Mid-April second vaccination greetings from Lake Norman/ Charlotte. This week, a box arrived containing an oversized, fleece-lined hooded blanket from T-Mobile (the package also included a loincloth-sized black towel entitled “verwhyzon”). The opening picture is my poor attempt to model the present (T-Mobile’s analyst blanket drop also prompted PC Magazine’s Sascha Sagan to pen an article last Friday called “Don’t Fall for This 5G Con Game”).

This week, we will focus on AT&T and Verizon’s wireless results. There’s a lot to cover, and we are still recovering from second vaccine aftereffects, so will keep our analysis focused this week. After Comcast and Charter announce earnings next week, we will compare them to Verizon and AT&T’s results.

Speaking of earnings, many of you indicated that the earnings calendar was a nice touch last January/ February, so here’s a brief summary of upcoming earnings conference calls for the ten companies we track each week:

- Verizon: Announced April 21

- AT&T: Announced April 22

- Google: Tuesday, April 27, 5:00 p.m. ET

- Microsoft: Tuesday, April 27, 5:30 p.m. ET

- Apple: Wednesday, April 28 5:00 p.m. ET

- Facebook: same as Apple

- Comcast: Thursday, April 29, 8:30 a.m. ET

- Amazon: Thursday, April 29, 5:30 p.m. ET

- Charter: Friday, April 20, 8:30 a.m. ET

- T-Mobile: May 4

The week that was

The best way to describe this week’s market activity for the Fab Five is “wait.” As indicated above, each Fab Five company reports next week, and for every downbeat prediction there’s a countering prediction of a blowout quarter. No doubt, cash will be flowing for each of the Fab Five, and net debt will be negative.

Apple held a very upbeat product unveiling on Tuesday with new 5G-enabled versions of the iMac and iPad Pro announced along with a completely revamped Apple TV 4K product and a new iPhone color (purple). One new iPad Pro feature is its compatibility with Microsoft Xbox and Sony PlayStation controllers. The 10-minute summary from CNET is here and Tom’s Guide take on what announcements should be in Apple’s future is here.

For those of you who need a good podcast to listen to this week, recently retired CEO of Amazon’s Worldwide Consumer Business, Jeff Wilke, has an insightful 30-minute inside look at Amazon’s management process. There’s a lot of valuable information packed into thirty minutes (reinspecting the process, service-oriented software architecture, input vs. output focus, protecting new divisions from larger legacy units, business mechanisms, leader as teacher, etc.). The interview by James Currier at NFX is here. I had the pleasure of working with Jeff for several months in the early 1990s while we were both at Andersen Consulting, and then over a decade later with the launch of the Amazon Kindle (where Sprint was the original Whispernet provider).

Speaking of Amazon, a recap of the week’s events would not be complete without mentioning Wednesday’s Amazon Web Services (AWS)-Dish announcement (here). This strategic relationship makes a lot of sense for two reasons: 1) Each of the current O-RAN vendors knows how to interface into AWS. There’s no learning curve – given that this is a new architecture, there’s value to having a well-known cloud partner connecting everyone together, and 2) It goes without saying but AWS will bring Dish a lot of potential trial partners in Las Vegas and around the globe. The AWS embedded base has a tremendous amount of value. While there are obvious topology advantages of using Las Vegas, we also think that there are very few “industry-centric” metropolitan areas left, and Las Vegas is known for one thing – gaming. If low latency, secure, personalized networks can’t make it in Vegas, then Dish has a very big problem on its hands. Couple Vegas with Dish’s partnership announcement with DraftKings in March (and Dish-owned SLING TV’s launch of a basketball betting channel with DraftKings last Thursday) and we start to get a picture of how customized networks can change addressable market sizes.

Finally, a shoutout to one of the best IoT blogs in the business (Stacey on IoT), and their writeup last week titled “How I made $10,000 providing part of Helium’s IoT network.” We featured Helium in our inaugural “Three Up and Comers” edition (October 2019) and are proud owners/ operators of a Helium Hotspot (see picture nearby). But Mooresville/ Davidson has a lot fewer Lime scooters than Austin, Texas, and our earnings in the first month have been in the hundreds of dollars. We are surprised, however, each time we accumulate Helium Network Tokens, and think they are really on to something. For more on the company and its business model, here’s Stacey’s original article on Helium.

Where’s the Wireless Service Growth (AT&T and Verizon Earnings Insights)?

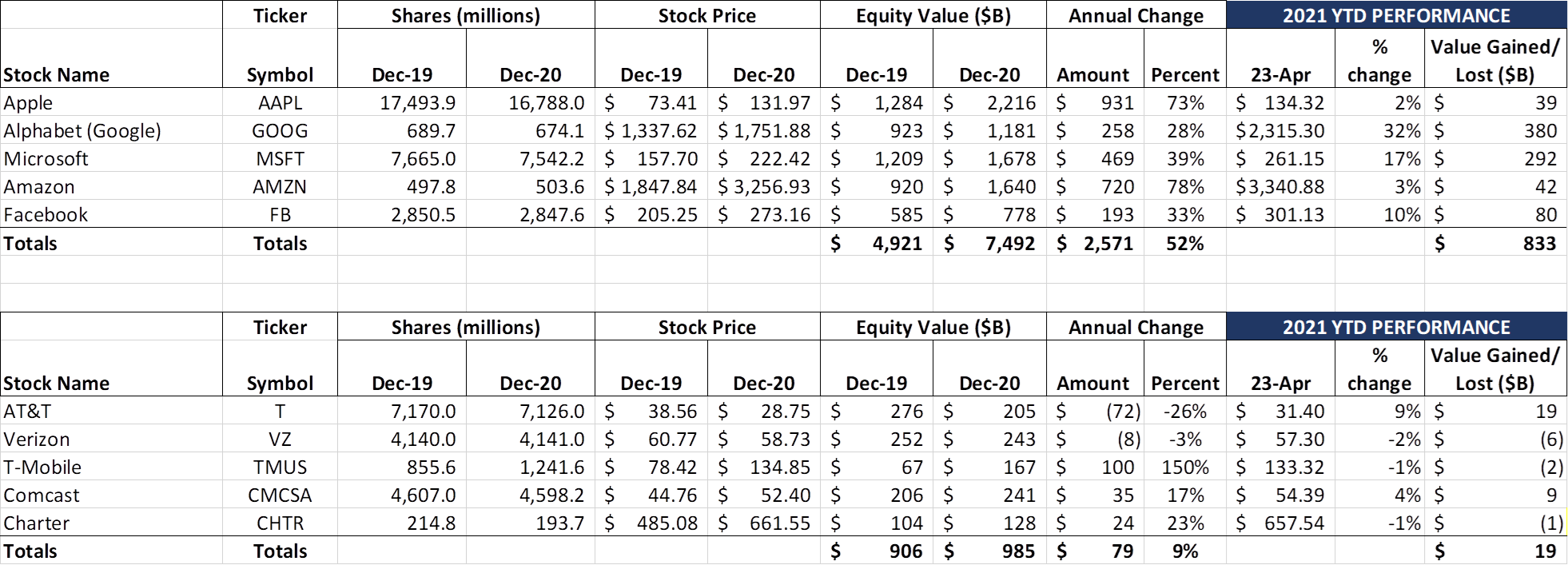

Both AT&T and Verizon announced earnings last week (AT&T package here and Verizon package here). As we showed in the market cap table above, the reaction to AT&T’s earnings was better received (T’s market cap +$10 billion wk/wk vs. -$4 billion for VZ). These weekly changes are small compared to their overall market capitalizations (~$456 billion combined as of Friday’s close), but they do tell us something about momentum. Ma Bell has some, Big Red has none.

AT&T, after losing 26% of its value in 2020, is coming back because of its growth strategy (grow wireless subscribers, grow fiber deployments, grow theatrical blockbusters and HBO Max, manage satellite and AT&T TV separately). There was a gap between last year’s rhetoric and actual changes in financials, but they now appear to be retaining customers, increasing their fiber presence, and debuting attractive content (Godzilla vs. Kong will cross $400 million in global box office receipts this week according to boxofficemojo.com).

Verizon, on the other hand, has a different story. Having just spent a $53 billion (including clearing costs) at the latest auction, they are touting the value of deploying large blocks of mid-band spectrum to consumers and businesses. As we discussed in our column “I Like Big Blocks, I Cannot Lie” there are some size and scale efficiencies for Big Red – whether that addresses the gap between the per MHz POP between CBRS and C-Band is unknown (we are skeptical).

Unlike AT&T, Verizon has not acquired a satellite provider and a media company. They have chosen instead to partner with content companies as a distributor. Disney+, Apple Music, and Discovery+ are part of Verizon’s strategy to grow ARPU. So far, that strategy has proven to be effective with over 45% of new gross additions signing up for a premium plan.

While Verizon does not do into a lot of detail on their economics with content providers, they have explained that they are incented to retain the customer when the six or twelve-month trial period expires. If the customer elects to stay with their current (non-premium) plan, Verizon can bill on Disney’s, Apple’s, or Discovery’s behalf. This preserves ARPU without significant margin sacrifice. (Note, in the fourth quarter earnings call earlier this year, Verizon disclosed that 2/3rds of customers either chose direct billing or moved to a premium plan).

AT&T’s HBO Max value proposition is different because the marginal cost to sell the next HBO Max subscription is negligible. More HBO Max subscriptions results in lower overall expenses tied to any individual account. If HBO Max grows to 120-150 million subscribers by the end of 2025 as they project, content costs allocated to the wireless business unit will come down and profitability will rise. As the nearby chart shows, they enjoyed a healthy sequential growth of three million subscribers in Q1.

More HBO Max means happier customers as well. In the March analyst day presentation, Jeff McElfresh, AT&T Communications CEO, shared the following data (Net Promoter Score is also known as NPS):

“Adding HBO Max to our best plans reduces churn and lifts NPS by 20 points. We see the same results when fiber is added to our unlimited accounts, up 20 points. And when our customers have the best of all our products, adding both HBO Max and fiber, we see 35 points of NPS lift compared to the unlimited base. We’re seeing clear NPS improvements across wireless. And as a result, we’re closing the gap to our competitors. In fiber, we’re also seeing clear NPS improvements, further extending our leadership position in the industry. Higher NPS translates to lower churn, which results in higher customer lifetime values.”

Jason Kilar, the CEO of WarnerMedia, also disclosed during the March analyst day that each US HBO Max customer yields a 90% incremental margin. While this does not remove the risks with content selection and production, it’s a lot easier to rally a company around a high margin product than, say, satellite or linear video distribution.

This rally will not be confined to the postpaid business when HBO’s Ad-Supported (AVOD) product is introduced in late June. John Stankey made the following revelation during the earnings call:

“So you can expect, for example, we believe the AVOD product actually pairs well with some of our prepaid offers and how we might position it because it tends to line up on a more price-sensitive socioeconomic dynamic. And we think that opens up marketing channel and awareness channel and ultimately an opportunity to drive penetration in other places where, again, customers are a bit more price-sensitive.”

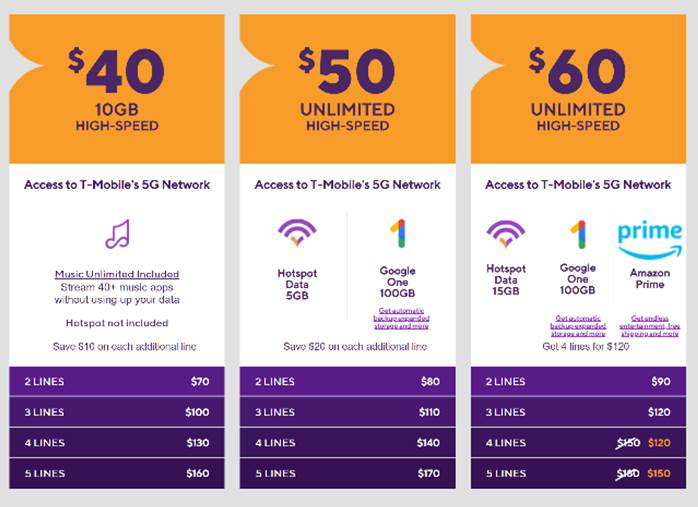

Metro by T-Mobile has Amazon Prime for their premium plans (see plans nearby), and now it appears that Cricket will get an AVOD version of HBO Max (remember, the AVOD version was described by Jason Kilar at AT&T’s analyst day as the same content without “day and date” theatrical releases). That will energize the channel versus Tracfone and Boost.

Despite a strong March (and assurances that the second quarter would be strong), Verizon’s Average Revenue per Account (ARPA) growth rate was 1.68% from Q1 2020. Normalized for roaming (removed from both periods based on management comments), annual wireless ARPA growth was just south of 1.8%, which is slower than what’s needed to achieve a total company growth rate of 2-3%. Verizon needs to achieve higher gross additions and base conversions to (premium) unlimited to hit their 2022 and 2023 goals (more discussion of this point in next week’s Brief when we discuss FiOS and business wireline).

Wireless service revenues for AT&T grew slightly, growing 0.6% versus Q1 2020 despite postpaid subscriber growth of 3.7%. Postpaid ARPU dropped 3% (phone only down 2.8%). Some of the decline in ARPU is attributable to international roaming revenue losses, but AT&T continues to rely on volume (including prepaid) versus ARPU growth.

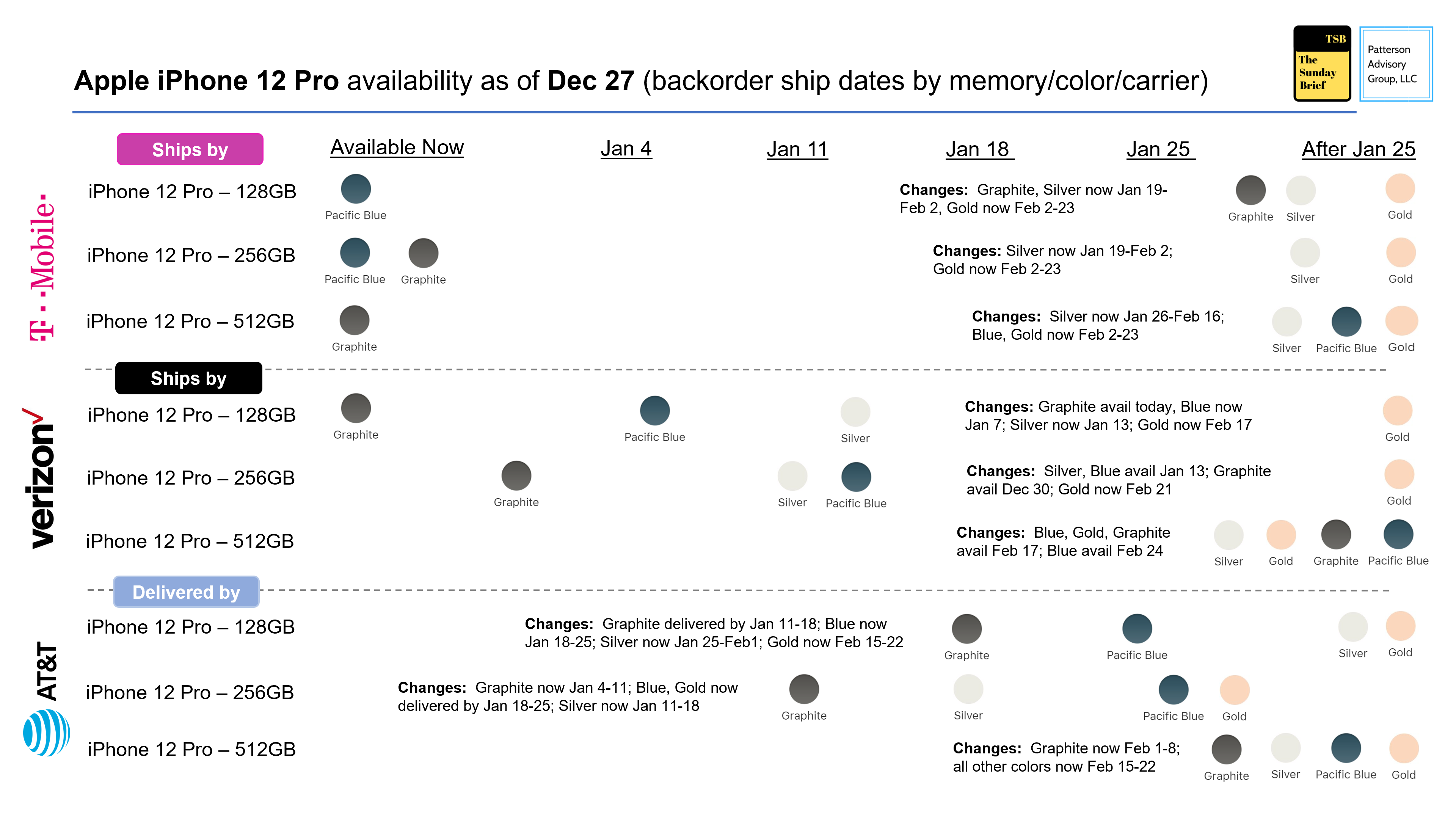

One final note on Q1 wireless gross additions. AT&T and Verizon (but especially AT&T) are highly dependent on new Apple launches for growth. As you will recall, we tracked AT&T and Verizon inventory levels using their online sites as a surrogate for overall backlog. Here’s the backlog assessment for the iPhone 12 Pro as of December 27:

Simply put, AT&T was out of stock of iPhone 12 Pro devices as the year closed out. These devices would have been either upgraded or added in Q1 2021. Verizon had some shortages as well (including iPhone 12 Pro Max), but not to the extent as AT&T experienced due to different promotional activity. Considering the backlog, it should be expected that AT&T should have a stronger Q1 than Verizon.

Bottom line: AT&T focused on volume growth, even at the expense of yield and EBITDA (although profitability will correct itself as the year goes on). Verizon focused on yield and profitability, at the expense of volume growth. While we need to wait a couple of weeks for T-Mobile’s earnings release, it appears that few legacy Sprint customers jumped ship to AT&T or Verizon. What didn’t happen may be the biggest headline this quarter.

One final punctuation on different approaches to growth that is worth mentioning: Verizon went out of their way on the earnings call to mention that, outside of continuing to invest in the business, their primary goal was going to be to enable the Board to increase dividends. When asked by CNBC about AT&T’s approach, John Stankey replied “My first priority is to get the stock price up so the dividend yield is no longer 6.9%. That’s what I am going to focus on.” This is not your father’s AT&T, at least when it comes to growth strategy.

That’s it for this week. Next week, we’ll review results for each of the Fab Five as well as Comcast and Charter (with a focus on broadband growth). Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals. Have a great week and Go Davidson Wildcats!

The post The Sunday Brief: Where’s the wireless service growth (AT&T and Verizon earnings insights)? appeared first on RCR Wireless News.