May Derby greetings from Lake Norman/ Davidson/ Charlotte, NC (pictured is one of the juleps consumed while watching the Derby with friends). We are going to do as much as possible to conserve print this week because of the concentration of earnings releases, but this issue traditionally runs long. Forewarned is forearmed.

We are going to cover several very important announcements (or confirmed rumors) that impact the telecom world. Then we will dive into Comcast and Charter earnings (with a peek at Altice) and talk about the impact this trio is having on AT&T and Verizon’s growth. Competition is increasing in residential wireless service, and, with Comcast’s new multi-line pricing, it is about to accelerate.

The week that was

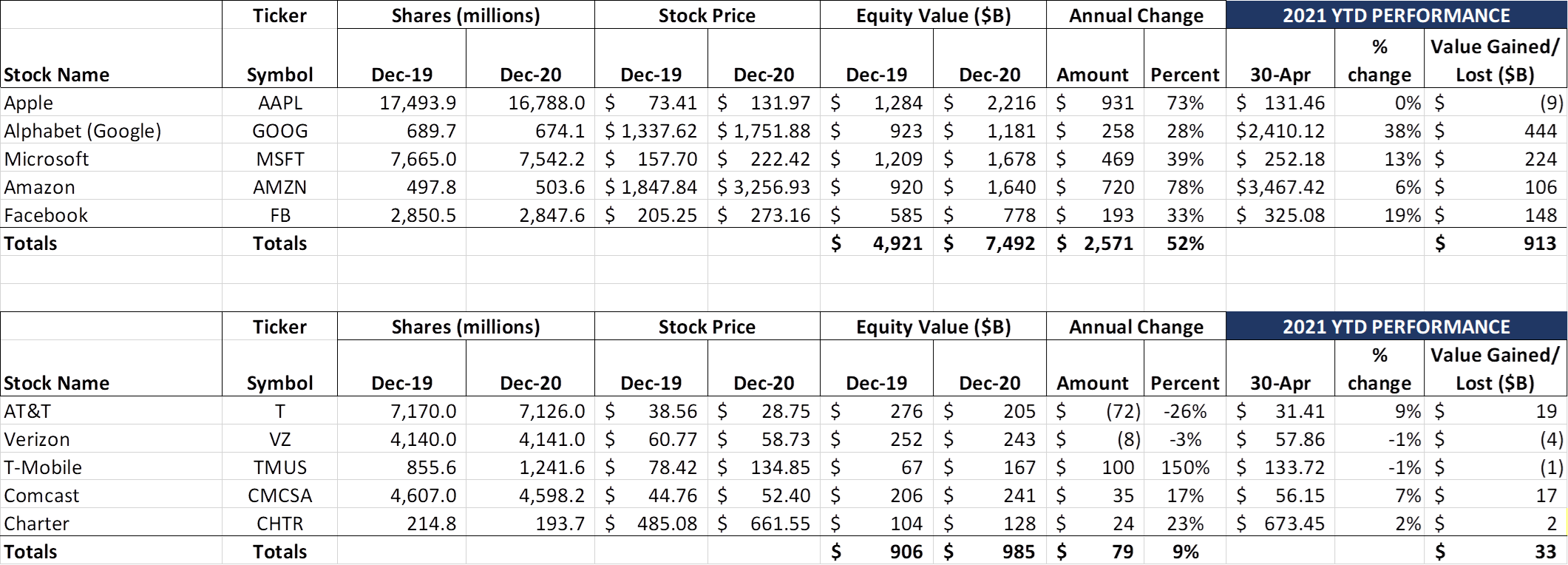

Well, the waiting paid off for the Fab Five. Each company reported earnings this week, and, as predicted, cash flowed in the first quarter (more on this topic in next week’s Brief). Google (+$64 billion), Amazon (+$64 billion) and Facebook (+$68 billion) were the big weekly winners, offset by losses at Apple (-$48 billion) and Microsoft (-$68 billion). Before you panic for Apple and Microsoft, remember that they have created $1.5 trillion and $1.1 trillion, respectively, in shareholder wealth since the beginning of 2019. One of the uses of Apple’s cash came to light on Monday as the company announced Raleigh, North Carolina as the site of their East Coast Hub. This represents the culmination of years of courting Apple (it did not hurt that Apple’s COO, Jeff Williams, is an NC State and Duke graduate), and carries some grousing about the $845 million of tax incentives granted to the Cupertino giant over 39 years by the state’s Economic Investment Committee. Apple will be building a 1 million square foot facility and has committed to hire at least 3,000 employees focused on machine learning, artificial intelligence, software engineering and other cutting-edge fields. In a rare bipartisan moment, Governor Roy Cooper and the Republican Senate Majority Leader and Speaker of the House came together to celebrate (see nearby picture). More on Apple’s commitments in their announcement here and in the Raleigh News and Observer coverage here.

Offsetting positive earnings and investment news is another event – Apple’s testimony in their trial with Epic, the software developer of the popular “Fortnite” series. The Washington Post has a lengthy but informative article with all of the details. Buried deep in the article is the crux of the trial:

“Epic argues that because Apple forces all app developers to use both the App Store for software distribution and Apple’s proprietary payment processing system, Apple is violating an antitrust provision that prohibits tying one product or service to the sale of another. Apple says Epic’s reading of the law is wrong because Apple’s payment processing system is part of one product: iOS. Tying can only occur if there are two separate and distinct products.”

The trial is scheduled to last for three weeks and will feature executives from both companies. Regardless of the trial outcome (but especially Apple wins), the drumbeat to increase scrutiny over the world’s most valuable company is going to get louder.

One last headline impacting the Fab Five – Roku announced on Friday that they were unable to come to terms with Google’s YouTube TV business unit and that the popular alternative to traditional cable TV would not be available to new customers via Roku starting Saturday, May 1 (existing ROKU/ YouTube TV customers should not be impacted provided they do not delete the channel from their lineup). The rhetoric really heated up on Friday, as this article from The Verge details. How this dispute ends up is anyone’s guess, but Roku is not new to this, having held up HBO Max and Peacock launches for several months.

The Telco Top Five had a relatively quiet week, all things considered (+$14 billion for the week). We will explore Charter and Comcast earnings below, but one rumor appears to be gaining reality – Verizon is likely to sell their Media unit to Apollo Global for $4-5 billion (Wall Street Journal article here; Ars Technica’s chronicle of Verizon’s struggles with the media unit here). The business, which is enjoying two consecutive quarters of double-digit annual growth, has been the subject of sale speculation as a means to reduce Verizon’s debt. But it would also open up Verizon to a potentially larger deal with Facebook or Google. It will be interesting to see if the company lowers its consolidated revenue objectives (released at the March analyst day) due to the sale.

One final note before diving into earnings: we will be updating share counts for both the Fab Five and the Telco Top Five in next week’s report. Both Apple and Google had share buybacks in the quarter, and both Boards authorized additional buybacks. As a result, the actual value created will be based on a lower overall share count. We will outline the changes next week when we dive into cash and (negative) net debt levels for each of the Fab Five.

Cable stole my growth!

In last week’s Brief, we bemoaned the abysmal wireless service growth levels for both AT&T (service revenues up +0.6% yr/yr, ARPU down 2.8% driven by high amortized marketing costs) and Verizon (consumer wireless service revenues +1.5% versus Q1 2020, consumer accounts down 0.2%). We had always assumed that T-Mobile would post strong growth (also led by lower than expected legacy Sprint churn), but Magenta is not the only company stealing AT&T’s and Verizon’s share/ growth. Cable is the growth thief in Q1, and it’s likely this will not be their only quarterly caper.

To the right is the summary of net additions growth for Comcast, Charter (d.b.a. Spectrum Mobile) and Altice since each company launched mobile service (earnings packages are here for Comcast, Charter and Altice). We have also added some additional rows to derive a homes passed penetration (regardless of one’s lines/ home passed assumption, both Comcast and Charter have a ways to go to even reach 10% market share). Think about Comcast and AT&T as having roughly the same number of homes passed (AT&T probably closer to 57 million homes versus the nearly 60 million shown for Comcast). The amazing thing about their progress is that neither Comcast nor Charter had competitive family plan offerings (until last week’s announcement by Comcast). They were basically confined to lower-usage single and double plans (and miniscule net additions in the business market) yet have accumulated nearly 6 million customers.

But Comcast and Charter played the cards that were dealt, focusing on leveraging their frequent customer contacts to upsell wireless through the service channel. They converted service centers into wireless retail outlets (as best as possible, even during COVID), but not a lot of new storefronts. They avoided costly content bundling deals, trade-in promotions and free phones (Comcast now has one free phone, the Moto one 5G ace – see last week’s Brief). While both Comcast and Charter augment their services with their Wi-Fi product, both build an LTE service expectation of 5-12 Mbps down and 2-5 Mbps up. Even with these limitations, Spectrum grew Q1 2021 revenues $234 million (91%) over the same period in 2020 while Comcast grew theirs $170 million (50%).

Because Comcast and Charter do not separate service from equipment revenues in their earnings announcements, it’s more difficult to determine the actual service revenue impact to AT&T or Verizon. But if AT&T had an additional $404 million of service + equipment growth, their total Q1 growth rate would have been 11.7% (Verizon’s Consumer unit, which includes FiOS broadband/ video/ phone revenues, would have posted 6.6% growth). In reality, however, Verizon and AT&T would have kept these migrating customers under current plan structures, resulting in even higher revenues and profitability. Cable stole Verizon and AT&T’s growth, and it’s about to get even worse with Comcast’s newly introduced plans.

All of this must translate into improved wholesale revenues for Verizon, right? Let’s revisit Verizon’s Consumer Group’s quarterly trends.

Even though Cable has added 2.5 million customers since Q1 2020, Verizon’s “Other” revenue growth is flat. The offsetting high margin wholesale revenue growth, a critical narrative point emphasized by Verizon management when describing this “vector,” is also gone. Cable stole the retail growth and the offsetting wholesale revenues! Ay caramba!

Better yet, more growth is not dragging down EBITDA levels. Comcast proudly announced that they were now breakeven on a stand-alone basis for the first time. Charter reiterated that they were at EBITDA breakeven (we assume at the product contribution level) after they crossed 2 million subscribers and that they continue to invest in the channel. The mobile product will soon contribute to cash flow, and when it does, cable will do what it does best – advertise and promote to their broadband base.

Speaking of broadband, both companies exceeded expectations on both residential and commercial High Speed Internet. Comcast’s broadband base grew by 1.92 million from Q1 2020 to Q1 2021. That’s around $1.4 billion in incremental revenue growth before adding any additional revenues from video or phone. Charter grew 1.89 million residential broadband subscribers over the same period. (Altice, a company we are beginning to track more closely, added 133K net subscribers over the last 12 months)

Compare that to residential growth at AT&T (+100K net adds last 12 mos, +213K fiber net adds) and Verizon (+571K net adds, with 232K or 41% non-FiOS and 339K FiOS). All told, there have been 4.62 million net additions between the four companies, and Comcast/ Charter/ Altice have managed to capture ~86% of the growth. Based on the currently available information, cable stole wired broadband market share in Verizon and AT&T markets as well. Oy vey!

Video margins are slipping as programming costs rise. Home telephone, which enjoyed a slight resurgence during the worst of work-from-home COVID, is back to its steady attrition. That leaves broadband and mobility, cable’s new double play.

Broadband and mobile are a great fit. Dual SSID enables Xfinity Wi-Fi customers to get faster speeds using their neighbor’s or friend’s Xfinity Wi-Fi router. Comcast’s and Spectrum’s small business deployments allow similar access options. A marketing message of “best speeds, best wireless value, better experience” resonates with wireless subscribers. The question is whether it’s better to be the wireless challenger with majority market share in broadband, or the other way around.

That scenario is highly dependent on cable’s ability to improve their DOCSIS 3.1 architecture. Tom Rutledge, Charter’s CEO, made a brief comment about plant upgrades on the earnings call (note – Dave Watson made similar comments on the Comcast earnings call):

“We’re continuously increasing the capacity in our core and hubs and augmenting our network to improve speed and performance at a pace dictated by customers in the marketplace. We have a cost-effective approach to using DOCSIS 3.1, which we’ve already deployed, to expand our network capacity 1.2 gigahertz, which gives us the ability to offer multi-gigabit speeds in the downstream and at least 1 gigabit per second in the upstream.”

Even before the oft-mentioned capabilities of DOCSIS 4.0, there are solutions that don’t involve significant re-architecture and capital spending to deliver upstream capabilities. Cable is still vulnerable, as AT&T metrics quoted on their call have shown, but, with some relatively low-cost upgrades, can yet hold on to most of their customer base.

This nonetheless begs the question “What causes a big share shift, akin to what happened with home phone penetration in the 2000s?” While we do not have the information for Comcast, we think that Charter has a silver bullet – broadband discounts/ upgrades for new and existing mobile customers. Charter’s CFO, Chris Winfrey, admitted on their earnings call that most of their base is on the 200 Mbps (entry level) tier, and that there isn’t a lot of aggressive upselling underway (cable’s strategy is to continue to increase the speed tier every 12-18 months for their baseline product). If Charter offered a higher speed tier in exchange for 2 or more lines of mobile service, and continued performance improvements for all existing subscribers, Verizon and AT&T would have to lower yields on their fiber product or forego 5-10% additional market share (each).

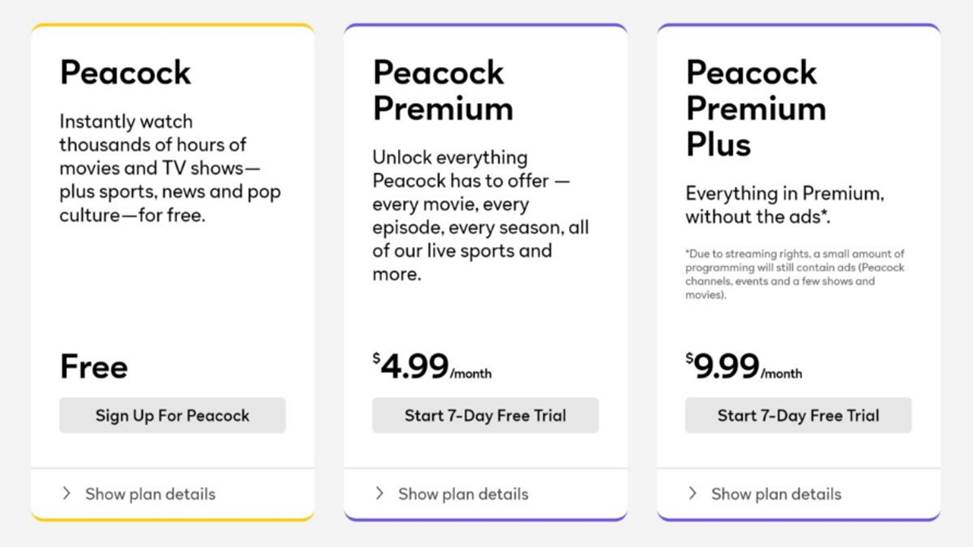

While this may not be needed right away, we also think that Comcast could do more with the Peacock Premium Plus product and Xfinity Mobile (pricing and features nearby). At a minimum, they should invent a means to use excess storage on a smartphone to store Peacock content (e.g., partially watched content) to improve the quality of the user experience. This is more proactive than a user-driven (download select titles) approach which is offered for Peacock Premium Plus customers today.

Where does this leave T-Mobile, who reports earnings next Thursday? It likely leaves them doubling down on their Home Internet strategy (including commercial last mile access), and also focused on scaling their local transport and backhaul infrastructure in most markets. Because T-Mobile will deploy faster wireless networks than Verizon (or cable) can produce in 2021 and 2022, they have the opportunity to demonstrate the value of their (potentially) slower Home Internet product to select segments of the market (see our recent Brief on this topic). But, if there were a T-Mobile Q1 earnings bingo, my bet would be on “Home Internet” right behind “synergies,” “2.5 GHz” and “cell site decommissioning.”

Bottom line: Cable stole wireless net additions, most of Verizon’s offsetting wholesale revenue gains, most of the incremental addressable market in broadband, and (not discussed) most commercial services as well. Verizon and AT&T need to rethink their challenger strategy in light of DOCSIS 3.1 improvements, and T-Mobile needs to transform as quickly as possible into a 5G-centric company.

That’s it for this week. Next week, we’ll review T-Mobile’s results, talk more about fab Five cash generation, and touch on small business/ enterprise share shifts across the industry. Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Have a great week and (can’t believe I’m saying this into May) – Go Royals!

The post The Sunday Brief: Cable stole my growth! appeared first on RCR Wireless News.