Big Game greetings from Lake Norman/ Charlotte/ Davidson, NC. Pictured (r-l) are Darius Warton, Bob Guth (audophile and telecom legend), Gary Eason and yours truly. Gary and Darius have started a business selling vinyl records and turntables – check out their selection at www.thetwistedvinyl.com.

We build on last week’s party game theme with a focus on four “secret” weapons that T-Mobile, AT&T, Comcast and Charter possess . Like last week, we will limit our markets discussion to a paragraph or two on Jeff Bezos’ legacy (Jeff will be transitioning to Executive Chair of Amazon and AWS lead Andy Jassy will become the new CEO). For those who are new readers, please note that on www.sundaybrief.com you can get a PDF of this Brief.

This week’s mid-week Sunday Brief online post focused on state-by-state unemployment. While there will (and should) be debates over the correct unemployment measure to gauge the impact of COVID-19 on the economy (the state-by-state information is U-3 while many of you suggested that U-6 might be a better measure – article here), the punch line still holds:

- 18 of 50 states have current (Dec 2020) unemployment rates below 5%

- 22 of 50 states are within 200 basis points of their 2020 low

- 12 of the 22 states are in the West or Midwest (AK, IA, ID, IN, KS, MN, MT, NE, OH, UT, SD, WY)

Glad to send the data set along to those interested in more details. While this sounds far fetched today, we will likely be back in the “full employment” discussion by December, especially in the 12 states mentioned above. Because of differing COVID-19 regulations and conditions, the recovery will be uneven.

One final note – this week (likely Wednesday or Thursday), I will be featured on the RCR Wireless podcast “Will 5G Change the World?” We will post the link on the Sunday Brief website as soon as it’s available.

The week that was

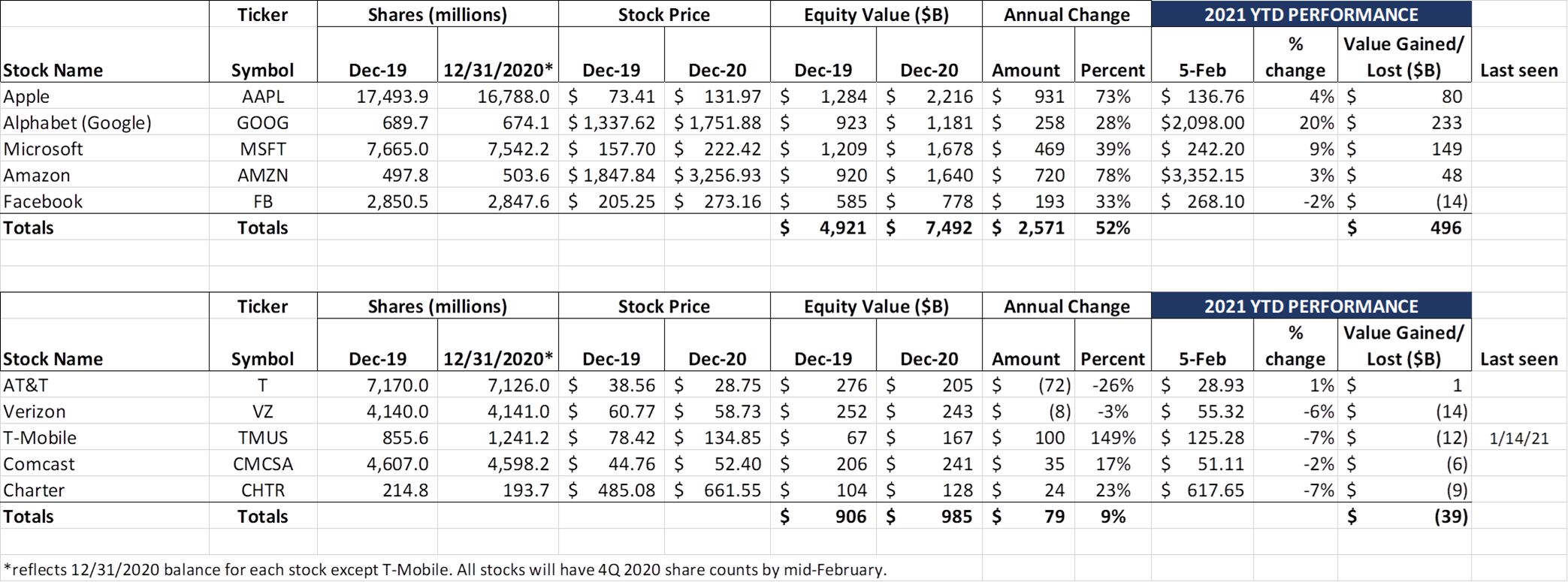

Most of the swings this week were earnings driven. Google parent Alphabet announced strong revenue and earnings growth (link here) and led the Fab Five in weekly market capitalization gains ($176 billion or $20 billion more than the current value of T-Mobile). As impressive as Google’s stock price gains were this week, they only represented 40% of the total Fab Five gains ($435 billion). Apple (+$81 billion), Microsoft (+$77 billion), Amazon (+$72 billion), and Facebook (+$28 billion) all gained.

Seven of the $13 billion in Telco Top Five gains this week came from Comcast. While there were some mid-week swings, T-Mobile (earnings announced this week – discussion below) pretty much ended up exactly where they ended January.

Amazon announced their executive succession plan on Tuesday which triggered many tributes to outgoing CEO Jeff Bezos. In his letter to employees, Jeff outlined many Amazon successes including Prime, Alexa, Kindle, customer reviews, and 1-Click shopping. It’s an impressive array of new businesses that changed how we live. For those of you who are not familiar with Amazon’s “flywheel” concept, defined as the inter-dependencies and knock-on impacts of new initiatives to Amazon’s existing businesses, there’s a terrific description of it here.

One of the things that’s most amazing about Amazon, however, is how few “flops” the company experienced (we were hard pressed to come up with one handful). That is a tribute to Amazon’s stringent business case/ evaluation process. Knowing when to say “no” (“maybe” is not an option), as well as orchestrating company resources to make each “yes” successful are two key sources of Amazon’s extraordinary long-term returns. The company’s investments in long-term improvements (especially logistics) have also contributed to their success. Andy Jassy now has the difficult job of defending the flywheel to regulators while Jeff makes the moon a vacation destination.

Earnings Recap Part #2 – I’ve got a secret.

Last week, we focused our earnings analysis on two truths and a lie:

- Truth #1: Despite bluster and promises, cable still dominated High Speed Internet net additions;

- Truth #2: While costly, AT&T’s embedded base retention strategy worked;

- Lie: AT&T’s purchase of DirecTV would add value. It didn’t and they wrote off $15.5 billion

This week, we tease out the greatest secrets from each of the Telco Top 5, starting with T-Mobile.

T-Mobile’s secret: Other revenues accounted for most service-related sequential growth. Nearby are the service revenue components from their latest release (3Q

2020 includes Sprint; 4Q 2019 excludes Sprint). Overall revenues grew 0.3% as higher-yielding Sprint customers who converted to T-Mobile saw lower ARPUs, and, per Mike Sievert’s comments at the beginning of the call, postpaid phone churn (1.03%) had a disproportionate legacy Sprint weighting. Prepaid revenues were down 1.2% due to increased switching activity (likely due to some COVID-19 pent up switching demand), and Wholesale revenues were essentially flat (note that Wholesale includes Boost which is a part of Dish for both 3Q and 4Q – likely that Dish did a better job of retaining customers than originally projected).

Then there’s the “roaming and other service revenues” line. We know from T-Mobile’s 3Q 10-Q disclosure that about $213 million of the $617 million (35%) is legacy Sprint wireline business. And we also know that T-Mobile exited 4Q 2019 with $295 million in other service revenues. So $500 million or so of the $617 million in September is pretty steady (if not slowly declining) revenue streams. What contributed, then to the 5%+ ($31 million) sequential growth between the third and fourth quarters? Was there a sudden shift in roaming?

Our take is that it’s a combination of TVision and T-Mobile Home Internet. Taking a $49 ARPU on TV (the $10 Vibe product, while small, weights it down) and a $51 ARPU on Home Internet, we come back to about 300,000 revenue generating unit growth with ~$22 million (71%) of the $31 million in revenue growth coming from Internet and the remainder from TVision. This implies a slightly less than 1% penetration of Home Internet into the account base (210K/ 25,754K accounts). This low penetration aligns with Mike’s classification of Home Internet as a “pilot” on the earnings call in response to Simon Flannery’s question on the topic:

“We’re in pilot phase right now. We quietly moved from LTE pilot to 5G pilot. That was an exciting milestone, but it’s a pilot. And part of what we’re doing here is we’re just taking our time and making sure that we put together the experience space that we need. And that means supply chain, it means customer experience, it means really being able to create a quality service. And so far, we[‘re] really liking what we’re seeing. So, as this network capacity starts to really hit its pace in 2021, we’ve got a big opportunity to get commercial and to really go out there and start attracting customers in bigger numbers.”

A 10% penetration of their current account base (2.6 million Home Internet + 1 million TVision subscribers) equates to $2.1 billion in revenue growth. It’s a secret worth keeping until 5G Home Internet is fully ready for commercial launch.

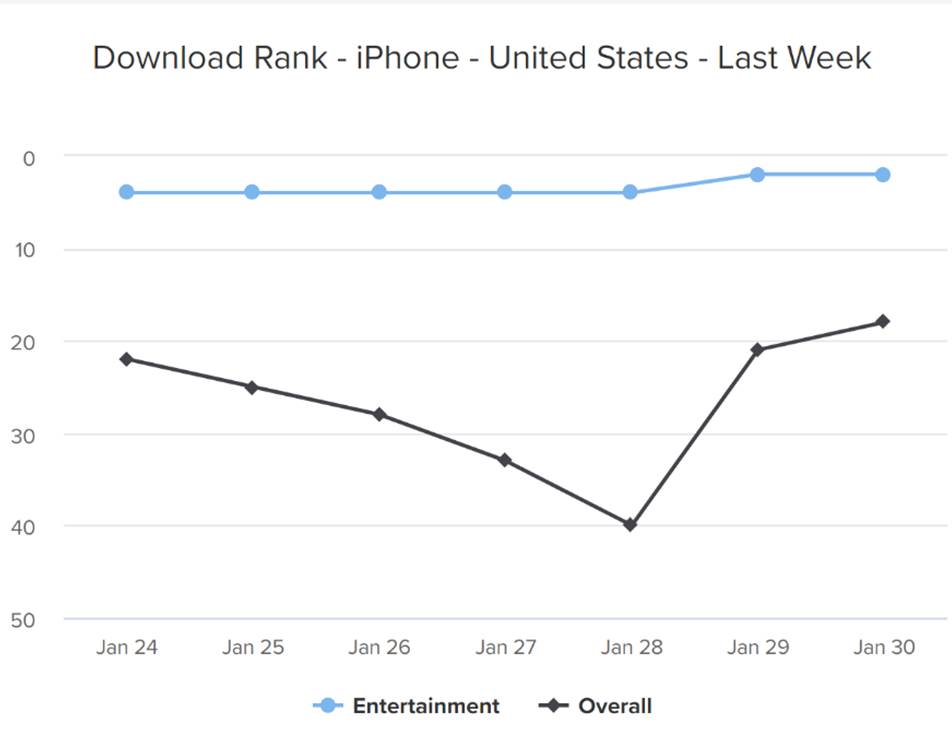

AT&T’s Secret: HBO Max. As critical as we are of some of AT&T’s other strategies (specifically their decision to buy back shares in 2018 and 2019 versus deploying value-creating fiber, and their acquisition of DirecTV that we discussed in detail last week), we are very bullish on HBO Max. Nearby is the App Annie chart of HBO Max US performance on iOS/ Apple.

HBO Max has held up very well since their launch, consistently ranking in the top 5 Entertainment downloads, and recently has spent a lot of time in the top 20 overall apps (as of Friday, HBO Max was ranked #34, just behind Disney+ #32 and Hulu #30). Netflix, who still has a bundling agreement with T-Mobile, was ranked #20.

Because AT&T has tied so much of their branding to HBO Max (see our Brief here which described the change), it’s not surprising that Ma Bell has seen a rise in HBO Max subscriptions. Unlike our broadband comments, we think that AT&T’s HBO Max strategy is accretive, and that HBO Max can easily reach 40 million domestic and international customers independent of HBO by the end of next year. Since some of these accounts will occur through addition of the AT&T Unlimited Elite wireless plan tier, we think it’s going to help retain (and, to a lesser degree, attract) wireless subscribers.

John Stankey has made no secret of his desire to make HBO Max the flagship product for the entire company. We think (and App Annie data shows) that HBO Max is not only a streaming contender, it’s a money maker. And, while this places a lot of pressure on AT&T to continue to increase production content quality, it will differentiate them from their communications peers (except Comcast).

Comcast’s Secret: Theme parks. What do you do when COVID-19 shuts down one of your cash cows? Renovate and rebuild? That’s what Comcast did. This was an unprecedented year for Universal Studios parks, with revenues plunging 69% ($4.1 billion) annually. But by the end of the year, Comcast figured out a way to safely open a few of their parks. Brian Roberts shared more about that reopening success on the earnings call:

“COVID had the most direct impact on our theme parks, which were either closed or running at limited capacity for the bulk of 2020. But I’m pleased with how quickly we were able to reopen Orlando and Osaka while ensuring the safety of our staff and guests. We continue to provide an amazing entertainment experience, And our guests are responding, as confirmed by our steadily increased attendance and our most recent financial results.

What we saw this fourth quarter, especially in Orlando, gives us even more conviction in the momentum that our theme parks will experience when we reach a sustainable recovery. We may experience some near-term setbacks with the most recent pickup in COVID cases. But I am optimistic as ever about the long-term trajectory of this very special business.”

In the fourth quarter, Comcast took an EBITDA loss of $15 million, far better than 3Q’s $203 million loss and 2Q’s $399 million cash drain. That’s with a 35% cap on Orlando capacity. While there will continue to be some hesitancy to return to theme parks in the first half of 2021, we expect Comcast to post positive EBITDA in Q1 and to grow the business back to a run rate of $6 billion revenue/ $2.5 billion EBITDA level by the end of the year. We even see the possibility of Comcast experiencing significant “sell out” days in Orlando thanks to pent up vacation demand.

As we have discussed in previous Briefs, Comcast is poised to grow double digits in multiple business segments. If rumors are to be believed, they largely stayed out of the C-Band auctions (a wise move), freeing up capital to improve their profitability in areas such as theme parks (re: Epic Universe construction in Orlando stopped last year and has not resumed).

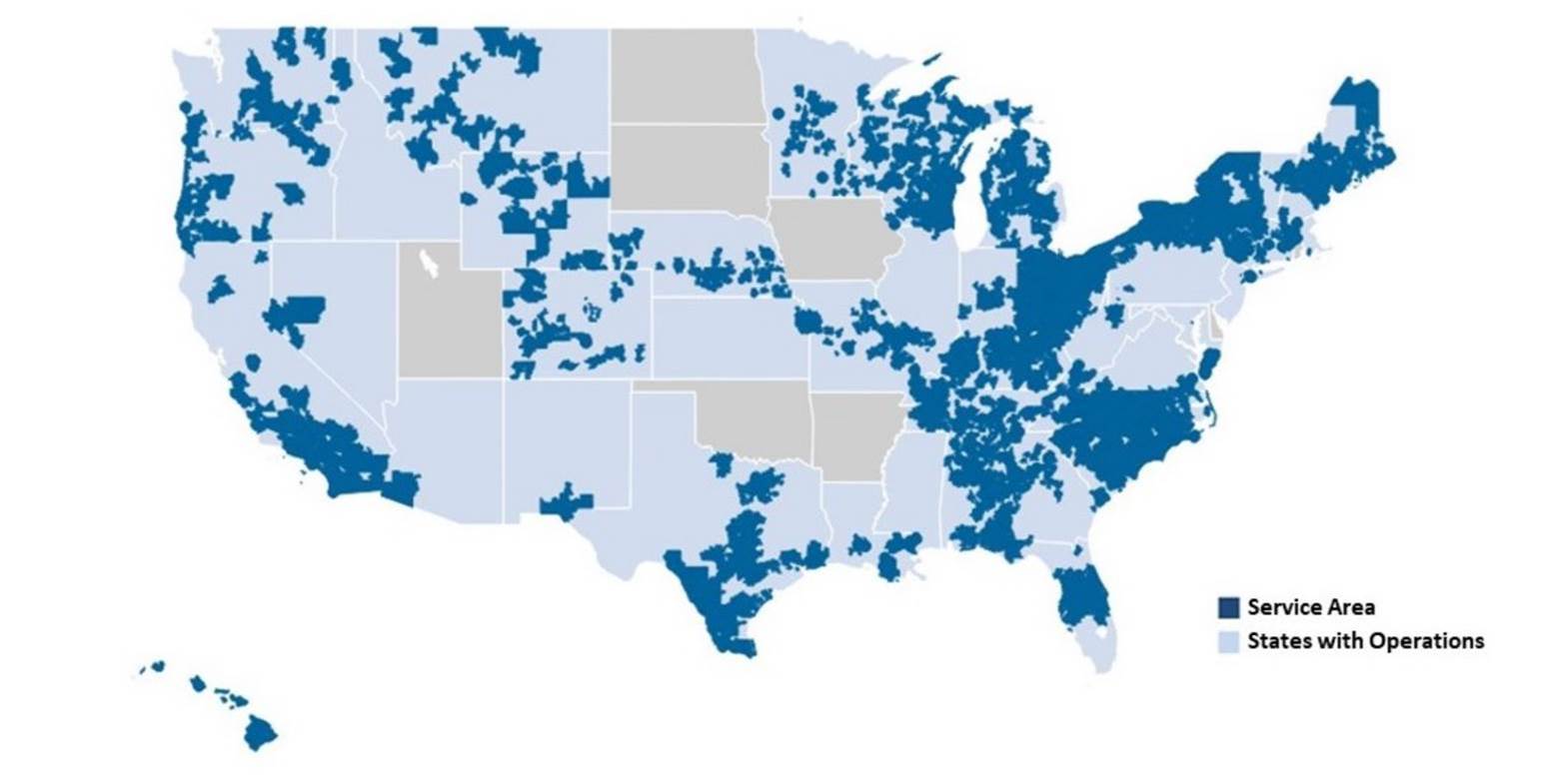

Charter’s Secret: Spectrum Business Growth. As we discussed last week, 2020 was a banner year for Charter: 5.1% overall revenue growth and nearly 10% EBITDA growth. Over 58% of the homes and commercial locations passed have a relationship with the company. While Charter lacks theme parks, theatrical production, and streaming services that compete with HBO Max, they have a wonderful commercial services operation that was battered by COVID-19.

The Commercial services business is divided into two categories: a) Small and Medium Business (which largely depends on DOCSIS 3.1 as its access medium), and b) Enterprise (served with a combination of DOCSIS and fiber solutions). In 2019, the SMB segment grew 5.5%. Growth slowed to 2.5% in 2020, largely due to business closures/ dormancies – but it grew! SMB Internet and voice revenues carry similar (and sometimes greater) margins than their residential counterparts. A few percentage points of additional growth flow quickly to the bottom line.

Charter has a territory advantage as well. While they are hamstrung by hard hit New York City and Los Angeles (see nearby map), they can offset that with growth in Dallas/ Ft. Worth, Austin, San Antonio, Tampa, North and South Carolina, and Ohio (one of the 12 states mentioned above where unemployment continues to drop). When migrations to and from metro areas are netted out, we think that Charter will be a winner.

That’s all for this week. Next week will celebrate Valentine’s Day with a Brief entitled “What I Love About Telecom.” Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Stay safe, keep your social distance, and Go Chiefs!

The post The Sunday Brief: Earnings recap part #2—I’ve got a secret appeared first on RCR Wireless News.