LTE will still play a fundamental role in the future of the mobile network. Mobile operators in developed markets face the challenge of unlocking new revenue streams to remain competitive while mobile operators in emerging markets continue relying on LTE for coverage and capacity before their transition to 5G. Globally, most of the operators have opted for the Non-Standalone (NSA) configuration in their deployment for 5G. In NSA mode, 5G network is dependent on LTE as an anchor in its core network, which helps operators to leverage existing assets while they progress towards 5G.

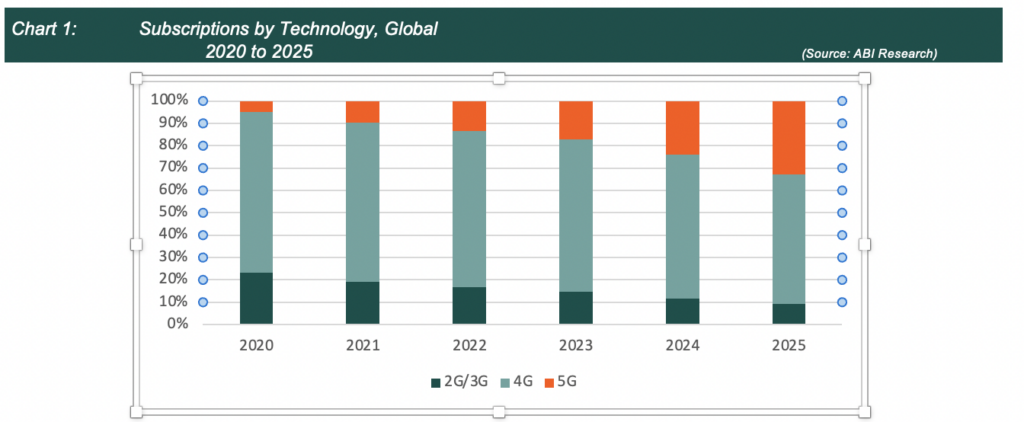

According to the Global mobile Suppliers Association (GSA) October 2021 report, there are more than 170 operators providing commercial 5G services (via NSA and Stand Alone (SA) mobile networks) and at least fifteen in SA mode for public network globally. LTE mobile subscriptions is expected to represent approximately 60% of global total subscriptions, reaching more than 3.1 billion by 2025. Users’ migration from 2G and/or 3G, which is expected to be turned off in the future, will fuel the increase in subscribers for LTE and 5G.

As 2G and 3G networks are switched off over the next five to seven years, the importance of LTE will increase as VoLTE (Voice-over-LTE) becomes the foundation of mobile voice in the 5G era. VoLTE enables a High-Definition (HD) voice experience over LTE with greater voice clarity and data capacity as compared to 2G and 3G.

Globally, based on the same GSA report, there are at least 280 operators investing in VoLTE and 228 operators who have launched networks for VoLTE. In addition, LTE is crucial for Narrowband-Internet of Things (NB-IoT), which is a primary driver for the growth of cellular IoT devices. NB-IoT also plays an important role in the 5G era in providing massive machine-type communication (mMTC).

Other applications such as 4K High-Definition video, live broadcasting, and mobile gaming, among others, will drive an increase in the amount of data traffic. Total mobile data traffic usage is expected to increase by a compound annual growth rate (CAGR) of 35% from 2021 to 2025. By 2025, mobile data traffic will reach approximately 2,700 exabytes (EB) with a large proportion (approximately 50%) carried through LTE technology.

Therefore, for mobile network operators, future-proofing LTE networks is still a key requirement as they pivot towards 5G.

Future proofing the LTE network in the 5G era

Future proofing the mobile network requires mobile operators to ensure they can address coverage and capacity challenges on the 4G layer as much as the 5G layer. There are three key areas that are important to take note of to achieve that outcome, namely: (i) infrastructure upgrades, (ii) software upgrades and (iii) deployment strategy.

i. Infrastructure and equipment set the foundations

Infrastructure and the telecommunication equipment form the foundation for the mobile network capability. Mobile operators need to future-proof their equipment to meet future traffic demands and avoid upgrading their infrastructure twice. Urban areas clearly have higher subscriber density as well as capacity demands, so 5G is also more likely to start deployment from urban areas and progressively move towards the sub-urban and rural areas. Therefore, it is crucial for mobile operators to choose the equipment which best meets current and future traffic demands. As data traffic increases, 30% of the cell sites in urban areas are expected to become congested. Existing 4T4R (four transmitting and four receiving antenna) cell sites, supporting 4×4 MIMO (Multiple-Input Multiple-Output), would not be able to meet the increase in data traffic.

Therefore, these cell sites should be upgraded to 8T8R which result in an increase of user downlink capacity. For ultra-high-capacity demand cell sites, the option would be to upgrade to 32T32R Frequency Division Duplex (FDD) Massive MIMO for LTE.

In rural areas, where subscriber density and capacity demand are lesser than urban areas, there is still a need to ensure future upswings in demand can be met by equipment deployed. Rural cell site upgrades from 2T2R to 4T4R should ensure higher capacity gain and to help to meet the future growth in demand. For rural deployment, architecture innovation (e.g., centralized baseband units (BBU) with a few micro nodes) could help bring better coverage for the community. Simplifying the overall deployment is key in bringing quality connectivity to rural communities. This can result in low total cost of operations, and shorter time for delivery and deployments.

ii. Software optimization required to bring out the best capabilities

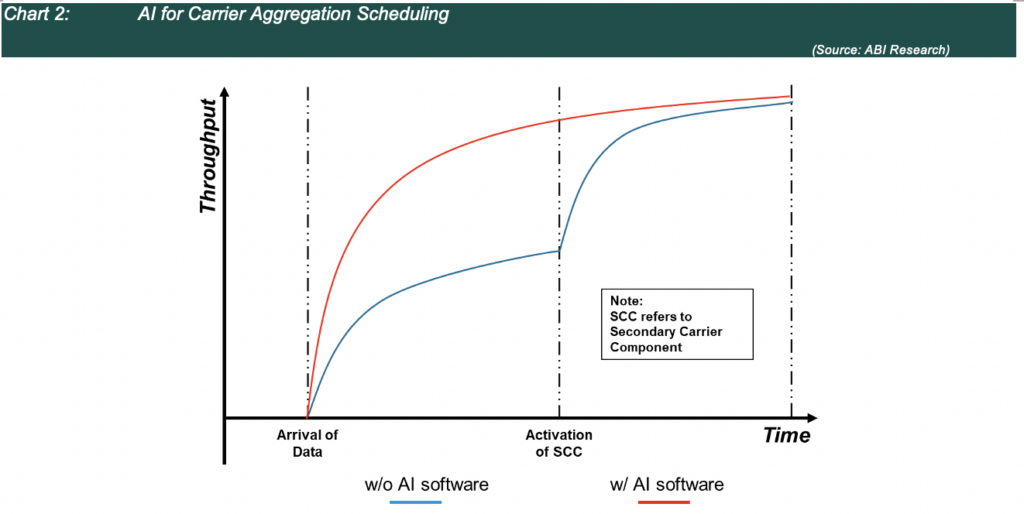

With the infrastructure upgraded and established, mobile network operators need to also derive the best performance from their networks. This is where software comes into play to make the installed infrastructure more versatile, for example, in scheduling and managing end-users. One critical enabler for this is the application of Machine Learning (ML) within the network. Machine Learning can be applied to several areas; for example, selecting the frequency bands best suited to an end-user based on proximity to the cell site (near or far-edge). This would benefit the overall user experience for users in the cell. Another aspect is carrier aggregation for enhanced experience and spectral efficiency for coordination. This is achieved by reducing the latency or delay for the secondary carrier component to be activated after initial data traffic has been sent. It is important that additional spectrum capacity is activated to complete the data traffic transfer for a particular user (e.g., the end-user has requested the download of a whole video clip).

The Low Band (<1 GHz) is precious due to its limited quantity and best-in-class propagation characteristics. To optimize the use of the Low Band, it is best to use it for end-users who are located close to the cell edge where other frequency bands might not reach. Incorporating software to help allocate end-users to the optimal frequency bands based on relative distance to the cell center can boost all end-users’ experience. This is especially crucial in rural areas, but also relevant for urban areas.

Optimization is also required for VoLTE as it forms the foundation for the future technical solution for supporting voice calls. This is necessary as legacy networks start to shut down, as they have started to in Europe. As more users migrate to LTE and get on the VoLTE band wagon, VoLTE will need to be robust enough to manage future demands.

iii. Deployment strategy is essential to ease deployment and reduce TCO

The last critical factor to note is deployment strategy. Physical space limitations at the cell site requires mobile operators to choose solutions which streamline and work within the physical space available. Deploying additional cell sites is never to be taken lightly due to factors such as increased aggregate total cost of operations (TCO), availability of cell sites and complex radio frequency (RF) planning, among others.

Ensuring new cell sites are deployed judiciously and only when there is a strong rationale, base station deployment should be streamlined and optimized as possible. This means minimizing the weight and size of equipment installed onto the cell site, implementing mistake free cabling and deploying integrated solutions. These can potentially reduce the number of man-hours required for deployments, improve Time-to-Market and reduce overall TCO by up to potentially 30% over a five-year period. The TCO savings derives from reductions in rental fees to tower management companies, engineering and ongoing operational costs of running the cell sites. Another way to avoid deploying additional cell sites is to have a well-integrated site solution which can resolve deployment challenges. This could look like, for example, deploying three sectors seamlessly using a single antenna and a single multi-band remote radio unit (RRU). In addition, with less equipment used for deployment, labor costs can be minimized and overall TCO reduced by up to 50%.

Conclusion

ABI Research believes LTE will remain indispensable even as the industry move into the 5G era. Since we expect 60% of subscribers in 2025 will still be on LTE and it provides fall back services for 5G end-users that roaming into 5G areas, it is still essential to invest in the LTE layer and complements 5G. As more 2G and 3G networks shutdown, LTE networks will play the fundamental role for the future of mobile voice and support novel applications such as NB-IoT. Therefore, it is necessary for mobile operators to plan and future proof their networks for LTE and 5G.

Increasingly, mobile operators are being evaluated by regulators not just for how much 5G coverage or data throughput per second but also the Quality of Experience (QoE) throughout the year for a cross section of end-users, business, prosumer, urban and rural end-users. Due to the intense competition in most markets, end-users can, and do, move to a new operator. If an operator does not maintain a healthy market-share, it can have a dramatic impact on their profit margins and thereby impact investor Return on Investment (ROI). In developed markets, continued investment in LTE can help mobile operators deliver high quality experience aiding its competitiveness. For emerging markets, sustained investment into LTE is necessary for competitiveness but also to prepare for 5G. Infrastructure upgrades, software upgrades and deployment strategy are crucial for network mobile operators to take into consideration in the 5G era.

The post 5G infrastructure upgrade underway… Is your 4G infrastructure optimized? (Analyst Angle) appeared first on RCR Wireless News.