Greetings from Kansas City and Delray Beach, Florida (pictured), where the Brief staff are taking a mini-corporate retreat before next week’s 2022 Metro Connect conference in Miami. Looking forward to seeing many of you there and hopefully celebrating a third consecutive AFC Championship for the Kansas City Chiefs.

There were many earnings announcements this week, and, in the spirit of providing detailed insights, we have kept the analysis below to three: AT&T, Comcast, and Charter. There’s a lot more we will discuss (e.g., the entire M&A/ anti-trust environment for the Fab Five in light of Microsoft’s bold bid for Activision Blizzard), but these three provide the most uniquely company-specific insights. In the mid-February Brief, we will compare Verizon’s decent performance (and intriguing fixed wireless outlook) to that of T-Mobile (who announces on Wednesday afternoon).

The week that was

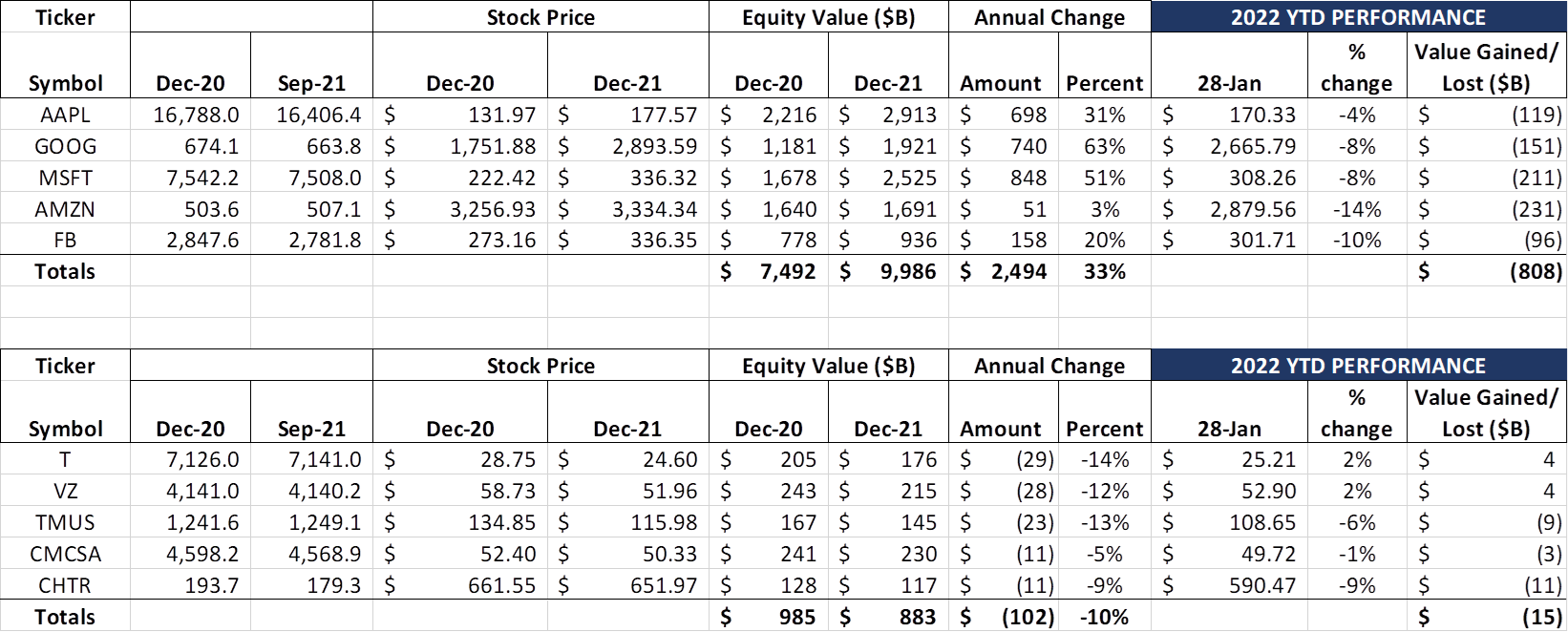

Another week of volatility capped by earnings from six of the ten stocks. The Fab Five doubled their YTD 2022 equity losses over the last two weeks to $808 million, with around half of the loss coming from Amazon. The Seattle-based company is the only one of the Fab Five that has erased gains achieved in 2021 (down $231 billion so far in 2022, and up $51 billion in 2021).

Reaction to earnings from four of the Telco Top Five was mixed, with AT&T and Verizon continuing to hold on to gains in 2022 despite some losses over the past two weeks. The worst performer so far in 2022, Charter Communications, had a meaningful bounce back following Friday’s earnings release (discussed below).

Big news this week broke on Friday when the Ninth Circuit Court of Appeals upheld California’s right to impose their own Net Neutrality regulations (Reuters article here and recent summary of the future of net neutrality with a new FCC from CNBC is here). Because the FCC had reclassified broadband as an “information” as opposed to a “telecommunications” service, the court said, they lacked the jurisdiction to challenge state-specific provisions. This is an interesting argument as it’s widely expected that the FCC will reconsider classifying broadband as a telecommunications service when Gigi Sohn is confirmed. Ping… pong… ping…

The Sunday Brief is a supporter of network transparency regulation that would enable customers to see precisely where degradation of their experience is occurring. Net neutrality is important but is based on an increasingly less meaningful assumption that bandwidth is not available to satisfy a congested home connection. If AT&T wants to offer caps on certain types of connections (and also offer a cap-less HBO to the same connection), they should be free to do so, provided that there is a comparable consumer alternative that meets the broadband threshold (100 Mbps down and either 20 Mbps or 100 Mbps up).

The disproportionate attention that is delegated to optimized home connections (neighborhood network quality) vs competitive last mile fiber and wireless access (neighborhood competitive quantity) is disappointing and shortsighted. We urge the FCC to devote resources to ensuring that there are multiple multi-hundred Mbps alternatives and watch the neutrality discussion evaporate.

AT&T: Let it Bleed

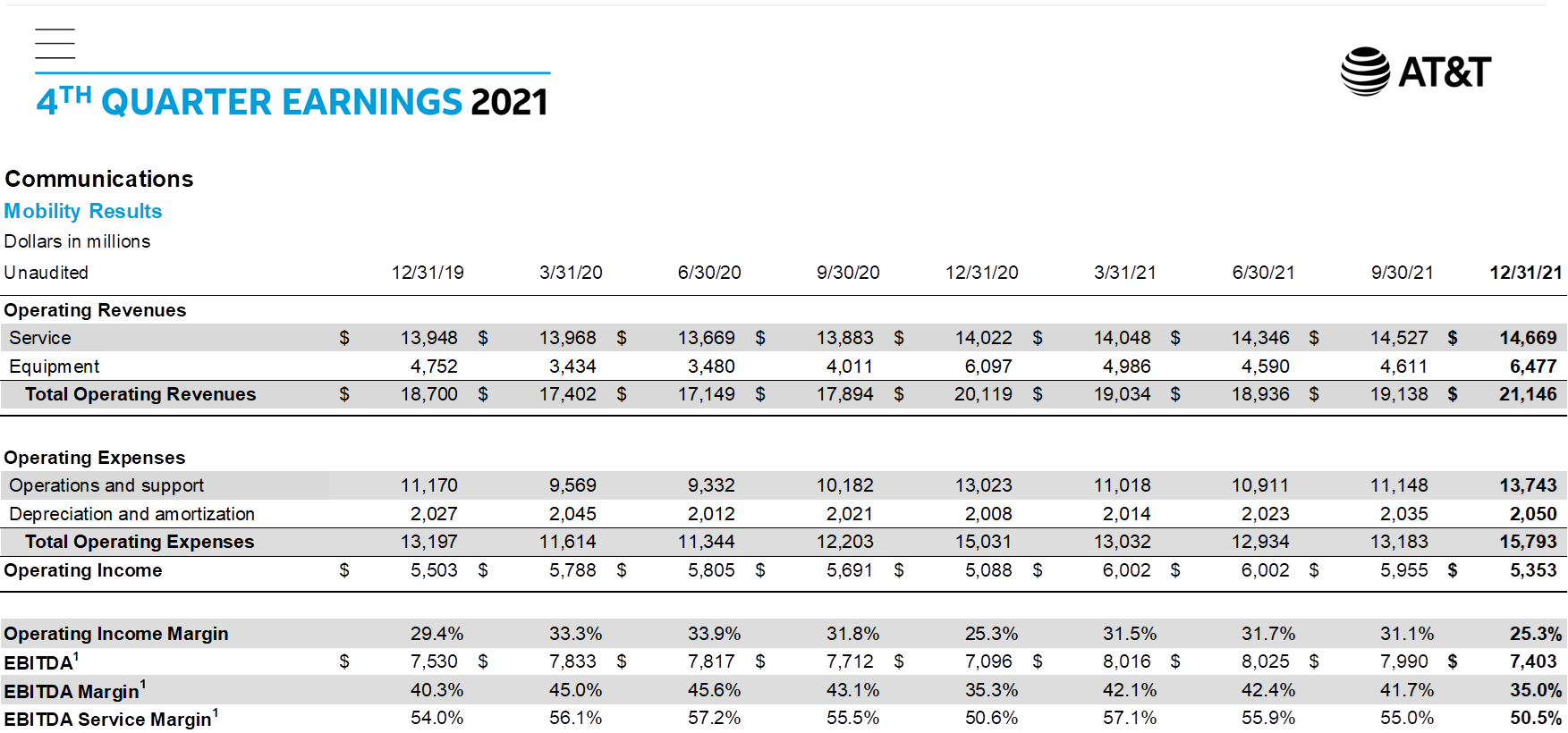

AT&T reported results on Wednesday morning and provided more color on their prerelease covered in the last Brief. Their wireless postpaid phone preservation strategy appears to be working, but it’s not cheap. Here’s the consumer unit’s quarterly EBITDA trends:

What’s notable with the current strategy is the depth of the fourth quarter EBITDA hit (which corresponds to Apple’s iPhone upgrade cycle). And, while this was expected to occur in the first year of the transformation, it surprisingly occurred with equal vigor in 4Q 2021. The original notion of reducing churn by extending new customer promotions to the base has turned into a customer expectation that they must be rewarded to stay. Since it’s not presented in the same “lollipop” (AT&T ad here) manner by Verizon and T-Mobile, this marketing tactic is becoming uniquely AT&T’s.

AT&T made the right decision to implement a preservation strategy in late 2020 given their position as the third-largest US wireless service provider (and their understanding that it would be several years before the full impact of C-Band capacity would be felt), but they need to guard against perpetuating trade-in subsidies against a small portion of their base to preserve margins.

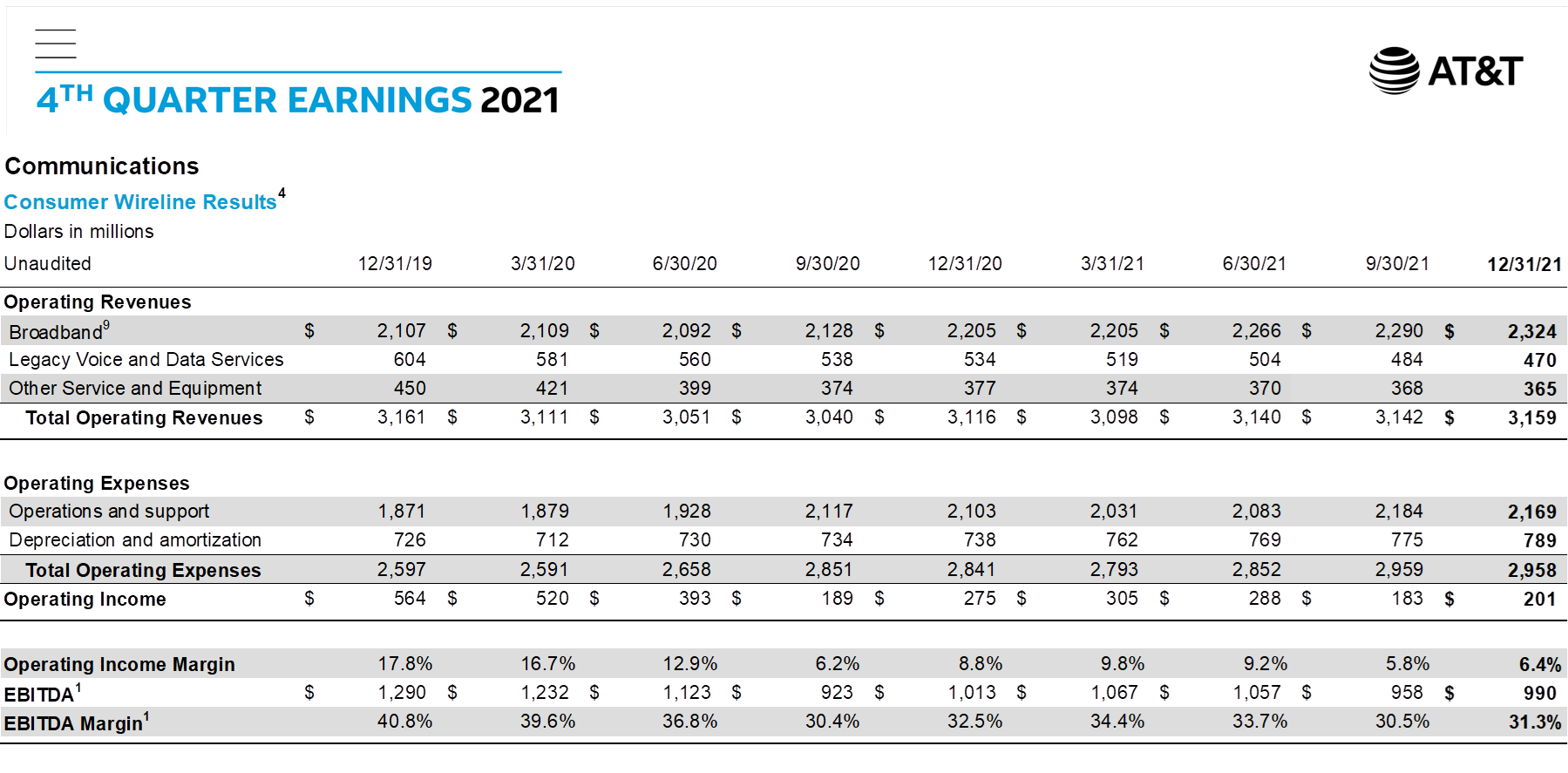

Wireless was clearly the bright spot for AT&T. Here’s their consumer wireline picture, which is not as pretty:

The good news is that broadband revenues rose for the fifth consecutive quarter – each quarter’s year-over-year revenue rise has been 5-8%. The bad news is that the costs to operate multiple networks (or the costs to accelerate fiber builds from their pre-2020 levels) is growing faster than the total operating revenues.

AT&T has made a lot of progress on fiber deployments: the deployment “engine” can clearly serve more homes than prior to the fiber refocus, and their overall 30% penetration speaks to the viability and attractiveness of the product to a significant minority of their territory. But what about the underserved homes still living with DSL technology? Interestingly, AT&T CEO John Stankey was asked about this question, and here was his response (apologies for the length, emphasis added in italics):

“In terms of your question on the wireline footprint. We spend a lot of time far back as 2012 and constantly revisiting and relooking how we wanted to work through the transition of our business. And I’m not a big believer right now that us going out and taking the less utilized parts of our wireline footprint and sending them out to somebody at a steep discount and continuing to have to do things like operationally provide services to that entity for many, many years to come on infrastructure, IT systems, et cetera, that have to be maintained, is the right thing for a healthy and sustainable business.

My point of view is that as a management team that runs networks and what we do around here, our job should be to rationalize those assets in an effective way and do it in the best interest of our shareholders. And you’ve heard me talk about that.

When I talk about transformation and shutting down products and thinking about how we become a company that offers products on fiber, what’s going on behind the scenes on that is actually backing away and moving deliberately through a process of taking products that served us incredibly well. That have been the mainstay of this company for a period of time. And doing in a very, very smart and tactical way this shutdown and sunset of those. And as we sunset them, take the high cost operating model that supports them away.

And so, when we talk about transformation and we talk about getting savings from shutting down applications and IT infrastructure and product sunset, that’s really synonymous with us actually walking away from square miles and infrastructure and costs and all the things that have seen their better day. And so we intend to ultimately capture that value and return it to the shareholder. Not do it in a front-end loaded transaction that’s highly discounted, that leaves us saddled with distracting operating models that don’t allow us to be a focused broadband fiber provider, offering the best products available in the market.”

To quote the Rolling Stones classic album, we think John Stankey kindly said “Let it bleed.” Having long service transition agreements to operate voice-centric functions diverts a lot of focus away from higher-value-adding activities (although we assume a deal could have been constructed that would have yielded a return greater than AT&T’s cost of capital). To actually say that Ma Bell is going to abandon their legacy infrastructure in disproportionately rural America just at the time state legislatures are beginning to assess how to allocate $40+ billion in infrastructure funds is the definition of “tone deafness.”

Bottom line: AT&T is an outstanding company undergoing transformational change under a highly focused and experienced CEO. If only he weren’t so clear in his statements to bleed cash from copper-focused territories to sustain a rich dividend. It will be interesting to see how AT&T explains these comments to state Public Utility Commissioners as they apply for broadband infrastructure funds.

Comcast’s broadband battle plan

Comcast announced earnings a day after AT&T and two days after their wireless network partner Verizon (one of the companies to be discussed in the next Brief). We could spend an entire edition decomposing their earnings call as it was chock full of insights, but will focus instead on their broadband battle plan.

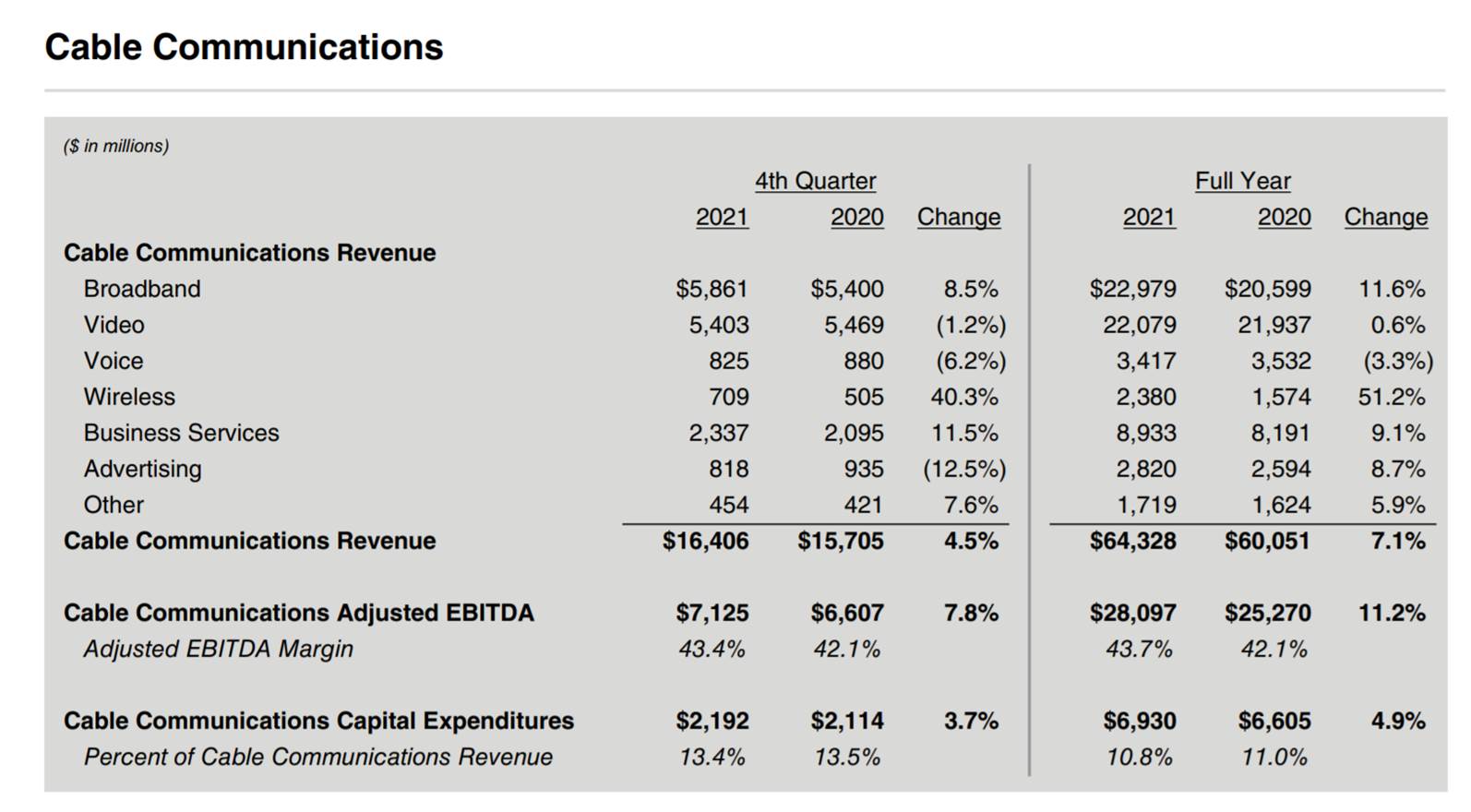

Here’s the breakdown of the cable unit’s growth for the current quarter and the full year:

While fourth quarter broadband growth slowed (to a very respectable 8.5%), annual growth was robust at 11.6%. Reflecting a full quarter of revenues from the Masergy acquisition, Comcast Business also showed excellent growth for the quarter and the year. Even with weakness in video and voice, they kept capital expenditures strong in the quarter at 13.4% of revenues. There’re a lot of new fiber routes and augments in that 13.4% – behind the scenes, Comcast is creating a more robust fiber network.

How will Comcast create a competitive advantage against new fiber competitors including AT&T and others? Their CEO, Brian Roberts, outlined three things in his opening remarks:

- Strike the “right balance” between a growing addressable market and long-term profitable growth. A possible translation to this is “More bandwidth for same ARPU. No price drops.” As we will see with Charter below, rural expansion is probably not the “right balance”.

- Evaluate every opportunity to increase serviceable passings including pursuing subsidies from federal, state, and local programs. To think about this in context, Comcast would naturally build to the new housing development across the street (leveraging scale), but they might not accelerate the build five miles down the road across a bridge. However, if another authority would pay a portion of the costs and de-risk the accelerated timeline, Comcast will gladly reconsider.

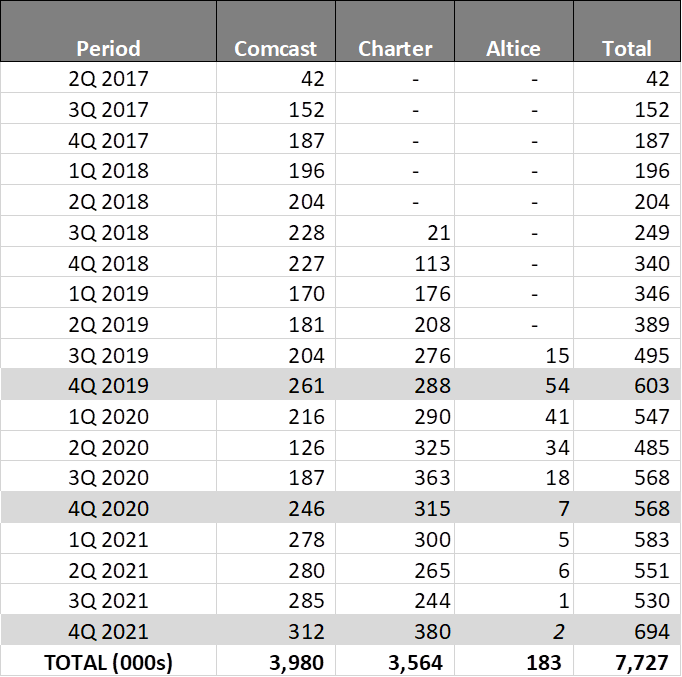

- Compete for market share by aggressively marketing products bundled around broadband. This was extremely clear in their (and Charter’s) mobility results – see the nearby schedule. Nearly 700K net additions between Charter and Comcast for the quarter (our estimate is that ~90% of these are actually phones not tablets or watches), and their multi-line strategy is just getting started.

- Improve the service experience and make this a competitive differentiator. They believe that their improved Wi-Fi and Xfinity X1 products are going to clearly differentiate them from Verizon’ 5G Home Internet product. We aren’t so sure, but know that Comcast has room for improvement in this area.

This is a very different strategy than we saw from Comcast entering 2019 or 2020. Video (or double play) preservation was most critical at that time. Many of us thought that Peacock would be the bundle that would further enhance broadband. These still play important roles, but mobility is the bundle of choice for Comcast, and they are just beginning to scratch the surface.

Comcast CFO, Michael Cavanaugh, reiterated the company’s commitment to 11% capex to revenue spending for the foreseeable future:

“As we noted on our call in July, we expect our Cable CapEx intensity will remain around 11% for the next few years as we continue to increase the number of homes and businesses that we pass and accelerate our investment in the technology that will enhance the overall capacity of our network, both downstream and upstream. This is a direct step to DOCSIS 4.0, which allows for multi-gig symmetrical speeds essentially with a software update, providing very little to no disruption to the home in a very capital-efficient way.”

We will discuss the specific steps to complete high split architecture transformations in a future Brief, but from our initial research, it’s capital efficient, and, as indicated above, the subsequent transition to DOCSIS 4.0 is not much more costly than the transition was from DOCSIS 3.0 to DOCSIS 3.1 once the high split architecture changes have been made.

Bottom line: We still think Comcast has a very strong and diverse array of assets that are managed very well. They are going to face material competitive headwinds from AT&T in Chicago, Atlanta, and Florida in 2022 and 2023 and must incorporate wireless into their operations to an even greater extent to increase market share.

Charter: Many changes, many opportunities

Charter closed the communications earnings parade on Friday with a “matter of fact” assessment of their results. As we discussed with Comcast, the high split upgrades required for Charter are less disruptive to broadband customers than AT&T’s conversion from copper to fiber and Verizon’s transition to a fixed wireless solution. They also happen to cost less as well. These factors increase their probability of retention and new housing development market share gains.

Charter, however, is taking a pioneering position with respect to rural expansion. As many of you recall, we covered their initial announcement of a $5 billion investment using the Rural Development Opportunity Funds (RDOF) program last May in a Brief titled “The Plight of the Resurrected Telco.” Charter’s CEO, Tom Rutledge, spent time discussing these efforts in his opening comments (this is our best transcription from their webcast as Charter does not provide an earnings call transcript):

“We’re also in the midst of hiring more than 2,000 employees and contractors to support our rural expansion. But our rural construction initiative is not limited to RDOF commitments. We’ll continue to build in other rural areas as well, and we will pursue opportunities to receive broadband stimulus funds, including the American Rescue Plan Act funds and funds from Infrastructure Investment Act and Jobs Act. We’ll also extend our network passed homes in areas adjacent to our subsidized builds that our network does not currently reach today.”

Comcast and Charter are the first examples of large cable companies stating that they would be pursuing state and local monies, and we do not think it will be the last. These initiatives can be viewed in three ways: 1) efforts to “fill in” existing clusters (e.g, portions of Ohio or North Carolina); 2) accelerated “edge out” using current low densities to justify the need for “rural” subsidies (but following existing new housing build trends; example would be Charlotte, North Carolina, suburbs); and 3) establishing new territories (we view the East Texas expansion that way).

While increased use of state infrastructure funds may result in increased territory expansion, we think that it will additionally drive the extension and densification of fiber (versus original models) which might have relied on more CBRS spectrum. More nodes results in more optionality 3-5-7 years down the line, and in a state like Texas with high growth, this additional infrastructure “cushion” matters.

Inherent in the conference call comments, especially related to SMB, were the unique geographic concentrations presented by Charter, specifically New York state and Los Angeles. Our focus has primarily been on their Texas, Florida, and Carolinas growth, but Charter’s big city exposure, long considered an asset, might become less valuable in a post-COVID world. The three regions that are growing should offset most losses, but we wonder if some of Charter’s losses are Cox Communications’ gain (particularly the exodus from California to Arizona and Las Vegas).

Charter’s strategy is simple: Stay the course on “everyday low prices,” sell in mobile services (particularly multi-line) while resisting the device subsidy trends and accelerate passings using government grants and CBRS spectrum as de-risking vehicles. Given their broadband focus, we think it’s a winning formula.

That’s it for this week’s Brief. In two weeks, we will complete our discussion of large company earnings results. Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, and Go Davidson Wildcats and Go Chiefs!

The post The Sunday Brief: Let it bleed appeared first on RCR Wireless News.