Greetings from Kansas City and Nebraska. Pictured is our colleague, Bob O’Keefe, surveying the Omaha landscape during one of the coldest days of 2022. Trust us – under that grin is one nearly frozen individual. We had a terrific time in Nebraska this week but look forward to celebrating the Mardi Gras in Louisiana. Laissez les bon temps rouler!

This week, after a very full market commentary, we continue to analyze fourth quarter and full year 2021 earnings with a focus on results from regional broadband providers Altice and Frontier. Our conclusion – fiber can fix a lot of things, but fiber cannot fix everything. More below.

The week that was

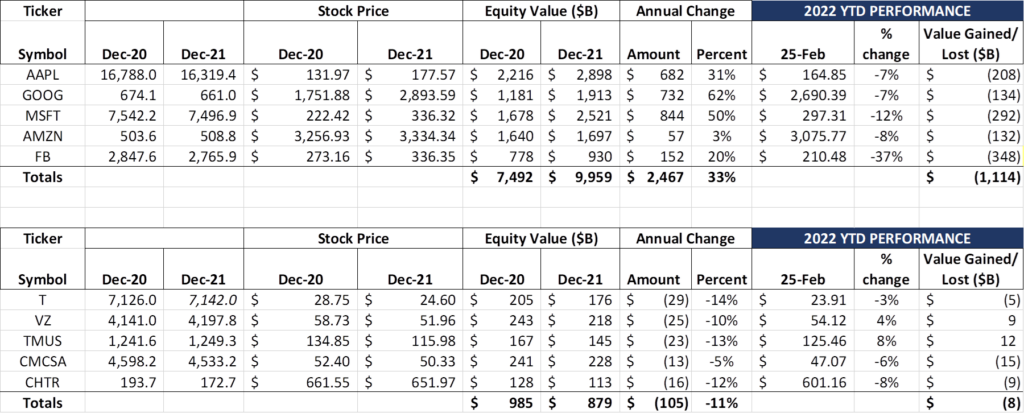

With war, inflation, and interest rate turmoil roiling the markets at large, the last two weeks were relatively calm for both the Fab Five (-$60 billion) and the Telco Top Five (-$8 billion). Meta/ Facebook continued its slide, losing an additional $25 billion in the last fortnight. Their current stock price (chart here) has not been seen since May 2020.

Amazon is the only other Fab Five stock that has given back their 2021 gains, but this is largely due to the remarkable (50%+) surge that occurred during 2Q 2020. The storyline between these two companies is completely different, with Amazon shareholders content to see the company hold on to pandemic-related stock gains in the near term as the company continues to expand into new lines of business.

Meanwhile, the remaining Fab Five stocks have lost value in 2022 but are still holding on to most of 2021’s gains. As we explored in a website-only post here, each of the Fab Five stocks created significant value in 2019, 2020, and 2021. Some pullback was inevitable. To have all but Amazon and Facebook holding on to the majority of their near-term gains is remarkable.

For example, from 2019-2021, Apple’s equity market capitalization growth (even with share buybacks) was ~$2.16 trillion. The recent pullback represents about 10% of that gain. Google’s figures are similar (~$1.2 trillion, 11% giveback). Microsoft’s $292 billion in 2022 losses represent 17% of their 2019-2021 market capitalization gains. Sometimes pullbacks are not interest-rate driven (we don’t think Fed rate increases are the source of the recent changes) – stock valuations simply got ahead of earnings, and the market took their gains.

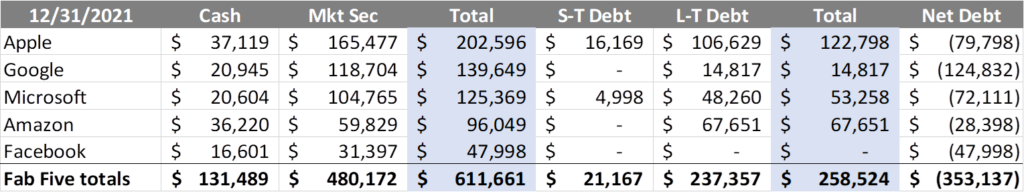

One question that should be asked, however, is whether the level of cash and marketable securities on the Fab Five balance sheet represent a value risk in a high-inflation environment. As reference, here are the balance sheet figures for cash and debt as of 12/31/2021:

To put these balances in context, at the end of June 2021, the sum of cash and marketable securities for the Fab Five was $614 billion – a $2 billion or about 1/3 of 1% decrease. No doubt, Facebook’s $16 billion drop in six months is material, but cash for the remaining four is steady if not rising.

Net debt is also essentially unchanged at negative $353 billion (June’s figure was negative $369 billion). Nearly all of this change is driven by Facebook/ Meta (Amazon’s net debt is also lower). Meta is the outlier but has no debt and still has $50 billion in cash on hand.

Too much cash in a high-inflation environment is a concern, especially when marketable security real yields are negative (2-yr yield is around 1.58% with inflation at 7.5%). We would expect to see some of the Fab Five use their leverage capacity to adjust for these changes.

The Telco Top Five had a relatively quiet two weeks, with gains in T-Mobile and Verizon offsetting losses among the remaining three. Of particular interest is Comcast, who has lost $15 billion in value since the beginning of the year, yet has (especially after AT&T’s WarnerMedia spinoff) the broadest portfolio of assets among this group. While we neither prognosticate on specific stock prices nor recommend the purchase or sale of any single stock, it appears that business portfolio breadth is out of vogue. That’s a headscratcher, given Comcast’s asset base.

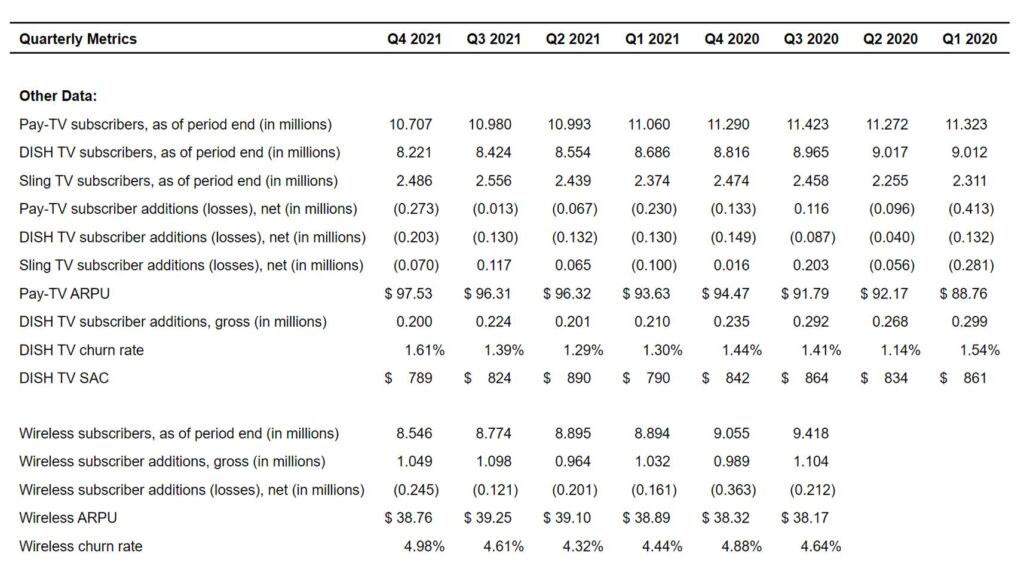

Dish reported earnings last Thursday, and the stock surged after their conference call. The following table summarizes their results:

While little in these results is encouraging, their wireless progress, particularly in their first market (Las Vegas) was particularly encouraging. CEO Charlie Ergen sounded pragmatically optimistic: “We probably ended up doing a lot more development than we thought in some of the technologies with our vendors. But [Las Vegas] is up and operational and when it works, it works pretty well… We’re not ready to spike the football, we have work to do to develop through all the cities and to optimize the network. But the technical challenges have been resolved for some of the core things that we needed to do.”

There is a fundamental difference between “works in the lab” vs. “works in the field, at scale.” This applies not only to each network element in a pioneering Open RAN (ORAN) architecture, but also on an end-to-end basis. Dish realized this prior to 2022, but the clock is ticking. They will meet the FCC’s 20% coverage deadline. We are also encouraged by their spectrum position which will make them a strong partner for enterprise customers.

The base business, however, is weak, and the transition from CDMA to 5G is going to be painful. We would not be surprised to see churn rates in the 6-6.5% range in 2Q. But, as we explained with T-Mobile, these levels are not run ratable and Boost ARPUs are hanging in there despite accelerating losses. How Dish manages the cumulative effect of these changes to drive a materially higher stock price (especially against Verizon’s renewed wholesale efforts) remains to be seen (a five-year view of Dish’s share price is here).

Finally, Samsung held their annual Galaxy Unpacked event on February 9 (link to full YouTube presentation here), which highlighted how hard it is going to be to squeeze out material smartphone improvements. One big development, however, was the reintroduction of the stylus with the Galaxy S22 Ultra and the Galaxy Tab 8 (see accompanying picture of the S22’s Samsung.com exclusive colors).

The Galaxy S22 Ultra features a 40 MP front-facing camera (similar to its predecessor). For comparison, the Google Pixel 6 Pro has an 11 MP front-facing camera, and the OnePlus 9 Pro 5G has a 16 MP camera. All are capable of transmitting data in 4K (roughly 25 Mbps upstream required, but this also depends on the application throughput). Samsung’s 40 MP camera is likely capable of transmitting in 8K (again, dependent on application throughput). This would require 80-100 Mbps upstream per channel. If you were looking for a good 5G or symmetric bandwidth use case, look no further than the Samsung Galaxy S22 Ultra. If used at its full potential, it will strain traditional DOCSIS 3.1 networks (Spectrum Ultra, for example, is a 400 Mbps down/ 20 Mbps up service). Note: this would require mirroring the Galaxy S22 Ultra to the television to get the full impact (more on how to do that here), but, if you are a Samsung fan and want to enjoy the highest resolution, it’s now possible, with enough upstream bandwidth, to do it.

If all of this sounds a bit klugey just to get a high-resolution image, it is. If only tablet resolution were on par with smartphones! Enter the Galaxy Tab S8 Ultra, which has dual 12 MP front-facing cameras capable of 4K resolution starting at $1199. Contrast this with a $999 Samsung Chromebook (0.92 MP front-facing; 720p resolution) and HP’s top of the line $1300 Spectre laptop (5 MP front-facing camera; 1080p resolution). The only device we could find with a 12 MP camera was the Facebook Portal Plus (here on Amazon for $250) but it only advertises HD resolution (again, something may be going on with the Messenger app to govern speeds). The Tab S8 Ultra gives us a taste of what’s coming – higher resolution interactive communication displayed on larger screens. If that sounds like the ideal “work from home” setting, it is.

Now that this capability exists, it becomes a question of affordability. 1080p rear-facing lenses took about seven years from first appearance to ubiquity. 4K transmission is on the same trajectory. 8K was introduced in TVs in 2018 and now is in some smartphones. Could the need for larger screen transmission be commonplace by the end of this decade? We think so (if not sooner).

Earnings Recap: Fiber Fixes (Almost) Everything!

We have had a lot of fun reading, listening to, and analyzing earnings calls this quarter. Part of this comes with our new role running strategy for a rural broadband company (American Broadband). While listening to several of the calls, it became apparent that the words “fiber” and “Gig/ Gigabit” have become the “e-anything” or “cloud” or “SD-WAN” buzzwords of the decade. Simply put, if you say the words “fiber” or “Gig” enough, investors/ analysts/ customers will forgive all past sins and ignore present-day blemishes.

Take for example Altice’s earnings release and corresponding transcript. They mentioned fiber 79 times and multi-gig (or Gig) another 13 times on their fourth quarter conference call (and referenced mobile only 10). That’s 92 times in less than an hour! Frontier topped that with 91 mentions of fiber on their conference call and 10 derivations of the word “gig.”

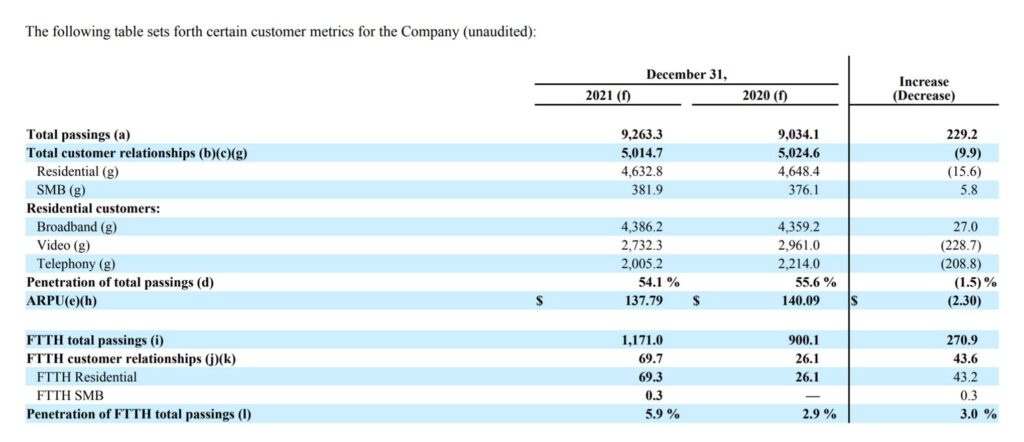

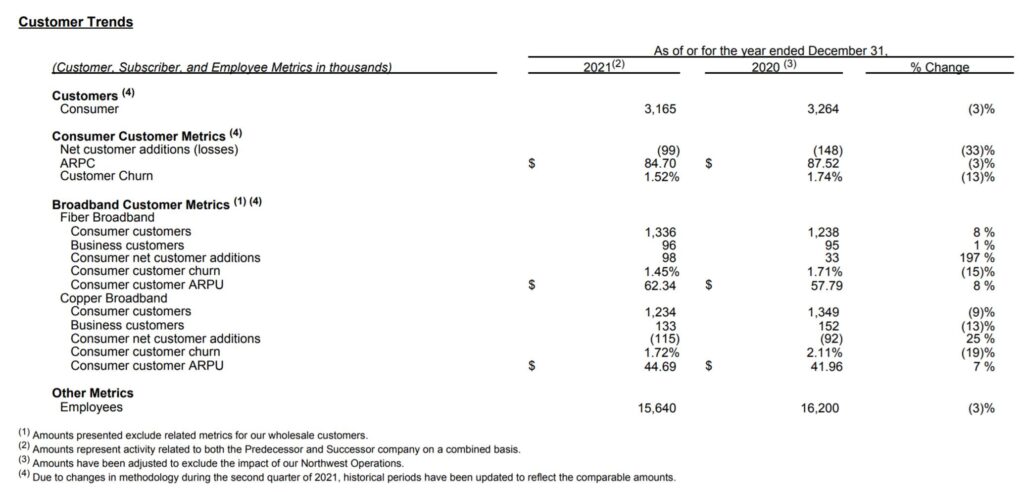

Here are Altice’s latest operational metrics (from their latest annual report filing):

Passings are growing (+2.5%), even during a pandemic – that’s good. But total residential customer relationships fell in 2021. Sure, it was a small number (0.34%), but what does that signal? Is it due to the legacy Cablevision territory, which has a high overlap with Verizon’s FiOS product (Verizon added 339K FiOS subscribers in 2021)? Is it indicative of new entrants like Vexus Fiber (just purchased by MetroNet who is backed by Oak Hill Capital), who is taking market share from legacy Suddenlink territory in Texas (note the specificity of the follow-up 100% fiber announcement here)? Is mobile + broadband an ineffective counter-bundle to a fiber-only offering (mobile added a scant 18K customers for the year and now has somewhere between 3 and 4% total penetration of broadband customers)?

There are problems at Altice, and they start with $26.5 billion in debt (about $2,860 per passing and $5,300 per YE 2021 customer relationship). Adding more debt for fiber to that number will not help, even if $20+ billion (75%) of the debt is not due for the foreseeable future.

Accompanying the $26.5 billion figure is just over $8 billion in goodwill associated with acquisitions. Should Altice be revalued to reflect increased competition, both from government programs as well as well-heeled new entrants?

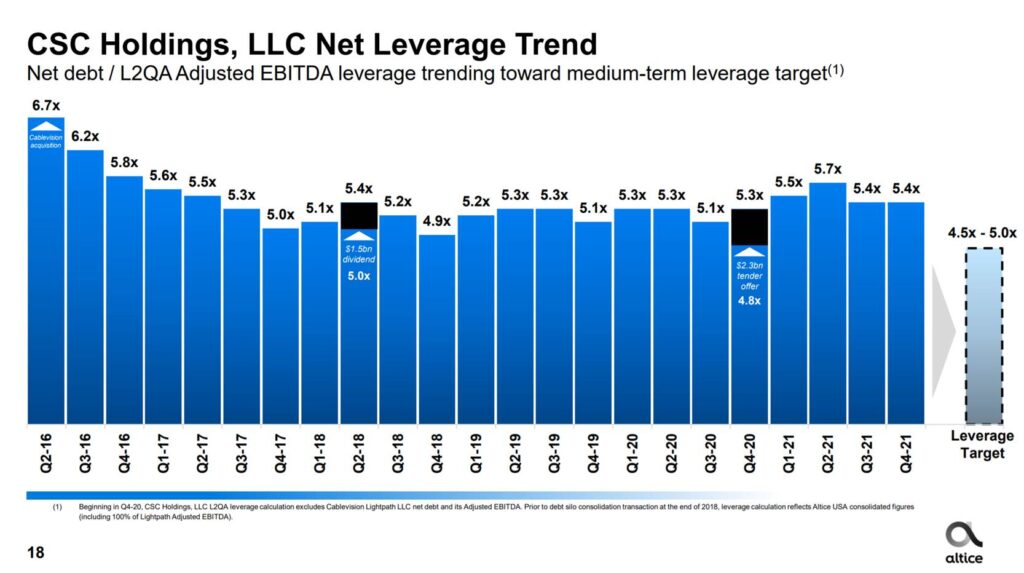

In the earnings presentation, Altice laid out the following leverage slide:

Recognizing that the competitive dynamic is changing, what’s the case to expand leverage for fiber deployments? Said another way, what’s the yield that keeps customers on Altice’s network and simultaneously hinders new investment? We struggle to think that it’s a slam dunk to deploy fiber. Bottom line: We could continue to wax eloquently about Altice’s woes, but with 32% less equity market value than they had on January 1, and 66% less than they had a year ago, there’s a lot of explaining to do. No amount of fiber can cure overvalued acquisitions and poor management. As we have cited in many previous articles, Altice is quickly becoming an example of the axiom “Fiber Always Wins (Until it Doesn’t).”

Then there’s Frontier, who emerged from bankruptcy last April (due in large part to an over-inflated view of Verizon’s copper and FiOS assets, particularly in Florida, California, and Texas). They had an extremely upbeat earnings call (materials here) where they celebrated adding more fiber customers than their copper losses (a low bar, indeed). Frontier was re-listed on the NASDAQ last May at $30/ share and is now trading at $27.75.

Frontier shares many similarities with Altice, but there are also very big differences. Here are the changes in customer relationships for Frontier per their latest annual report:

Even with a large number of new fiber passings in 2021, Frontier’s penetration is just below 42% and they have room to grow. Clearly, they have reversed their acquisition mishaps of the last decade. Even better, they are growing fiber broadband ARPUs by 8% and lowering churn (while 1.45% is still higher than it should be, it’s going in the right direction). Management went through a long list of projects that the company is pursuing to improve the customer experience on the earnings call, and they also announced a 2 Gbps offering across their entire fiber footprint. This is not a company in retreat or one content with 40s market share. They want it all, and they want it now.

On the balance sheet side, Frontier has emerged from bankruptcy with ~$8 billion in debt (~$2,500 per customer and likely less than $2,000 per home passed with either fiber or copper). The company has a leverage ratio of ~ 2.4x, and has enough cash on hand (or will generate from operations this year) to fund 2022 fiber builds. Most importantly, unlike Altice, Frontier provided 2022 guidance of $2.4-$2.5 billion in capital expenditures, 1 million new fiber locations, and adjusted EBITDA of $2.0-$2.15 billion.

Frontier’s footprint, however, overlaps heavily with Charter (Rochester, Dallas/ Ft Worth, Tampa, and California). They face each cable provider in Connecticut (a heavily fragmented market), and still have a large portion of their rural properties to either build out/ relaunch or sell (referred to as Wave 3, this encompasses 5 million passings). Every percentage point of market share will come through a win over DOCSIS 3.1. There continues to be skepticism about how the “new” Frontier compares to the “old.” Fiber helps a lot, but it does not convince everyone.

Bottom line: Frontier has a ways to go but they are definitely on the right track. They likely need to rebrand, and they cannot lose sight of converting all copper to fiber conversions to eliminate the costs to maintain copper in each of their regions. But, in Act II, Frontier has learned what not to do, and is leading with speed and service as differentiators. This should serve them well even as they struggle to get back to their IPO price.

That’s it for this week’s Brief. In two weeks, we will cover all of the activities surrounding Verizon’s 2022 Investor Day and likely touch on the latest earnings reports in the telecom industry. Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, and go A-10-leading Davidson Wildcats!

The post The Sunday Brief: Earnings wrap—fiber fixes (almost) everything! appeared first on RCR Wireless News.