Easter greetings from Lake Norman and Charlotte, North Carolina, where buds are turning into leaves and everything is renewing. But don’t eat outside at the Arby’s – take it home!

Easter greetings from Lake Norman and Charlotte, North Carolina, where buds are turning into leaves and everything is renewing. But don’t eat outside at the Arby’s – take it home!

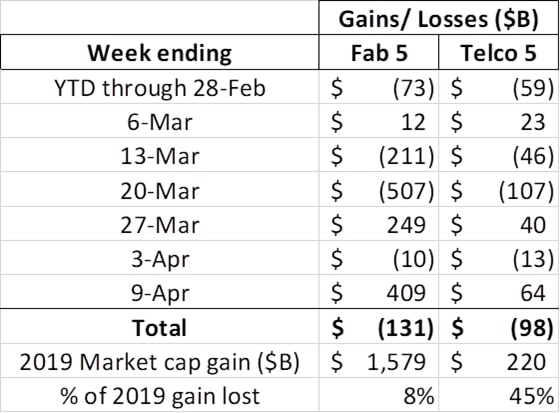

This is part one of a two-part Sunday Brief earnings preview, and, after finishing up our COVID-19 value tracker, we will include a few TSB follow-ups. It was definitely a short but sweet recovery week for both the Fab 5 and the Telco Top 5. Here are the 2019 and 2020 value trends for the week ending April 9 (markets were closed on April 10th in observance of Good Friday):

While every one of the 10 stocks tracked here had a good week, the big winners in overall market capitalization gains were Apple (+$116 billion), Google (+$78 billion), and Facebook (+$60 billion). These three stocks gained more in one week than the total current equity market capitalization of Verizon ($238 billion as of Thursday). Welcome to pre-earnings announcements market volatility.

Because of the strong week, these 10 stocks have now given back 8% (Fab 5) and 45% (Telco Top 5) of the value that they created in 2019 (re: just three weeks ago, we were at 49% and 86% of the 2019 gains consumed by market losses). Microsoft, Amazon, and T-Mobile are all up year-to-date, and Charter is also knocking on that door. This is a very good time to own those companies that have cash, few debt maturities, and essential monthly recurring product streams (Amazon Prime, Microsoft Office 365 and Teams, and of course broadband and wireless).

How will traders and analysts look at Q1 and Q2 earnings? As we forecasted in the March 29 TSB, most companies are going to project as little as possible and focus on current trends. No one can predict when normalcy will return, but the three questions outlined in our Essential Economy presentation will rule the day:

- Do I absolutely need it to survive?

- Can I live without it?

- Can I defer this purchase (or “Is it worth using savings to purchase now?”)

How companies position their products and services to answer these questions will drive the speed of our recovery. With that preamble, let’s see how the pandemic will impact the telecommunications industry.

Q1 earnings: Before and after

Several of us who follow the industry collectively create buzzword bingo sheets for use during earnings calls. Dynamic Spectrum Sharing, mid-band (spectrum), millimeter wave, small cell, fiber, SD-WAN and of course 5G (sometimes followed by NR for “new radio” or preceded by SA for “stand alone”) are a few of the popular terms (we also had one called “John (Legere) cussed” – sadly, that is no longer needed).

These are different times. This quarter, the buzzwords will be replaced by “before and after”

- Gross additions/ upgrades before March were running at XX per week (or % of total postpaid base)

- Bad debt as a percentage of revenues was ___% before 2020

- Peak busy hour was from 7-9 p.m. before shelter-in-place orders were instituted

- Hotspot usage was ____ GB on average before work-from-home became the standard

- Video cord cutting was ____ per month before we lost live sports

- Moving activity (new and existing homes) was _____ per week/ month before it was curtailed

- Prepaid Average Revenue Per User was $_____ before the economic impact of COVID-19

- _____ MHz deployed before the emergency spectrum provisions were implemented

Emerging from these calls will be three important themes (we will tailor these themes for specific companies in next week’s Sunday Brief):

- For a significant minority of both the telecom and cable bases, there are no major behavioral changes (except perhaps postponed smartphone purchases). As we highlighted in our first writeup on The Essential Economy, at least 30% of the US population has savings to weather a lengthy storm or is living comfortably in retirement. Here’s the latest information (2018) from Statista on the over-65 segment:

Also from Statista, here is the US income stratification for 2018:

These two categories make up ~ 30% of the population (assuming some fraction of the retiree population still earns more than $150,000 per year). They behave differently even though they may still be prone to some economizing behaviors; signing up for age-based plans like these has likely already occurred. A few may cut the video cord as well (especially if retirement is accompanied by a move), but most will budget and pay for familiarity and convenience.

For high-income earning families, network availability and performance (including 5G) continue to be the most important factors. Many of these families have been on one network for years and have no plans to leave. Others may be able to expense their mobile phone service and are less price sensitive. Regardless, this base, while relatively small, provides a firm foundation for Verizon, AT&T, Comcast and Charter. Their loyalty should be rewarded.

- At the other end of the spectrum are ~ 40% of households that are barely getting by. We discussed their spending habits in the last two Sunday Briefs, and will not rehash those conclusions. Many of these customers are already prepaid retail customers, using carrier-branded prepaid services but also brands such as Visible (Verizon network), Total Wireless (Verizon), Simple Mobile (T-Mobile), Cricket Wireless (AT&T), Mint Mobile (T-Mobile), Red Pocket (all networks), Boost Mobile (Dish/ Sprint), and Walmart’s Straight Talk (all networks). To a lesser extent, some of the Spectrum Mobile and Xfinity Mobile customers could also be classified as “retail prepaid.”

These customers have a fixed budget, below average credit scores that disqualify them from advertised equipment installment payments, yet are highly dependent on their devices. Apple and Samsung are still their brands of choice (more likely an iPhone 7, 8 or XS than an 11 Pro Max), with Moto and LG models also very popular.

With the exception of Mint Mobile, most of service providers mentioned above share the same retail dependencies as their postpaid counterparts, and, as a result, have seen their businesses impacted by shortened store hours or closures. Jeff Moore of Wave7 Research recently published postpaid the following store closure estimates by carrier:

Sprint and T-Mobile appear to be most heavily impacted, although Wave7 also notes that most of the Verizon and AT&T stores are on limited hours. Assuming that the prepaid store percentage is closer to Sprint and T-Mobile, the impact to prepaid dealers could be significant. This could not come at a worse time as tax refunds and stimulus checks begin to appear in bank accounts and mailboxes.

On top of this, smartphone shipments plummeted in the first quarter as manufacturing ground to a halt and reopened factories are running at less than full capacity. Research first Strategy Analytics forecasted that 61.8 million smartphones were shipped in February, down from 99.2 million a year ago.

This “essential” segment will be more dependent on online channels and will take advantage of limited store openings. Downgrades will be prevalent, and T-Mobile’s new plans for $15/ mo. (~$18 with taxes and fees) for 2GB and $25/ mo. (~$29 with taxes and fees) will be the winners. In addition to low-budget plans, it’s highly likely that new “families” will emerge akin to Sprint’s previous “Framily” plans. This will further pressure postpaid ARPUs.

- The “frozen, anxious middle” make up the remaining 25-30%. This segment is worried but not in full panic mode, concerned that they will be the next to be furloghed or to go out of business. They are especially interested in switching carriers if the process is easy and they can save $20-30 per line ($60-90 per family) per month. Their savings has been depleted, and they aren’t likely to make large discretionary purchases (like a Samsung Galaxy S20) without careful deliberation. They are as communications dependent as each of the other segments, but might not have or want to spend money today to buy out the remaining installments on an equipment installment plan.

As we discussed in a previous Sunday Brief, this segment will weigh the evidence (which drives confidence, which in turn drives consumption). Many will consider budget priced device options like the newly launched Moto G Power (specs here) at $249 or the recently announced Samsung A series lineup with devices starting at $110 (and a 5G device for $500 or $21/ month for 24 months).

This segment is also heavily targeted by the recently introduced Apple Card (introduced with Goldman Sachs). While Apple stores in the US are closed, promotions will be limited. But when these stores start to reopen, it’s very likely that Apple will run some sort of “grand reopening” discount (more than the 6% they ran in December 2019) and/or extend the number of months new iPhone customers have to pay for a device. This will place additional pressure on sales performance at carrier-owned stores.

On top of this, T-Mobile is expected to announce their “Day 1” event around July 1 (around 70 days from this writing). This is when brands will change, and new pricing plans will be announced – more on this from Mike Sievert’s CNBC interview here. With smartphone supplies less than desired, it’s likely that T-Mobile will have both BOGO (Buy One Get One for $0/ mo. smartphone offers) as well as BYOD (Bring Your Own Device) incentives, likely building on Sprint’s successful Kickstarter program (which is still running as of April 12 – more details here).

Cable will also be active with this segment as well, seeing an opportunity to upgrade High Speed Internet customers to 1Gbps (or higher) speeds. An entirely new division of cable’s business segments will emerge (WFH or Work From Home segment) which will provide rich inventives for new business customers to ease the transition from home confinement to a social-distanced office. Because of cable’s reach, this could accelerate national opportunities for the financial services, engineering or consulting industries and provide a “back door” sales opportunity that Verizon and AT&T cannot match on a broad basis. This is a “win-win-win” (home+teleworker+corporation) for everyone and an opportunity to quickly grow market share while creating an entirely new service category.

Bottom line: Three key opportunities across each of three key segments: 1) reward loyalty, 2) provide a reliable safety net for the financially fragile, and 3) thaw out the frozen, anxious middle who are hungry for value. These form the basis of the “after COVID-19” strategies in the communications world.

TSB follow-ups

- The FCC did what? While you were sheltering in place, on April 1, the FCC announced a report and order opening up 1200 megahertz (not a misprint) of unlicensed 6 GHz spectrum (full order here). This is a very bold move by the Commission and will spur the development of Wi-Fi as an alternative to Private LTE (which, ironically, was a driver of the CBRS Priority Access Licenses). Between the General Authorized Access (GAA) portion of CBRS and 1200 MHz of primarily indoor access via Wi-Fi, the FCC appears to have reduced the value of the upcoming C-Band spectrum (at least to the extent that this particular band was going to be used to aid Private LTE). The benefits to the Fab 5 from this announcement are immense (note who is and who isn’t reacting in this CNET article). Reaction to this from the cable industry will be particularly interesting as the Report and Order does allow for outdoor application with some restrictions (which in turn would offload some LTE and 5G spectrum to Wi-Fi 6E).

- Quibi is the Heaven’s Gate of OTT. The “Quick Bites” format was introduced as a mobile-only streaming service at the time when most were confined to their homes (and presumably had a little extra time for long-form content). Timing aside, however, publications like Verizon-owed TechCrunch and CNET aren’t that enamored with the quality of the content (which is highly unusual given Jeffrey Katzenberg’s leadership). TechCrunch summarizes the content as follows (full article here):

“Quibi feels like some off-brand cable channel, with a mix of convoluted reality shows, scripted dramas and news briefs. Imagine MTV at noon in the mid-2000s. Nothing seemed must-see. There’s no Game of Thrones or Mandalorian here. While the production value is better than what you’ll find on YouTube, the show concepts feel slapdash with novelty that quickly fades.”

Ouch. But that pales compared to Spencer Kornhaber’s review in The Atlantic where he states:

…there is no great TV on Quibi. After having spent a day and a half gorging on “quick bites,” I have zero shows to enthusiastically recommend. What I instead have is the sort of soul-deep burnout I haven’t felt since middle-school sick days spent on the couch with Regis Philbin. Take the all-quadrant pandering and formulas of old-school network TV, add in the messianism of a telethon, and swirl in some Reddit-friendly raunch and crassness, and set it all to hyperspeed. Thus far, Quibi offers a vast wasteland perhaps even more waste-strewn than the one millions of viewers have fled in the past two decades.

There’s still time for a hit, but, with $1.75 billion already spent on the venture, it looks like Quibi is headed for Heaven’s Gate (or, if you prefer, Ishtar) status.

- T-Mobile’s additional 600 MHz spectrum deployment – OpenSignal’s analysis. After T-Mobile’s announcement that they had received FCC authorization to deploy Dish’s unused 600 MHz spectrum on a temporary, emergency basis, many of us wondered “I wonder how that all turned out?” OpenSignal published a study last Wednesday which showed that T-Mobile exercised remarkable speed in deploying the spectrum, augmenting their 600 MHz holdings in 85 of the top 100 Cellular Market Areas (CMAs) in ten days. The bandwidth impact is shown by the following chart from the report:

According to OpenSignal, when T-Mobile customers connected to the 600 MHz band, they now achieved 20.2 Mbps 4G LTE speeds on average as opposed to 9.9 Mbps prior to the emergency reallocation.

Nothing lasts forever, but one has to wonder “How valuable is this augment to T-Mobile?” and “Could an extension bring Dish some needed cash prior to the launch of their new network?” The next 30 days could provide some valuable benchmarks for Charlie Ergen.

That’s it for this week. Thanks again for your readership. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance! Happy Easter and Passover!

The post The Sunday Brief: The frozen, anxious middle appeared first on RCR Wireless News.