Greetings from Willard (Missouri), Davidson/ Lake Norman (North Carolina) and all points in between. Shown is a picture of (back to front) Friday, Gus, and Abby after one of their morning runs. We used this picture as well for the Sunday Brief “stub” post which was posted online here. It features some great interviews and articles, including a decent video recap of Google I/O 2021. Hope that your Memorial Day holiday was memorable and safe.

This week, we reevaluate and expand on our 5G themes started in July 2019 (here) and revisited last September (here) by analyzing comments made by two senior network executives – Neville Ray of T-Mobile and Igal Elbaz of AT&T. We will also have a full market commentary.

Please note that we will be changing the format of The Sunday Brief to bi-weekly starting in July to provide a little space for summer activities and to accommodate some new extracurricular activity (more on that in next week’s issue).

The week that was

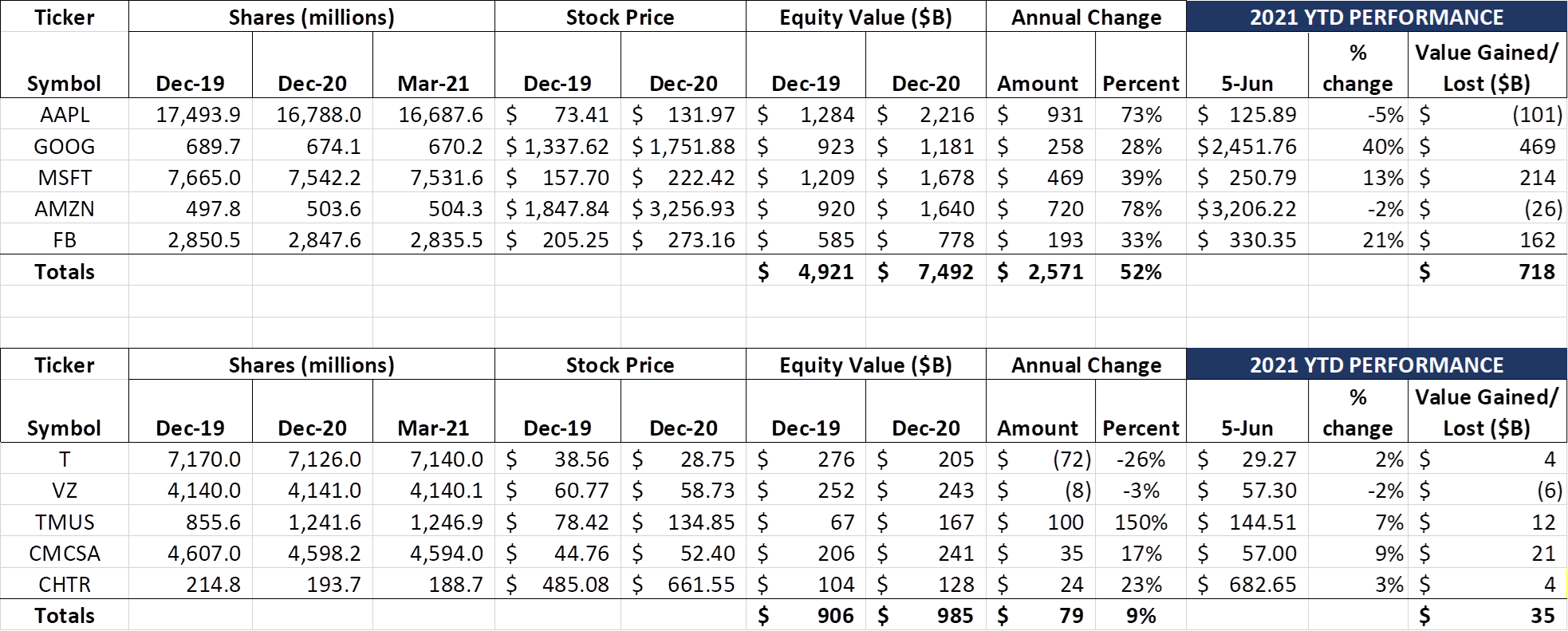

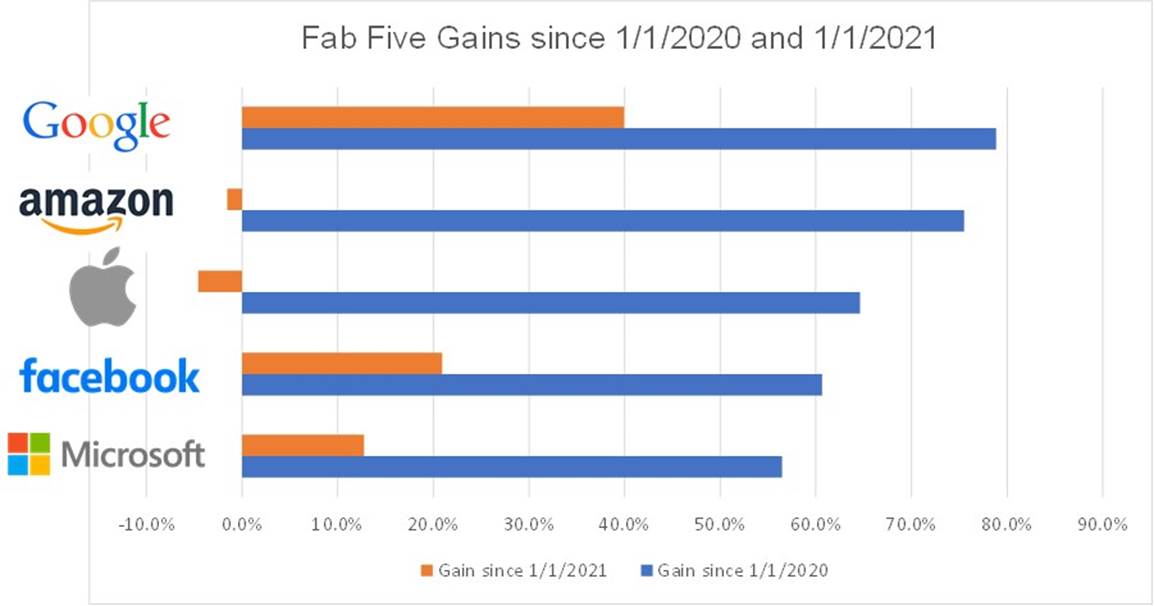

This was a typical post-holiday week with relatively little news. The Fab Five has managed to gain $163 billion in the past two weeks ($110 billion for the week prior to Memorial Day and $53 billion after), while the Telco Top Five have gained $14 billion ($12 billion prior and $2 billion post). Facebook and Google led the way, accounting for $111 billion or 68% of the two week capitalization gains. Not surprisingly, both FB and GOOG are hitting all-time highs.

What’s most interesting, however, is not the year-to-date gains for the Fab Five (which are uneven between each company) but the total gains since the beginning of 2020 (note – these are purely equity returns and do not include dividends). They are shown in the nearby chart. Overall, the equity appreciation since the beginning of 2020 ranges from 56.5% for Microsoft (with dividends, probably 57-58%) to 78.9% for Google parent Alphabet (no dividend paid). This compares to a range of -25% to 176% for the Telco Top Five (with T-Mobile’s gains impacted by the completion of their acquisition of Sprint in 2020). In the Fab Five world, everyone is a winner if 18-24 months is the horizon. And their percentage gains are on much larger numbers, resulting in a cumulative equity market value exceeding $8 trillion.

The Epic v. Apple trial wrapped up a few days after the last Brief, and there’s plenty of speculation concerning U.S. District Judge Yvonne Gonzalez Rogers’ ruling. The Washington Post’s May 25 article summarized the conventional wisdom best:

“The judge’s remarks on Monday hint at what she’s thinking for a verdict. Experts told The Washington Post that it’s unlikely that Epic Games will win outright, but Apple could be asked to change some of its App Store guidelines. Much has been made of Apple’s app store guidelines that bar developers from pointing users to alternative ways to purchase in-app products, for example. One possibility is that the judge could rule that Apple needs to reverse these guidelines as a compromise.”

We think this is a reasonable outcome, but would also not be surprised to see Judge Rogers side with Apple. As we recounted in the May 25 Brief, Apple CEO Tim Cook was a good witness for the defense and responded to questions completely and definitively. Anything perceived as an Apple win in the case will fan the regulatory flames in Sacramento and Washington, DC. Winning this case might result in a more intense push to break up the company.

On a lighter note, Google released their 2021 Guide to Summer last Thursday. Nearby are the “hot” destinations (literally, for some of these spots) based on Google hotel searches. We were surprised that there are no California or New York sites (including New York City) on the list. Taking the family to the big city is not as popular this year as the beach or the mountains/mesa or whatever reason one would want to vacation in Round Rock (vs. the Hill Country or Austin proper).

This anti-city bias is backed up by other data in the article, citing a 60% increase in RV-related searches and 90% increase in camping inquiries. Beach searches are up 40%, and parks are up 50%. When searching for cities, the most popular tended to be south and western locations like Phoenix, Denver, Houston, and Dallas. Outside of the Mile High City, the remaining three locations are perhaps the least desired for outdoor-related activity in July and August. America is venturing out, but more likely headed to Dollywood than Hollywood.

The American Customer Satisfaction Index (ACSI) also recently released their annual findings for the Big Three and a host of MVNOs. The news was good for AT&T (+1 yr/yr and tops among network operators) and Comcast Xfinity (-1 yr/yr but now tops among all MVNOs). The news was bad for T-Mobile (-5 yr/yr, and now slightly trailing Verizon and AT&T), Dish as a Sprint network MVNO (-4 yr/yr and now last among full service MVNOs) and Consumer Cellular (-7 yr/yr but still tops among value MVNOs). In particular, the study found that ACSI survey participants had a less favorable perception of T-Mobile’s network quality (score dropped from 77 to 74).

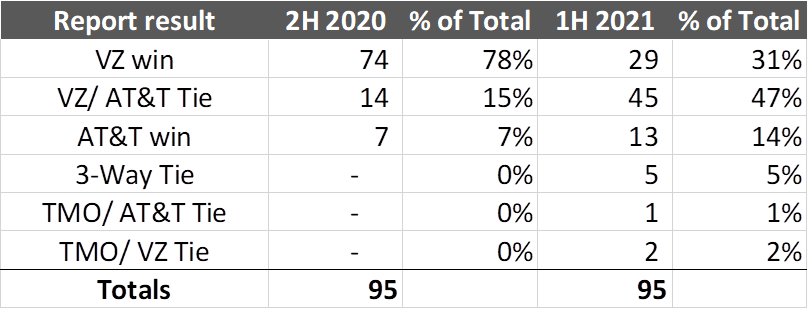

This information is consistent with what RootMetrics is showing for their metropolitan area RootScore reports. Here’s the latest data (re: RootMetrics tests 125 metros every six months using a randomly selected sample of indoor and outdoor locations using the same type of device for each carrier):

The “AT&T network quality is improving” headline is holding in the RootMetrics reports. While Verizon continues to hold on to very large cities (New York/ Tri-state, Chicago, Los Angeles, Seattle and many other large metros continue to be outright wins for Big Red), others like Denver, Houston, and San Francisco have moved from Verizon wins to Verizon ties. And AT&T is outright winning larger secondary markets like Las Vegas, Pittsburgh, and Raleigh. T-Mobile has no outright wins and eight ties. Bottom line: As the first half comes to a close, Verizon is no longer the clear cut winner, and T-Mobile is not winning a lot of markets yet. Despite their distractions, AT&T has managed in six months to stunt Verizon’s RootMetrics lead.

The (technical) future of 5G – AT&T vs. T-Mobile

This week was full of (virtual) analyst conferences. Cowen & Company hosted their Technology, Media, and Telecom Conference, Bernstein held their Strategic Directions conference, Barclays had a Future of Media conference, and UBS capped off the week with a Future of 5G Event. Our focus will be on the last event, although we managed to listen to each and every conference presentation.

Igal Elbaz, SVP of Wireless Technology, represented AT&T at the UBS event (materials here). While he reiterated a lot of points made at AT&T’s investor day, he disclosed an important, almost unbelievable statistic: 70% of AT&T’s fiber gross additions are actually new customers to AT&T (roughly at minute 21 in the webcast). This tells us a lot about what’s going on with the customer base:

- Current copper/ DSL customers are switching to cable out of bandwidth necessity (e.g., a large family that can get 100-200 Mbps from cable for the same price or a slight premium);

- Once fiber is deployed in their neighborhood (assuming they were under an exploding promotion to their cable company), the customer switches back to AT&T fiber. It could be due to a promotion (e.g., HBO Max) or simply to try fiber, but they are coming back. This is a large part of the 70% figure quoted above;

- Those who stayed with AT&T DSL are upgrading to copper in droves. Frankly, AT&T may not be giving them much of a choice;

- New movers (re: AT&T covers population centers such as Austin, Dallas, Houston, Atlanta, and Miami) are splitting (?) or at least shifting their bandwidth decisions away from “nearly all to cable” to “mostly to cable.”

Igal also reiterated an important point in his discussion: Fiber customers want to access the Internet through their Wi-Fi network and less through macro towers. One has to believe that a side benefit (perhaps now quantifiable) to fiber deployment is reduced macro and small cell network strain. We are not entirely sure it’s a keystone of AT&T’s strategy where they are the incumbent, but Igal drew out this relationship early on in the session.

The other surprising point Igal went out of his way to discuss is greenfield edge-out fiber builds. While he emphasized that the “majority” of builds would replace VDSL coverage, he also stated “we’re absolutely going to get into some greenfield areas.” Fiber needed for 5G macro and small cell builds is extended to a Multi-Dwelling Unit or a housing development or a strip mall. Multi-purpose infrastructure was a concept presented by John Donovan and Randall Stephenson in 2012 at their November Analyst Day, and it’s finally becoming the default.

Igal ended his discussion with a lengthy statement supporting Open RAN or O-RAN architectures. We have discussed the benefits of opening up subsystems to third-party vendors, but Igal added additional punctuation, stating that “there’s a belief out there Open-RAN architecture is only good for greenfield (networks). And let me tell you that the answer is absolutely not. By design, the O-RAN architecture is designed to have good detail availability between incumbents into new vendors. And because of the nature of how it’s going to work, different parts of the architecture mature in different times. And each one of us can decide which part of this we want to adopt.”

What Igal is getting at is that O-RAN not only provides potentially cheaper and better alternatives for 5G systems, but also provides the interface or gateway between legacy and new technologies. For those of us who have made network transitions (e.g., from Time Division Multiplexing or TDM to Voice over IP) the prospect of multiple alternative network solutions that improve handoffs and efficiency is promising.

While AT&T led off the UBS conference, they were not the only speaker. Neville Ray, President of Technology for T-Mobile, followed Igal and gave several updates on T-Mobile’s deployment (webcast here). Their low-band 5G deployment is “quickly approaching” 300 million POPs. This layer is important not only for coverage claims prior to mid-band deployment, but also as the uplink component post mid-band deployment.

Neville also provided speed updates where mid-band 5G was deployed, saying that 330-335 Mbps average download speeds were common and growing, supported by 60-80 MHz of mid-band spectrum (with a target of 100 MHz deployed by the end of 2021, which, per Neville, should improve average download speeds “above 400 Mbps”). On propogation, he reiterated his previous statements that 3.5 GHz (C-Band) spectrum does not propogate as well as T-Mobile’s 2.5 GHz spectrum and that Verizon and AT&T would need to deploy 50% more cell sites with C-Band to get the same coverage as T-Mobile’s 2.5 GHz.

The power constraint arguments that Verizon has used to offset the propogation arguments were also a topic of discussion. Neville explained that while the C-Band power constraints were fixed, the 2.5 GHz power levels were dependent on the size (degree range coverage) of the antenna – more of a “sloping line” – the wider the angle of the antenna, the lower the power allowed by the FCC rule. He went on to explain that T-Mobile is using 65 degree antennas which allow for higher power consumption per the FCC rules than the 90 degree antennas used in Verizon’s analysis. “With MIMO, you aren’t using 90 degree arrays to spray over God’s given earth. You concentrate the beams, you use smaller antenna beam widths, and you can support higher concentrations of power… If you look at the FCC rules, you can actually have higher levels of power in rural areas then C-band, up to four times more… We’re very confident in our position, and will also deploy C-Band where and when it makes sense.” (Note: the preceding quote is a Sunday Brief paraphrase).

On millimeter wave, Neville was more blunt, saying “I’ve never been a believer in millimeter wave deployments as a coverage layer.” He stated that they are targeting 50,000 small cells, but “we’ll see where that goes.”

Neville Ray’s response to Batya Levi’s question on fiber ownership was also interesting. Previously, T-Mobile’s reply to fiber ownership has been something like “No. We rely on our wide array of strategic suppliers to provide backhaul and transport.” This time, Neville answered “Not right now.” We might be splitting hairs here, but this change in tone might be telling. Neville continued, “You have to sit back and look at what’s happening in the marketplace today. The one competitor that has the strongest owner economics is AT&T. We estimate that they have their own fiber to half of their sites. We’re not sure about Verizon but their base might be 30%. For the vast majority of sites, they use the same model that we do… If we decide at some point in time that the economics don’t work, we will change. But right now, the economics absolutely work for us with the model that we have.”

We think that the economics are beginning to tip to dark fiber leases at a minimum for the 100 million POPs that make up many urban areas. Perhaps the capital budget favors synergy initiatives today, but with multiple 10 Gbps circuits deployed into towers, there has to be a point where investing in connectivity to key data centers and applications makes a lot of sense. It could take the form of IRUs today, but T-Mobile’s ability to grow millions of fixed wireless customers in the suburbs can’t occur without additional fiber investment. And it’s the suburbs that lack competitive suppliers.

Neville continues with comments about O-RAN (“let the ecosystem develop”) and Fixed Wireless (“really good for solving rural broadband issues”) which you can digest in the latter part of the above link.

Bottom line: T-Mobile and AT&T are approaching 5G from different legacies – AT&T as a means to develop deeper relationships with Amazon, Microsoft and others as they develop low-latency software for business customers (and also as a key contributor to a multi-purpose dense fiber deployment), and T-Mobile as a means to quickly deploy fallow spectrum and open up new markets such as fixed wireless. What’s most telling is that 5G embodies T-Mobile’s daily focus, while AT&T will continue to digest DIRECTV issues, WarnerMedia spinoffs, and incumbent telephone losses. T-Mobile has a more focused task list for the next 24 months, and that’s a good thing.

That’s it for this week. Next week, we will continue with our strategic analysis of Verizon. Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals and Go Sporting KC!

The post The Sunday Brief: The (technical) future of 5G—AT&T vs. T-Mobile appeared first on RCR Wireless News.