A break in the clouds from the COVID stay-at-home: For our neighbors: homemade cheesecake. For us: homemade boerewors (traditional South African farmer’s sausage) and the Editor’s chakalaka. Silver Linings.

After covering this week’s market news, briefly evaluating T-Mobile’s Work from Anywhere (WFX) announcement and discussing the latest batch of RootMetrics Metro RootScore reports, this week’s Brief takes a “one year later” view of The Essential Economy. We will recap our 2020 predictions and refresh our thoughts concerning economic recovery (spoiler alert: it’s going to be uneven) and telecommuncations growth.

One quick note on last week’s Brief – please make sure to share the Corrected (or second) version with friends. Apologies for our erroneous calculations. It did not change the overall thesis that “big blocks” of power-enabled spectrum are going to be very difficult to justify paying 3-4x more than CBRS and other bands, but numbers matter. (For more on the debate on power requirements currenty occurring between the FCC and wireless carriers concerning current and to-be-auctioned spectrum bands, check out Mike Dano’s excellent article posted Friday in Light Reading here).

The week that was

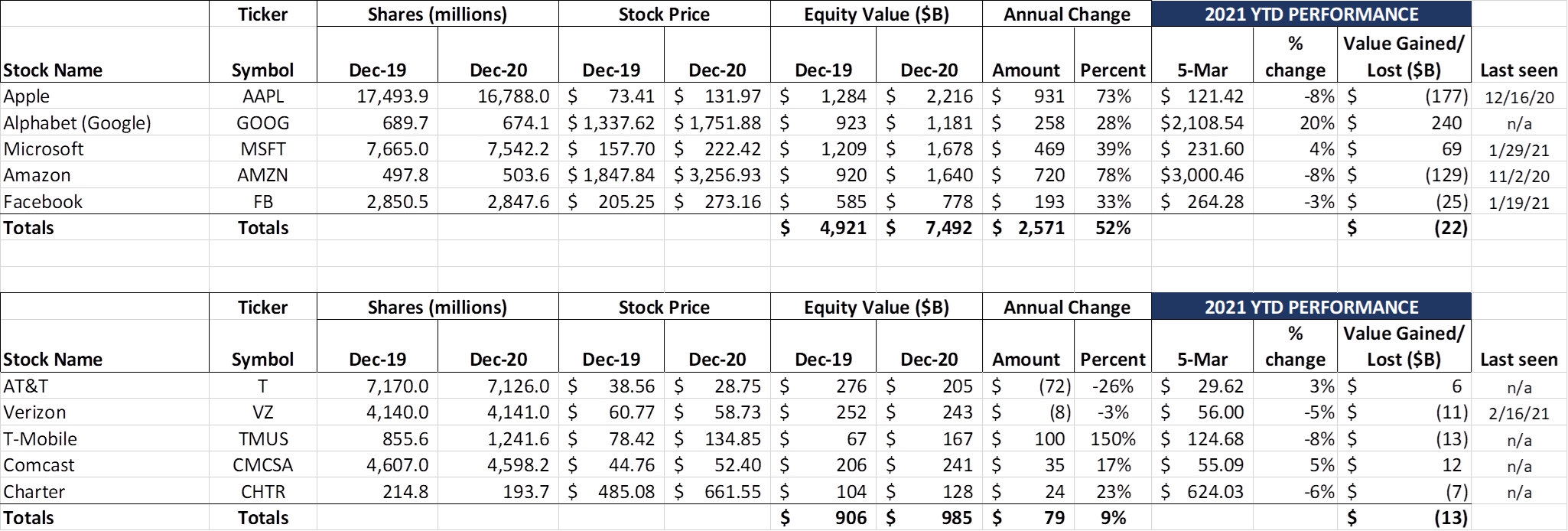

“Whipsawed” would be a good word to describe this week’s market activity. Apple traded in a $10 range this week ($117.72 to $127.79 per share) before settling down within 16 cents of last Friday’s close. Same song, different verse for Microsoft, which traded in a $12 range this week before settling down 78 cents per share. And, for the first time in nearly a year, the Fab Five have lost more total equity market capitalization in 2021 than their Telco Top 5 peers (although that’s on a base that was 7.6x larger exiting 2020).

On the Telco Top Five front, each stock contributed to a healthy $34 billion gain in cumulative market capitalization. This week’s gains result in Comcast being the most valuable company in the Telco Top 5 (now $252 billion), inching out Verizon ($232 billion) and leading AT&T by a comfortable $41 billion margin ($211 billion). As we have mentioned in several previous Briefs, the economic recovery helps every major Comcast business unit (cable, networks, theme parks and advertising). Each line of business generates healthy incremental margins, and the European recovery weakness for their Sky unit will likely be made up through a weaker dollar (which translates into exchange rate-driven revenue growth). If the trend in the nearby dollar index chart continues, even Sky could turn out to be a growth engine.

Before diving into T-Mobile’s latest Uncarrier announcement, we thought we would revisit the RootMetrics Metro RootScore results (more here and tracking chart available upon request; I have also posted the data in my news feed on LinkedIn). The picture is not looking good for Verizon. Of the 30 markets measured through March 5 (all won outright by Verizon in 2H 2020 – no ties):

- Verizon retained an outright win in 5

- Verizon and AT&T tied for the RootScore award in 14

- AT&T was awarded the market (no ties) in 8

- Verizon, AT&T, and T-Mobile all tied for the market in 2

- AT&T and T-Mobile won (and Verizon placed 3rd) in 1

Interestingly, there isn’t a strong correlation between Verizon metro wins and their 5G Ultra Wideband deployments. Verizon did not outright win UWB markets like Columbus (OH), Las Vegas, San Jose, Syracuse or Tucson, but they were the sole winner in Colorado Springs and Salt Lake City. Admittedly, this is only one rating system and thirty data points, but it appears that their stranglehold on RootMetrics awards is over until C-Band is deployed.

T-Mobile’s Work from Anywhere (WFX) announcement – compelling value, many options

The big news in the telecom front was T-Mobile’s announcement of their Uncarrier enterprise program. Magenta has historically been under-represented in the business market for a variety of reasons, and the acquisition of Sprint Business bolstered their presence in the C-Suite. As we will see below, their WFX solution blends an existing unlimited pricing construct and an existing software partnership with one of their fastest growing product lines. Here are the basic components of T-Mobile WFX (Work From Anywhere):

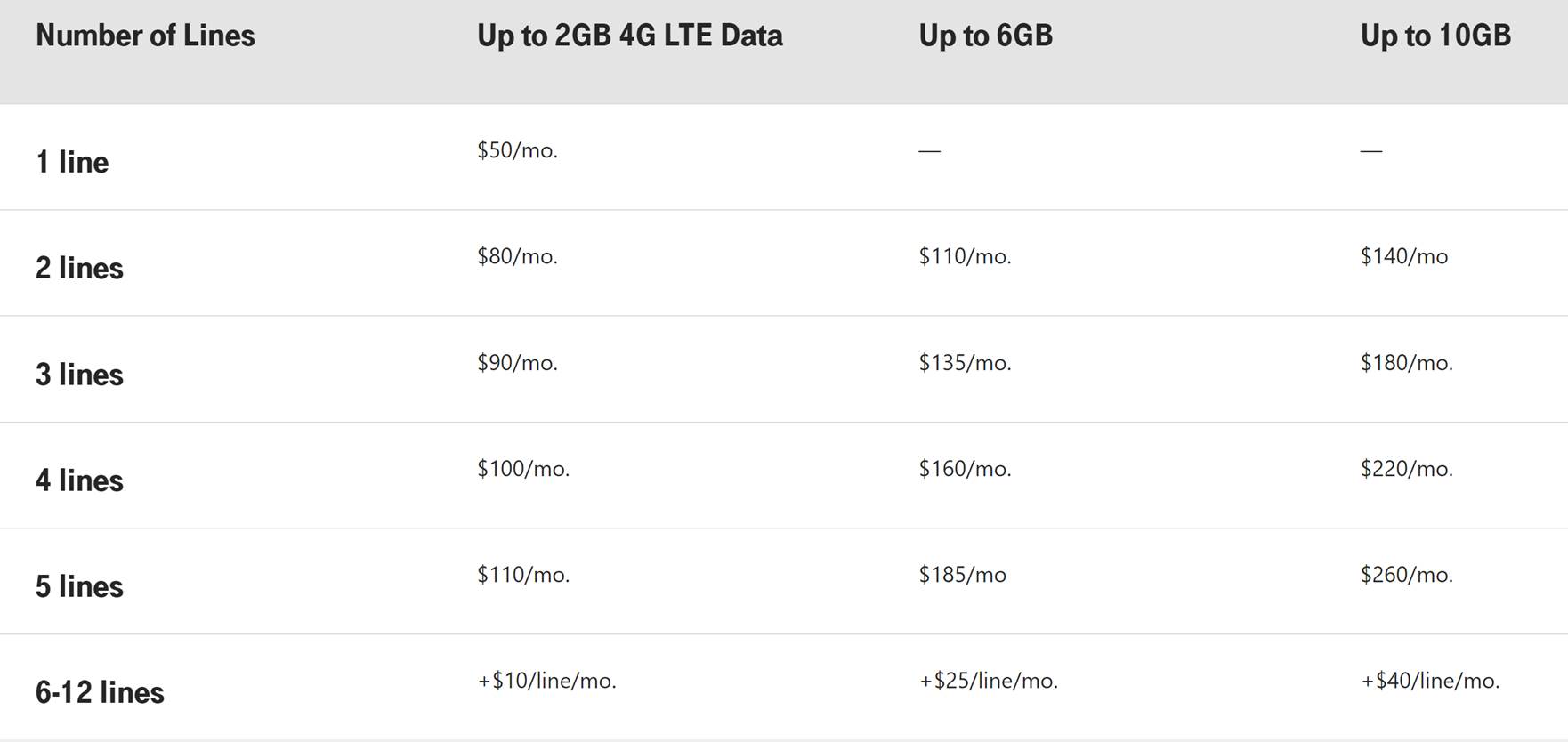

1. The elimination of pooled data pricing for business customers. As CEO Mike Sievert noted in the pre-recorded announcement (here), an entire cottage industry of cost consultants had sprung up to try to keep track of plan utilization. Even T-Mobile’s current “Simple Choice” rate card (see below) was becoming unwieldy.

All plans under the WFX banner will have unlimited data (deprioritized after 50 GB of individual line usage) as well as 10 GB of Hotspot per line (plenty for “around town” usage, but not enough for road warriors). They are also including Inflight texting, an hour of data usage per flight and their scam call detection software.

2. The bundling of Dialpad software with Enterprise Unlimited plans. This is in some ways a continuation of the Sprint relationship (see previous Sprint/ Dialpad training materials here) but with improvements to take advantage of Dialpad’s latest Artificial Intelligence features. Rather than repeat what we said when we identified Craig Walker’s company as an “Up and Comer,” we will just point readers back to the article. Thankfully, T-Mobile did not try to do it on their own (despite announcing that they considered that alternative).

T-Mobile plans to bundle Dialpad and Enterprise Unlimited together starting at $37/ line. Assuming the feature functionality is similar to Dialpad’s current offers (see here), the value proposition should be compelling. While integration into Microsoft Office 365 is standard, it is unclear whether the $37 rate includes a license of Microsoft 365 Business Basic (a current component of the T-Mobile For Business plans).

Regardless of the offer specifics, T-Mobile picked a good partner who really understands Unified Communications as a Service (UCaaS). To smaller businesses, they provide an excellent turnkey solution. To medium and large businesses, they provide a conferencing alternative to Cisco, Microsoft, Zoom, Verizon, and others. As T-Mobile For Business grows, it’s likely that the company will have multiple partnerships and integrations. This partnership gets them started with a robust bundle.

3. Home broadband connectivity. This is a more fortified (and expensive, starting at $90/ mo.) version of their Home Internet product. One of the announcement features we found intriguing is that the service “prioritizes access to employee devices and filters non-business content, so WFH employees can stay productive while the rest of the household can stream, study, game and more on personal Wi-Fi without disrupting work.” Our guess is that this enables businesses to limit access to selected sites (versus T-Mobile controlling which sites can be accessed) – hopefully they will provide more details on this development next week.

The connectivity product will be available to 60 million homes at launch (~ half of the country) with more added as the company continues to expand their 5G (600 MHz + 2.5 GHz) network. No equipment cost, no service activation fees, and no contracts cap a very compelling value proposition. This sets the table for a more comprehensive transport/ connectivity initiative – secure connection of each employee to private and hybrid clouds.

Bottom line: T-Mobile WFX is a very positive development for the business community. AT&T (with Microsoft and/or Cisco) and Verizon (using their BlueJeans acquisition) will need to respond. T-Mobile’s announcement will actually add more credibility to Comcast’s newly launched WFH offer (more on their efforts here). Overall, it looks likely that some of the real estate savings from office reconfigurations/ downsizings is going to be redirected to WFH business grade solutions. T-Mobile is ready with a compelling solution.

The essential economy in 2021 – uneven, unstable, unemployed, and underwater

For those of you who are new to The Sunday Brief, we spent a lot of time last March thinking about the post-COVID recovery process. Our thesis was that COVID would have positive economic impacts for a few, have negative impacts for many (but not most), and be neutral for others. The March 2020 index of Essential Economy Briefs is here.

Our predictions were generally right, although we had some meaningful misses. While we caught the broadband wave, we overestimated the video cord-cutting downdraft’s impact on Charter (less impactful than we predicted). We thought that inflation would rear its ugly head sooner (missed by a few months, thanks to the offsetting plunge in energy and airline ticket prices). We also thought that a second stimulus would trigger increased interest rates (it’s actually the third stimulus that brought on the interest rate fears – see nearby 10-yr Treasury note yield chart). Most importantly, we underestimated the propensity to save (vs spend) stimulus checks.

While vaccinations are ramping, travel (at least locally) is increasing (see Apple’s index for Houston and other metros here). Office parking lots, playgrounds, classrooms, and stadiums are beginning to fill up. Happy hours are no longer virtual. Certain grocery store shelves are well-stocked. Charlotte almost has a “rush hour” again. There are some signs of March 2019 activity, although “back to normal” is an empty phrase to describe 2021. The lingering aftereffects from last year will be unusually abnormal.

Telecom infrastructure performed well – all things considered. The cloud and cable kept us connected to Zoom, Disney+, and CNN. Mobility mattered less thanks to “shelter in place” orders, but few homes reverted to landline phones. And, despite some delays, Apple launched the iPhone 12 and Samsung launched the Galaxy S20 – with full 5G capabilities. 2020 could have been a lot worse for the telecommunications industry.

We thought at length about how to succinctly anticipate the remainder of 2021. Our basis for this analysis is several dozen interviews across all parts of our economy along with hundreds of pages of documents and articles (many cited below or in future Briefs). We think that 2021 (and the post-COVID recovery in general) can be summarized in four words:

a. Uneven. Every economic recovery is different, but this one will be the most unusual we have ever seen. There are municipalities and states that will sadly never recover. Then there’s the upper Midwest with many states already back to pre-COVID employment levels and 5-yr high commodity prices. Retirees on fixed incomes who sheltered in place have since been vaccinated in droves since the beginning of the year –and are resuming activities. But, as we predicted, about 40% of the population will sustain medium to long-term impacts from 2020. From depleted savings (and the corresponding financial anxiety) to business closures (especially in low-income neighborhoods) to curtailed public transit, life got a lot harder for many.

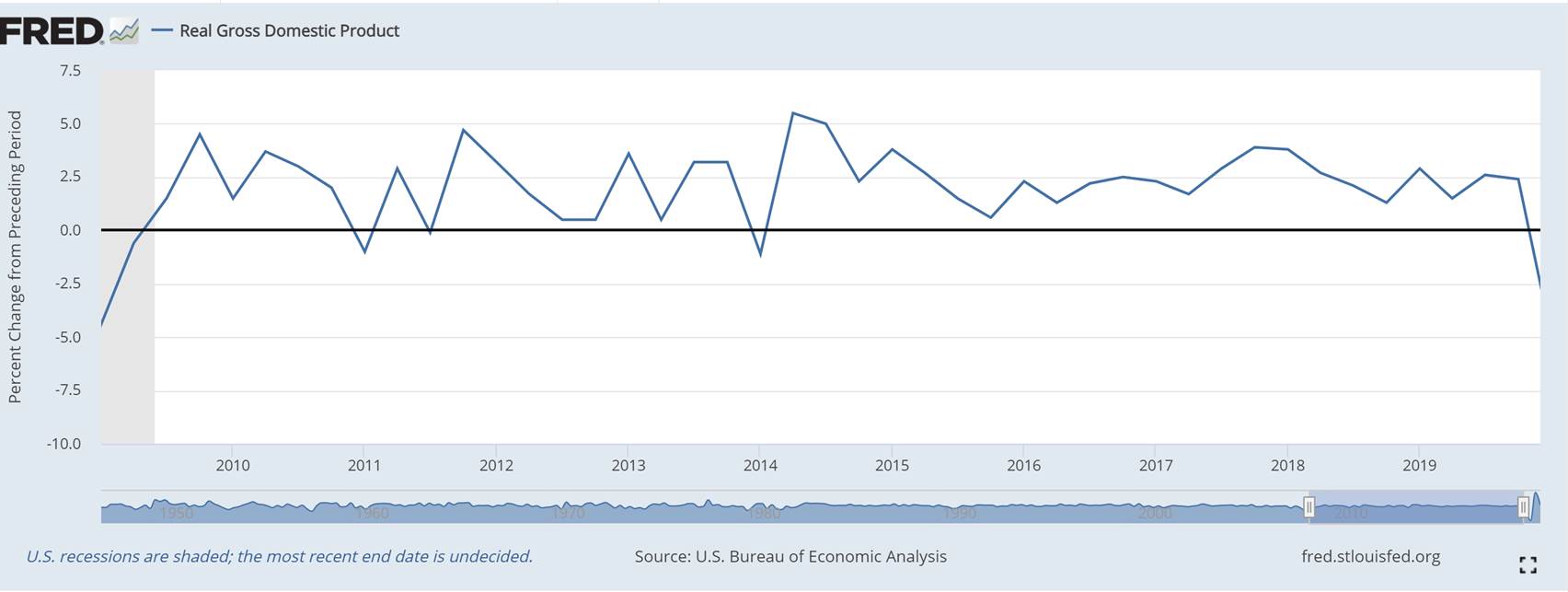

b. Unstable. When we emerged from the Great Recession of 2008-2010, it was anything but slow and steady as this chart from the Federal Reserve clearly shows (also pictured below). Real Gross Domestic Product growth gyrated from 3Q 2009 through 3Q 2016. Then it steadied for about four years until COVID hit. The assumption of linear progression is not standard and should not be the expectation. If the interest rate jitters from last week raised blood pressures (see this New York Times article), just wait a few weeks. It’s going to be a wild ride.

c. In case you forgot from the previous recession, the U3 is the official unemployment rate (currently at 6.2%, up from 3.5% in Feb 2020), but there are two additional and important unemployment metrics. U5 includes discouraged workers and all other marginally attached workers (currently at 7.3%, up from 4.3% in Feb 2020), and U6 includes all workers who are working part-time purely for economic reasons (currently at 11.1%, up from 7.0% in Feb 2020).

More employment is going to be the rallying cry for 2021, whether it’s for increased infrastructure or other government initiatives. While we have made remarkable improvements, the hard work from 2015-2019 to bring more people into the workforce (adding to state and municipal tax bases) has been largely undone. The Work from Anywhere (WFX) initiative described earlier could accelerate the pace of workforce reentry.

Uneven unemployment will also be a theme. Based on the latest municipal employment data (through December 2020), the major cities in Texas have ~389,000 jobs to add to get back to the levels seen at the beginning of 2020. For Michigan (roughly 1/3rd the population of Texas), that number is 521,000. For New York state (about 2/3rds the population of Texas), the number is between 1.1 and 1.2 million. State government treasuries will recover, but states like Texas and Florida (and North Carolina) will experience full economic recoveries (defined as employment levels equal to or greater than that seen in December 2019) by 2022.

d. Underwater. As we mentioned last March, about 40-50% of the population lives paycheck to paycheck. Evictions, foreclosures, student loan payments and personal bankruptcies are being delayed thanks to legislation, but not eliminated. It’s a trend that is very hard to ignore. For more details on the pending eviction/ foreclosure wave, see this list of state-by-state data from the National Low Income Housing Coalition.

How do these four factors impact the telecommunications industry? Affordable broadband (through wireless, coax, or fiber) is going to take center stage in any infrastructure initiative. Providing the ability for school-aged children to “Learn from Anywhere” is going to be critical. Government programs that assist low-income households with broadband costs (Lifeline for Broadband) will be instituted, and more emphasis will be placed on reviving rural America (a beneficiary of WFH if broadband infrastructure is enabled).

As we discussed last week, we think that the C-Band auction (and one less competitor) are going to lead to service plan inflation. This will not be as dramatic we have seen with gas prices in recent weeks, but rather a steady 2-3% real growth in service revenues across the industry. Inflation is great for capital-intensive industries, until that asset needs to be replaced, and, as I reminded many of you this week, we now need to plan for replacing aging fiber and coaxial infrastructure (think MCI Metro and inter-city networks, Sprint’s long-distance network, and the earliest cable broadband markets).

There’s a lot left to discuss in future Briefs. We welcome your thoughts and comments. Next week, we will recap all of the investor days that the C-Band “winners” are hosting. Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Have a great week and Go Davidson Wildcats!

The post The Sunday Brief: The essential economy in 2021—uneven, unstable, unemployed, and underwater appeared first on RCR Wireless News.