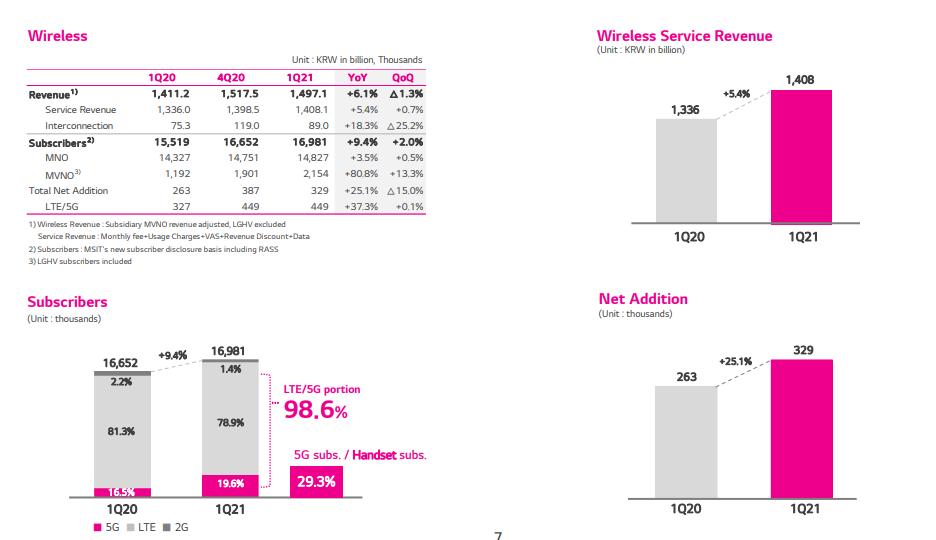

However, LG U+’s financial results show positive growth, despite the massive amount of CAPEX the operator has had to invest to deploy its nationwide network. Moreover, South Korean is a saturated market, where all three operators are aggressive in targeting each other’s subscribers. LG U+ has managed to increase its subscriber share in the past quarter and years, and migrate more subscribers to its 5G network, which is more energy consumption, performance, and cost efficient than its 4G network.

Similar activity is also evident in the enterprise domain, where both South Korea and China are utilizing 5G as a key component of their B2B strategies and as a key component of enterprise digitization. China’s recent “Sailing” plan highlights 5G as a key component of the country’s digital transformation for both consumer and enterprise domains, which will likely help 5G reach a critical mass for the enterprise cellular domain. Indeed, China Mobile, China Unicom, and China Telecom are aiming to launch network slicing for industry verticals in 2021, while private and hybrid networks are being rolled out in China for enterprise use cases.

Learning from the East

China, Japan, and South Korea are well ahead compared to the rest of the world in terms of 5G deployments and all these highlight that a dense infrastructure deployment will indeed create the foundation for new types of services in both consumer and enterprise domains. South Korea, in particular, is executing what 5G has promised, with new use cases and XR applications. There is no major barrier for other countries to follow its example. ABI Research expects similar cases to be deployed across the globe once dense enough 5G deployments take place, but when this happens, China and South Korea will already be on the next wave of evolution for 5G, most likely on the enterprise domain.

The post 5G business success insights from China, Korea, and Japan (Analyst Angle) appeared first on RCR Wireless News.