Warm summer greetings from Houston, Texas, and Charlotte, North Carolina, where we are starting to see the first fruits of our “stay at home” garden. This week also featured our first airplane trip since late February and, despite the mask-wearing in 95-degree humidity, everything went very smoothly. Those of you who have already traveled can attest that it’s a lot harder to get the morning cup of coffee or an evening meal in the airport than it was four months ago. Some travelers have returned, but in both Charlotte and Houston, airport commerce has not rebounded as quickly. We are hopeful it will be a short-term phenomenon.

Speaking of our recovering economy, it’s more affordable than ever to get engaged given the current diamond glut. In our Essential Economy discussions, we talked about the negative impact on luxury items, and last week Bloomberg ran this article describing the current diamond environment. While diamonds may be forever, these prices are not.

In this week’s Brief, we return to the “Three Up and Comers” series where we will provide updates on companies we have featured in the past and then highlight three new entrants, all of whom have raised $90 million or more since the beginning of the year and impact the telecom or technology industries. But first, a look at market valuation changes.

The week that was

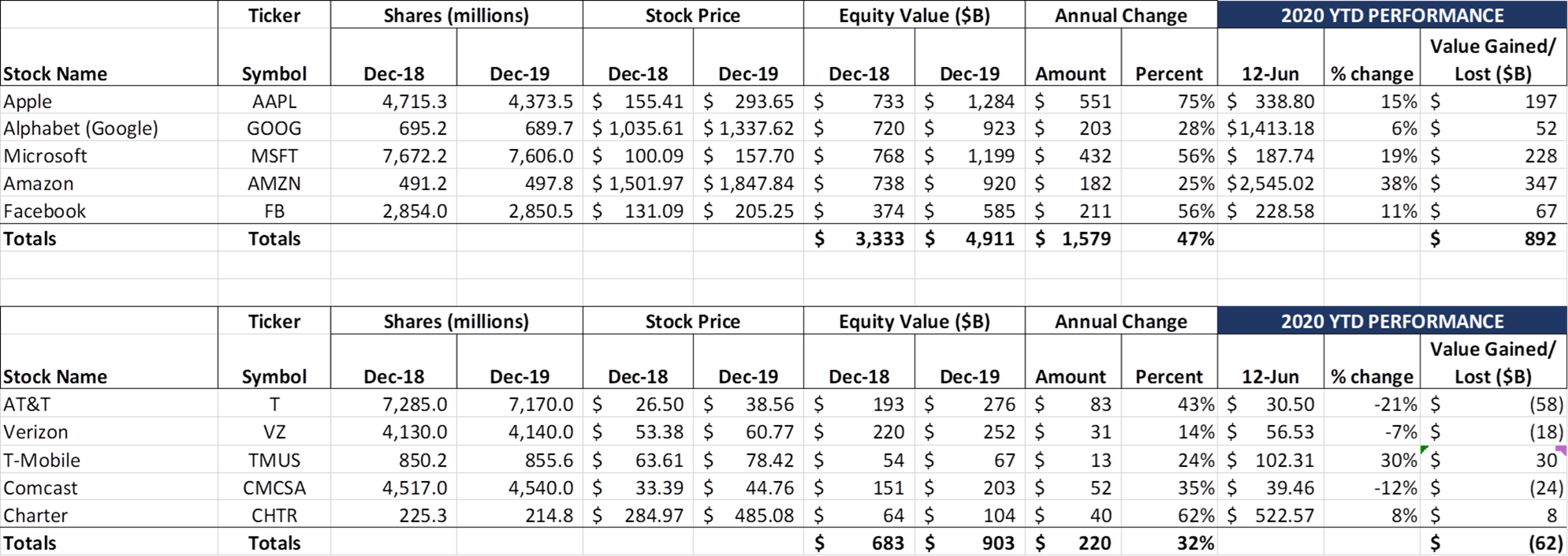

From the market headlines you would have thought that Thursday’s market plunge would have destroyed stocks this week. By Friday’s closing bell, however, most stocks were relatively unchanged with the Fab 5 gaining $44 billion for the week and the Telco Top 5 losing $34 billion. One gainer this week: Apple (+2.2% week/ week, $31 billion of weekly market cap growth), largely in anticipation of the WWDC announcements expected on June 22 (a good set of articles from Ars Technica here) and initial signs of a China iPhone recovery. Amazon (+2.5%, +$31B) also had a strong performance this week.

On the Telco Top 5 front, T-Mobile (+1.2%, +$2B) continued to shine while AT&T (-6.9%, -$16B) and Comcast (-6.2%, -$12B) fell, likely as a result of near-term profit taking as the end of 2Q quickly approaches. On Friday afternoon, however, CNBC broke a story that AT&T is considering the sale of their Warner Bros gaming unit (“Harry Potter,” “Lego,” and “Mortal Kombat” among the popular titles) to Take-Two Interactive, Activision Blizzard, or Electronic Arts for $4 billion or more. The proceeds will likely go towards paying down Ma Bell’s massive debt load ($164 billion as of the end of March).

On the Telco Top 5 front, T-Mobile (+1.2%, +$2B) continued to shine while AT&T (-6.9%, -$16B) and Comcast (-6.2%, -$12B) fell, likely as a result of near-term profit taking as the end of 2Q quickly approaches. On Friday afternoon, however, CNBC broke a story that AT&T is considering the sale of their Warner Bros gaming unit (“Harry Potter,” “Lego,” and “Mortal Kombat” among the popular titles) to Take-Two Interactive, Activision Blizzard, or Electronic Arts for $4 billion or more. The proceeds will likely go towards paying down Ma Bell’s massive debt load ($164 billion as of the end of March).

One additional note involving Facebook – Chris Cox, an early employee of FB (2005) – is returning as Chief Product Officer after his departure last March. More on why he is returning to the social media giant in this New York Times article. Having worked with Chris in 2009 (Sprint) and 2010 (Mobile Symmetry), his return will be invaluable to Facebook’s core messaging products and services.

It’s important to note that even with the market turmoil headlines (which many times falsely create an impression that stock price ascents will last forever), the Telco Top 5 is pretty much back to where it was at the beginning of the crisis (-$59B end of Feb vs. -$62B today). And, as we have chronicled every week, the Fab 5 are all rising, with Apple adding $748B and Microsoft adding $660B in equity value since the beginning of 2019. Overall, the Fab 5 have added $2.47B over the past 17+ months, and, as we discussed in The Intel Trinity Sunday Brief here, larger companies with cash-rich balance sheets tend to do very well exiting recessions.

There are many more innings to this recovery, and, as we have discussed, there will be increased clarity on consumer/ small business health with second quarter earnings releases. Telecom and technology will emerge stronger for many reasons, with low-latency cloud connectivity being the hottest trend.

Three “up-and-comers” update

For those of you who have forgotten the companies we have previously highlighted in the “Three Up and Comers” Sunday Brief series, here’s a progress report:

- Starry Wireless ($300+ million raised in four rounds). Things have been fairly quiet with the wireless internet service provider as they continue to add buildings in their existing markets (Boston, New York, Los Angeles, Washington DC, and Denver). They also continue to expand their relationships with affordable housing providers and associated agencies (see their news release with the Harlem Congregations for Community Improvement or HCCI here and their $15/ month plan being completely funded through Related Companies here). They appear to be very well positioned to serve the needs of many housing communities.

- Cologix ($500 million raised in September 2019). Similar to Starry, Cologix does not appear to be in a hurry to overpay for data center assets any time soon. They have, however, been aggressively working to install new onramps for Microsoft Azure (in Vancouver, BC and Minneapolis) and Oracle Cloud (in each data center).

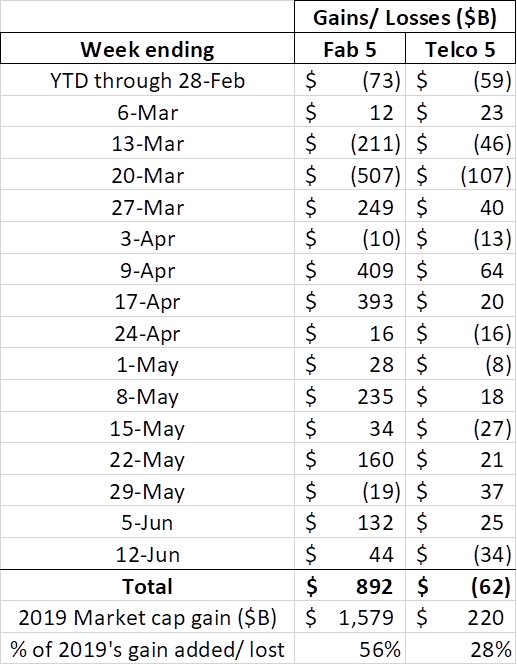

Helium Network ($54 million raised). On June 9, the San Francisco start-up activated its 4,000th hotspot (currently priced at $350 and heading back to $425 on June 15). More should be activated throughout June as they ship a new batch of devices. A chart of active cities is shown in the nearby picture. The company was also featured as one of Forbes’ Top 20 IoT Startups to watch in 2020 (article here) as well as Fast Company’s Top 10 Innovative Consumer Electronics Companies in 2020 (article here). On top of operations, the company is also using their funds raised to more aggressively court applications providers for their platform through their #IoTForGood contest (full rules and details here), which was co-sponsored by several companies including global semiconductor giant Semtech (announcement here). We still think that Helium is the best kept secret in telecommunications.

Helium Network ($54 million raised). On June 9, the San Francisco start-up activated its 4,000th hotspot (currently priced at $350 and heading back to $425 on June 15). More should be activated throughout June as they ship a new batch of devices. A chart of active cities is shown in the nearby picture. The company was also featured as one of Forbes’ Top 20 IoT Startups to watch in 2020 (article here) as well as Fast Company’s Top 10 Innovative Consumer Electronics Companies in 2020 (article here). On top of operations, the company is also using their funds raised to more aggressively court applications providers for their platform through their #IoTForGood contest (full rules and details here), which was co-sponsored by several companies including global semiconductor giant Semtech (announcement here). We still think that Helium is the best kept secret in telecommunications.-

Netly FIber (local fiber provider – $40 million raised). The company continues to deploy fiber across the Solana Beach and surrounding areas, and expects to launch with Ting as a distribution partner soon. More on the deployment in this Ting blog post. ‘

-

Onecom ($130 million raised). We have been unofficially told that the company “has its hands full” with their Vodafone UK partnership and is heads down scaling their business and quickly adapting to a full “Work From Home” environment thanks to their existing Vonage relationship (article here). They appear to be well positioned for the hybrid post-COVID 19 “work from anywhere” environment.

6. Augury ($59 million raised, including $8 million from Qualcomm Ventures). Augury has had several big new items since late December, including the addition of Brian Fitzgerald (Veracode, RSA, EMC) as Chief Marketing Officer and Nelson Ricciardi Parente (NICE, Citigroup) as Chief Services Officer in April, as well as a partnership announcement with global pump leader Grundfos in February. Last week, they announced a pioneering product called Guaranteed Diagnostics which, per the news release, provides “Financial compensation to the customer to offset the cost of failures if they are not identified in advance by the Augury platform.” This backing is provided by a division of MunichRE called HSB.

Each company has taken a slightly different approach to the current economic environment, with most being extremely selective regarding any large investments. Partnerships are clearly becoming more important to these companies, as well as day-to-day execution and stringent cash management.

Three Up and Comers – Summer 2020 Edition

As we mentioned above, the stakes (and the raise amounts) jumped in this latest batch of Up and Comers. Here is the summer 2020 class of Three Up and Comers:

- Ligado (www.ligado.com) is a wireless network provider formerly known as LightSquared Networks. A great overview of the company was provided by their CEO, Doug Smith, at a recent Wireless Infrastructure Association Virtual event here. The company’s 40 MHz of spectrum is in the coveted “mid-band” at 1500-1700 MHz. They also operate the SkyTerra 1 satellite. On April 20, despite objections from several government departments, the FCC unanimously approved Ligado’s 5G license plan to operate at a substantially lower power level with increased guard bands (news release here).

Capitalizing on this momentum, the company raised $100 million to begin to operationalize their wholesale 5G IoT network focused on private (enterprise) wireless solutions. But Ligado continues to meet some stiff resistance from the House Armed Services Committee, who is calling into question potential conflicts of interest with the testing company used by the FCC (more here), and language in the upcoming National Defense Authorization Act (NDAA) which “prohibits the use of [Department of Defense] funds to comply with the [Federal Communications Commission] Order on Ligado until the Secretary of Defense submits an estimate of the costs associated with the resulting GPS interference.” More on last week’s drama here and here.

Based on our understanding of the FCC testing performed in advance of the ruling, we think the company is ultimately successful in resolving the GPS interference concerns of the Department of Defense and that they form a series of partnerships with large enterprises (and perhaps a tech giant such as Microsoft) to shake up the enterprise wireless market. With $100 million in backing, and seasoned executives such as Ivan Seidenberg (Verizon) as Chairman and Doug Smith (Clearwire, Sprint, Nextel) as CEO, Ligado will have the resources to fight back and ultimately win.

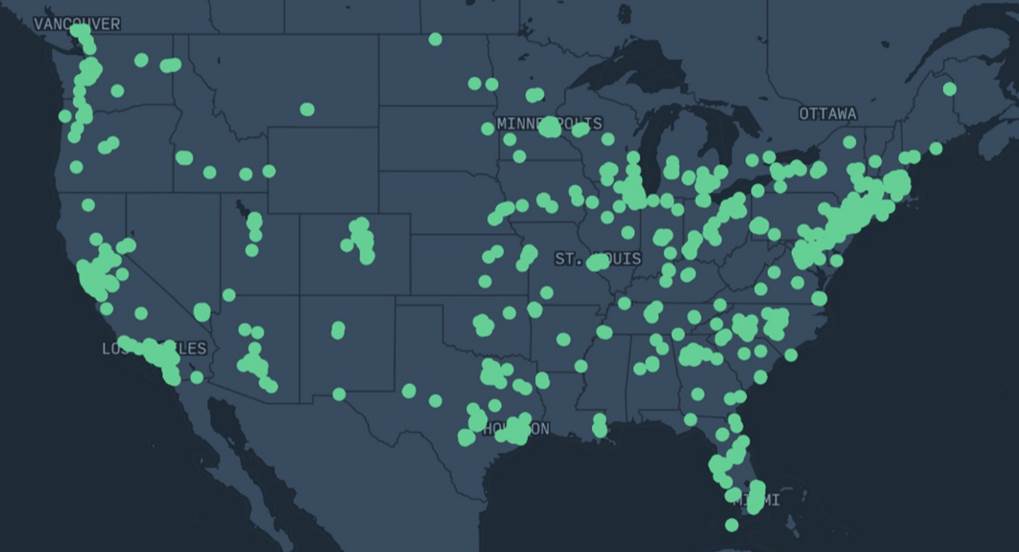

2. Zinier (www.zinier.com, Series C $90 million; $120 million total raised since 2015) is reinventing how field service is performed for telecom and utility field service technicians. Based in San Mateo, California, Zinier was able to attract new money from ICONIQ Capital as well as Tiger Global Management, while nearly all of the original investors (Accel, Founders Fund, Nokia-backed NGP Capital, France-based Newfund Capital and Qualcomm Ventures LLC) returned.

Automating the field service workflow process is long overdue. According to this TechCrunch article, Zinier has made significant inroads into the global carrier community already with 40% of their current clients in the US, 40% in Latin America, and the remainder in Asia Pacific. Overland Park-based Black & Veatch is one of many key proponents of the new company (more on that here).

Automating the field service workflow process is long overdue. According to this TechCrunch article, Zinier has made significant inroads into the global carrier community already with 40% of their current clients in the US, 40% in Latin America, and the remainder in Asia Pacific. Overland Park-based Black & Veatch is one of many key proponents of the new company (more on that here).

Using an AI platform called ISAC, Zinier examines a company’s work force history (age of build, last maintenance performed, construction and maintenance technician (and third party as applicable), etc.) to organize field operations tasks and personnel. The benefits of predictive maintenance can be seen instantly and are especially valuable when the operator’s network spans a broad geographic area. Unlike some other field management software packages, Zinier has an easy to understand Application Programming Interface (API).

Per their mid-January fundraising announcement, the new round will accelerate:

- Continued global expansion including entry into Australia, Brazil, Chile, France and the Iberian Peninsula

- R&D to expand ISAC’s AI-driven platform capabilities and configurability

- Expansion into additional industries that rely on field service work for business success

- Partnerships with leading system integrators around the world

This is another example of the benefits of fusing AI with time and people-intensive departments. Most importantly, tracking individual performance will allow the most productive technicians to advance more quickly then their peers (and in the process, improve overall network/ grid quality levels).

3. Astranis (www.astranis.com, $90 million debt+equity Series B round, $108 million total raised to date). Space is very hot right now, and San Francisco-based Astranis has assembled a 100+ person team of engineers and scientists from SpaceX, Boeing, Lockheed Martin, Skybox, Planet Labs, NASA, Google and Apple to reinvent how satellites are designed and deployed.

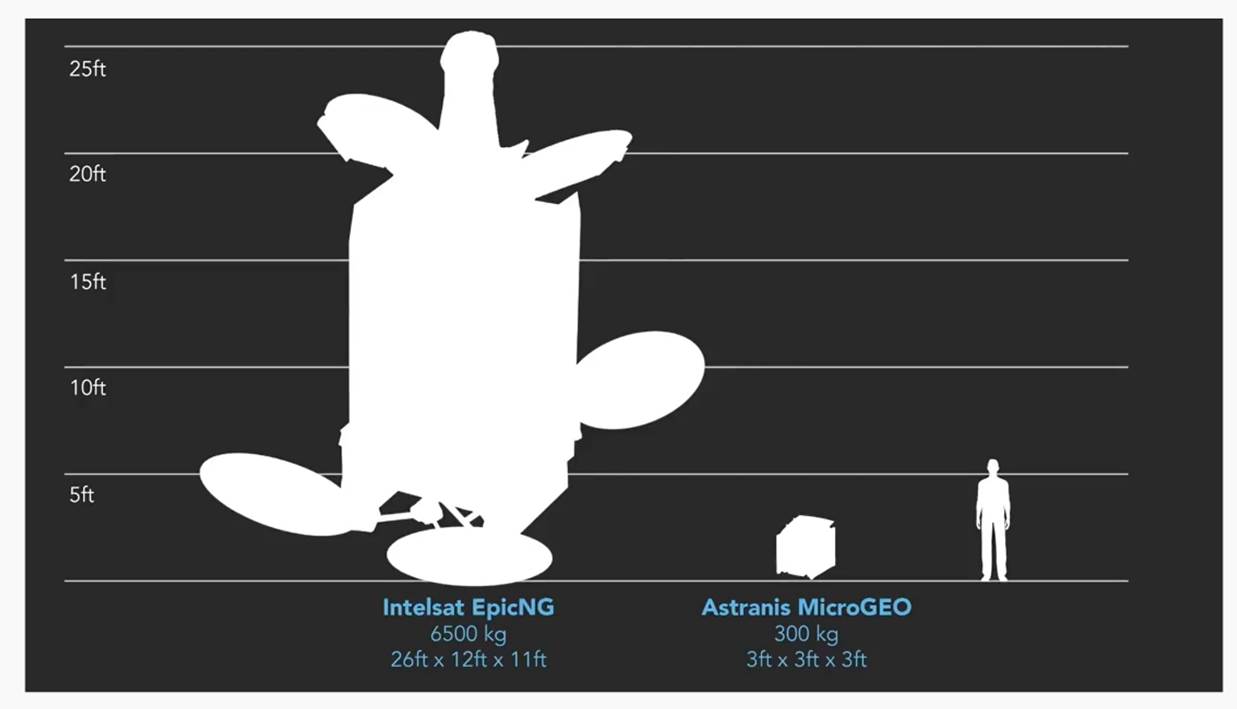

Their latest round, consisting of a $40 million equity investment led by Venrock, as well as a $50 debt facility from Triple Point Capital, will allow the company to deploy their first satellite over Alaska and deliver reliable Internet services (7.5 Gbps of capacity) through a partnership with Pacific Dataport (more in this blog post). Per Astranis’ website, their new geostationary satellite (called MicroGEO) is 20x smaller than legacy satellites and powered by a software-defined radio that can be reprogrammed while in orbit.

Their latest round, consisting of a $40 million equity investment led by Venrock, as well as a $50 debt facility from Triple Point Capital, will allow the company to deploy their first satellite over Alaska and deliver reliable Internet services (7.5 Gbps of capacity) through a partnership with Pacific Dataport (more in this blog post). Per Astranis’ website, their new geostationary satellite (called MicroGEO) is 20x smaller than legacy satellites and powered by a software-defined radio that can be reprogrammed while in orbit.

There’s a lot of additional details on Astranis in this Andreessen Horowitz blog post, and we look forward to seeing a successful launch in Alaska. Beyond their initial deployment, we also look forward to seeing how they will effectively compete against Elon Musk’s Starlink service (who just launched 58 additional satellites yesterday bringing their total in-air to 540 per this space.com article).

Next week, we will begin our two-part “Second Quarter Questions We Would Ask” series. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here.

Also, If you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!

The post The Sunday Brief: Summer 2020 edition–three up-and-comers appeared first on RCR Wireless News.